An initial public offering (IPO) is a significant event for a company as it is a process by which the company offers its shares to the public for the first time. IPO investing has been quite popular among investors, and if you intend to invest in one, you must be aware of the regulations governing the distribution of shares in an initial public offering (IPO).

In this blog, we will give you an overview of IPO allotment rules and explain how these shares are allocated.

IPO Allotment Rules

A corporation must launch an initial public offering (IPO) to offer its shares to the general public when it wishes to go public. In India, the Securities and Exchange Board has established various rules that a company must follow to issue its shares to the general public.

The rules related to IPO are mentioned below.

- The Registrar oversees the allotment of IPO shares in consultation with the registered stock exchange.

- The allotment of IPO depends on the number of shares the company offers and the investor’s bid.

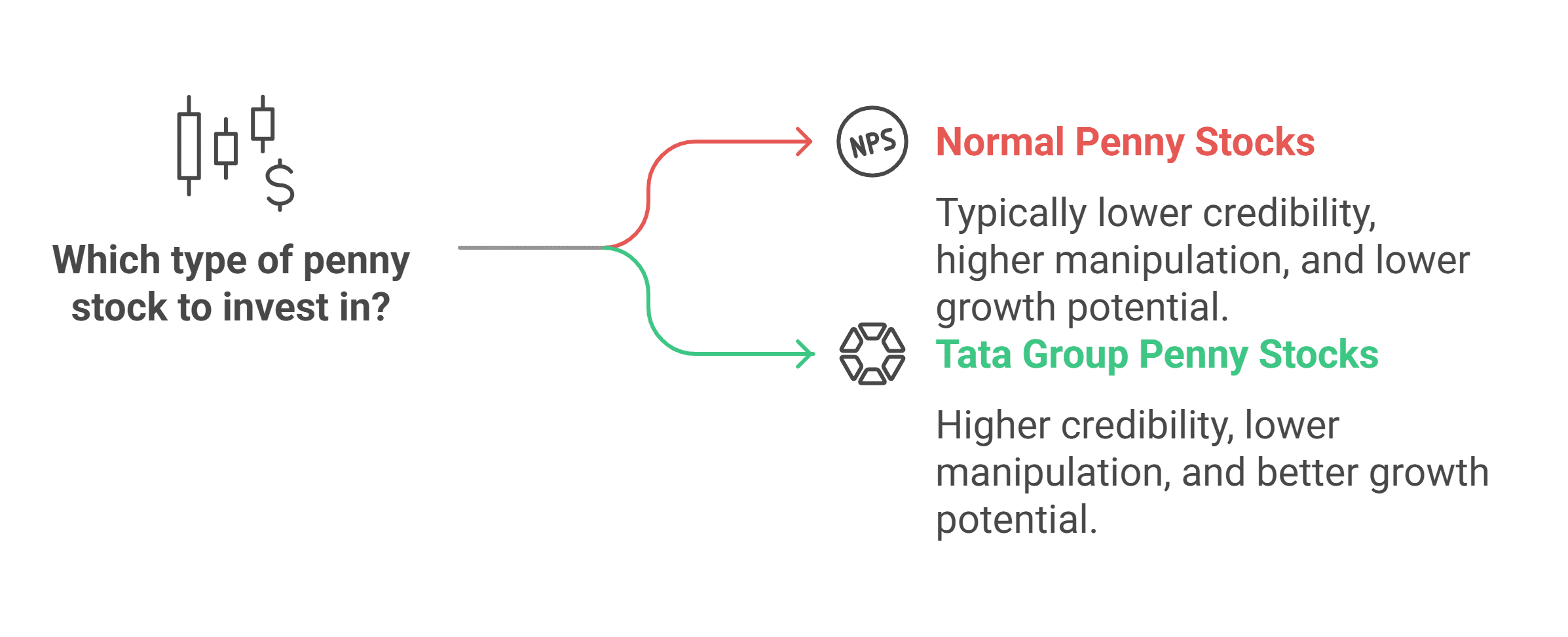

- There are different categories of investors, such as Retail, NII and QIB; however, the rules are different for different categories.

- Only valid applications are accepted for the allotment. Applications with incorrect information, such as an invalid demat account number or multiple applications using the same PAN card, are rejected.

- Applications made at or above the cut-off prices are considered for allotment in the book-building process.

- Oversubscription in a particular category can be adjusted with the undersubscription of another category with the consultation of the lead manager, exchange, etc.

- The registrar prepares and publishes a document that states the basis of allotment.

How are IPO Shares allotted?

