In India, Hedge funds are officially called Category III Alternative Investment Funds (AIFs). This name is a bit long, but it just means they are an “alternative” to regular options like bank deposits or gold. They are meant for “sophisticated” investors. These are people who have a lot of money and understand that high returns often come with high risks.

In simple words, a hedge fund is a pool of money from many high net-worth individuals (HNIs). A professional manager uses this money to invest in the stock market, commodities market and currency market etc. using advanced math and strategies. The goal is to get “Alpha.” This is a fancy word for returns that are better than the normal market average. They want to make sure your money grows regardless of whether the Nifty 50 index is green or red.

In this blog, we will see how hedge funds operate in India, how they generate alpha, and why they are meant for sophisticated investors.

Top Hedge Funds in India (Category III AIFs)

| Rank | Fund Name | Manager | Strategy | Notable Performance (2025) |

|---|---|---|---|---|

| 1 | ASK Absolute Return Fund | ASK Group | Absolute return, long-short | Top 10 long-short (Jul 2025) |

| 2 | Abakkus All Cap / Long-Short Fund | Abakkus Asset Manager | All-cap long-short equity | 3.31% (Sep 2025) |

| 3 | Negen Undiscovered Value Fund (Cat III) | Negen Capital | Value equities | 3.08% (Jul 2025) |

| 4 | Motilal Oswal MOSt Focused Multicap (Cat III) | Motilal Oswal Asset Management | Focused multicap | Strong YTD mentions |

| 5 | IIFL India Special Situations Fund | IIFL Asset Management | Special situations | Consistent performer |

History of Hedge Funds

It starts with Alfred Winslow Jones in 1949. He was not even a finance person; he was a sociologist. He wrote an article about how to predict the market and then decided to start his own fund. He had a simple idea: if you buy some stocks and sell others at the same time, you are “hedged”. This means you are protected.

Jones introduced two things that are still used today. First, he used “leverage.” This means he borrowed money to buy more stocks than he could afford with just his own cash. Second, he took a “performance fee.” He told his investors that he would take 20% of whatever profit he made for them. This made sure he worked very hard to make them rich. In 1966, a famous magazine called Fortune wrote about him. After that, everyone wanted to start a hedge fund.

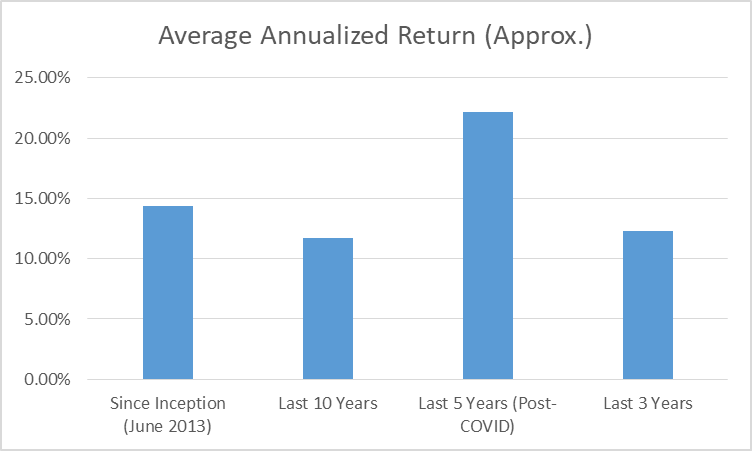

In India, the story is much newer. For a long time, we did not have a clear way for these funds to work. Many rich Indians sent their money to other countries like Singapore or Mauritius to invest in such funds. Finally, in 2012, SEBI brought out the AIF Regulations which changed everything. And the Edelweiss Alpha Fund became India’s first registered Category III AIF in June 2013. It gave a home to hedge funds in India. Since then, the industry has grown from almost nothing to managing lakhs of crores.

| Period | Average Annualized Return (Approx.) |

|---|---|

| Since Inception (June 2013) | 14.4% |

| Last 10 Years | 11.7% |

| Last 5 Years (Post-COVID) | 22.2% |

| Last 3 Years | 12.3% |

Note: These are average index returns. Top-performing “Long-Only” AIFs have often crossed 20–25% CAGR, while “Long-Short” funds often target 12–15% with much lower volatility than the Nifty.

Read Also: Best Target Maturity Mutual Funds in India to Invest

Understanding the Different Types of Hedge Funds

To understand how these funds work, we can look at the “tools” they use. Not all hedge funds do the same thing. Some are like safe boxes, while others are like racing cars. Let us break them down into simple categories so we can see which one does what.

1. Equity Long-Short Funds

This is the most popular type. When the manager is bullish on any stock, they buy it. This is called going long. At the same time, if they are bearish on stocks this is called going short. If the market goes up, their “Long” stocks make money. If the market crashes, their “Short” position actually makes money. This helps them stay positive even in highly volatile markets.

