Today, an excellent way to invest smartly and easily is through ETFs (exchange-traded funds). ETFs can be considered as mutual funds that trade like stocks and track indices, gold, or bonds. ETFs are becoming increasingly popular in India as they offer low expense ratios, more transparency, and good liquidity. If you want to know how to invest in ETFs or buy ETFs in India, then this blog is for you. In this guide, we will tell you what an ETF is, how to choose one, and where to buy one in simple terms.

What is an ETF?

An ETF, or exchange-traded fund, is an investment instrument that tracks a particular index, such as the Nifty 50, Sensex, or an asset such as gold. Its purpose is to replicate the performance of that index as accurately as possible. ETFs can be bought and sold on the exchange like stocks, meaning trading is possible throughout the trading session. It helps you diversify your portfolio like a mutual fund, but instead of a fund manager actively investing in stocks on your behalf, it follows the index—that is, it is an example of passive investing.

Investing in ETFs costs less because there is no active management fee. Also, there is more transparency in ETFs because information about holdings is readily available. Many types of ETFs, like equity, gold, international, and bond, are now available in India, which are considered easy and smart investment options.

Why invest in ETFs?

Investors today are looking for investment options that are low cost, low risk, and offer good returns in the long term, and this is why ETFs are becoming increasingly popular in India.

- Low cost : The management fees and other expenses in ETFs are very low, which reduces the total expenses of the investors. Due to low expenses, the returns are better in the long term.

- Transparent investment : In ETFs, it is clear in which index or asset the investment has been made. This gives the investor a correct idea of his investment and makes it easier to track investment performance.

- Best for new investors : ETFs are an easy and safe way for new investors to begin their investing journey. Through ETFs, one can invest in the wider market without selecting specific stocks. It reduces the risk and is suitable for beginner investors.

- Opportunity to diversify the portfolio : ETF investment can diversify the portfolio well. This reduces the risk, as the investment is spread across many sectors and companies.

- Open the doors to International Markets: Through ETFs, one can easily invest in markets outside India, like America, China, and other global markets.

- Growing popularity of index investing : In India, especially young and new investors are now preferring index-based ETFs over investing in individual stocks. This trend has increased due to ETF’s transparency, simplicity, and diversity.

Moreover, ETFs are fully regulated under SEBI rules, making them safe and reliable. The total assets under management (AUM) of ETFs in India is constantly growing, which reflects the growing confidence of investors.

Know More: Calculate returns on ETF investments.

How to Select the Right ETF?

