As an investor, you have probably heard that a firm is planning an Initial Public Offering (IPO), representing the company’s first attempt to raise money from the general public. But what if the business wishes to raise more money after already launching an IPO? There is a procedure called a “Follow-on Public Offer” whereby a company already listed on the stock exchange can raise money from the general public after the IPO.

In this blog, we will give information about the Follow-on Public Offer (FPO),

What is a Follow-on Public Offer (FPO)?

A publicly traded corporation can raise money by issuing shares through follow-on public offerings. The corporation raises money to meet capital requirements, expand operations, pay off debt, and other goals. Since the procedure is comparable to an Initial Public Offering (IPO), it can be regarded as a fantastic choice for an established business with a solid track record.

How does a Follow-on Public Offer (FPO) work?

The steps involved in a Follow-on Public Offer are as follows-

1. Deciding for FPO – The company must first determine whether to raise money through a follow-on public offering. It must also determine the reason behind the FPO, which can be expansion, paying off debt, etc.

2. Preparing the Document – After determining the goal of the follow-on public offer, the corporation must prepare the document containing FPO’s details, including the number of shares, pricing, and usage of proceeds.

3. Filing the document with the Regulator – The prepared paperwork must be sent to the Securities and Exchange Board of India, the Indian capital market regulator.

4. Type of FPO – When developing its offering, the business must choose between a dilutive and a non-dilutive FPO.

5. Price Band– The price band within which the investors can bid for shares offered in the FPO must be decided.

6. Subscription – Investors can subscribe to the issue by submitting applications through their brokers.

7. Allocation of Shares – Following the subscription period, the shares are credited to the demat accounts of investors.

8. Listing of Shares – The latter stages involved listing the shares on the market and allowing the general public to trade them.

Types of Follow-on Public Offers (FPOs)

The two kinds of Follow-on Public Offer are –

1. Diluted Follow-On Public Offers – The corporation issues new shares in a diluted follow-on public offer, increasing the overall number of free float shares in the market over time. As a result, existing investors’ shareholding is diluted, but the business gains from this since they can use the funds for debt reduction or expansion.

2. Non-Diluted FPO – As stated in the Non-diluted Follow-on Public Offer, current shareholders, including promoters and venture investors, sell a portion of their shareholding rather than the company issuing new shares. This signals that current shareholders are selling their stakes, which raises the market’s share count and liquidity. Investors must exercise caution when investing in such FPOs.

Examples of Follow-on Public Offers

Two of the most recent Follow-on Public Offers in India are given below-

1. Ruchi Soya Limited launched its follow-on public offer of INR 4,300 crores in 2022 to raise capital to reduce its debt.

2. Yes Bank launched an FPO in 2020 to raise INR 15,000 crores and it was a dilutive FPO.

What are the Benefits of a Follow-on Public Offer?

FPO offers various benefits for both companies and investors, as shown below.

For Companies – The significant benefits of Follow-on Public Offer for companies are as follows-

Capital – Companies can raise adequate funds through follow-on public offerings that can be used for various purposes.

- Increased Liquidity – The company’s number of shares will increase after the IPO, which increases liquidity.

- Reducing Debt – The debt of the company can be reduced through proceeds received from follow-on public offerings.

- Attracts Investors –Investors usually want to invest in companies that are raising funds to fund their expansion projects.

- Acquisition – With the raised capital, the company can acquire different companies and expand its business.

- International Expansion – Through FPO, companies can raise capital and export their goods to other countries to expand their geographical reach.

For Investors – The significant benefits of Follow-on Public Offer for investors are as follows-

- Opportunities – The investors consider a follow-on public offer as an investment opportunity.

- Proven Track Record – Established companies with proven track records issue follow-up public offers.

- Discounted Prices – Follow-on public offers are typically offered at a discount compared to their market price.

- Diversification – If the company has strong fundamentals, you can add it to your portfolio to diversify it.

Why does a Company bring its Follow-on Public Offer?

The major factors which make a company bring its Follow-on Public Offer are as follows-

- Additional Capital – The company might require additional funds to expand its operations, acquire new companies, etc.

- Debt Reduction – The companies can use the capital raised to reduce debt, which eventually reduces interest expense.

- Improve Liquidity – When a company floats new shares in the market, the liquidity increases.

- Opportunity to Raise Funds– When the company is performing well and the market sentiment is favorable, the companies can raise funds through follow-on public offers to leverage the investor’s high interest.

- Compliance – Some companies are required to maintain a minimum of a certain percentage of public shareholding; therefore, a follow-on public offer can be a way to increase the number of shares available for trading in the market.

- Mergers and Acquisitions – The company can use the funds raised through follow-on public offers to acquire new companies without taking any loans from banks.

How to Apply for a Follow-on Public Offer?

There are two ways to apply for a Follow-on Public Offer-

Online Method

1. Login – Through online mode, the first step is to log in to your broker account.

2. Choosing Option – Then go to the section of FPO or IPO.

3. Choosing the FPO – A table will list FPOs open for subscription, and you can choose the FPO you want to apply for.

4. Details of Application– Enter the details, such as the quantity of the shares and the price at which you wish to apply.

5. ASBA– ASBA stands for Application Supported by Blocked Amount, which is the method approved by SEBI to participate in an FPO. Ensure that the amount required to apply for an FPO is in the bank account.

6. Submission – The last step would be submitting the application form.

7. Approval of Mandate – The investors are requested to approve the mandate request received on their UPI application. This will block the amount in the investor’s account.

Offline Method

1. Getting the Form – You must visit your broker’s branch and ask about the FPO application form.

2. Filling the Details – The form provided by the brokers requires various details, such as a Demat account number, PAN Card, quantity to be purchased, and bidding details.