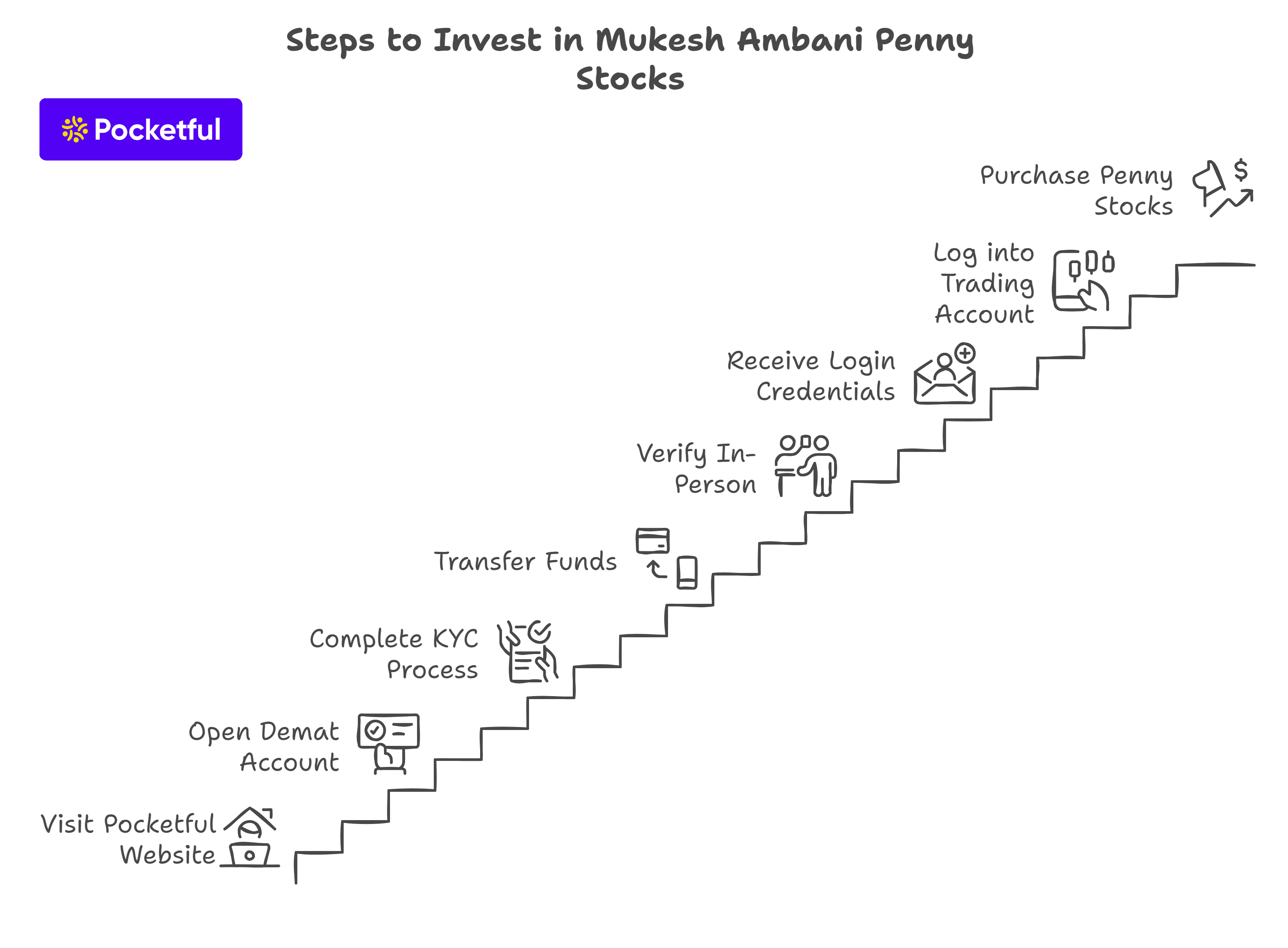

The allotment of shares in an IPO takes several steps, a few of which are mentioned below-

1. Process of IPO Application – Investors apply for an IPO through a bidding process within a specific price range through the ASBA (Application Supported by Blocked Amount) process.

2. Categories and Reservation – Shares are reserved for different categories of investors, such as retail, NII and QIB.

3. Allocation – After the categorization of investors, the shares are allocated to them based on the bid information.

4. Finalization – Once the IPO is closed for subscription, the shares are allotted to the successful bidder based on SEBI guidelines.

5. Debit of Amount – The shares are allotted or credited to the investor’s demat account, and the amount is debited from the investor’s bank account.

6. Refund – For applicants who do not get any shares, the amount reserved for IPO application is unblocked.

7. Communication – The proper communication is made to the successful investor and the shareholders who do not get any shares.

