शेयर मार्केट एक ऐसा फील्ड है जहाँ सही नॉलेज और स्ट्रेटेजी से ही सक्सेस मिलती है। यहां हर दिन कुछ नया होता है, इसलिए अपडेटेड रहना और समझदारी से फैसले लेना बेहद जरूरी है। किताबें न सिर्फ बेसिक कॉन्सेप्ट्स क्लियर करती हैं, बल्कि लॉन्ग टर्म थिंकिंग, रिस्क मैनेजमेंट और इन्वेस्टर माइंड सेट भी बिल्ड करती हैं। खासकर बिगिनर्स के लिए बुक्स एक ठोस आधार देती हैं। इंग्लिश में तो बहुत किताबें है, लेकिन हिंदी में अच्छी क्वालिटी के रिसोर्सेज कम हैं। इसलिए ये किताबों की लिस्ट उन लोगों के लिए है जो हिंदी में शेयर मार्केट को समझना चाहते हैं ।

टॉप 15 शेयर मार्केट बुक्स की लिस्ट – Best Stock Market Book in Hindi

| क्रम | किताब का नाम | लेखक | किसके लिए उपयोगी | टॉपिक |

|---|---|---|---|---|

| 1 | द इंटेलिजेंट इन्वेस्टर | बेंजामिन ग्राहम | एडवांस | वैल्यू इन्वेस्टिंग |

| 2 | वन अप ऑन वॉल स्ट्रीट | पीटर लिंच | इंटरमीडिएट | स्टॉक पिकिंग |

| 3 | कॉफी कैन इन्वेस्टिंग | सौरभ मुखर्जी | बिगिनर | लॉन्ग टर्म इन्वेस्टिंग |

| 4 | इनवेस्टोनॉमी | प्रांजल कामरा | बिगिनर | भारतीय मार्केट की बेसिक जानकारी |

| 5 | द साइकोलॉजी ऑफ मनी (Hindi) | मॉर्गन हॉसल | आल लेवल्स | फाइनेंस बिहेवियर |

| 6 | रिच डैड पुअर डैड | रॉबर्ट कियोसाकी | बिगिनर | फाइनेंशियल एजुकेशन |

| 7 | द वॉरेन बफेट वे | रॉबर्ट जी. हैगस्ट्रॉम | एडवांस | इन्वेस्टमेंट फिलॉसफी |

| 8 | रेमिनिसेंसेस ऑफ़ स्टॉक ऑपरेटर | एडविन लेफ़ेवर | इंटरमीडिएट | ट्रेडिंग साइकोलॉजी |

| 9 | बेसिक्स ऑफ़ स्टॉक मार्किट। कम्पलीट गाइड फॉर स्टॉक बिगिनर्स | अरविन्द अरोड़ा | बिगिनर | स्टॉक मार्किट बेसिक्स |

| 10 | ऑप्शन ट्रेडिंग से पैसे का पेड़ कैसे लगाएं | एम.सी. कौशिक | इंटरमीडिएट | ऑप्शन ट्रेडिंग |

| 11 | ट्रेडनिती | युवराज कलशेट्टी | इंटरमीडिएट | ट्रेडिंग स्ट्रैटेजी |

| 12 | कैसे स्टॉक मार्केट में निवेश करें | सीएनबीसी आवाज़ | बिगिनर | रिटेल इन्वेस्टमेंट |

| 13 | बुल्स, बेयर्स और अदर बीस्ट्स | संतोष नायर | इंटरमीडिएट | इंडियन मार्किट स्टोरीज |

| 14 | स्टॉक्स टू रिचेस | पराग पारिख | आल लेवल्स | बिहेवियरल इन्वेस्टिंग |

| 15 | द धंधो इन्वेस्टर | मोहनीश पब्बराई | इंटरमीडिएट | लो रिस्क वैल्यू इन्वेस्टिंग |

यह भी पढ़ें: 10 भारत के सबसे महंगे शेयर– प्राइस और रिटर्न

यह लिस्ट हर उस रीडर के लिए है जो हिंदी में सीखना चाहता है लेकिन कॉन्सेप्ट्स को डीप और सही तरीके से समझना भी चाहता है।

