When you start to trade in commodities, one of the major questions or challenges that you will face will be linked to the valuation.

Though it might sound like a very basic thing, in reality, understanding the key concepts linked to the valuation becomes very important. This will ensure that not just you know what you are paying for, but also whether you are paying right or wrong.

This is where the concept of commodity valuation comes into play. So, to help you understand this better, we have curated this guide. From definition to mechanisms and factors affecting commodity valuation, everything is covered here. So, read this to know everything easily.

What is Commodity Valuation?

Commodity valuation is the process of assessing the fair market price of raw materials. It is for products such as metals, energy products, and agricultural goods. These are the products that are highly dynamic in nature. Their prices fluctuate based on various factors, starting from global demand and supply to every economic event.

The main aim of the commodity valuation is:

- Provide clarity on the price

- Ensure there is no case of overpricing or underpricing

- Benefiting the traders with a transparent mechanism for price discovery

For traders and investors, understanding valuation is crucial. It is the key factor that impacts the buying, selling, and hedging calls. Businesses also rely on accurate valuation to manage procurement costs and reduce financial risks.

So, if we summarize this, commodity valuation is a simple act of creating a framework for the price discovery to ensure there is fairness and efficiency in the commodity market. This, in turn, helps the participants make informed choices instead of trading blindly.

Features of Commodity Valuation

To understand commodity valuation better, it is important to understand the key features of the same. Now, one important point to note here is that it is not like retail or wholesale price valuation. It is quite different. So, here are the features to know.

- Market-Driven Nature: Valuation is highly based on the demand and supply conditions. This makes it sensitive to the seasonal changes and global market conditions as well. Also, consumer demand is an important aspect that impacts the value.

- Dynamic Pricing: Commodity prices change every day. The dynamic pricing makes it very important for the traders to stay updated on the market conditions and the changes happening around.