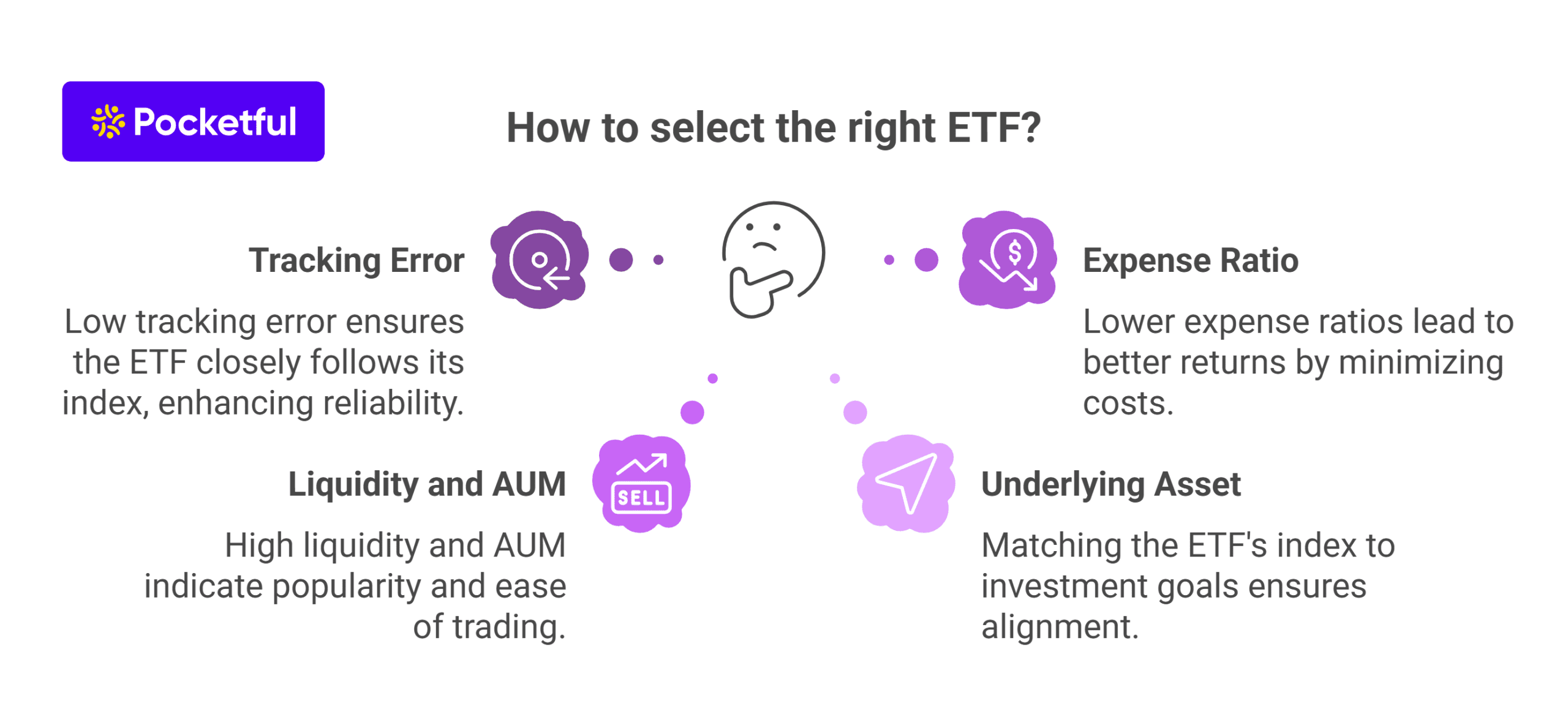

Before investing in ETFs, it is very important to pay attention to some important factors so that the investment is safe and profitable.

- Tracking Error: This shows how much the performance of the ETF differs from its index. ETFs with low tracking error are considered better. Example: Nippon India ETF Nifty BeES is known for low tracking error.

- Expense Ratio: There is an annual fee charged on ETFs. The lower the expense ratio, the better the returns. Example: ICICI Prudential Nifty 50 ETF has a very low expense ratio.

- Liquidity and AUM: The trading volume and total AUM (assets under management) of the ETF indicate how popular and liquid it is.

- Underlying Asset or Index: The index the ETF is tracking, such as Nifty 50, Sensex, or Gold, should match the investment objective.

Choosing an ETF is not a difficult task, but it is very important to be cautious of how a specific ETF affects your overall investment portfolio. Invest, keeping in mind tracking error, expenses, liquidity, and index, so that you get better returns and stability in the future.

How to Buy an ETF in India – Step-by-Step Guide

Buying an ETF is as easy as buying a stock. If you are investing for the first time, then you can start investing in ETFs without any hassle by following the steps given below:

- Open a Demat Account: To buy an ETF, first of all, it is necessary to have a Demat account. It can be opened with any brokerage platform like Pocketful.

- Login using Credentials: Log in to your trading app or web platform and enter the name or ticker symbol of the ETF you want to buy (e.g., “NIFTY BEES” or “GOLD BEES”) in the search bar.

- Place the order : Check the price of that ETF on NSE or BSE, enter the quantity and click on the ‘Buy’ option.