1. द इंटेलिजेंट इन्वेस्टर

वैल्यू इन्वेस्टिंग को समझने के लिए इसे सबसे ऑथेंटिक और इम्पैक्टफुल किताब माना जाता है। Benjamin Graham ने समझाया है कि कैसे एक इन्वेस्टर को स्टॉक मार्केट में इमोशनल डिसीजन लेने से बचना चाहिए और हमेशा इंट्रिंसिक वैल्यू पर फोकस करना चाहिए। लॉन्ग-टर्म वेल्थ क्रिएट करने के लिए डिसिप्लिन, पेशंस और सही समय पर एक्शन लेना सबसे ज़रूरी है। मार्केट के शॉर्ट-टर्म अप्स एंड डाउन्स से डिस्ट्रैक्ट हुए बिना कन्सिस्टेंट इन्वेस्टिंग ही सफलता की कुंजी है।

मुख्य सीखें :

- इंट्रिंसिक वैल्यू से कम पर स्टॉक्स खरीदना चाहिए।

- मार्केट के इमोशनल स्विंग्स से दूर रहना चाहिए।

- इन्वेस्टिंग में डिसिप्लिन और पेशंस ज़रूरी है।

2. वन अप ऑन वॉल स्ट्रीट

पीटर लिंच की ये किताब बताती है कि आम लोग भी मार्केट में अच्छा परफॉर्म कर सकते हैं अगर वो खुद की रिसर्च करें और अपने आसपास के प्रोडक्ट्स, सर्विसेज़ और ट्रेंड्स पर ध्यान दें। Lynch का फोकस बॉटम-अप अप्रोच और सिंपल बिज़नेस पर रहता है। उन्होंने एक्सप्लेन किया है कि रीटेल इन्वेस्टर्स कैसे अर्ली-स्टेज में मल्टीबैगर स्टॉक्स पकड़ सकते हैं। यह किताब स्टॉक सिलेक्शन में एक प्रैक्टिकल और रिलेटेबल अप्रोच देती है।

मुख्य सीखें :

- रोज़मर्रा की ज़िंदगी से इन्वेस्टमेंट आइडियाज़ मिल सकते हैं।

- कॉम्प्लेक्स बिज़नेस से ज़्यादा फायदा सिंपल बिज़नेस में होता है।

- रिसर्च और ऑब्ज़र्वेशन से अच्छी अपॉर्च्युनिटीज़ मिलती हैं।

3. कॉफी कैन इन्वेस्टिंग

लॉन्ग-टर्म इन्वेस्टिंग को सिंपल और इफेक्टिव तरीके से समझाने वाली ये बुक बताती है कि कैसे हाई-क्वालिटी स्टॉक्स में इन्वेस्ट करके वेल्थ क्रिएट की जा सकती है। Saurabh Mukherjea ने 10 साल से ज़्यादा कन्सिस्टेंट परफॉर्मेंस देने वाली कंपनीज़ को फिल्टर करने की मेथड एक्सप्लेन की है। इस अप्रोच में लो चर्न, पेशंस और डेटा-ड्रिवन सिलेक्शन पर फोकस होता है। बिगिनर से लेकर सीरियस इन्वेस्टर्स तक सभी के लिए ये एक लॉन्ग-टर्म माइंडसेट बिल्ड करने वाली किताब है। मार्केट के अप्स एंड डाउन्स को इग्नोर करके कम्पाउंडिंग कैप्चर करना इसका मेन मैसेज है।

मुख्य सीखें :