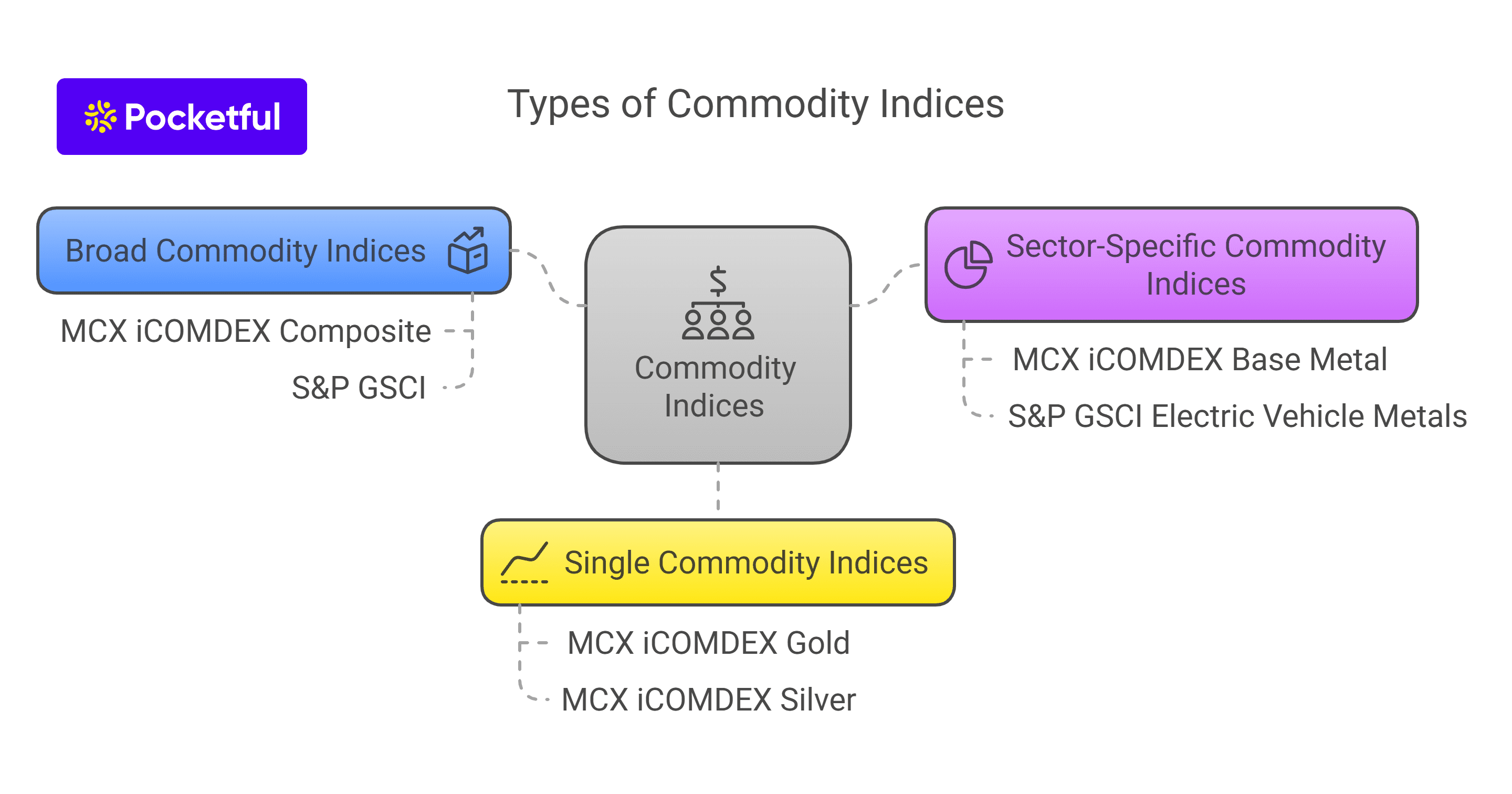

- Standardisation and Benchmarks: Commodities are often valued against international benchmarks. These can be the key indices like WTI for crude oil or LBMA for gold. The idea of using these is to ensure transparency and uniformity.

- Quality and Grade Sensitivity: Every commodity has different grades. The higher the grade, the more would be the price. This is directly linked to the quality and features available. So, be sure to check the same as well.

- Global Interlinkages: Commodity valuation is affected by the global factors as well. Be it the policies or current values, everything impacts them, and so one should stay updated on the cross-border policies as well.

Read Also: What is Commodity Market in India?

Pricing Mechanisms of Commodity Transactions

Commodity prices are discovered through different mechanisms, each suited for particular market needs. The major ones include:

1. Fixed Price

Buyer and seller lock in a price in advance, regardless of future market movements. It offers certainty but removes the chance to benefit from favourable price shifts.

2. Floor and Ceiling Price

A minimum (floor) and maximum (ceiling) price is set, usually by an exchange or authority. This prevents extreme losses or gains while keeping prices within a safe band.

3. Variable Price

The price is decided by current demand and supply conditions. Since these factors change constantly, this mechanism reflects real-time market dynamics.

4. Floating Price

Common in long-term contracts, the final price is determined by averaging market prices over a set period. It reduces the impact of sudden volatility, often used in oil or gas trades.

5. Spot Pricing

Reflects the immediate market value for instant delivery of a commodity. It is the most transparent but also the most volatile pricing method.

6. Futures Pricing

Prices are set for future delivery via exchange-traded contracts. This is mainly aimed at hedging and considers all the key aspects linked to the pricing factors.

7. Auction or Negotiated Pricing

This is more in agricultural and niche commodities. The prices are decided through direct negotiations or auctions between buyers and sellers based on need and quality.

Quick Comparison of Pricing Mechanisms

| Mechanism | What it is | Pros | Cons |

|---|---|---|---|

| Fixed Price | Buyer and seller agree on a price in advance for delivery later | Provides certainty, protects from sudden price swings | No benefit if market moves favourably after agreement |

| Floor & Ceiling | Sets minimum and maximum prices for a commodity | Controls extreme volatility, gives safe trading range | Limits potential gains and flexibility |

| Variable Price | Price is decided in real time based on demand and supply | Reflects true market conditions, transparent | Highly volatile, harder to plan budgets |

| Floating Price | Final price is averaged over a set period in long-term contracts | Reduces impact of short-term fluctuations, stable over time | May not capture sudden favourable moves |

| Spot Pricing | Price for immediate purchase and delivery | Transparent, shows real market value instantly | Very volatile, risky for large buyers |

| Futures Pricing | Contracts set today for delivery in future at agreed price | Useful for hedging, helps forecast costs | Complex, requires margin money and market knowledge |

| Auction/Negotiated | Price set using buyer-seller negotiation | Flexible, often considers quality and local demand | Less standardised and lack transparency |

Key Factors Affecting Commodity Valuation

It is now clear that commodity valuation is based on various factors. But the question is, what are they? Well, here are the common ones to know:

1. Demand and Supply

The basic driver of all valuations. When demand is high or supply is low, prices rise. Likewise, when the demand is less and the supply is high, prices fall. Seasonal aspects and market needs will impact this.

2. Global Benchmarks

International standards serve as the price benchmarks. These include Brent Crude for oil, LBMA for gold, or COMEX for metals. The local markets align with these for transparent and fair prices.

3. Government Regulations

Any changes in the government policies linked to import and export will change the prices. Also, if there is a ban on a certain product, prices will change as well.

4. Currency Fluctuations

Since commodities are largely priced in US dollars, exchange rate changes directly impact local valuation. A weaker local currency usually makes commodities more expensive.