2. Arbitrage Funds

These are very safe funds, they look for tiny price differences in different markets. For example, if a stock is selling for 100 rupees in the regular market and its future price is Rs.101, they can lock in that 1 rupee profit. It is almost like a risk-free way to earn a little extra money. Arbitrage trading is not a manual human activity anymore. While a human manager oversees the strategy, the actual trading is done by computers.

3. Global Macro Funds

These funds look at the “Big Picture.” They don’t just look at one or two companies. They look at the whole world. They look at things like interest rates, oil prices, and wars. If they think the US dollar will get stronger or gold will go up, they make huge bets on that. George Soros is the most famous manager in this category.

4. Event-Driven Funds

These funds wait for something big to happen in a company. This could be a merger, a takeover, or a big lawsuit. They try to guess how the stock price will change because of this event. It is a bit like being a detective and an investor at the same time.

Advantages of Hedge Funds in India

- Protection from Crashes: The biggest win is that they can protect you when the market is falling. While others are losing money, a good hedge fund might still be in the green.

- High Returns: Over a long time, these funds can give better returns than traditional mutual funds. This is because they have more freedom to move money around.

- Expert Management: These funds are run by the smartest minds in the business. You get access to institutional-level research that normal retail investors don’t see.

- Tax Benefits: The fund pays the taxes before distributing the money to you. This means you don’t have to worry about complicated tax filings every year for every trade.

Risks of Hedge funds in India

- High Entry Cost: You need Rs.1 crore just to enter. That is only suitable for the High net-worth individuals (HNIs).

- Lock-in Periods: You cannot take your money out whenever you want. Many funds ask you to keep your money with them for 3 or even 5 years.

- Leverage Risk: They use borrowed money to increase returns. But if a bet goes wrong, the loss is also much bigger because of that borrowed money.

- Complexity: It is very hard to understand exactly what the manager is doing. You have to trust them completely with your money.

Read Also: Decoding Hedge Funds In India

How the Future Looks for 2030

The future of money in India is changing. By 2030, we expect India to be the third-largest economy in the world. As people get richer, they will want better ways to manage their wealth. Experts believe that the AIF market (which includes hedge funds) could grow to over 500 billion dollars by 2030. This is a massive jump from where we are today.

We are also seeing the rise of GIFT City in Gujarat. This is a special financial zone that makes it very easy for international investors to bring money into India. This will bring more global technology and better strategies to our hedge fund industry. We will also see more use of Artificial Intelligence (AI). AI can look at millions of data points every second to find the best trades.

Another big change will be how we track our money. In the past, you had to wait for a paper statement from your fund manager. Now, with apps like Pocketful, everything is on your phone. You can see your stocks, bonds, and other investments in one place. Even if you are not a Rs.1crore investor yet, these tools help you prepare for that level of wealth. They make the stock market feel less scary and more like a tool for your future.

Conclusion

Hedge funds in India have come a long way since the rules were made in 2012. They are no longer just a “western” concept. They are a real and growing part of the Indian financial story. While they are meant for the wealthy today, the strategies they use are slowly helping the whole market become more mature.

If you are looking at the long term, towards 2030, the outlook is very positive. Our economy is strong, our regulators are smart, and our fund managers are among the best in the world. It does not matter if you are a big investor or not, it is important to know about these funds for your financial investments. They represent the high end of the financial world and show us what is possible with smart planning.

As an investor you should not be afraid of these complex names or big numbers. At the end of the day, it is all about making your money work for you. For financial investments one shall always stay curious, keep learning, and your financial future will be bright.

Frequently Asked Questions (FAQs)

What does a Hedge Fund mean in simple terms?

A hedge fund is a special type of investment where a group of people pool their money and a professional manager uses this money for buying and selling of stocks, bonds, and other financial products. The most important thing is they can bet against the market to protect your money even during a falling market scenario.

What are the benefits of these funds compared to mutual funds?

Freedom is what you get in hedge funds, in mutual funds you stay invested all the time, but a hedge fund can move to cash or bet that the market will go down. This can lead to higher returns and less loss during market crashes.

How can I use a Hedge Fund in my investment plan?

If you have at least 1 crore rupees to spare, you can use a hedge fund to diversify your portfolio. It should usually be a small part of your total wealth. It acts as a safety net for your other investments like direct stocks or property.

Why is the year 2030 important for these funds?

By 2030, India’s economy will be much larger. This means more rich people and more companies to invest in. Experts project that the money in these alternative funds will grow by more than 5 times by then.

Can I invest in a Hedge Fund with a small amount?

Currently, the law says you need a minimum of 1 crore rupees for a SEBI-registered hedge fund (Category III AIF). However, you can use apps like Pocketful to invest in similar themes or “Pockets” of stocks with much smaller amounts to grow your wealth until you reach that 1 crore mark.