- क्वालिटी बिज़नेस में लॉन्ग-टर्म होल्ड करो।

- फ्रिक्वेंट ट्रेडिंग से रिटर्न्स कम होते हैं।

- कन्सिस्टेंसी, परफॉर्मेंस और डेटा एनालिसिस ज़रूरी है।

4. इनवेस्टोनॉमी

इन्वेस्टोनॉमी खासकर बिगिनर्स के लिए है जो इन्वेस्टिंग की जर्नी शुरू करना चाहते हैं। प्रांजल कामरा ने इस किताब में स्टॉक्स, म्यूचुअल फंड्स, रिस्क मैनेजमेंट और इन्वेस्टर साइकोलॉजी जैसे टॉपिक्स को रिलेलेटेबल एग्जाम्पल्स से एक्सप्लेन किया है। हिंदी भाषा में लिखी गई ये किताब कॉम्प्लेक्स फाइनेंशियल कॉन्सेप्ट्स को भी आसान तरीके से समझाने में सफल है। स्टेप-बाय-स्टेप गाइड की तरह स्ट्रक्चर्ड ये बुक लॉन्ग-टर्म इन्वेस्टिंग में डिसिप्लिन और क्लैरिटी लाती है।

मुख्य सीखें :

- इन्वेस्टमेंट से पहले नॉलेज ज़रूरी है।

- स्टॉक मार्केट में पेशंस और कन्सिस्टेंसी से सफलता मिलती है।

- रिस्क और रिटर्न को समझकर प्लान करना चाहिए।

5. द साइकोलॉजी ऑफ मनी

यह किताब बताती है कि पैसा सिर्फ नंबर्स का गेम नहीं, बल्कि बिहेवियर का सब्जेक्ट है। मॉर्गन हॉसल ने बताया कि कैसे इंसान का एटीट्यूड, डिसीजन और माइंडसेट उसकी फाइनेंशियल सक्सेस को डिफाइन करता है। सिंपल लैंग्वेज में एक्सप्लेन किए गए कॉन्सेप्ट्स जैसे ग्रीड, फीयर, कम्पाउंडिंग और सेविंग हैबिट्स, हर इन्वेस्टर को प्रैक्टिकल नजरिया देती हैं। साइकोलॉजी को समझे बिना इन्वेस्टिंग अधूरी है – यही इस किताब का कोर मैसेज है।

मुख्य सीखें :

- मनी डिसीजन लॉजिक से नहीं, बिहेवियर से इन्फ्लुएंस होते हैं।

- वेल्थ बनाना और वेल्थ बनाए रखना अलग स्किल्स हैं।

- कन्सिस्टेंट सेविंग्स और लॉन्ग-टर्म सोच ज़रूरी है।

6. रिच डैड पुअर डैड

फाइनेंशियल लिटरेसी की इम्पोर्टेंस को समझाने वाली ये बुक सिर्फ पैसे कमाने के तरीके नहीं बताती, बल्कि पैसे को सही तरीके से समझने, उसे ग्रो और मैनेज करने की सोच विकसित करती है। रोबर्ट कियोसाकि ने दो विषम सोच – एक रिच डैड (उनके मेंटर) और एक पुअर डैड (उनके असली पिता) के ज़रिए बताया है कि क्यों औपचारिक शिक्षा से ज़्यादा ज़रूरी होती है फाइनेंशियल एजुकेशन। किताब में एसेट्स vs. लाइबिलिटीज, पैसिव इनकम, और फाइनेंशियल फ्रीडम जैसे कॉन्सेप्ट्स को बड़े ही सिंपल और प्रैक्टिकल अंदाज़ में समझाया गया है।

मुख्य सीखें :

- एसेट्स खरीदो, जो पैसे बनाएं – सिर्फ इंप्रेसिव चीज़ें नहीं।

- फाइनेंशियल एजुकेशन से ही असली ग्रोथ होती है।

- पैसिव इनकम बनाना फाइनेंशियल फ्रीडम की कुंजी है।

7. द वॉरेन बफेट वे

यह किताब वॉरेन बफेट के इन्वेस्टमेंट फिलॉसफी को डिकोड करती है। बफेट के फोकस एरियाज़ जैसे – इकोनॉमिक मोट, मार्जिन ऑफ सेफ्टी, और कंपाउंडिंग को डिटेल में एक्सप्लेन किया गया है। रॉबर्ट हैगस्ट्रॉम ने बफेट की स्ट्रैटेजीज़ को केस स्टडीज के जरिए प्रेज़ेंट किया है जिससे एक रीडर आसानी से इनको रियल लाइफ में अप्लाई कर सके। ये किताब बफेट के लॉन्ग-टर्म, वैल्यू ओरिएंटेड एप्रोच को फॉलो करने वालों के लिए एक परफेक्ट गाइड है।

