इंट्राडे ट्रेडिंग का मतलब है एक ही दिन के भीतर शेयर को खरीदना और बेचना। इस प्रक्रिया में निवेशक का उद्देश्य होता है दिनभर के उतार-चढ़ाव का फायदा उठाकर मुनाफा कमाना। यानी जो शेयर सुबह खरीदा गया, उसे उसी दिन शाम को बाजार बंद होने से पहले बेच देना होता है।

इस ब्लॉग में हम इंट्राडे ट्रेडिंग के साथ-साथ इसके लाभ, जोखिम और रणनीतियों के बारे में विस्तार से बताएंगे।

इंट्राडे ट्रेडिंग क्या होती है? – Intraday Trading Kya Hoti Hai?

“इंट्राडे” शब्द का मतलब होता है “दिन के अंदर”। यह ट्रेडिंग का वो तरीका है जिसमें लंबी अवधि का इंतज़ार नहीं किया जाता और खरीद और बिक्री एक ही दिन में की जाती है। यहाँ तेजी से फैसले लेना और बाजार की दिशा को समय रहते समझना बेहद जरूरी होता है।

इस तरह की ट्रेडिंग में सफल होने के लिए तकनीकी ज्ञान, चार्ट पढ़ने की क्षमता और सही एंट्री–एग्ज़िट पॉइंट्स की समझ जरूरी होती है। आमतौर पर इसमें मूविंग एवरेज, आर.एस.आई., वॉल्यूम जैसे इंडिकेटर का इस्तेमाल किया जाता है ताकि छोटे-छोटे प्राइस मूवमेंट्स का सही अंदाज़ा लगाया जा सके।

हालाँकि, इंट्राडे ट्रेडिंग में मुनाफे की संभावना होती है, लेकिन साथ ही इसमें जोखिम भी अधिक होता है। इसलिए यह ज़रूरी है कि ठोस स्ट्रैटेजी और रिस्क मैनेजमेंट के बिना इंट्राडे ट्रेडिंग न करें।

यह भी पढ़ें:15 बेस्ट शेयर मार्केट बुक्स हिंदी में | Stock Market Books Hindi

इंट्राडे ट्रेडिंग का एक आसान उदाहरण

एक ट्रेडर सुबह ITC के 150 शेयर ₹320 के भाव पर खरीदता है, इस उम्मीद के साथ कि कीमत बढ़ेगी। जब मार्केट में तेजी आती है और प्राइस ₹335 तक पहुंच जाता है, तो वह अपने सारे शेयर बेच देता है। इस तरह उसे प्रति शेयर ₹15 का लाभ होता है, यानी कुल ₹2,250 का मुनाफा। इसमें से ब्रोकरेज और अन्य चार्जेज़ कम किए जाते हैं।

अगर कीमत नीचे गिरकर ₹310 तक पहुंच जाती है, तो ट्रेडर अपने नुकसान को सीमित करने के लिए तुरंत शेयर बेच सकता है। इस उदाहरण से साफ दिखता है कि इंट्राडे ट्रेडिंग में छोटे-छोटे दामों में होने वाले बदलावों को फटाफट समझकर फैसले लेने पड़ते हैं।

ध्यान रहे, इंट्राडे ट्रेडिंग में सभी ट्रांजैक्शन्स उसी दिन निपटाने होते हैं चाहे मुनाफा हो या नुकसान। साथ ही, मार्जिन के जरिए ट्रेडर को अपने निवेश की तुलना में ज्यादा पैसे से ट्रेड करने का मौका मिलता है, जिससे लाभ तो बढ़ता है लेकिन जोखिम भी। इसलिए सावधानी और समझदारी बहुत जरूरी होती है।

