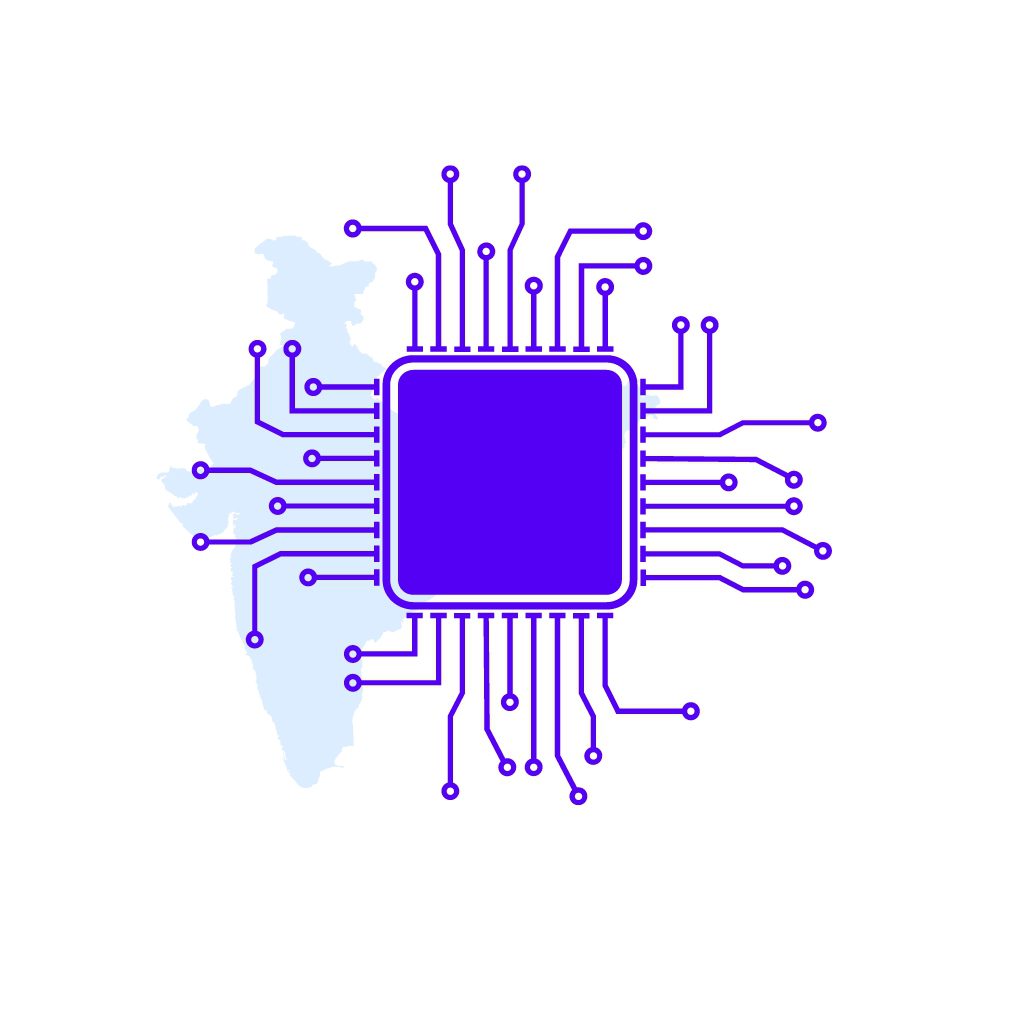

The tiny chips in electronic devices that often go unnoticed are an important part of the contemporary world. Semiconductors are the powerful brains that drive everything from the smartphones in our pockets to the ground-breaking artificial intelligence revolutionizing several industries. With India’s increasing prominence in the global semiconductor industry, it is important to know the steps taken by the Government of India to make India a global hub of the semiconductor industry.

In today’s blog, we will explore the semiconductor industry in India, the India Semiconductor mission, factors that favor the semiconductor industry, and its future outlook.

Overview of the Semiconductor Industry in India

The Indian semiconductor market is experiencing strong growth and is expected to grow at 17.10% CAGR between 2024 and 2028 due to its growing population, rising disposable incomes, etc. India aims to become a global leader in the semiconductor industry, with its domestic semiconductor consumption projected to exceed $80 billion by 2028. This industry is fiercely competitive, with major players from countries like the United States, China, South Korea, and Taiwan dominating the market.