- Delivery will be in Demat Account: Just like the shares are stored in the Demat account, ETF units will also start appearing in the Demat account after the settlement process.

Benefits of Investing in ETFs with Pocketful

If you want to easily invest in ETFs, Pocketful is a great choice. Its modern and user-friendly mobile app is designed specifically for beginner investors.

- ₹0 Brokerage and ₹0 AMC : There is no brokerage fee charged on delivery of ETFs on Pocketful, and there is also no annual maintenance fee (AMC). This provides investors an opportunity to earn more returns at a lower cost.

- Simple interface, easy start : Pocketful is a user-friendly app designed especially for new investors. No complicated process, just sign up and start investing.

- Smart Analytics and Data-Driven Recommendations : Pocketful provides investors with market insights, making decisions easier.

Read Also: Read Also: What is Nifty BeES ETF? Features, Benefits & How to Invest?

Track, Review & Rebalance

Investing in ETFs is not limited to just buying at regular intervals. You should monitor your portfolio regularly so that it remains in line with your financial goals. You should follow the below measures to be more profitable:

- Active monitoring : You should actively monitor your portfolio to ensure timely booking of profits and check whether the ETF’s performance is equivalent to underlying asset’s performance or not.

- Compare Performance : It is important to periodically compare the performance of different ETFs and invest in ETFs with the lowest cost for better returns.

- Importance of Rebalancing : Maintaining a balanced portfolio is crucial to protect against market fluctuations. Moreover, an individual should evaluate his financial position and make the required changes to his investment portfolio.

- Use of digital tools : Platforms like Pocketful simplify portfolio tracking and rebalancing, allowing for smart and informed investing.

Know the Risks Before Investing in ETFs

ETF investing has many advantages, but it is equally important to understand the risks.

- Market Risk: ETF prices change according to market movements. If the price of the underlying asset falls, the value of the ETF may also fall.

- Sectoral Concentration: Some ETFs invest only in specific sectors or industries, which can reduce portfolio diversification and increase the risk.

- Tracking Error: The purpose of an ETF is to track an index, but sometimes there may be a difference between the ETF performance and the index performance, which is called tracking error.

- Liquidity Risk: Less traded ETFs may be difficult to sell, which may cause losses to investors.

Investing in ETFs should be done only after understanding these risks so that better and safer investment decisions can be made.

Taxation on ETFs in India

| Type of ETF | Long-Term Capital Gains (LTCG) | Short-Term Capital Gains (STCG) |

|---|---|---|

| Equity ETFs | 12.5% (Exempt up to ₹1.25 lakh per year) | 20% |

| Gold ETFs | 12.5% | Taxed as per income tax slab |

| Debt ETFs | Taxed as per income tax slab | Taxed as per income tax slab |

| Other Non-Equity ETFs | 12.5% | Taxed as per income tax slab |

Conclusion

ETF investing is an easy, affordable and smart way to enter the markets. Be it equity, debt, gold or international ETFs each brings its own benefits. With the right information, research and portfolio monitoring, ETFs can become an effective investment instrument for investors. Nowadays, with the help of platforms like Pocketful, it is even easier to start investing as you can invest in ETFs without paying any brokerage. Now is the time to take the first step towards your financial goals, choose wisely, review regularly and invest for the long term. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

What is an ETF?

An ETF (Exchange Traded Fund) is an investment instrument that tracks the performance of an index, sector, commodity or asset and trades on an exchange like a stock.

Is ETF investment safe for beginners?

Yes, investment in ETFs is considered safe as they usually track diversified indices or precious metals, making them a low-risk investment option for beginners.

Do I need a Demat account to invest in ETFs?

Yes, one needs to have a demat and trading account to invest in ETFs.

Are ETFs better than mutual funds?

Both ETFs and mutual funds have their own advantages. However, ETFs have lower fees and can be easily traded.

What is the minimum amount required to buy an ETF?

Some of the ETFs tracking gold and silver can be bought for as little as ₹100.