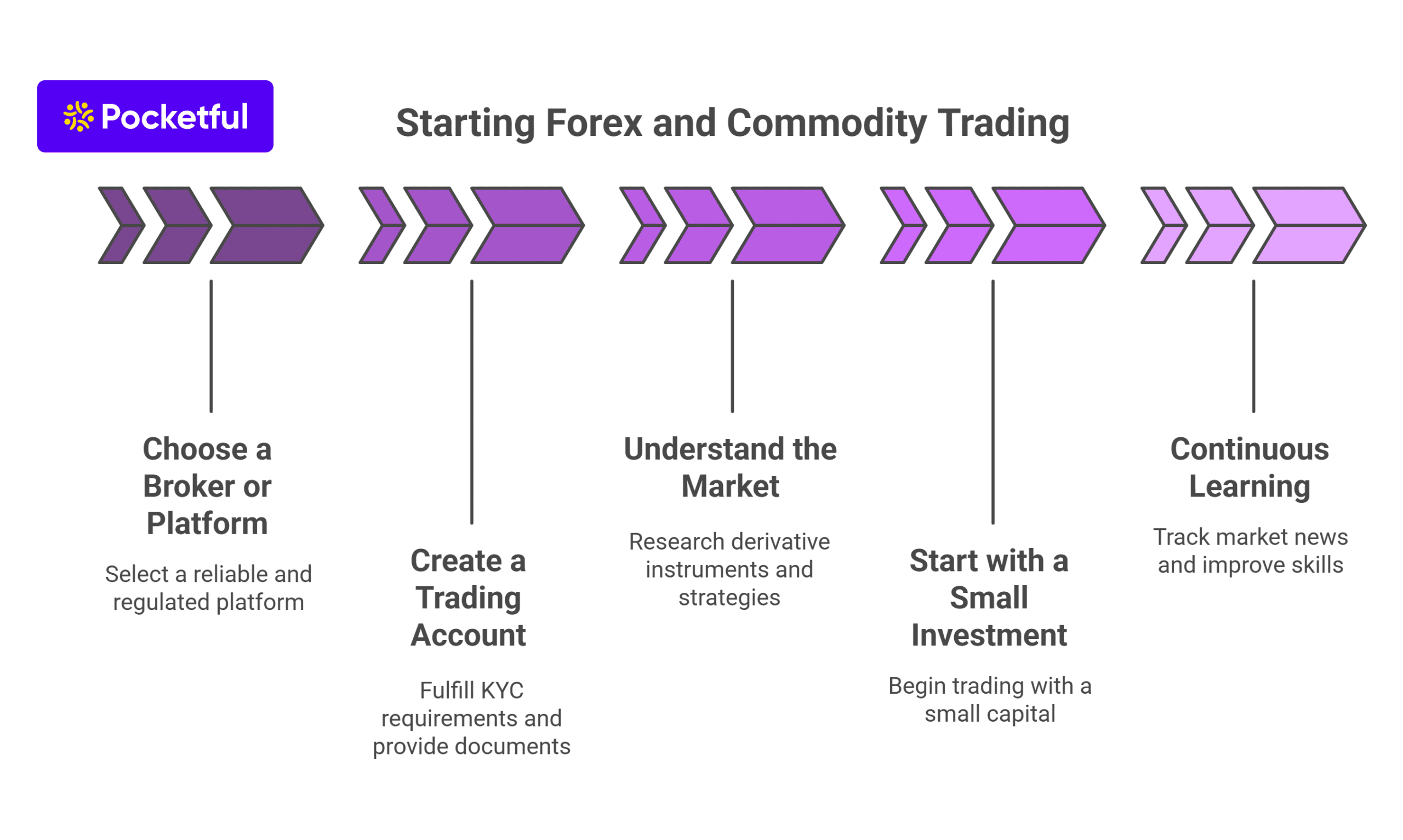

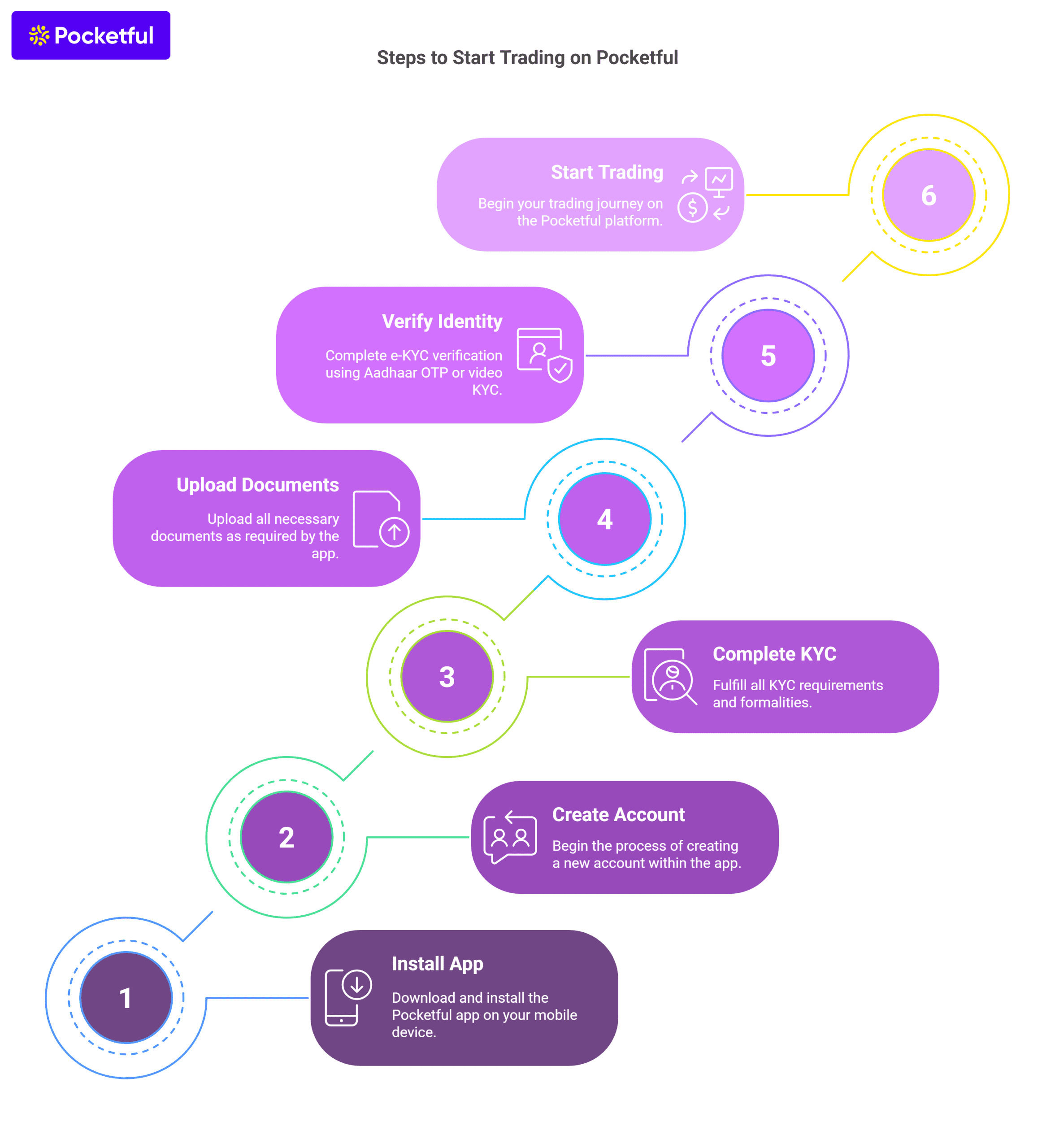

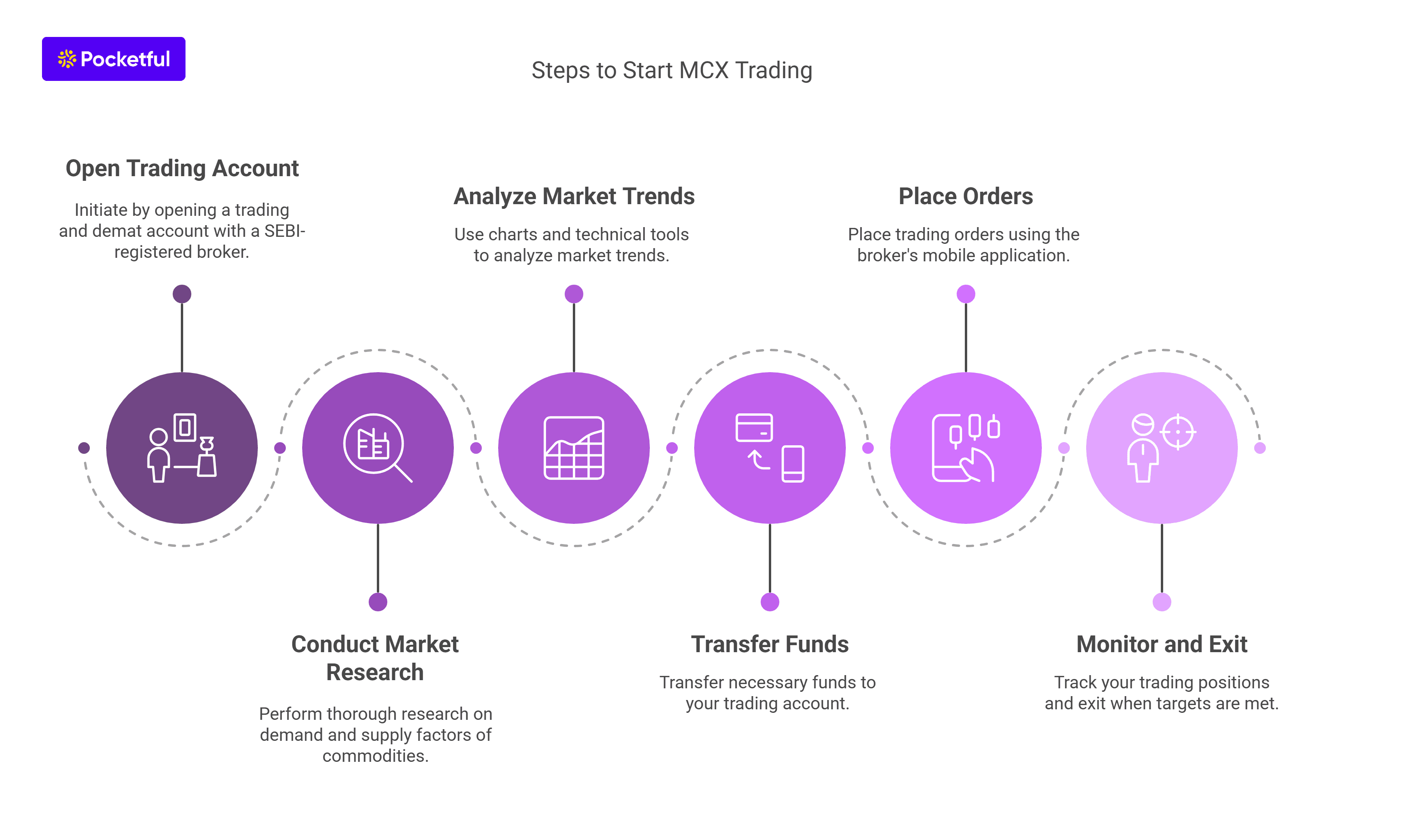

इंट्राडे ट्रेडिंग शुरू करने के आसान कदम

आप नीचे उल्लिखित प्रक्रिया का पालन करके इंट्राडे ट्रेडिंग शुरू कर सकते हैं:

- डीमैट और ट्रेडिंग अकाउंट खोलना : इंट्राडे ट्रेडिंग शुरू करने के लिए सबसे ज़रूरी होता है एक अच्छा डीमैट और ट्रेडिंग अकाउंट खोलना। ऐसा अकाउंट होना चाहिए जिसमें ब्रोकरेज चार्ज कम हों और प्लेटफॉर्म यूजर-फ्रेंडली हो। पॉकेटफुल में ये सारी सुविधाएं मिलती हैं, जिससे मार्केट की हर हलचल पर जल्दी डिसीजन लेना आसान हो जाता है।

