If you are new to the stock market and about to begin your investing journey, then you must know about trading accounts and demat accounts to better understand the stock market. A trading account allows you to place buy and sell orders in the stock market. Whereas, a demat account lets you store securities in electronic form.

In this blog, we will explain a Demat Account and a Trading Account, their importance and differences. Moreover, we will also look at the fees associated with these accounts.

What is a Demat Account?

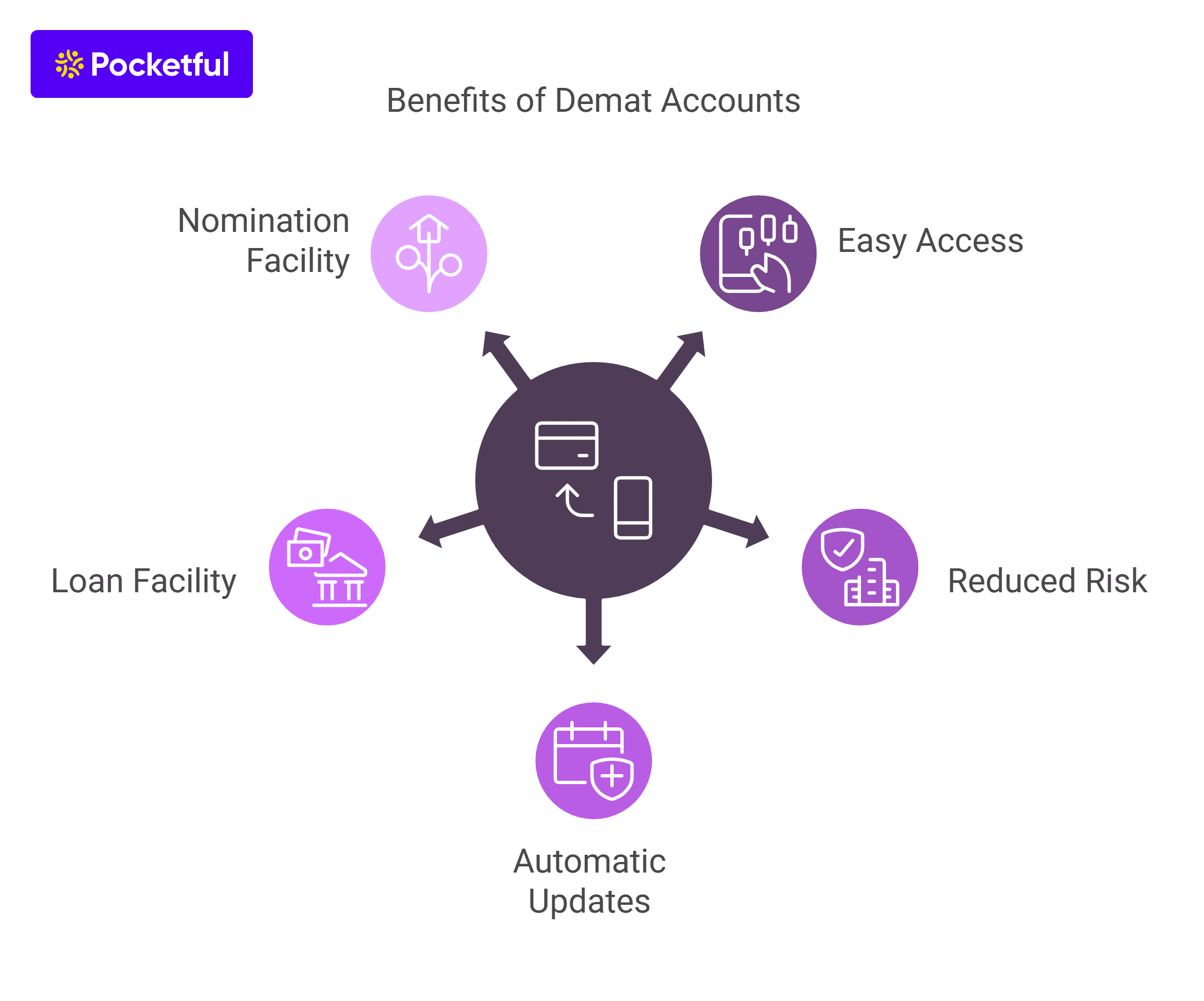

A demat account is an account that investors use to keep securities like bonds, equities, mutual funds, and exchange-traded funds (ETFs) in electronic format. Before 1996, securities were bought and sold using physical certificates, which included several dangers, including losses from forgeries and theft. To mitigate these dangers, the concept of Demat Accounts was created. To participate in the Indian Stock Market, you must have a Demat Account. Demat account also allows you to nominate your near ones so that the securities can easily be transferred to them in case the investor dies. The other benefit of having a Demat account is the smooth settlement of securities.

