Every year before the budget, public discussion revolves around the same question: what new measures will the government introduce this time for both the common man and businesses? The Union Budget 2026 will be presented in Parliament on February 1, 2026 (Sunday) at 11:00 AM. A notable aspect this year is that despite it being a Sunday, the NSE and BSE will remain open for the entire trading day (9:15 AM to 3:30 PM). The indications emerging regarding tax relief, government spending, and various sectors are considered crucial in determining the direction of the upcoming financial year.

Union Budget 2026-27 Expectations

| Area / Sector | Budget 2026 Expectations (As per reports & experts) |

|---|---|

| Income Tax (Middle Class) | The standard deduction is likely to increase to ₹1 lakh, there will be clarity on the basic exemption limit and tax slabs, and tax compliance will be made simpler. |

| Section 87A & Capital Gains | Clear guidelines on the applicability of Section 87A rebate on capital gains. |

| Healthcare & Insurance | Relief from rising hospital costs and health insurance premiums, updating Section 80D limits. |

| Senior Citizens & Long-Term Care | Increased interest income exemption, policy support for assisted living and home-care expenses. |

| Real Estate & Housing | Focus on stability, liquidity and sustainable growth, home loan tax benefits for affordable housing policy continuity |

| Consumer Spending & Rewards | 15–20% growth in discretionary spending (electronics, apparel, auto) after Budget, smarter loyalty & rewards ecosystem |

| Labour Compliance & Power Sector | Simpler labor compliance, predictable inspections, electricity pricing me transparency (market coupling, VPPAs) |

| Technology in Tax Filing | Simplifying application forms, improving pre-filled data, and streamlining the contactless assessment system. |

| Crypto & Digital Assets | Clarity on the tax treatment of crypto profits and losses, and rationalizing loss set-off rules. |

| Retail Investors & Markets | Tax clarity for long-term investing, stable policy direction, harmonisation of capital gains framework |

| NPS & Retirement Savings | Strengthening pension benefits under the new tax regime, and improving retirement readiness for the aging population. |

| Housing Finance & Credit Access | Predictable EMIs, easier credit access for first-time and non-metro buyers. |

| GST & Workplaces | Incentives for GST rationalization, green & energy-efficient offices |

| Tax Administration | Faster refunds, time-bound disposal of appeals, easier compliance |

| Surcharge & High Tax Rates | Rationalization of surcharge to ease the high effective tax rate. |

| New Tax Regime | Stability, fewer changes, focus on ease of compliance rather than new slabs |

| Health Insurance Adequacy | Making insurance coverage adequate to keep up with medical inflation, not just affordable. |

| Freelancers & Gig Workers | Simpler, digital-friendly tax framework for multiple income sources |

| Global Investors | Predictable regulation, lower tax & transaction friction |

| Digital Payments (UPI) | Sustainable funding model, security & infrastructure investment for payment ecosystem |

| Indexation & LTCG Relief | Reconsideration of indexation benefits for real estate, gold, and debt funds. |

| International Credit Card & LRS | Bringing international card spends into LRS framework |

| Microfinance Sector | Stronger KYC norms and borrower protection |

| EVs & Green Energy | Clarity on tax rules of EV & hybrid vehicles, battery & storage incentives |

| Education & Skills | Upskilling programs par GST reduction, AI/ML apprenticeships |

| Defence & Aerospace | Increase in defense capital expenditure, support to drones & space sector |

| Digital Economy & Startups | Plea for electronics and infrastructure, and expansion of DPI (Digital Public Infrastructure) |

| Markets Overall | Instead of big-bang reforms, focus on stability, clarity, and continuity. |

1. Income Tax Expectations: Focus on Middle-Class Relief

- Standard Deduction: The focus is on increasing the standard deduction for salaried taxpayers to ₹1 lakh.

- Basic Exemption Limit: There is talk of aligning the tax-free income limit in the new tax regime to around ₹5-6 lakh.

- Section 80D (Health Insurance): Experts are emphasizing the need to allow health insurance deductions in the new regime as well.

- LTCG Exemption: The agenda includes revising the LTCG exemption limit for small investors to above ₹1.25 lakh.

- Section 87A on Capital Gains: The industry has pointed out the need to clarify the treatment of rebates on capital gains.

- 30% Tax Slab Entry Point: A proposal to shift the threshold for the top tax slab upwards is being discussed for professionals and entrepreneurs.

- Surcharge Rationalization: Rationalizing the surcharge cap to control the high effective tax rate remains a key topic.