- पेपर ट्रेडिंग या डेमो पर प्रैक्टिस करना : असली पैसे से ट्रेडिंग करने से पहले, बिना किसी डर के पेपर ट्रेडिंग या डेमो अकाउंट पर हाथ आज़माना चाहिए। डेमो अकाउंट नए ट्रेडर्स के लिए बढ़िया है क्योंकि इससे मार्केट की चाल समझ में आती है और असली पैसा लगाने से पहले गलतियां कम हो जाती हैं।

- बेसिक चार्ट्स और ट्रेडिंग पैटर्न समझना : मार्केट के ट्रेंड को पकड़ने के लिए चार्ट पढ़ना सीखना जरूरी है। ‘हेड एंड शोल्डर’, ‘डबल टॉप’, ‘ट्रेंडलाइन ब्रेक’ जैसे बेसिक पैटर्न को समझना Pocketful के ट्रेडिंग टूल्स से आसान होता है, जिससे सही टाइम पर ट्रेड करना संभव हो जाता है।

इंट्राडे ट्रेडिंग के लिए सही समय का चयन

भारतीय शेयर मार्केट रोजाना सुबह 9:15 बजे खुलता है और शाम 3:30 बजे बंद हो जाता है।

- इंट्राडे ट्रेडिंग के लिए सुबह का टाइम : सुबह 9:15 से 10:30 तक का वक्त सबसे ज़्यादा एक्टिव होता है। इस दौरान मार्केट में बड़ी तेजी से कीमतें ऊपर-नीचे होती हैं, जिससे प्रॉफिट के अच्छे मौके मिलते हैं।

- दोपहर का टाइम : लगभग 11 बजे से दोपहर 2:30 तक बाजार में उतनी हलचल नहीं होती। इस वजह से ट्रेडिंग भी थोड़ी धीमी हो जाती है।

- शाम के आखिरी घंटे : दोपहर 2:30 से 3:30 बजे तक ट्रेडर्स अपने दिन के पोजीशन्स को बंद करने लगते हैं, इसलिए मार्केट फिर से एक्टिव हो जाता है।

- इंट्राडे ट्रेडिंग का एक जरूरी नियम : दिन भर की ट्रेडिंग में जो भी पोजीशन्स लिए जाते हैं, उन्हें दोपहर 3:30 बजे से पहले क्लोज़ करना जरूरी होता है, ताकि कोई ओपन पोजीशन अगले दिन के लिए न रह जाए।

इंट्राडे ट्रेडिंग में लगने वाले शुल्क और खर्चे

इंट्राडे ट्रेडिंग करते समय सिर्फ प्राइस मूवमेंट पर ही ध्यान नहीं देना होता, बल्कि हर ट्रांज़ैक्शन पर लगने वाले चार्जेस भी प्रॉफिट या लॉस को प्रभावित करते हैं।

- ब्रोकरेज चार्ज: यह हर ब्रोकर का अपना होता है। कुछ ब्रोकर्स फ्लैट ₹20 प्रति ट्रेड लेते हैं, तो कुछ ट्रेड वैल्यू का एक छोटा प्रतिशत काटते हैं।

- STT (सिक्योरिटीज ट्रांसैक्शन टैक्स): सिर्फ सेल साइड पर लगता है और इंट्राडे के लिए इसकी दर 0.025% होती है।

- एक्सचेंज ट्रांजैक्शन चार्ज: यह चार्ज NSE या BSE के हिसाब से अलग-अलग होता है।

- GST (गुड्स और सर्विसेज टैक्स): ब्रोकरेज और एक्सचेंज चार्जेस पर 18% की दर से लागू होता है।

- SEBI चार्ज और स्टैम्प ड्यूटी: ये मामूली होते हैं, लेकिन हर ऑर्डर पर लागू होते हैं।

अगर दिन में कई बार ट्रेडिंग की जा रही हो (जैसे हाई-फ्रिक्वेंसी ट्रेडिंग में होता है), तो यह सारे खर्च मिलकर कुल प्रॉफिट को काफी कम कर सकते हैं। इसलिए सिर्फ प्राइस पर नहीं, इन चार्जेस पर भी नजर रखना ज़रूरी होता है।

यह भी पढ़ें: भारत में टॉप 10 सबसे अधिक देने वाले डिविडेंड यील्ड स्टॉक

इंट्राडे ट्रेडिंग बनाम डिलीवरी ट्रेडिंग: क्या है बेहतर?