Importance of Demat Account

A few points signifying the importance of Demat accounts are mentioned below-

- Holding Securities – The sole facility that enables you to hold securities electronically is a Demat Account.

- Transactions – The settlement of transactions is easier if you have a Demat account.

- Nomination – The investor may designate a close relative to inherit the securities housed in their demat account in the event of the investor’s death.

- No Minimum Balance – You are not required to have any minimum balance, which means that it is not mandatory to own a certain number of securities in your demat account to keep it active.

- Corporate Actions – The demat account manages and updates the securities data of all the corporate actions like right issues, bonus shares, mergers, etc.

What is a Trading Account?

Buying and selling financial instruments, including stocks, bonds, commodities, derivatives, and other tradable securities, is done through a trading account. The investor’s bank account and demat account are connected to this account. Brokers give investors an online platform to follow real-time market movements and place buy and sell orders. A trading account is mandatory to actively place buy and sell orders in stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Importance of Trading Account

The importance of a trading account is mentioned below-

- Real-Time Tracking – Investors can use their broker’s online trading platform to follow real-time market movements.

- Different Orders – With the help of trading applications, you can execute various types of buy and sell orders.

- Ease of Access – One can easily access the market data through trading applications and access it anywhere with the help of a mobile or laptop.

- Manage Risk – Various trading platforms allow you to place stop-loss orders, which helps the investors mitigate the risk.

The Nature of Two Account

Demat Account – The Demat account serves as a custodian for the investor’s securities, including stocks, bonds, mutual funds, and other assets. It allows you to dematerialize and rematerialize shares but does not let you purchase or sell equities.

Trading Account – As an intermediary between your bank account and the demat account, the trading account serves as a transactional account, enabling you to buy or sell stocks. It allows for real-time trading, enabling investors to make trades right away.