2. Old vs New Tax Regime: Policy Clarity Needed

- Coexistence of Both Regimes: The Budget 2026 will clarify whether the Old Tax Regime will continue or if the New Tax Regime will become the primary system.

- Limited Deductions in New Regime: There is discussion about including some essential deductions in the New Tax Regime, such as:

- HRA (House Rent Allowance)

- Home loan interest

- Health insurance (Section 80D)

- NPS contribution

- Senior Citizens Relief: There may be a focus on introducing separate slabs or targeted rebates for senior citizens, especially considering pension and capital gains income.

- Taxpayer Shift Trend: Now, over 72% of taxpayers have opted for the New Tax Regime, which means the government is focusing more on stability and clarity rather than frequent changes.

3. Healthcare & Insurance Expectations

- Medical inflation has reached approximately 11-14%, so the focus in Budget 2026 is expected to be on controlling healthcare costs.

- There is discussion about increasing the health insurance deduction limits under Section 80D to reflect current premium levels and including it in the New Tax Regime.

- The need for clear guidelines on hospital room rent and treatment charges is being emphasized to reduce out-of-pocket expenses for patients.

- The policy focus is shifting from simply making insurance cheaper to ensuring adequate coverage so that major illnesses are fully covered.

- Strengthening group health insurance plans offered by employers through tax incentives is also being considered.

- There is a strong push to recognize assisted living and home-care services for senior citizens as healthcare expenses and to create a separate support framework for them.

4. Senior Citizens & Retirement Planning

- Interest Income Relief: There are reports that the exemption limit on interest income from bank FDs and savings accounts for senior citizens may be increased from ₹50,000 to ₹1,00,000 to help alleviate the pressure of inflation.

- Tax Slabs for Seniors: Discussions are underway regarding separate tax slabs or special rebates for senior citizens to ensure a balanced tax burden on their pensions and fixed incomes.

- NPS Support: The need to strengthen the tax benefits available on NPS contributions under the New Tax Regime is being highlighted to encourage better savings for retirement.

- Long-Term Care & Assisted Living: Emphasis is being placed on providing policy support for assisted living and long-term care insurance, as medical and care expenses are increasing rapidly with age.

- Caregiving Recognition: The need to establish home-care and caregiving services as a structured and recognized profession is being emphasized to ensure reliable care for senior citizens.

5. Real Estate & Housing Finance

- Affordable Housing Limit: Discussions are underway to increase the affordable housing limit in metro cities from ₹45 lakh to ₹65 lakh.

- Home Loan Tax Benefit: There is a focus on increasing the limit for tax deductions on home loan interest to reduce the burden of EMIs.

- REIT & Small Investors: Including REITs under Section 80C could provide small investors with an easier way to invest in real estate.

- Green Buildings: The need for incentives to promote energy-efficient and eco-friendly construction is being highlighted.

- Easy Home Loans: The focus is on making loan access easier for first-time buyers and those in smaller cities, making homeownership more practical.

6. Infrastructure & Capital Expenditure

- Capital Spending: This time, capital expenditure on infrastructure is expected to exceed ₹12 lakh crore.

- Roads & Highways: There is discussion about allocating approximately ₹2.9 lakh crore for road and highway projects.

- Railways: The railways could receive around ₹3 lakh crore, which would include funding for safety systems (Kavach), Vande Bharat, and Amrit Bharat trains.

- Metro & Rapid Rail: The focus is now on expanding Metro and Namo Bharat projects to Tier-2 and Tier-3 cities.

- Ports: New funding is being considered for major ports like Vadhavan and port-linked industrial areas.

7. MSMEs & Small Business Support

- CGTMSE Credit Guarantee Expansion: The focus is on expanding the CGTMSE credit guarantee cover to ensure that small businesses can access loans more easily.

- Quarterly GST Filing: Simplifying the quarterly GST return system for micro-enterprises has been proposed to reduce the compliance burden.

- AI-based Customs Clearance (Up to ₹10 Lakh): The focus is on implementing an AI-based fast customs clearance system for import-export shipments up to ₹10 lakh to save both time and costs.

- 45-Day Payment Rule Enforcement: The need to strictly enforce the 45-day payment rule is being emphasized to ensure timely payments to MSMEs by large buyers.

- Simplified Labour Compliance: The emphasis is on making labour laws and inspections simpler and more predictable so that small businesses can operate without fear.

8. Manufacturing & Make in India 2.0

- Milestone-based Incentives: Instead of providing blanket subsidies to manufacturing companies, the focus is on a policy of offering incentives upon the achievement of production and performance milestones.

