As important as it is to choose the right mutual fund in the market, it is equally important to know who is managing that fund. In 2025, there are many fund managers whose wisdom and experience have consistently brought good profits to investors.

In this blog, we will know about those top fund managers of India, due to whom the trust of many investors remains intact.

Who is a Fund Manager?

A fund manager is a professional who manages the investments of a mutual fund. That is, he decides how to invest your money. His aim is to get you better returns and manage the risk simultaneously. A fund manager does many important tasks, as listed below:

- Portfolio management: Decides in which companies to invest and how much money to invest in which sector.

- Market analysis: Analyzes the trends of the stock market, economic data and the performance of the company.

- Risk control: Keeps the direction of investment such that the chances of loss in the long term are less.

A good fund manager can move your capital in the right direction. His strategy, research and experience can improve your returns manifold. On the other hand, if the decision is wrong, then even a good fund can perform poorly.

Before investing in a mutual fund, don’t just look at the return graph, but also know who is managing that fund. Understanding the fund manager’s past performance and investment philosophy is the mark of a smart investor.

Top 10 Fund Managers in India 2026

| Fund Manager | AMC | AUM (in ₹ crores) | Schemes Managed | Experience |

|---|---|---|---|---|

| Sankaran Naren | ICICI Prudential Mutual Fund | 6,74,085 | 23 | 26 years |

| R. Srinivasan | SBI Mutual Fund | 1,14,343 | 14 | 30 years |

| Shreyash Devalkar | Axis Mutual Fund | 1,16,687 | 6 | 14 years |

| Jinesh Gopani | Taksh Asset Management | Undisclosed | Undisclosed | 20 years |

| Harsha Upadhyaya | Kotak Mahindra Mutual Fund | 2,01,344 | 14 | 20 years |

| Sohini Andani | Ex-SBI Mutual fund | 74,657 | 2 | 23 years |

| Manish Gunwani | Bandhan MF | 35,683 | 7 | 25 years |

| Aniruddha Naha | PGIM AMC | 19,777 | 4 | 22 years |

| Chandraprakash Padiyar | Tata Mutual Fund | 23,149 | 3 | 25 years |

| Ankit Agarwal | UTI Mutual Fund | 17,903 | 3 | 17 years |

- AUM = Assets Under Management, which shows the total investment of their funds.

- Schemes Managed includes information on how many schemes they are managing.

Overview of the Top 1o Fund Managers in India

An overview of the top 10 fund managers in India is given below:

1. Sankaran Naren

Serving as CIO at ICICI Prudential since February 2011, Naren joined the AMC in October 2004 and has been active in the financial sector for nearly 26 years so far.

AUM and Schemes : Naren is currently managing 23 mutual funds with a total AUM of around ₹6.74 lakh crore This figure puts ICICI Prudential AMC among the top AMCs in the country.

Key schemes : He manages several leading equity and hybrid funds – such as Multi‑Asset Fund, Value Discovery Fund and Equity & Debt Fund .

Understanding risk-management : Naren also explains that with a large AUM, even a small mistake can lead to huge losses.

Why are they the best?

| Reason | Description |

|---|---|

| Experienced and Strategic | 26+ years of experience, Educated from IIT Chennai and IIM Kolkata |

| Experience of managing a Large AUM | Efficiently managing an AUM of over ₹6.7 lakh crore |

| Balanced Approach | Pays attention to risk and valuation along with returns |

2. R. Srinivasan

R.Srinivasan joined SBI Mutual Fund in May 2009, and has been serving as CIO Equity for a long time now. He has over 30 years of experience in finance and equity investments.

AUM and Schemes : They manage SBI’s flagship equity and hybrid schemes such as SBI Small Cap Fund, Focused Equity Fund, and Equity Hybrid Fund. The total AUM of these funds was around ₹1,14,343 crore as of July 2025.

Performance of key schemes : SBI Small Cap Fund has delivered returns of around 19–21% CAGR over the last 10 years, and has topped the list with around 21.9% CAGR over the last seven years, reflecting its robust strategy.

Investment Strategy and Approach : Srinivasan believes in bottom-up stock selection emphasizing on the quality and valuation of individual companies. He adopts an investment approach based on a quantitative model, forensic accounting, etc. which keeps his portfolio balanced and diversified.