मुख्य सीखें:

- कंपाउंडिंग को पकड़ने के लिए टाइम और पेशंस चाहिए।

- क्वालिटी बिज़नेस ही लॉन्ग-टर्म में रिटर्न देते हैं।

- मार्जिन ऑफ सेफ्टी एक प्राइमरी रूल है।

यह भी पढ़ें: पेनी स्टॉक्स क्या हैं? निवेश के लाभ, जोखिम, और सर्वश्रेष्ठ स्टॉक सूची

8. रेमिनिसेंसेस ऑफ़ स्टॉक ऑपरेटर

रेमिनिसेंसेस ऑफ़ स्टॉक ऑपरेटर एक क्लासिक किताब है जो जेसी लिवरमोर की लाइफ और ट्रेडिंग साइकोलॉजी को दर्शाती है। ये बुक दिखाती है कि कैसे एक आम ट्रेडर अपने अनुभव, गलतियों और सीख से मार्केट मास्टर बनता है। इसमें स्पेक्युलेशन, मार्केट टाइमिंग, और ह्यूमन बिहेवियर के रियल इंसाइट्स मिलते हैं। ये सिर्फ एक कहानी नहीं, बल्कि हर उस ट्रेडर के लिए एक मिरर है जो फास्ट प्रॉफिट के पीछे भागते हैं और इमोशंस में बह जाते हैं। मार्केट में डिसिप्लिन, पेशंस, और साइकॉलॉजिकल कंट्रोल कितना ज़रूरी है, यही इस किताब का मेन मैसेज है।

मुख्य सीखें:

- इमोशंस कंट्रोल करना ट्रेडिंग में सबसे ज़रूरी है।

- हर लॉस एक नई सीख का मौका होता है।

- मार्केट साइकोलॉजी को समझना टेक्निकल एनालिसिस जितना ही जरूरी है।

9. बेसिक्स ऑफ़ स्टॉक मार्किट। कम्पलीट गाइड फॉर स्टॉक बिगिनर्स

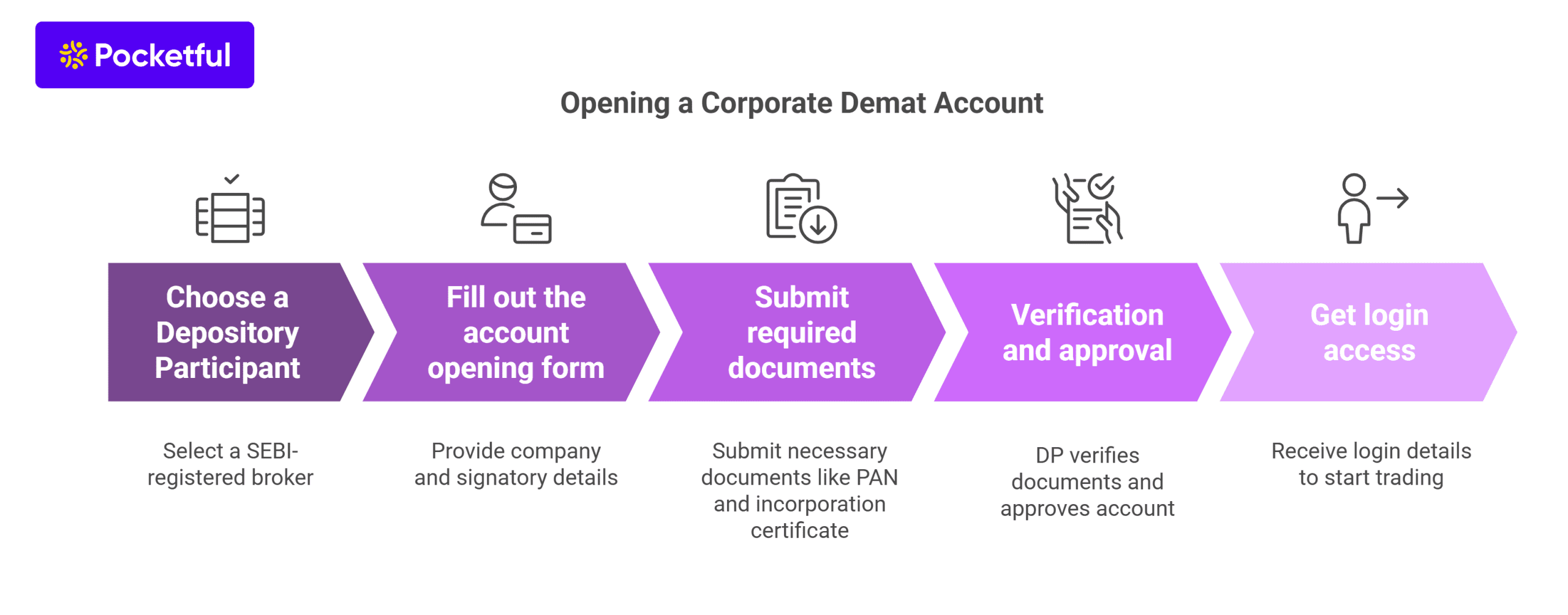

स्टॉक मार्केट गाइड फॉर बिगिनर्स एक प्रैक्टिकल और सिंपल किताब है जो खासतौर पर उन लोगों के लिए लिखी गई है जो स्टॉक मार्केट में पहली बार कदम रख रहे हैं। अरविन्द अरोड़ा ने इसमें शेयर मार्केट की बेसिक टर्म्स, ट्रेडिंग और इन्वेस्टिंग के डिफरेंस, डिमैट अकाउंट खोलना, और स्टॉक्स का सिलेक्शन कैसे करें, ये सब आसान भाषा में समझाया है। यह किताब न केवल थ्योरी बताती है बल्कि प्रैक्टिकल नॉलेज और मार्केट बिहेवियर का भी अच्छा गाइड देती है। बिगिनर्स के लिए ये एक बेस्ट स्टार्टिंग पॉइंट है।

मुख्य सीखें:

- स्टॉक मार्केट की बेसिक समझ बहुत ज़रूरी है।

- ट्रेडिंग और इन्वेस्टिंग में फर्क जानना जरूरी है।

- सही नॉलेज से ही रिस्क को कम किया जा सकता है।

10. ऑप्शन ट्रेडिंग से पैसे का पेड़ कैसे लगाएं

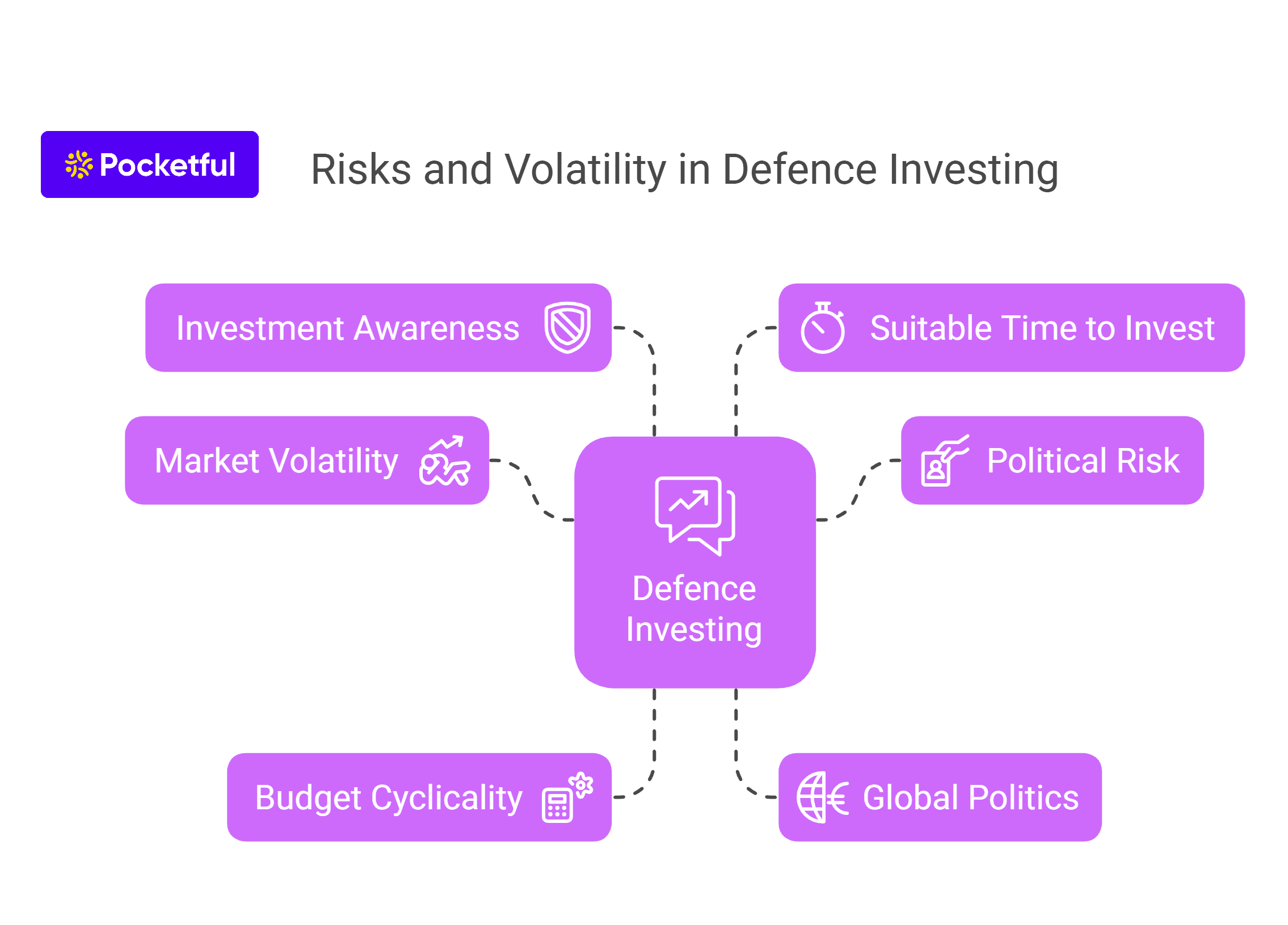

ऑप्शन ट्रेडिंग एक एडवांस लेवल की ट्रेडिंग है, और ये किताब इसे बड़े ही आसान और प्रैक्टिकल अंदाज़ में समझाती है। एम.सी. कौशिक ने बताया है कि कैसे सही स्ट्रैटेजीज़, मार्केट मूवमेंट्स की समझ, और रिस्क मैनेजमेंट के साथ ऑप्शन ट्रेडिंग से रेगुलर इनकम और ग्रोथ संभव है। किताब में कॉल ऑप्शन, पुट ऑप्शन, स्टाइकल प्राइस, और टाइम डिके जैसे कॉन्सेप्ट्स को रियल लाइफ एग्ज़ाम्पल्स के साथ समझाया गया है। ये किताब उन ट्रेडर्स के लिए है जो डेरिवेटिव मार्केट को समझना और उसमें प्रॉफिट कमाना चाहते हैं।

मुख्य सीखें :

- ऑप्शन ट्रेडिंग में स्ट्रैटेजी और टाइमिंग सबसे ज़रूरी है।

- सही रिस्क मैनेजमेंट से लॉस को कंट्रोल किया जा सकता है।

- मार्केट ट्रेंड की समझ के बिना ऑप्शन ट्रेडिंग रिस्की हो सकती है।

11. ट्रेडनिती

ट्रेडनिती एक ऐसी किताब है जो ट्रेडिंग की दुनिया को एकदम बेसिक से लेकर एडवांस तक कवर करती है। युवराज कलशेट्टी ने इसमें टेक्निकल एनालिसिस, चार्ट पैटर्न्स, सपोर्ट-रेजिस्टेंस, और इंडिकेटर्स को बहुत ही आसान भाषा में समझाया है। ये किताब खासकर उन लोगों के लिए है जो शॉर्ट-टर्म ट्रेडिंग, इंट्राडे या स्विंग ट्रेडिंग करना चाहते हैं। इसमें मार्केट साइकोलॉजी, रिस्क मैनेजमेंट, और ट्रेडिंग डिसिप्लिन जैसे जरूरी टॉपिक्स को भी बखूबी कवर किया गया है। प्रैक्टिकल एप्रोच और स्टेप-बाय-स्टेप गाइड इसे एक परफेक्ट ट्रेडिंग मैन्युअल बनाते हैं।

