IPO provides you with an opportunity to invest in companies which are going public for the first time. Nowadays, IPO applications can be made online using UPI. But while applying for an IPO, you need to enter a bid price within the price range offered by the company. Now the question arises: at which price one should place their bid?

In this blog post, we will explain to you what a cut-off price is and how selecting the correct cut-off price can increase your chances of getting an IPO allotment.

What is the Cut-Off Price in an IPO?

A cut-off price is the final price at which the shares are allotted to the investor during the IPO. During the subscription period of the IPO, the company announces a price band at which investors can place bids. The lead managers play an important role in deciding the cut-off price of an IPO, which is determined based on the weighted average figure of all the bids received during the IPO subscription and it is the final issue price for the IPO.

Investors who bid at or above the cut-off price are considered eligible for allotment of shares. Whereas investors who bid below the cut-off price are deemed ineligible for IPO shares, i.e. their IPO applications are rejected and their money is refunded.

Example of Cut-off Price

Let’s understand the cut-off price with a real-time example of the LIC (Life Insurance Corporation of India) IPO, which was one of the largest IPO in India.

- IPO Subscription date was from 4th May 2022 to 9th May 2022.

- Price Band: ₹902 – ₹949 per share

- Total Issue Size: 21,008.48 crores.

The cut-off price is the final issue price of the IPO at which the shares are allotted to the investors. Remember, those who are applying below the cut-off price will not be allotted any shares.

- On the Listing Date, the shares of LIC were listed at ₹872 on NSE, which was a discount to the price band’s lower price, which means investors made a loss on the listing date.

Read Also: How to Apply for an IPO Under the HNI Category?

How to Apply at the Cut-off Price?