Why are they the best?

| Reason | Description |

|---|---|

| Fund Outperformance | SBI Small Cap Fund has consistently given 19-21% CAGR and 7 year performance of above 21.9% |

| Decisions based on in-depth research | Stocks are selected using data and model based analysis |

| Core‑Satellite Approach | Allocates a significant portion of portfolio to stable, long-term investments and smaller portion to high-growth investments, effectively balancing risk and returns. |

3. Shreyash Devalkar

Shreyash Devalkar is the head of equities at Axis Mutual Fund since August 2023 and has been associated with the company as a senior fund manager since November 2016. He started at JP Morgan as a credit analyst in 2004 and then worked for IDFC securities and BNP paribas, now with 16+ years of investment experience.

AUM and Schemes : Devalkar manages a total of 6 schemes with a total AUM of around ₹1.16 lakh crore as of July 2025

Performance of key schemes : Axis Growth Opportunities Fund has given around 20.35% CAGR in the last 3 years, while Mid Cap Fund has a 3-year AUM of ₹26,079 crore; both have ranked better than category average.

Investment strategy and approach : Devalkar relies on thematic- and bottom-up stock selection. He has identified 10 key themes such as auto, pharma, renewables in H1–2025 and focuses on finding value in industrial manufacturing

Why are they the best?

| Reason | Description |

|---|---|

| Theme-Driven Strategies | Actively investing in upcoming sector themes (manufacturing, pharma, IT) |

| Fund performance | Funds like Axis Growth Opportunities give 20%+ CAGR |

| Experience | Consistent track record from BNP Paribas to Axis over 15+ years |

4. Jinesh Gopani

Jinesh Gopani started Taksh Asset Management Private Limited in Jan 2024 and was previously employed at Axis Mutual Fund since 2009 as a senior fund manager and later on as Head of Equities. Prior to this, he also worked with Birla Sun Life AMC and Voyager India Capital, which gave him a deep understanding of the equity market.

AUM and Schemes : AUM of his company is not publicly disclosed as it is a private company. At Axis, he managed an AUM of $14 billion and his investments returned 35% CAGR in the last three years and 42% CAGR since its inception in 2009.

Key Schemes Managed at Axis: At Axis, he managed Axis Growth Opportunities Fund, Axis Focus 25 Fund, Axis ESG Fund, etc.

Investment Philosophy and Strategy : Gopani follows a ‘quality at reasonable price’ approach, where both quantitative analysis and qualitative team insights are valued. He has adopted a diversified approach, giving importance to thematic stock selection and global allocation.

Why are they the best?

| Reason | Description |

|---|---|

| Impressive Returns | 42% CAGR since inception at Axis. |

| Quality-based selection | Focus on ROE/ROCE, cash flow and management pedigree |

| Theme + Global Approach | International diversification with thematic picks |

5. Harsha Upadhyaya

Harsha Upadhyaya serves as Chief Investment Officer – Equity at Kotak Mahindra AMC. He has held research and management roles at UTI, DSP BlackRock and Reliance and now has nearly 20+ years of investment experience.

AUM and Schemes : Harsha currently manages around 14 major equity/hybrid schemes including Kotak Flexi Cap Fund , Multicap Fund , ELSS Tax Saver, etc.

Performance of key schemes : Kotak Flexi Cap Fund was ranked third in the flexi‑cap category with ₹17,943 crore AUM at the start of 2025 and has delivered a CAGR of 27.5% over the last three years.

Investment Strategy and Approach : Harsha uses bottom‑up research and quantitative modelling. He adopts a highly diversified approach along with thematic investing (Manufacture in India), maintaining a balance of growth‑oriented and value‑based schemes in his portfolio

Why are they the best?

| Reason | Description |

|---|---|

| Strong AUM | He manages 14 mutual fund schemes and has a total AUM of ₹2,01,344 crores |

| Outstanding performance | Consistent outperformance in Flexicap and Multicap categories |

| Data‑Based Decisions | Balanced portfolio using quant models and thematic investing |

6. Sohini Andani

Sohini Andani joined SBI Mutual Fund as Head of Research in October 2007, and has been working as Portfolio Manager since May 2010. Her total investment experience spans around 23 years. She recently stepped down from the role in April 2024.

AUM and Schemes : She managed SBI Bluechip Fund and SBI Magnum Midcap Fund, with an AUM of ₹43,355 crores and ₹16,459 crores respectively.

Performance of Key Schemes : SBI Bluechip Fund has delivered around 15.4–15.5% annualised return over the last 10 years. SBI Magnum Midcap Fund has delivered 22.2% CAGR over the last 3 years, which is better than the category average.

Investment approach and strategy : Her focus was on companies with a long-term growth potential, strong management, and good promoter holding . She picks stocks that are not capital-intensive and show systematic growth over time.