मुख्य सीखें:

- टेक्निकल एनालिसिस से सही एंट्री और एग्ज़िट डिसाइड की जा सकती है।

- ट्रेडिंग डिसिप्लिन और रिस्क कंट्रोल से ही प्रॉफिट पॉसिबल है।

- मार्केट साइकॉलॉजी समझना हर ट्रेडर के लिए जरूरी है।

12.कैसे स्टॉक मार्केट में निवेश करें

कैसे स्टॉक मार्केट में निवेश करें एक बेहद उपयोगी और सरल भाषा में लिखी गई किताब है जो बिगिनर्स के लिए एक परफेक्ट गाइड है। इसमें बताया है कि कैसे एक आम इंसान भी बिना किसी फाइनेंस बैकग्राउंड के स्टॉक मार्केट में समझदारी से निवेश शुरू कर सकता है। किताब में फंडामेंटल एनालिसिस, डायवर्सिफिकेशन, रिस्क कंट्रोल, और लॉन्ग टर्म इन्वेस्टिंग की स्ट्रॉन्ग बेसिक जानकारी दी गई है। ये किताब पढ़कर रीडर्स को एक क्लियर माइंडसेट और स्टेप-बाय-स्टेप अप्रोच मिलती है कि कहां और कैसे इन्वेस्ट करें।

मुख्य सीखें:

- स्टॉक मार्केट में शुरुआत सोच-समझकर और जानकारी के साथ करनी चाहिए।

- फंडामेंटल एनालिसिस से अच्छे स्टॉक्स चुने जा सकते हैं।

- लॉन्ग टर्म अप्रोच और डायवर्सिफिकेशन से रिस्क कम होता है।

13. बुल्स, बेयर्स और अदर बीस्ट्स

बुल्स, बेयर्स और अदर बीस्ट्स एक फाइनेंशियल थ्रिलर जैसी किताब है जो भारतीय स्टॉक मार्केट की इनसाइड स्टोरी को मजेदार अंदाज़ में पेश करती है। संतोष नायर ने इसमें 1990s से लेकर 2000s तक के बुल रन, क्रैश, और स्कैम्स को रियल कैरेक्टर्स के ज़रिए बताया है। किताब में बताया गया है कि कैसे ट्रेडर्स, इन्वेस्टर्स, ब्रोकर, और रेगुलेटर्स की दुनिया आपस में जुड़ी होती है।

मुख्य सीखें:

- मार्केट सिर्फ नंबर्स नहीं, इंसानों की सोच और लालच से चलता है।

- हिस्टॉरिकल घटनाओं से बहुत कुछ सीखा जा सकता है।

- मार्केट बिहेवियर को समझना बहुत जरूरी है।

14. स्टॉक्स टू रिचेस

पराग पारिख ने इस किताब में इंडियन स्टॉक मार्केट इन्वेस्टर्स की कॉमन गलतियों को उजागर किया है और बताया है कि कैसे बिहेवियरल फाइनेंस का सही इस्तेमाल करके इन्वेस्टिंग में ग्रोथ पाई जा सकती है। इसमें बताया गया है कि हर्ड मेंटालिटी, ओवर ट्रेडिंग, और शॉर्ट टर्म ग्रेटिफिकेशन कैसे आपके रिटर्न्स को नुकसान पहुंचाते हैं। यह किताब आपको सोचने पर मजबूर करती है कि इन्वेस्टमेंट सिर्फ एनालिसिस नहीं, सेल्फ-कंट्रोल और साइकॉलजी का भी गेम है।

मुख्य सीखें :