Procedure for Allotment of Shares in IPO

Let’s look at a firm called ABC Limited that issued 10,000 shares and then split those shares into lots of 50 shares. This refers to there being 200 lots overall, and an investor may apply for more than one lot. Various subscription scenarios are mentioned below. This can lead to several results, some of which are listed below:

1. Under Subscription – This situation occurs when the investor’s bids for IPO shares are less than the total number of shares issued by the company. Since more shares are available, each investor is allotted shares for which they applied.

2. Oversubscription – Oversubscription of shares occurs when the total number of shares applied for by investors exceeds the number of shares the company is offering. For this scenario, the Securities and Exchange Board of India (SEBI) establishes the rules that govern the distribution of shares to investors.

3. Small Oversubscription – Every investor with a valid application receives one lot if there is a slight oversubscription, and the remaining lots will be distributed proportionately.

4. Large Oversubscription – According to the rules established by the Securities and Exchange Board of India, the lottery mechanism will randomly distribute the shares to investors and at least one lot to each bidder in the event of a very high oversubscription.

IPO Allotment Calculation

Based on the subscription data, the IPO shares are distributed. The two probable scenarios are listed below.

- Undersubscription – All successful bidders are given shares in the event of undersubscription, and each bidder receives the quantity of shares they requested.

- Oversubscription – Oversubscription of shares is a situation when the total number of shares applied for by investors exceeds the number of shares the company is offering. Two techniques will be used to distribute the shares to the investors: the lottery system and proportionate distribution.

- Proportionately – Under this method, the shares are allotted to the investor proportionately. If an investor has applied for 100 shares and the IPO has been subscribed 20 times, then each investor will receive 5 shares.

- Lottery System – Under the lottery method, a random applicant who has applied for the shares at or above the cut-off price is selected.

Important Aspects of IPO Allotment

The process of IPO allotment involves various steps to keep the process transparent; below mentioned are the major aspects of IPO allotment-

- Categorization – The applicants are categorized into retail, QIB or NII, and each category has a reservation in the IPO.

- Allotment – The shares are allotted to the investors based on the subscription status, such as oversubscription or undersubscription.

- Market Lot – The total issue will be divided into lots, which represent an equal number of shares and an investor is required to apply in multiples of the lot size.

- ASBA – An investor can bid for an IPO only through ASBA or an Application Supported by the Blocked Amount, a mechanism in which the application amount is blocked in the investor’s bank account.

- Communication – Once the allotment is finalized, a message is sent to the investor by the registrar through mail or SMS.

- Credit of Shares – The investors to whom the shares are allotted receive shares in their demat account.

Reason for no Allotment of Shares

There can be various reasons why investors might not get any shares in an IPO. Some of these are listed below.

- Oversubscription – In case of high demand for shares during the IPO, the chances of receiving an allotment decrease.

- Computerized Lottery System – In case of oversubscription, the shares are allotted through a lottery system. In this case, if you are not selected for the allotment, you will not receive any shares.

- Error in Application – If you have made an error such as wrong PAN Card details or an incorrect Demat account number while submitting the IPO application, then your application will be rejected, and you will not be allotted any shares.

- Multiple Applications – As per the regulations issued by the Securities and Exchange Board of India, if you have submitted multiple applications using the same PAN details, your IPO application will be rejected.

- Low Bid Amount– If you have submitted your application with a bid amount below the cut-off price, your application will be rejected and will not be considered for allotment.

Read Also: Aadhar Housing Finance: IPO And Key Insights

Conclusion

To sum up, investors must comprehend the IPO allocation regulations before applying for an IPO. The SEBI has several regulations regarding the IPO process. Investors are categorized into different categories, with a reservation for each category in the IPO. If the IPO is undersubscribed, each applicant is allotted shares for which they applied. On the other hand, if the IPO is oversubscribed, shares are either allotted proportionately or through a lottery system. You must speak with your investment advisor before investing.

Frequently Asked Questions (FAQs)

What could be the possible reason for the non-allotment of shares?

Several factors can lead to the non-allotment of shares in an initial public offering (IPO), but the two main reasons are multiple applications from the same PAN number and oversubscribed IPOs.

How long does the IPO allotment process take?

The IPO allotment process takes around seven days, during which the registrar allots shares to the successful bidder.

How can we increase the chances of getting an IPO allotment?

You can improve your chances by applying through multiple demat accounts registered under different PAN cards and submitting the IPO application at the cut-off price.

Are IPO shares allotted on a first-come, first-served basis?

No, IPO shares are not distributed on a first-come, first-served basis; instead, the distribution procedure is based on the subscription status of an IPO. A computerized lottery procedure will be used to finalize the allocation if the IPO is oversubscribed, and each investor will receive the shares they applied for if it is undersubscribed.

How do you check if an IPO is allotted or not?

You can check the IPO allotment status by visiting the registrar’s website and entering relevant information.