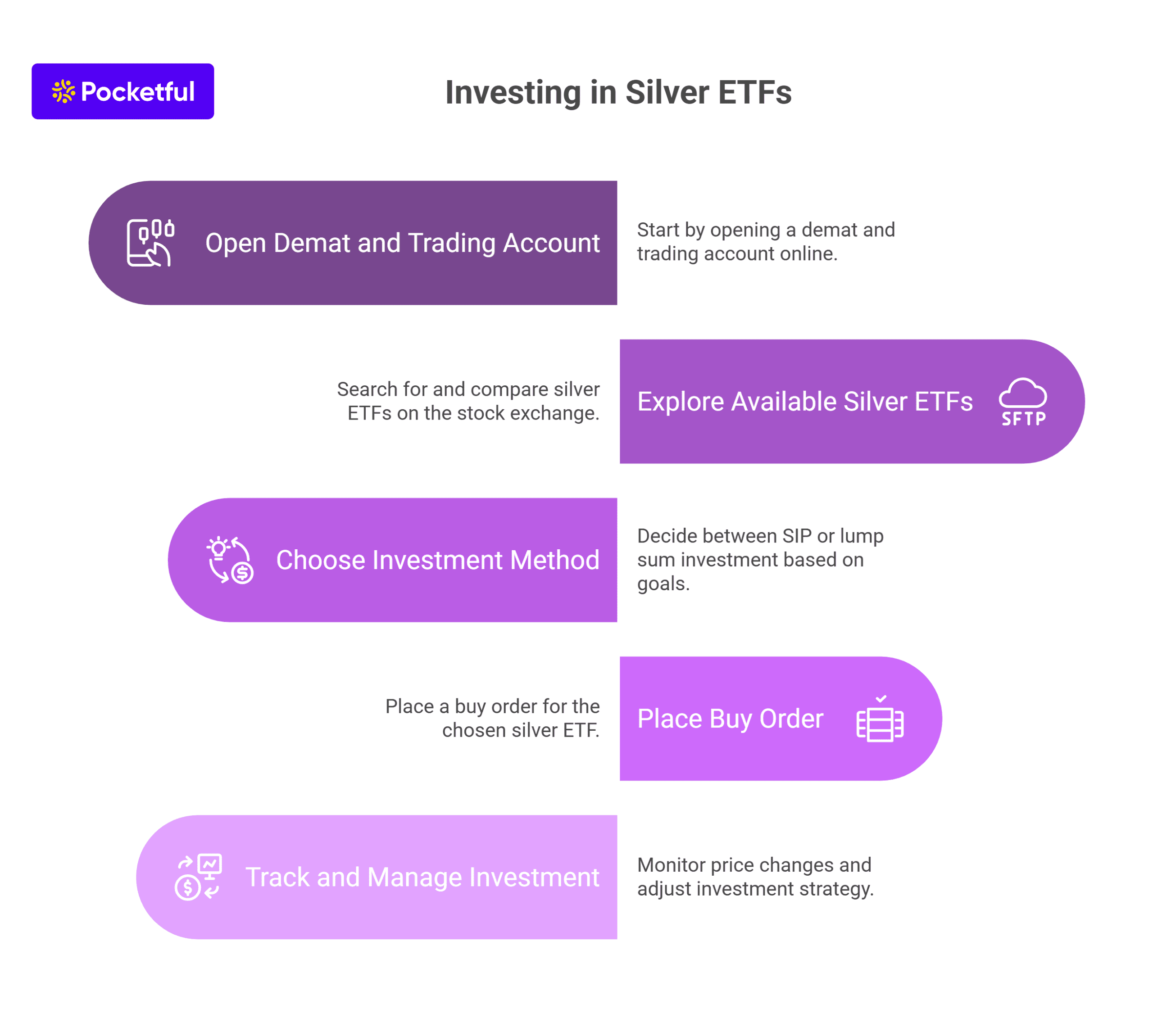

You can easily apply for an IPO at the cut-off price be following the steps below:

- Log in to your trading account and find the IPO section.

- Select the IPO you want and choose the cut-off price option when entering your bid price.

- Enter the number of lots you wish to apply for (each lot has a fixed number of shares).

- Funds equal to the maximum price in the price band multiplied with the number of shares applied for will be blocked in your bank account via ASBA.

- After the IPO closes, you pay the final cut-off price per share if the shares get allotted to you. However, if the shares are not allotted then the blocked amount will be refunded automatically.

Applying at the cut-off price simplifies the process and improves your chances of allotment.

Read Also: Apply in IPO Through ASBA- IPO Application Method

Factors Impacting Cut-off Price

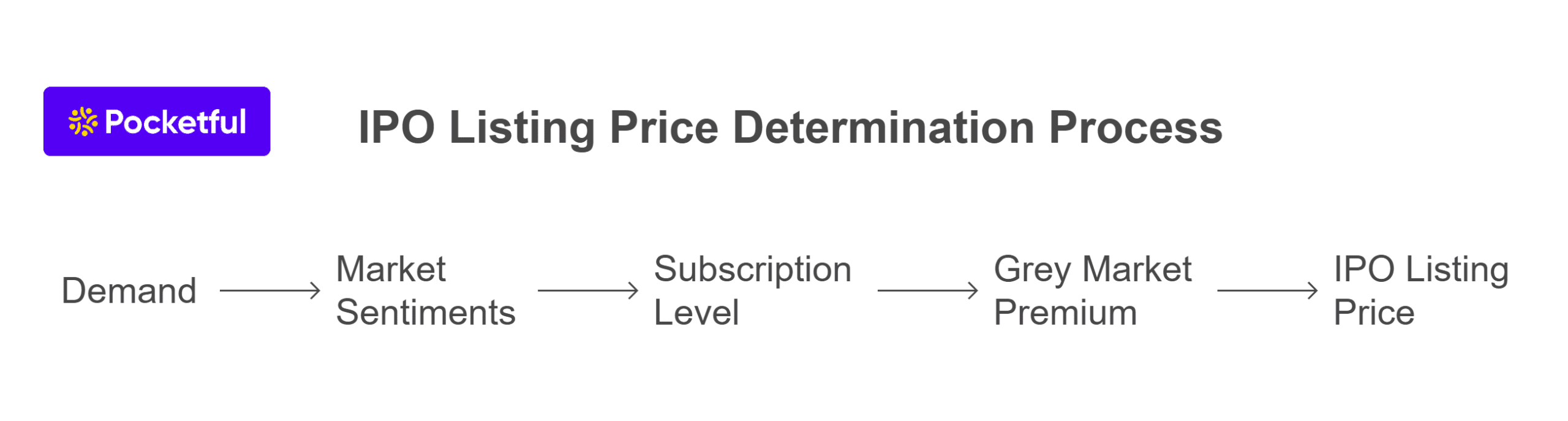

The factors which affect the cut-off price are as follows:

- Demand: IPO demand plays an important role in determining the cut-off price. If the demand is on the higher side, the cut-off price will be at the upper price band.

- Market Sentiments: If the market sentiments are negative, the investors are more likely to place a bid below the upper price band, which can reduce the cut-off price.

- Comparison: To evaluate the IPO valuation, investors compare the company’s valuation with its listed peers and decide the bidding price accordingly.

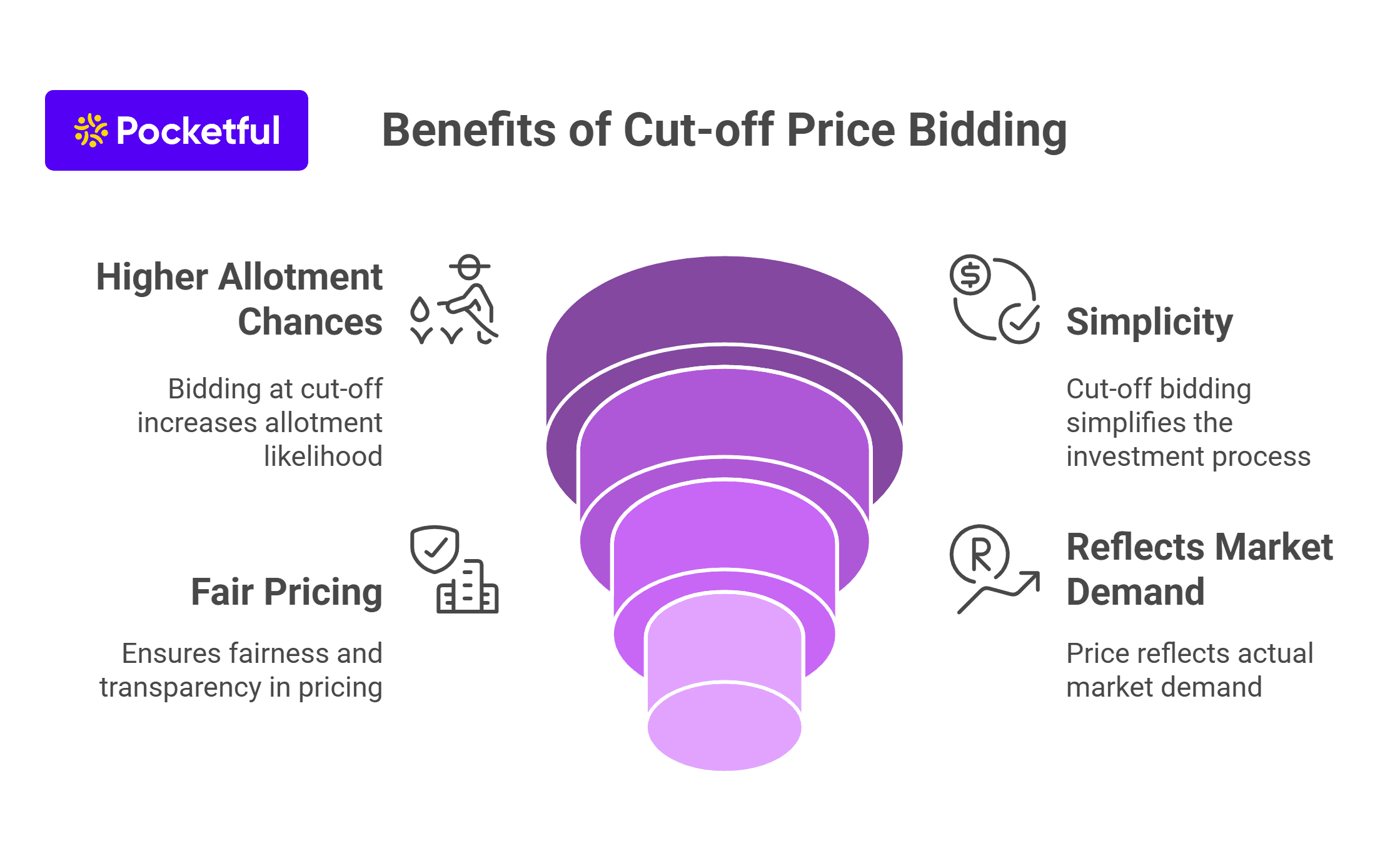

Benefits of Bidding at the Cut-off Price

The significant benefits of investing at the cut-off price are as follows:

- Higher Chances of Allotment: Bidding at the cut-off price increases your chances of allotment, as you are agreeing to purchase the shares at the final price decided after considering all the bids received for the IPO.

- Simplicity: The investors who want to give themselves the best chance to receive an allotment can opt to apply at the cut-off price.

- Fair Pricing: The investors who bid at a cut-off price or above it ensure the fairness and transparency in the bidding and allotment process.

- Reflects Market Demand: The cut-off price calculated considering all the received IPO bids is based on market demand-driven approach. Hence, it provides a balance between company valuation and the interest of investors.

Limitations of Bidding at Cut-off Price

There are a few limitations which investors should be aware of:

1. High Price: If you have applied at the cut-off price, then you will be agreeing to pay whatever the final issue price is within the price band. In that case, you might have to pay more than what you have intended.

2. Does not Guarantee Allotment: Bidding at the cut-off price increases your chance of allotment; however, it does not provide any guarantee for the same. If the IPO is oversubscribed, the allotment will be done through a lottery system.

3. Loss on Listing: If the shares are listed below cut-off price, it can cause immediate loss to the investor.

Should I select the cut-off price for the IPO?

As a retail investor, you must apply at the cut-off price to increase your chances of allotment, as applying at a cut-off price, you are agreeing to pay the final allotment price within the price band determined considering all the bids.