- बिहेवियरल बायसेस इन्वेस्टिंग में नुकसान कराते हैं।

- हाइप से दूर रहकर लॉन्ग-टर्म थिंकिंग ज़रूरी है।

- डिसिप्लिन और ऑब्जेक्टिविटी से ही सक्सेस मिलती है।

15. द धंधो इन्वेस्टर

यह किताब कम रिस्क और ज़्यादा रिटर्न वाली इन्वेस्टिंग स्ट्रेटेजीज़ को बेहद आसान भाषा में समझाती है। मोनिश पब्बराई ने वैल्यू इन्वेस्टिंग को रियल-लाइफ बिज़नेस के उदाहरणों और इंडियन इन्वेस्टर्स के पर्सपेक्टिव से समझाया है। इनका मेन फोकस होता है – “Heads I win, tails I don’t lose much”, यानी ऐसा इन्वेस्टमेंट जहाँ घाटे की संभावना बेहद कम हो और फायदा ज्यादा मिले। यह किताब उन लोगों के लिए परफेक्ट है जो सिंपल अप्रोच के साथ लॉन्ग-टर्म वेल्थ बनाना चाहते हैं।

मुख्य सीखें:

- कम रिस्क वाले बिजनेस में इन्वेस्ट करके भी अच्छा रिटर्न पाया जा सकता है।

- किसी बिजनेस को पूरी तरह समझकर ही पैसा लगाना चाहिए।

- सिंपल और टेस्टेड इन्वेस्टिंग मॉडल्स सबसे ज्यादा इफेक्टिव होते हैं।

यह भी पढ़ें: भारत में टॉप 10 सबसे अधिक देने वाले डिविडेंड यील्ड स्टॉक

निष्कर्ष

शेयर मार्केट में सक्सेस पाने के लिए सिर्फ थ्योरी या इनफार्मेशन ही काफी नहीं होती, बल्कि प्रैक्टिकल नॉलेज भी महत्वपूर्ण है। ये बुक्स सिर्फ मार्किट के बेसिक्स ही नहीं समझातीं, बल्कि लॉन्ग-टर्म विज़न, रिस्क मैनेजमेंट और सही साइकोलॉजिकल एप्रोच अपनाना भी सिखाती हैं। खासकर हिंदी में क्वालिटी और रिलाएबल कंटेंट की कमी को देखते हुए, ये टॉप 15 बुक्स की लिस्ट इन्वेस्टर्स के लिए एक बहुमूल्य रिसोर्स साबित होगी। इन किताबों से मिली इनसाइट्स से निवेशकों को बेहतर डिसिशन-मेकिंग में मदद मिलेगी और मार्किट के उतार चढ़ाव में भी वे स्थिर रह पाएंगे।

अक्सर पूछे जाने वाले प्रश्न

शेयर मार्केट सीखने के लिए सबसे अच्छी किताब कौन सी है?

“कॉफी कैन इन्वेस्टिंग” और “इनवेस्टोनॉमी” बिगिनर्स के लिए बहुत अच्छी हैं क्योंकि ये बेसिक्स और इन्वेस्टिंग मानसिकता अच्छे से समझाती हैं।

क्या हिंदी में शेयर मार्केट की अच्छी किताबें मिलती हैं?

हाँ, कई अच्छी किताबें हिंदी में हैं जो सरल भाषा में कॉम्प्लेक्स फाइनेंसियल कन्सेप्टस समझाती हैं।

शेयर मार्केट की किताबें पढ़ने से निवेश में फायदा होगा?

बिलकुल, सही किताबें इन्वेस्टिंग नॉलेज बढ़ाती हैं और बेहतर निर्णय लेने में मदद करती हैं।

क्या इन बुक्स से ट्रेडिंग भी सीखी जा सकती है?

हां, ऑप्शन ट्रेडिंग से पैसे का पेड़ कैसे लगाएं, ट्रेडनिती जैसी बुक्स ट्रेडिंग के लिए प्रैक्टिकल गाइडेंस देती हैं।

क्या इन बुक्स को पढ़ने के लिए फाइनेंस की बैकग्राउंड ज़रूरी है?

नहीं, इन बुक्स को इस तरह लिखा गया है कि नॉन-फाइनेंस बैकग्राउंड वाले लोग भी आसानी से समझ सकें।