| मापदंड | इंट्राडे ट्रेडिंग | डिलीवरी ट्रेडिंग |

|---|---|---|

| समय सीमा | एक ही दिन में खरीदना और बेचना होता है | शेयर खरीदे जाते हैं और लंबे समय तक रखे जाते हैं |

| रिस्क लेवल | हाई रिस्क, लेकिन जल्दी मुनाफा कमाने का मौका | लो रिस्क, लेकिन मुनाफा धीरे-धीरे आता है |

| ब्रोकरेज चार्ज | अधिक हो सकते हैं, क्योंकि बार-बार ट्रांजैक्शन होते हैं। | अपेक्षाकृत कम, क्योंकि ट्रेड कम बार होते हैं। |

| फोकस | प्राइस की छोटी-छोटी मूवमेंट्स पर निगरानी ज़रूरी | कंपनी के फंडामेंटल और ग्रोथ पर फोकस रहता है |

| टाइम और ध्यान की जरूरत | दिनभर एक्टिव रहना पड़ता है, टाइम इन्वेस्टमेंट ज्यादा है | कम निगरानी में भी मैनेज किया जा सकता है |

| इन्वेस्टमेंट स्ट्रैटेजी | शॉर्ट-टर्म मूवमेंट्स से फायदा उठाना | लॉन्ग टर्म ग्रोथ और वेल्थ बिल्डिंग पर फोकस |

| लिक्विडिटी | बहुत हाई, दिन में कई बार एंट्री-एग्ज़िट संभव | कम, क्योंकि लंबे समय तक होल्ड करना होता है |

| किसके लिए बेहतर? | जिनके पास समय है, रिस्क झेल सकते हैं और मार्केट की समझ रखते हैं | जो लॉन्ग टर्म निवेश में भरोसा रखते हैं और स्थिरता पसंद करते हैं |

इंट्राडे ट्रेडिंग के लिए उपयोगी संकेतक

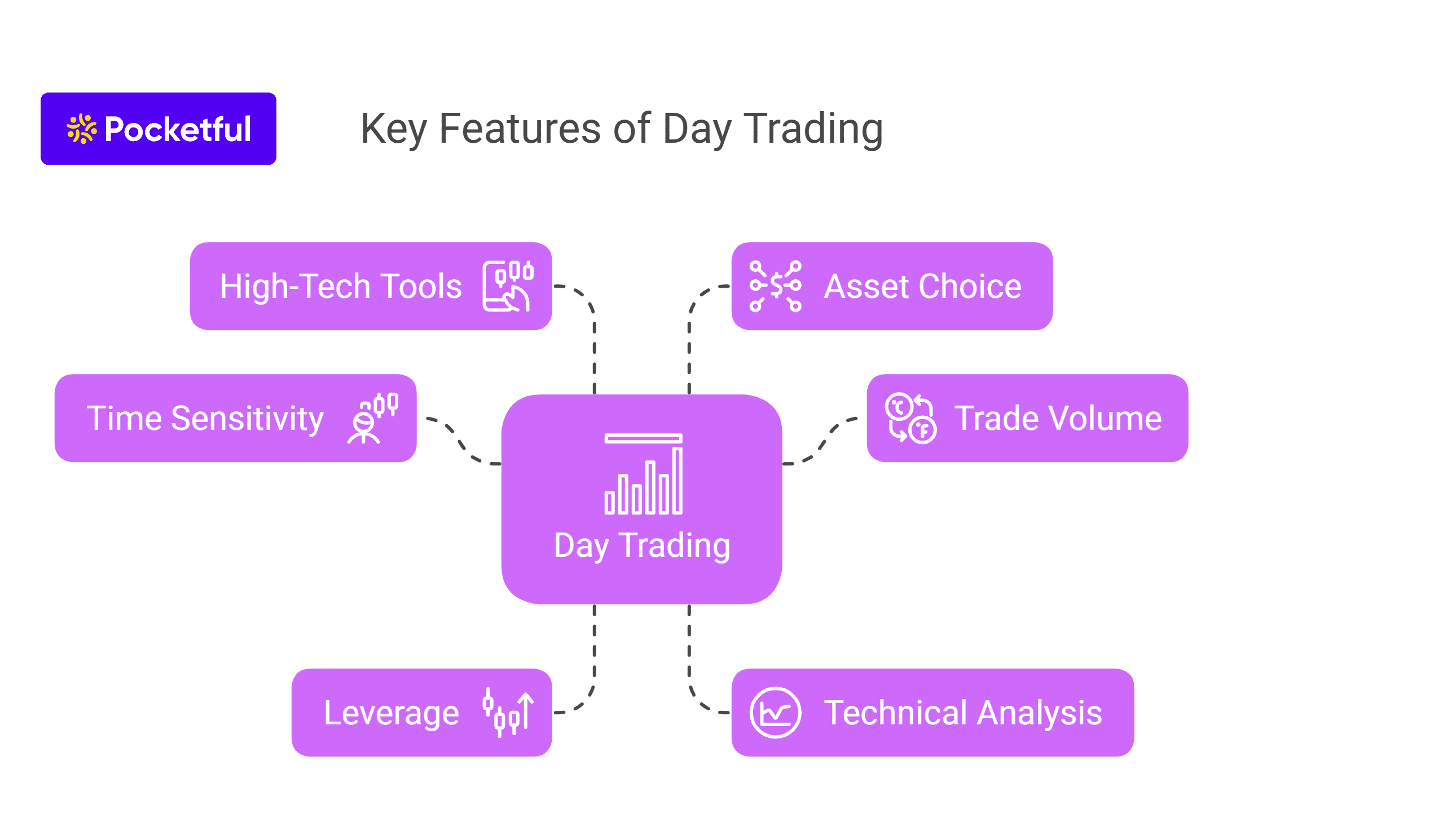

इंट्राडे ट्रेडिंग में सही समय पर एंट्री और एग्ज़िट लेना ही गेम बदलता है। इसके लिए टेक्निकल चार्ट्स पढ़ना जितना ज़रूरी है, उतना ही जरूरी है कुछ खास संकेतकों (Indicators) को समझना। ये संकेतक मार्केट के मूवमेंट को पकड़ने में मदद करते हैं।