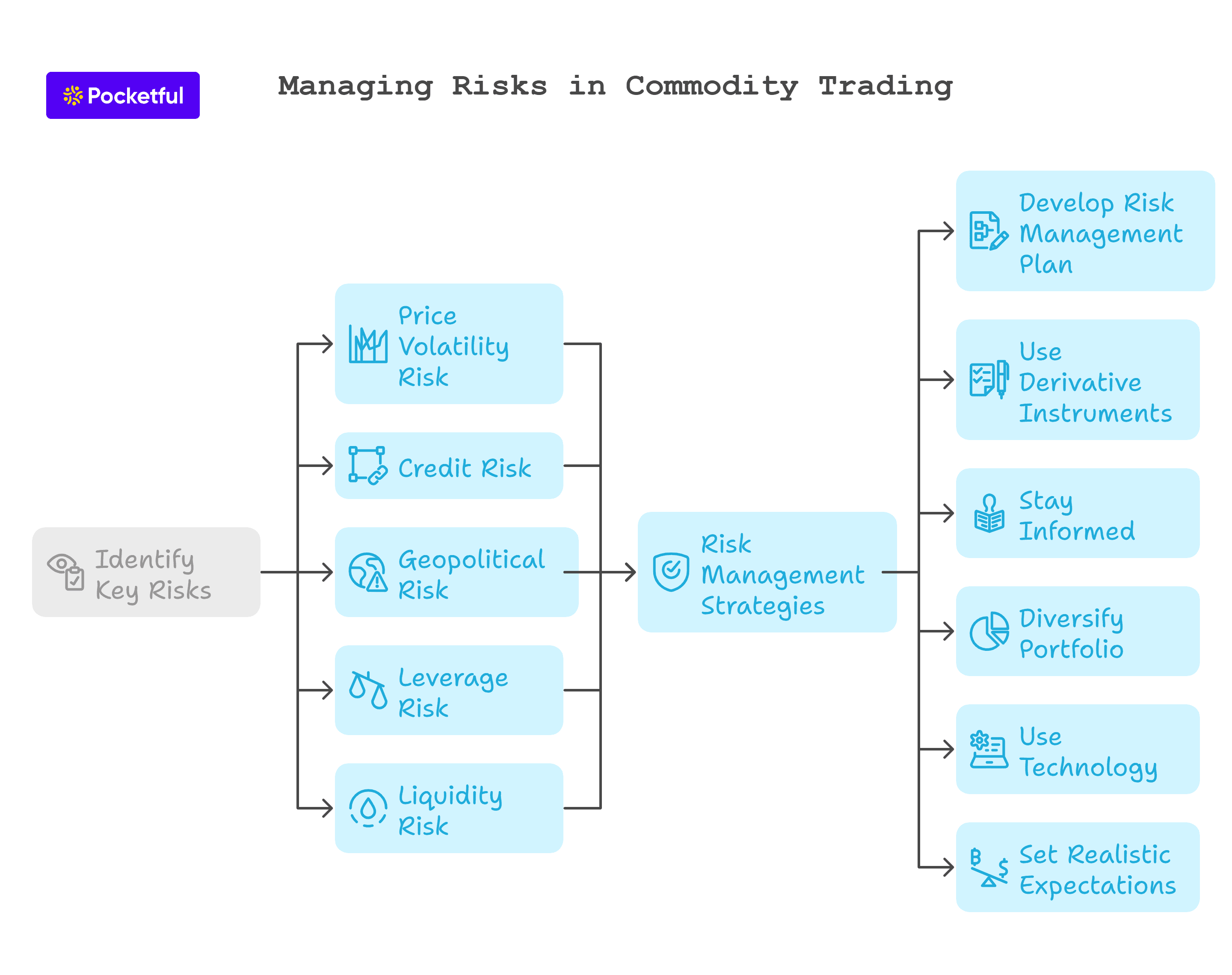

5. Geopolitical Events

Wars, sanctions, and global conflicts can disrupt supply chains. This often impacts the supply and thereby the prices.

Read Also: Understanding Commodity Market Analysis

Why is Commodity Valuation Important?

Commodity valuation guarantees fairness and transparency. But there are other reasons as well that make it very important. These are:

- Traders can get assurance on the prices while buying and selling.

- Investors can plan and manage risks better to avoid losses.

- Businesses can get the raw materials at the right prices easily.

- Farmers and exporters can negotiate prices in a fair manner.

- Regulators can manage inflation and unwanted spikes to avoid chaos.

- Local industries can stay ahead and match the global market.