Demat Account Vs. Trading Account

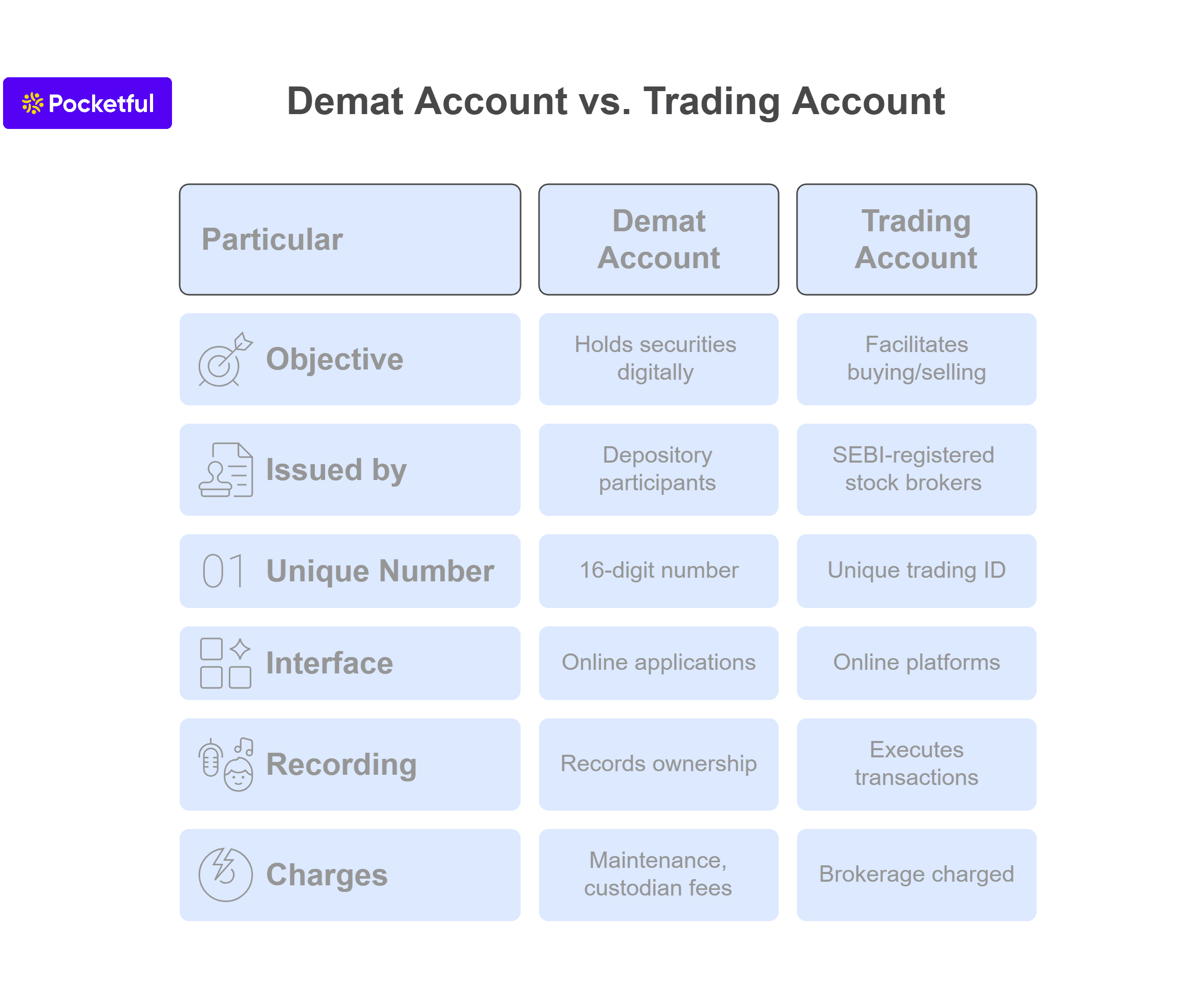

The difference between trading and demat account are described in below mentioned table-

| Particular | Demat Account | Trading Account |

|---|---|---|

| Objective | It is used to hold financial securities in digital form. | It facilitates the buying and selling of securities. |

| Issued by | The demat account is issued by depository participants. | A trading account is opened by SEBI-registered stock brokers. |

| Unique Number | A Demat account has a unique 16-digit number. | Trading accounts have a unique trading ID depending on the stockbroker. |

| Interface | Demat account is accessible through online applications provided by depository participants. | It is accessed through online platforms provided by the stock brokers. |

| Recording | It records the ownership of securities. | It only executes transactions made in the stock market. |

| Charges | The charges levied by the demat account include annual maintenance charges, custodian fees, etc. | The brokerage is charged by the broker for using a trading account for transactions executed by the investors. |

Read Also: What is Tick Trading? Meaning & How Does it Work?