Why are they the best?

| Reason | Description |

|---|---|

| Strong AUM | ₹43k Cr+ in Bluechip, ₹16k Cr+ AUM managed in Midcap |

| Performance | Two great funds with 15%+ and 22%+ CAGR |

| Smart Selection | Balance between growth and value, focus on promoter holding and capital intensity |

7. Manish Gunwani

He is currently employed in Bandhan mutual fund as Head of Equities and has previously worked as CIO (Equities) at Nippon India Mutual Fund since September 2017, but resigned from the position in January 2023. His total experience in the equity sector spans nearly 25 years, including the role of senior fund manager at ICICI Prudential AMC .

AUM and Schemes : Gunwani handles around 4 mutual fund schemes namely Bandhan Focused Equity Fund, Bandhan Flexi Cap, Bandhan Innovation Fund, etc. Their collective AUM was around ₹35,000 crore as of July 2025.

Performance of key schemes : Bandhan Emerging Businesses Fund Direct Growth and Bandhan Core Equity Fund Direct Growth gave a CAGR of 35.8% and 29% in the last three years respectively.

Investment strategy and approach : Gunwani believes in ‘growth at a reasonable price’ style. He keeps the portfolio risk balanced through bottom-up stock picking and flexible asset allocation.

Why are they the best?

| Reason | Description |

|---|---|

| Emphasis on quality | Growth at reasonable price to balance returns and risk |

| Large AUM and diversified schemes | ₹35k Cr+ AUM across 7 schemes |

| Strong track record | CAGR of 14.3% in Growth Fund vs 12.7% of category |

8. Aniruddha Naha

Aniruddha Naha serves as a CIO of Alternatives at PGIM India and joined the company as a Senior Fund Manager in 2018. He has nearly 22 years of experience in both equity and debt markets.

AUM and Schemes : As a Senior Fund manager and head of equities, Naha oversaw 4 flagship mutual fund schemes with a combined AUM of around ₹20,000 crores.

Performance of key schemes : Midcap Opportunities Fund has shown 19% (3Y) and 15.6% (5Y) CAGR under his leadership, while its benchmark was around 13% Balanced Advantage Fund has given around 8% CAGR returns, and aims to provide equity-like returns with low volatility .

Investment Strategy and Approach : Naha is a proponent of the GARP (Growth at Reasonable Price) approach as he picks businesses that have strong cash flows, healthy balance sheets, and modest valuations. He does bottom-up stock selection and controls downside risk with a core-satellite allocation.

Why are they the best?

| Reason | Description |

|---|---|

| Strong Midcap Performance | Better returns than benchmark with 15–19% CAGR over 3–5 years |

| Process-driven selection | GARP + Cash-flow oriented Systematic Research |

| Downside Protection | Controlling volatility through diversification |

9. Chandraprakash Padiyar

Chandraprakash Padiyar joined Tata Asset Management in September 2018 as a Senior Fund Manager. Prior to this, he has worked with UTI Mutual Fund and Alchemy Capital his total experience is around 25 years, which includes in-depth research and portfolio management.

AUM and Schemes : He handles flagship schemes like Tata Small Cap Fund, Tata Large & Mid Cap Fund, and Tata Aggressive Hybrid Equity Fund.

Performance of key schemes : Tata Small Cap Fund has consistently delivered high growth since September 2018, weathering market fluctuations.

Investment philosophy and strategy : Padiyar emphasises on ‘growth with free cash flow’ ; his focus is on companies that have strong balance sheets and are relatively undervalued. He maintains a narrow focus and pays equal attention to liquidity management.

Why are they the best?

| Reason | Description |

|---|---|

| Small‑Cap Specialization | Maintained small-cap exposure with liquidity control for a small cap mutual fund scheme with an AUM of ₹10,000+ crore AUM |

| Long term consistency | Balance between growth and stability even across market cycles |

| Selection based on strong fundamentals | Priority given to businesses with free cash flow and low valuation |

10. Ankit Agarwal

Ankit Agarwal is the Fund Manager for Equity Funds at UTI Mutual Fund since August 2019. He holds a PGDM from IIM Bangalore, and has worked with prestigious organizations like Lehman Brothers, Barclays Wealth, BNP Paribas, and Centrum Capital his total experience is about 17 years.

AUM and Schemes : Agarwal manages UTI Mid Cap Fund and UTI Small Cap Fund and UTI Innovation Fund. The combined AUM of his schemes is over ₹15,500 crore with the Mid Cap Fund alone reaching ₹10,900 crore .