- मूविंग एवरेज : यह संकेतक पिछले कुछ समय की औसत कीमत दिखाता है। यह यह बताने में मदद करता है कि स्टॉक ऊपर की दिशा में है या नीचे जा रहा है। खासतौर पर 20-Day या 50-Day मूविंग एवरेज इंट्राडे में काफी उपयोगी होते हैं।

- रिलेटिव स्ट्रेंथ इंडेक्स : RSI यह बताता है कि कोई स्टॉक ओवरबॉट है या ओवरसोल्ड। इसका उपयोग करके यह समझा जा सकता है कि अब कीमत में रुकावट आएगी या फिर कोई नया ट्रेंड शुरू हो सकता है।

- बोलिंजर बैंड्स : यह इंडिकेटर वोलैटिलिटी को पकड़ने में मदद करता है। जब प्राइस बैंड से बाहर जाता है, तो संभावित ब्रेकआउट या रिवर्सल का इशारा मिलता है।

- वॉल्यूम वेटेड एवरेज प्राइस : VWAP बताता है कि दिनभर में शेयर का औसत मूल्य वॉल्यूम के साथ क्या रहा। यह संकेत करता है कि प्राइस अभी सस्ता है या महंगा।

- एमएसीडी (MACD) : MACD इंडिकेटर दो मूविंग एवरेज के बीच का अंतर दिखाता है और मार्केट में ट्रेंड की ताकत समझने में मदद करता है।

इन संकेतकों का इस्तेमाल अकेले नहीं, बल्कि एक-दूसरे के साथ मिलाकर करना ज्यादा सटीक परिणाम देता है।

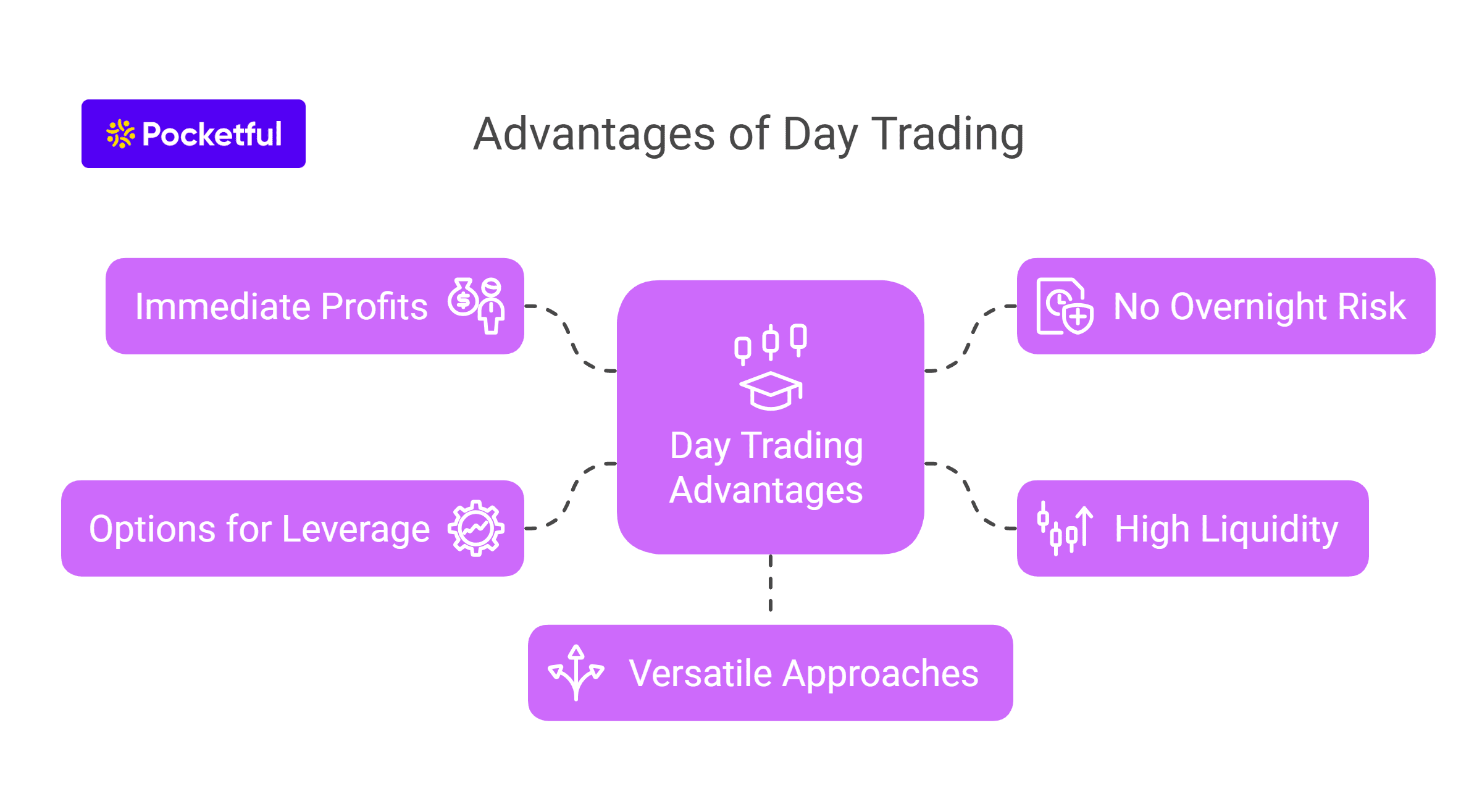

इंट्राडे ट्रेडिंग के मुख्य फायदे

इंट्राडे ट्रेडिंग के नीचे सूचीबद्ध कई लाभ हैं:

- इंट्राडे ट्रेडिंग उन लोगों के लिए फायदेमंद है जो हर दिन बाजार की चाल पर नज़र रखते हैं और तेज़ फैसले लेने में माहिर हैं।

- कम पूंजी में शुरुआत संभव : मार्जिन की सुविधा से ट्रेडर कम पूंजी में भी बड़े सौदे कर सकते हैं। यानी ₹10,000 के निवेश से भी ₹50,000 तक की पोज़िशन ली जा सकती है।

- तेज़ मुनाफे की संभावना : दिनभर के छोटे उतार-चढ़ाव को पकड़कर कुछ ही घंटों में मुनाफा कमाया जा सकता है। यह लंबी अवधि की ट्रेडिंग के मुकाबले तेज़ रिटर्न देने वाला तरीका है।

- लिक्विडिटी का फायदा : ज्यादातर इंट्राडे ट्रेडिंग लिक्विड स्टॉक्स में होती है, जिनमें खरीदने और बेचने में देर नहीं लगती। इससे ट्रेडिंग का फ्लो बना रहता है और एग्ज़िट आसान होता है।

- ओवरनाइट रिस्क नहीं होता : क्योंकि सभी पोज़िशन उसी दिन बंद करनी होती हैं, इसलिए किसी खबर या घटना जिसकी घोषणा बाजार समय के बाद की जाती है उसका असर ट्रेड पर नहीं पड़ता।

- कम ट्रांजैक्शन शुल्क : डिलीवरी के मुकाबले इंट्राडे में ब्रोकरेज और अन्य चार्जेज कम होते हैं, जिससे नेट प्रॉफिट बढ़ सकता है।

इंट्राडे ट्रेडिंग में शामिल जोखिम

इंट्राडे ट्रेडिंग जितनी तेज़ मुनाफा दिला सकती है, उतनी ही तेज़ नुकसान भी करा सकती है खासकर तब, जब निर्णय जल्दबाज़ी में लिए जाते है।

- तेज़ उतार-चढ़ाव से नुकसान का खतरा : मार्किट में पलभर में ट्रेंड बदल सकता है। अगर ट्रेंड के उलट पोज़िशन ली गई हो, तो बड़ा नुकसान हो सकता है।

- भावनाओं पर नियंत्रण न होना : जल्द मुनाफा कमाने के चक्कर में कई बार लोग डर या लालच में गलत फैसले ले लेते हैं, जिससे लगातार घाटा हो सकता है।

- ओवर ट्रेडिंग की आदत : हर छोटे मूवमेंट पर बार-बार ट्रेड करना, बिना स्पष्ट सेटअप के, पूंजी को धीरे-धीरे खत्म कर सकता है।

- समय और स्क्रीन पर फोकस की मांग : इंट्राडे में हर मिनट की चाल मायने रखती है। थोड़ी भी चूक या ध्यान भटकना, गलत एंट्री या लेट एग्ज़िट का कारण बन सकता है।

- ज़्यादा ट्रांजैक्शन शुल्क : इंट्राडे में ब्रोकरेज और अन्य चार्जेज ज़्यादा होते हैं, जिससे नेट प्रॉफिट कम हो सकता है।

इंट्राडे ट्रेडिंग में मुनाफा है, लेकिन इसके साथ अनुशासन, अनुभव और ठंडे दिमाग की भी ज़रूरत होती है।

इंट्राडे ट्रेडिंग के लिए असरदार रणनीतियाँ

इंट्राडे में सफल होने के लिए चार्ट्स को पढ़ना जितना ज़रूरी है, उतना ही ज़रूरी है सही तकनीकों को समय पर इस्तेमाल करना। नीचे कुछ प्रमुख रणनीतियाँ दी गई हैं, जो ट्रेडिंग में प्रॉफिट दिला सकती हैं:

- ब्रेकआउट ट्रेडिंग : यदि कोई स्टॉक लंबे समय तक एक दायरे में ट्रेड कर रहा हो और अचानक सपोर्ट या रेसिस्टेंस लेवल को पार कर जाए, तो उस क्षण एंट्री ली जाती है। इसमें बाजार की दिशा में आने वाली नई चाल का फायदा उठाने की कोशिश होती है।

- स्कैल्पिंग : यह हाई-फ्रीक्वेंसी रणनीति है, जहां मिनटों में दर्जनों ट्रेड लिए जाते हैं। इसमें उद्देश्य होता है हर छोटे प्राइस मूवमेंट से सीमित लेकिन लगातार मुनाफा कमाना। यह स्ट्रेटेजी तेज़ फैसले और सटीक एग्ज़ीक्यूशन की मांग करती है।