Commodity Valuation in India

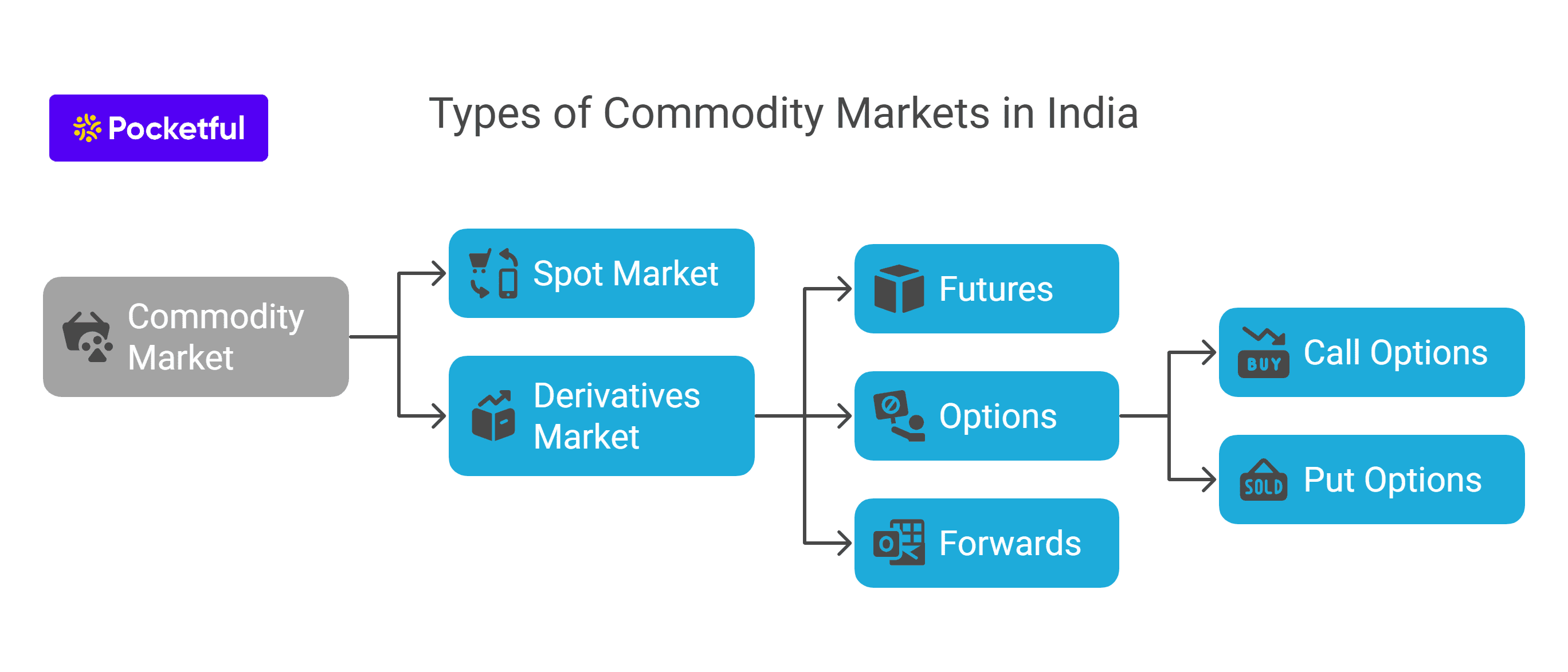

In India, commodities are mainly traded through the two platforms which are:

Prices on these exchanges are influenced by various factors like global standards and domestic demand. So, if there is a change in any one of the factors, the prices will change on these exchanges. This will ensure that the traders and investors pay a fair price and earn better.

Read Also: Types of Commodity Market in India

Conclusion

Investing in commodities is a great decision. But while you plan to do so, it is important that you understand the commodity valuation as well. This will ensure you pay fair prices and are earning profits too.

In India, where exchanges like MCX and NCDEX lead the market, knowing how valuation works can protect you from risk and open better opportunities. If you are planning to enter the commodity market, start your journey with Pocketful and trade with confidence.

Frequently Asked Questions (FAQs)

How are commodities valued in India?

Commodities in India are valued based on various factors. From the demand and supply to the government policies, everything impacts the prices.

Which commodities are most traded in India?

Gold, silver, crude oil, and natural gas are a few commonly traded commodities. Agricultural products like soybean, cotton, and wheat are a few others that are actively traded commodities on Indian exchanges.

What is the role of MCX in commodity valuation?

The Multi Commodity Exchange (MCX) provides a transparent platform. It is where buyers and sellers discover fair prices for commodities through real-time trading.

How do global prices affect commodity valuation in India?

Since many commodities are priced internationally in US dollars, global benchmarks are important. These directly impact Indian prices after adjusting for currency movements.

Can commodity valuation impact inflation in India?

Yes, the commodity valuation can impact the inflation in India. Hence, these are tracked by the policymakers very closely.