The Indian Government wants to boost the semiconductor industry with the ‘Make in India’ campaign and has also announced plans to establish semiconductor fabrication plants in the country.

India Semiconductor Mission (ISM)

Indian Semiconductor Mission is a specialized and independent business division of Digital India Corporation (DIC). The aim of the mission is to make India self-reliant in terms of semiconductors.

The mission received an allocation of INR 76,000 crore for the establishment of three semiconductor units. The approved three semiconductor units are:

- Semiconductor Fabrication plant: Tata Electronics Private Limited (“TEPL”) will collaborate with Powerchip Semiconductor Manufacturing Corp (PSMC), Taiwan, to set up a semiconductor fabrication unit in Gujarat. PSMC is well known for its logic and memory foundry segments and has six semiconductor foundries in Taiwan. The fabrication plant will have a capacity of 50,000 wafer starts per month (WSPM).

- Semiconductor ATMP unit in Assam: Tata Semiconductor Assembly and Test Pvt Ltd. (“TSAT”) will set up a semiconductor ATMP (Assembly, Test, Marking and Packaging) unit in Assam. The unit is developing indigenous advanced semiconductor packaging technologies and will have a capacity of 48 million semiconductor chips per day.

- Semiconductor ATMP unit for specialized chips: CG Power will partner with Renesas Electronics Corporation, Japan, and Stars Microelectronics, Thailand, to set up a semiconductor unit in Gujarat. Renesas is a market leader in developing specialized chips and operates 12 semiconductor facilities. The unit will have a capacity of 15 million semiconductor chips per day.

The chips developed in the above three units will have applications in various industries, such as electric vehicles, consumer electronics, mobile phones, etc. Moreover, these units will generate 20,000 direct jobs and about 60,000 indirect jobs.

Read Also: Semiconductor Penny Stocks in India with Price List

Favorable Factors for the Semiconductor Industry in India

There are numerous factors that will help India to become a global leader in the semiconductor industry. Some of these factors are:

- Skilled Workforce: India has a large workforce in the fields of Science, Technology, Engineering, and Mathematics (STEM), which is required for semiconductor design, manufacturing, etc.

- Cost Advantage: Companies are investing in India due to the lower cost of production. Moreover, the location of India is also a benefit as it is close to major semiconductor markets in Asia, which reduces transportation costs.

- Global supply chain diversification: Until now, the semiconductor industry has been concentrated in a few countries, which makes the industry prone to concentration risk and can result in supply shocks. The development of the semiconductor industry in India will reduce the concentration risk.

- Government support: The government of India has launched ISM and has introduced favorable policies.

Future Outlook of Semiconductor Industry

The future of the semiconductor industry looks bright due to the following reasons:

- The demand for semiconductors in AI and ML applications is projected to experience substantial growth.

- IoT (Internet of Things) devices, including smartphones, industrial automation, and healthcare, will boost demand for semiconductors.

- The rollout of 5G networks is fuelling the need for advanced semiconductors in mobile devices, base stations, and IoT applications.

- The growth of renewable energy sources, such as solar and wind power, will drive the demand for semiconductors used in energy conversion and storage systems.

Read Also: Best Small Cap Semiconductor Stocks in India

Conclusion

To summarize, the semiconductor industry has a lot of growth potential and is an exciting and dynamic space. The Government of India has identified this opportunity and launched the India Semiconductor Mission to make India a semiconductor hub in the future. Many foreign companies have partnered with Indian firms to set up facilities in India. Moreover, factors such as lower cost of production, skilled workforce, strategic location, and favorable government policies will help the semiconductor industry grow in India.

Frequently Asked Questions (FAQs)

What are Semiconductors?

A semiconductor is a material with electrical conductivity ranging between that of an insulator and a conductor and has unique electronic properties.

What are the favorable factors for the semiconductor industry in India?

Lower cost of production, skilled workforce, and government support are a few factors that support the growth of the semiconductor industry in India.

What is ISM?

ISM refers to the India Semiconductor Mission, which was launched by the Government of India.

What is the expected growth rate of the semiconductor industry in India?

The Indian semiconductor industry is expected to grow at a CAGR of 17.10% between 2024 and 2028.

Which foreign companies are collaborating with Indian firms to establish semiconductor units in India?

Powerchip Semiconductor Manufacturing Corp (PSMC), Renesas Electronics Corporation, and Stars Microelectronics are a few prominent companies collaborating with Indian firms to establish semiconductor manufacturing facilities.