- AI & Digital Manufacturing Support: There are proposals to provide tax benefits and subsidies for the adoption of AI, automation, and digital tools in factories.

- MSME Competitiveness Platform: The focus is on launching a national scoring platform to measure the productivity and technological readiness of MSMEs, enabling targeted support.

- Supply Chain & Logistics Efficiency: Attention is being given to improving logistics and supply chain efficiency to make raw material supply, transport, and delivery systems faster and more cost-effective.

9. Agriculture & Rural Development

- NICRA Scheme Expansion: The focus is on expanding the NICRA scheme across the country, aiming to protect approximately 50,000 villages from crop losses caused by climate change.

- AgriStack Digital System: AgriStack aims to provide farmers with easier access to loans and crop insurance by integrating land records and crop data.

- Climate-Resilient Seeds: There are discussions about providing incentives for the adoption of high-yield and climate-resistant seeds.

- Crop Insurance Reforms: The emphasis is on expediting claim settlements by linking crop insurance with digital records.

- Food Security: Steps can be taken to strengthen long-term food security through a new Seeds Bill and modern technologies.

10. Education & Skill Development

- GST Relief on Upskilling: There is a push to reduce the GST on upskilling and reskilling courses from 18% to 5%, making learning more affordable for working professionals and youth.

- AI/ML Apprenticeships: The introduction of AI and ML-related apprenticeship programs in regional languages has been proposed to benefit young people from rural and non-English speaking backgrounds.

- Digital Universities & Online Degrees: The focus is on mainstreaming digital universities and online degree programs to make higher education more accessible.

- Quality-Based Funding: Education funding is being linked to quality, outcomes, and infrastructure rather than solely to enrollment numbers.

11. Defence, Space & Aerospace

- Defence Spending: Defence sector capital spending is set to increase by approximately 20% to boost domestic manufacturing and investment in new equipment.

- Space Sector Support: The space sector may be granted critical infrastructure status, enabling private companies to access cheaper and long-term funding.

- Drones & R&D: Discussions are underway for a separate PLI (Production Linked Incentive) scheme for the drone industry and strengthening R&D funding to develop local technology.

- Aircraft MRO: Tax benefits may be offered to encourage increased investment in aircraft maintenance (MRO), aiming to establish India as a regional MRO hub.

12. Green Energy & Electric Vehicles

- GST Reduction on Battery Energy Storage Systems (BESS) : There is a push to reduce the GST on Battery Energy Storage Systems from 18% to 5% to make it easier and cheaper to integrate renewable energy into the grid.

- Battery Recycling Incentives: Separate incentives and policy support are being considered to promote the recycling infrastructure for EV batteries, thereby reducing dependence on raw materials.

- Focus on Eliminating Inverted Duty Structure: The need to eliminate the inverted duty structure is being emphasized to address the problem of higher GST on inputs and lower GST on outputs for EV manufacturers.

- Changes to PLI Scheme for MSMEs: To make PLI schemes more practical for MSMEs, work may be done on lower investment limits and targeted benefits.

- Clarity in EV Tax Rules: There is a need for clear rules regarding the tax treatment of electric and hybrid vehicles to avoid confusion for both companies and buyers.

13. Digital Economy & Technology

- There are discussions about a ₹10,000 crore PLI (Production Linked Incentive) scheme to boost electronics manufacturing.

- Plans are underway to integrate digital services with healthcare and government services to expedite processes.

- The need to simplify tax rules on ESOPs (Employee Stock Ownership Plans) for startups is being highlighted.

- With the increase in online payments, greater emphasis will be placed on data security.

- Work may be done to simplify and standardize the KYC (Know Your Customer) process.