If in case you applied at a price below the cut-off price then your IPO application will be rejected and you will not get any allotment.

However, if you are an experienced investor and are able to evaluate the financial performance of a company and determine the actual price at which the shares can be allotted, then you can place your bid accordingly.

Read Also: What is the Book-Building Process in an IPO?

Conclusion

On a concluding note, the cut-off price plays an important role in IPO applications. Cut-off price helps an investor maximize his or her chances of getting an allotment. Cut-off price is important for retail applicants, who may not be able to accurately determine a company’s valuation. However, it is advisable to consult your financial advisor before bidding for any IPO.

To bid for an IPO, you need to open a Demat and trading account, which can be opened online free of cost through the Pocketful website. Pocketful also provides an advanced trading platform equipped with advanced trading tools.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Anchor Investors in IPOs – Meaning, Role & Benefits |

| 2 | How to Cancel an IPO Application? |

| 3 | Why Invest in an IPO and its Benefits? |

| 4 | What is Face Value in an IPO? |

| 5 | What is NII in IPO? |

Frequently Asked Questions (FAQS)

What is the meaning of price band in an IPO?

A price band is a price range within which an investor can bid for an IPO.

Does bidding at the cut-off price guarantee to get an allotment?

No, bidding at a cut-off price only increases your chance of getting an allotment. However, if the IPO is oversubscribed, the allotment will be based on a lottery basis.

How is the cut-off price decided?

The cut-off price is determined by the lead managers and is based on the weighted average of all the bids received during the IPO subscription period.

Is it mandatory to bid at a cut-off price?

No, it is not mandatory to bid at a cut-off price, as you can place your bid at any price between the price band.

What is the maximum amount for which an investor can apply for an IPO under the retail category?

As per SEBI, an investor can apply for IPO under the retail investor category for a maximum of ₹2,00,000 worth of shares.