Performance of key schemes : UTI Mid Cap Fund has generated around 24.37% (3Y) returns under his leadership and UTI Small Cap Fund has generated around 26.32% (3Y) returns.

Investment approach and strategy : Agarwal believes in bottom-up stock selection and prioritises aspects such as innovation and scalability. His Innovation Fund focuses on backing disruptive businesses, while Small/Mid Cap focuses on turnaround investment opportunities.

Why are they the best?

| Reason | Description |

|---|---|

| Effective approach | Achieving returns with a focus on companies experiencing a turnaround and focussing on innovation |

| Strong AUM | Leading schemes with AUM above ₹17,000 crores |

Read Also: What is Asset Under Management (AUM) in Mutual Funds

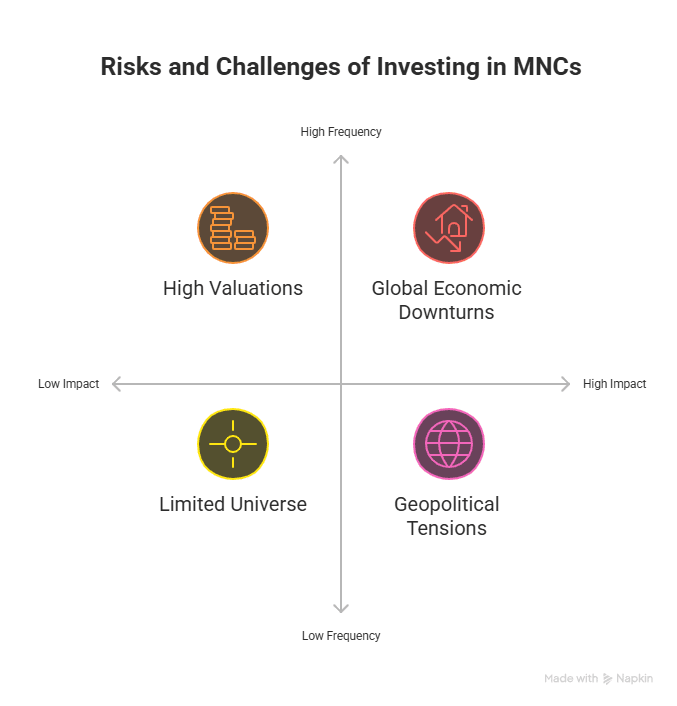

How to Choose the Right Fund Manager as an Investor?

You can choose the right fund manager for yourself based on the points mentioned below:

- Check the track record of the fund manager : The past performance of any fund manager gives a glimpse of his/her strategy and investment style. See what kind of returns he/she has given in the last 5–10 years—not just in good times, but also how he handled the portfolio during economic downturns. Consistent performance is a characteristic of a reliable fund manager.

- Fund managers’ investment strategy matches your Financial goals: Every fund manager has a specific investment philosophy—like value investing, growth, thematic or multi-cap approach. You should choose the manager whose strategy matches your financial goals and risk profile.

- AMC and research support : A good fund manager can be successful only if he gets the support of a strong AMC and research team. Big AMCs like HDFC, SBI, Kotak, Axis and UTI also have strong research infrastructure and risk management teams.

- Open and transparent communication style : Does the fund manager provide regular updates to investors on his strategy and market positioning? This is a sign of transparency and accountability.

Read Also: What Is The Difference Between Large Cap, Mid Cap, And Small Cap Funds?

Conclusion

The foundation of a successful investment is not just selecting the right fund, but also the right fund manager. His experience, way of thinking and ability to understand the market can directly affect your returns. Therefore, before investing in any scheme, it is good to assess the rating of the mutual fund scheme and the past performance and investment approach of that fund manager. Remember, a good fund manager can turn your financial goals into reality in the long run. It is advised to consult a financial advisor before investing in any mutual funds.

Frequently Asked Questions (FAQs)

Who is the best mutual fund manager in India right now?

Sankaran Naren, R. Srinivasan and Shreyash Devalkar are counted among the top fund managers in 2025.

How to evaluate a fund manager’s performance?

Assess the funds based on their long-term returns, consistency, and performance in market downturns.

Does a fund manager really impact mutual fund returns?

Yes, the investment strategy and experience of the fund manager directly impacts the fund’s returns.

Should beginners consider fund managers while investing?

Of course, choosing the right fund manager before investing can lead to better and stable returns.

Can the same fund perform differently under a new manager?

Yes, the new manager’s investment philosophy and style can change the fund’s performance.