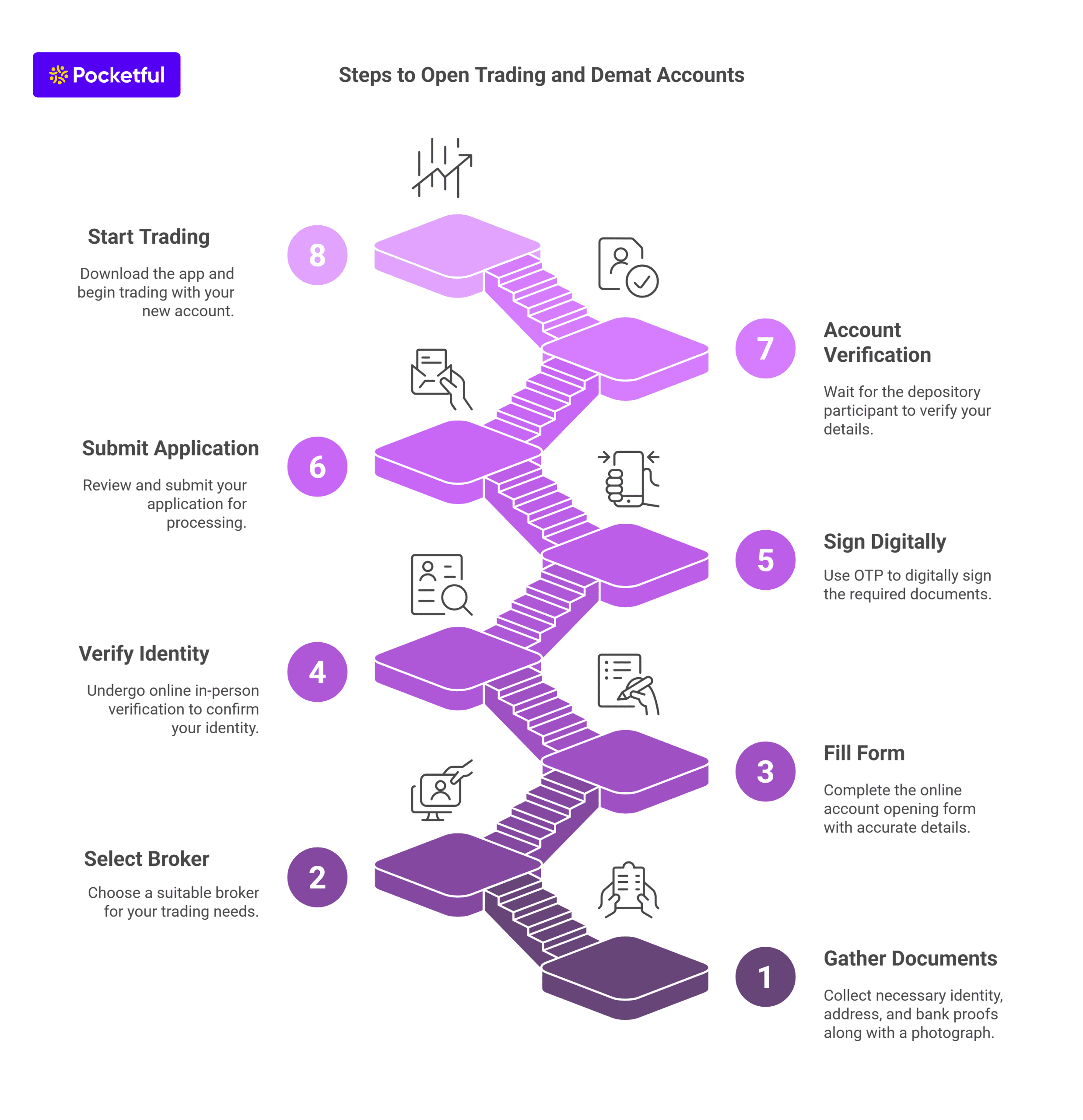

Steps to Open Trading and Demat Accounts

Technological advancements allow you to open a Demat and Trading account in about 15 minutes. The procedures for opening a Trading and Demat account are as follows:

1. There are a few essential documents that you will need to open a trading and Demat account.

- Identity Proof – The identity proof includes the PAN Card, Voter ID card, or Passport of the investor.

- Address Proof – This will include your Aadhar card, driving license, etc.

- Bank Proof – The bank proof will include a leaflet of cheque, passbook, bank statement issued by the bank etc.

- Photograph – A latest passport-size photo is also required.

- Basic details such as mobile number, email ID, occupation, income slab, etc.

2. After arranging all the relevant documents, you must select a broker.

3. Visit the broker’s website and find the Account Opening form.

4. Fill in all the required details in the given fields.

5. Then, you will be required to perform in-person verification online to verify your identity. Nowadays, in-person verification can be done online.

6. Under the online process, you will be prompted to sign the document digitally, which can be completed through an OTP on your mobile number.

7. Review your documents and submit your application.

8. After completing all the processes, the depository participant verifies your details. Upon successful verification, the account will be opened, and you will receive your login ID.

9. Download the broker’s mobile application or web portal and start trading.

Fees of Trading Account and Demat Account

There are various types of fees charged for having a Trading and Demat account-

- Brokerage – The investors and traders typically pay the brokerage for using the broker’s platform to execute trades. Brokerage can be charged in two ways: fixed fees or fees based on transaction volume.

- Account Maintenance Fees – Brokers will charge fees from their clients who have their accounts with them. These charges vary from broker to broker.

- Account Opening Fees – A one-time fee is charged by some brokers while opening a demat account with them. However, many brokers are offering zero account opening fees.

- Margin Interest – Brokers lend money to their clients and charge interest on it.

- Custodian Fees – This is a monthly charge levied depending on the number of shares held in the demat account. This charge can range from 0.5 INR to 1 INR for each ISIN.

- Dematerialization Charges – Investors must pay demat charges when they convert physical shares into electronic form.

Role of Trading and Demat Accounts

Both trading and demat accounts have unique roles in the Indian Stock Market.

Demat Account – It permits investors to hold securities in electronic form, including bonds, stocks, exchange-traded funds, and so forth. The depository’s statement gives a clear picture of the investor’s assets. Any shares purchased by an investor are credited to their demat account; conversely, any shares sold by them are deducted from it.

Trading Account – An investor can execute, buy, and sell orders in real time on the stock exchange by using a trading account. Investors can easily keep an eye on the market through their trading accounts. If they believe a security will move in a specific way, they can execute a trade to create a long position using a trading account.

Read Also: Demat Account Charges Comparison

Conclusion

To sum up, you must comprehend the distinction between trading and demat accounts before investing. There are several brokers throughout India, but there are only two depositories. It is necessary to open both accounts to trade the stock market with ease because the trading account allows you to execute transactions, and the demat account lets you store the purchased securities. However, investors must do thorough research regarding the fees associated with trading and demat accounts before choosing a broker.

Frequently Asked Questions (FAQs)

Who can open a trading and demat account?

Any Indian citizen, NRI, HUF, minor and business entity can open a demat account.

How many digits does a Demat account number have?

A Demat Account account is a unique 16-digit number that is provided by the depository.

Is there a difference between a demat account and a trading account?

The trading account allows you to purchase and sell assets, whereas the Demat account just stores them in electronic form.

Is it mandatory to add a nominee while opening a demat account?

While opening a demat account, you must choose to add a nominee or opt out of nomination.

Can I open a trading and demat account with the same broker?

We can open a trading and demat account with the same broker.