- रिवर्सल ट्रेडिंग : जब किसी शेयर की प्रॉफिट बार-बार एक निश्चित रेंज में घूम रही हो, तब ट्रेंड पलटने के संकेतों को पहचानकर उल्टी दिशा में ट्रेड करना इस स्ट्रेटेजी का मूल है। इसमें जोखिम थोड़ा ज़्यादा हो सकता है, लेकिन अनुभव के साथ इसकी सफलता की संभावना भी बेहतर होती है।

हर रणनीति की सफलता निर्भर करती है बाज़ार की स्थिति, अनुभव और अनुशासन पर। बिना विश्लेषण के ट्रेड करना एक रणनीति नहीं, बल्कि एक जोखिम है।

अधिक जानें – पेनी स्टॉक्स क्या हैं? निवेश के लाभ, जोखिम, और सर्वश्रेष्ठ स्टॉक सूची

इंट्राडे ट्रेडिंग और कर का गणित

आपको इंट्राडे ट्रेडिंग के कर निहितार्थों के बारे में पता होना चाहिए, जैसे कि:

- इंट्राडे ट्रेडिंग से होने वाला लाभ भारत में व्यावसायिक आय माना जाता है। इसका मतलब यह है कि इस आय पर कुल वार्षिक इनकम के अनुसार सामान्य टैक्स स्लैब के तहत टैक्स देना होता है।

- ट्रेडिंग में खर्च किए गए सारे खर्चे जैसे ब्रोकरेज फीस, सिक्योरिटी ट्रांजैक्शन टैक्स (STT), और अन्य लेनदेन शुल्क आय से घटाए जा सकते हैं। इससे टैक्स देयता कम हो जाती है।

- अगर ट्रेडिंग में नुकसान होता है, तो उस नुकसान को उसी वित्तीय वर्ष की अन्य व्यावसायिक आय से सेट ऑफ किया जा सकता है। यदि पूरे वर्ष नुकसान होता है, तो इसे अगले आठ सालों तक आगे भी बढ़ाया जा सकता है, ताकि भविष्य में मुनाफे से सेट ऑफ किया जा सके।

- टैक्स नियम समय-समय पर बदलते रहते हैं, इसलिए सही टैक्स प्लानिंग के लिए किसी प्रमाणित चार्टर्ड अकाउंटेंट या टैक्स सलाहकार से सलाह लेना आवश्यक है। इससे न केवल टैक्स की सही गणना होगी, बल्कि ट्रैडिंग पर फोकस भी बना रहेगा।

इंट्राडे ट्रेडिंग का सारांश

इंट्राडे ट्रेडिंग में दिन के अंदर ही शेयर खरीदने और बेचने का काम होता है, जिससे जल्दी मुनाफा कमाने का मौका मिलता है। हालांकि, यह काम धैर्य, समझदारी और सही रणनीति के बिना जोखिम भरा हो सकता है। जो ट्रेडर्स मार्केट की तेजी से बदलती परिस्थितियों को समझकर तेजी से फैसले लेते हैं, वे इस क्षेत्र में सफलता पा सकते हैं।

सही शुरुआत के लिए जरूरी है कि मार्केट की बेसिक जानकारी, चार्ट्स, और ट्रेडिंग टूल्स की समझ हो। जोखिम को कम करने के लिए स्टॉप लॉस का इस्तेमाल करें और बिना योजना के ट्रेड न करें। धैर्य और अनुशासन के साथ अभ्यास करते हुए अनुभव हासिल करें।

इस तरह, इंट्राडे ट्रेडिंग में उचित तैयारी और सही मनोबल से अच्छा मुनाफा संभव है, लेकिन बिना तैयारी के नुकसान भी हो सकता है। इसलिए हमेशा सीखने की प्रक्रिया जारी रखें और जिम्मेदारी से ट्रेडिंग करें।

इंट्राडे ट्रेडिंग से जुड़े सवाल और उनके जवाब (FAQs)

इंट्राडे ट्रेडिंग में ट्रेड कितने बजे तक बंद करना होता है?

सभी पोजिशन 3:30 PM तक बंद करनी होती हैं।

क्या इंट्राडे ट्रेडिंग से रोज़ाना कमाई की जा सकती है?

हाँ, लेकिन इसमें रिस्क होता है और मार्केट की अच्छी समझ जरूरी है।

इंट्राडे और डिलीवरी ट्रेडिंग में क्या अंतर है?

इंट्राडे में शेयर उसी दिन बेचना होता है, डिलीवरी में शेयर होल्ड किए जाते हैं।

क्या इंट्राडे ट्रेडिंग टैक्सेबल होती है?

हाँ, इसे स्पेकुलेटिव बिज़नेस इनकम माना जाता है और टैक्स स्लैब के अनुसार टैक्स लगता है।

नए ट्रेडर्स के लिए कौन-सी रणनीति बेहतर है?

ब्रेकआउट और ट्रेंड फॉलोइंग जैसी सिंपल स्ट्रेटेजीज़ से शुरुआत करना बेहतर है।

क्या स्टॉप लॉस ज़रूरी है?

हाँ, ये बड़े नुकसान से बचाने में मदद करता है।