3. ASBA Form Submission: Visit your bank branch and fill out an Application Supported by Blocked Amount (ASBA) form with all the details related to the FPO application.

4. Submission of Form – Submit the form to the broker with complete details.

5. Confirmation – Then, your broker will process your application form and provide you with confirmation.

Differences between an Initial Public Offer (IPO) and a Follow-on Public Offer (FPO)

The significant differences between an Initial Public Offer (IPO) and a Follow-On Public Offer (FPO) are as follows-

| Particulars | IPO | FPO |

|---|---|---|

| Meaning | An initial public offering (IPO) is the first time a private firm issues shares before going public. | It is a publicly listed company’s subsequent issuance of shares. |

| Stage of Company | A private limited firm that is going public for the first time launches an IPO. | FPO is launched by a business that is already listed on the stock exchange. |

| Price Range | The company determines the IPO price depending on its valuation. A book-building process is used to make the decision. | To attract investors, the shares in an FPO are often sold at a price lower than the current market price. |

| Compliance | The IPO is subject to strict regulations as the company is getting listed for the first time on the stock exchange. | Regulations requirements for an FPO are less stringent as the company is already listed. |

| Potential Returns | IPOs usually offer higher chances of capital appreciation. | FPOs usually have a lower potential for capital appreciation. |

| Risk | These are considered more risky due to the unavailability of adequate data related to the company’s past financial performance. | It is generally considered less risky because the company’s performance is already known to the investors. |

Conclusion

To sum up, a follow-on public offering is a fantastic method for a publicly traded company to raise more money, which it may use to grow its operations or pay down its debt. Additionally, it offers investors a fantastic chance to invest in an already listed company at a discount, as FPO shares are usually offered at a price lower than the current market price. It is recommended that you speak with your financial advisor and consider the risks associated with investing in an FPO of a particular company.

Frequently Asked Questions (FAQs)

What is the difference between FPO and IPO?

An FPO is issued by a company that has already gone public, while an IPO is a corporation’s initial sale of shares to the general public. This is the main distinction between the two. FPO is typically less risky for investors since the company’s stock has already been listed on a public exchange and offers a history of the business’s financial and operational performance.

Why do companies consider issuing FPO?

To boost the liquidity of the company’s stock, companies might conduct follow-on public offers by issuing more shares if they want to obtain additional funds for expansions, acquisitions, and debt reduction.

How can an FPO impact the stock price?

Share prices may drop in the short term in the event of a dilutive FPO, but in the case of a non-dilutive issue, the FPO issue has no effect on share prices, and if the firm does well, share prices will eventually rise in the long term.

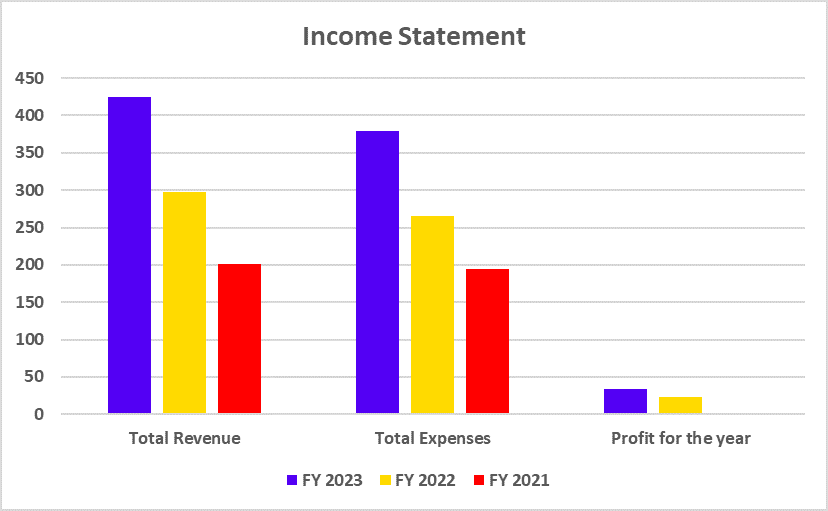

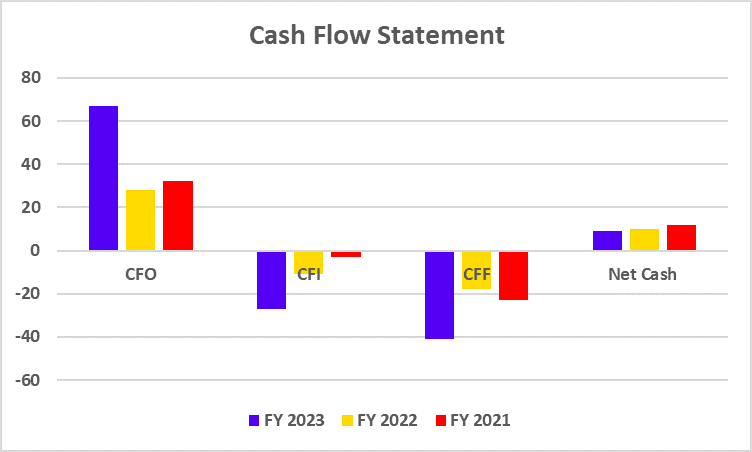

How do you access the valuation of a follow-on public offer?

One must assess several key financial aspects, such as historical performance, regulatory risks, reasons behind raising funds, etc., before applying for a follow-on public offer.

How can I subscribe for a follow-on public offer?

An investor can subscribe for a follow-on public offer through their broker. The application process is similar to an IPO, and individuals can apply during the subscription period and may receive the allocation based on demand.