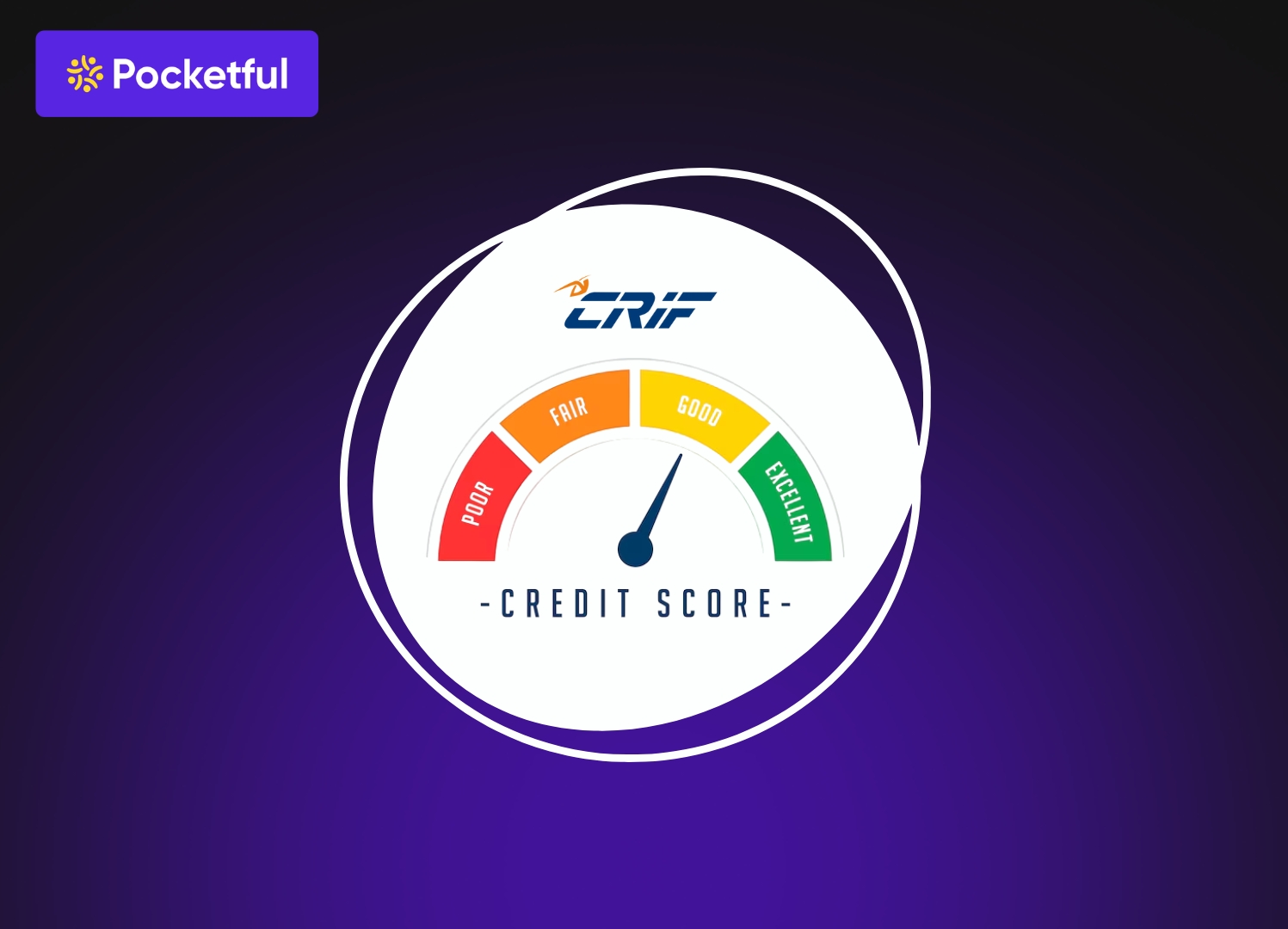

14. Markets, Investors & Capital Gains Policy

- There’s talk of increasing the LTCG (Long-Term Capital Gains) exemption limit.

- The need for simplifying and standardizing capital gains rules is being emphasized.

- The indexation benefit for real estate and gold may be reconsidered.

- Discussions are underway regarding balancing the Securities Transaction Tax (STT).

- There’s a demand for clear guidelines on cryptocurrency tax rules.

Conclusion

The expectations surrounding the Union Budget 2026 indicate that people want clear and practical changes in decisions related to taxes, investments, and everyday expenses. The focus will now be on how well the budget strikes a balance between the needs of the common man and the market, and how it shapes the economic direction for the coming year.

This Union Budget Day, trade intraday with zero brokerage on Pocketful – featuring advanced charts & fundamentals for new-age traders and investors.

Frequently Asked Questions (FAQs)

When will the Union Budget 2026 be presented?

The Union Budget 2026 will be presented on February 1, 2026 (Sunday) at 11:00 AM.

Will the NSE and BSE be open on Budget day 2026?

Yes, since the Budget is on a Sunday, the NSE and BSE will remain open throughout the day (9:15 AM to 3:30 PM).

What are taxpayers expecting from Budget 2026?

Taxpayers are expecting changes in standard deduction, health insurance relief, and capital gains rules.

Which sectors may get priority in Budget 2026?

Infrastructure, healthcare, real estate, MSMEs, green energy, and the digital economy are likely to receive special attention.

Is Budget 2026 likely to help senior citizens?

Senior citizens are likely to receive relief on interest income and increased healthcare support.