Every time you take your car or motorcycle to the garage for maintenance, engine oil is always a topic of discussion. Engine oils and other lubricants are essential for the smooth functioning of automobiles. Castrol is one of the firms that manufacture these products and has been a well-known name among automobile enthusiasts.

In this blog, we will examine Castrol India Case Study in detail, review its financial statements, and do a SWOT analysis.

Castrol India Overview

Castrol was established in the UK in 1899 by Charles Wakefield and was previously known as CC Wakefield & Company. The business started operations in India by importing automotive lubricants from CC Wakefield & Company in 1910. The business manufactures lubricants for large machinery and automobiles. The parent company of Castrol India was acquired by BP Group in 2000 for $4.73 billion. The business was listed on the Bombay Stock Exchange in 1982. The company changed its name to Castrol India in 1990. The business introduced a range of improved engine oils between 2010 and 2020. The company’s headquarters is in Mumbai.

Business Model of Castrol India

The Castrol India business model generates revenues by selling specialty lubricants such as engine oils, transmission fluids, and greases for automobiles and industrial machines. The company has formed strategic alliances with well-known automakers, including Tata Motors, Ford, Honda, Land Rover, etc. In addition, the company offers its products via an e-commerce platform and has over a million retail locations nationwide, as well as a robust distribution network.

Product Portfolio of Castrol India

The company offers a wide range of products to their clients, a few of which are mentioned below-

- Lubricants for Vehicles – The company sells engine oils that improve the performance of both passenger and commercial vehicles.

- Lubricants for Industries – Additionally, the company sells machine oils and fluids that increase the machine’s life by reducing wear and tear.

- Special Products – Additionally, it provides a selection of coolants and brake fluids for automobiles.

Market Details of Castrol India Limited

| Current Market Price | INR 255 |

| Market Capitalization (In Crores) | INR 25,183 |

| 52 Week High | INR 284 |

| 52 Week Low | INR 132 |

| Book Value | INR 21.6 |

| P/E Ratio (x) | 28.5 |

Read Also: Indian Oil Case Study: SWOT Analysis and Marketing Strategy

Financial Statements of Castrol India

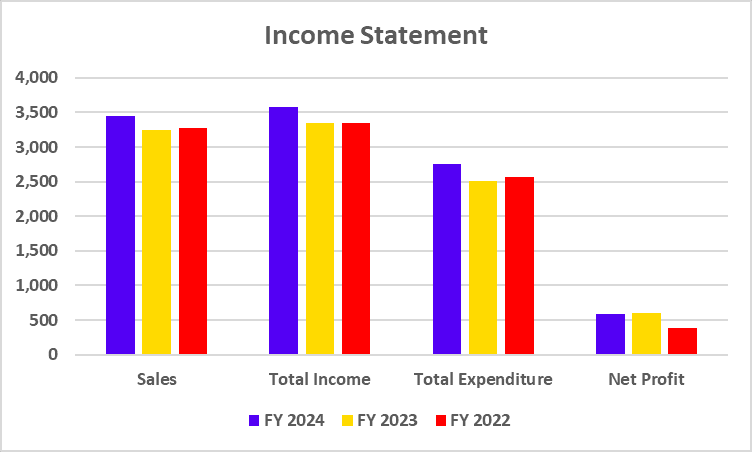

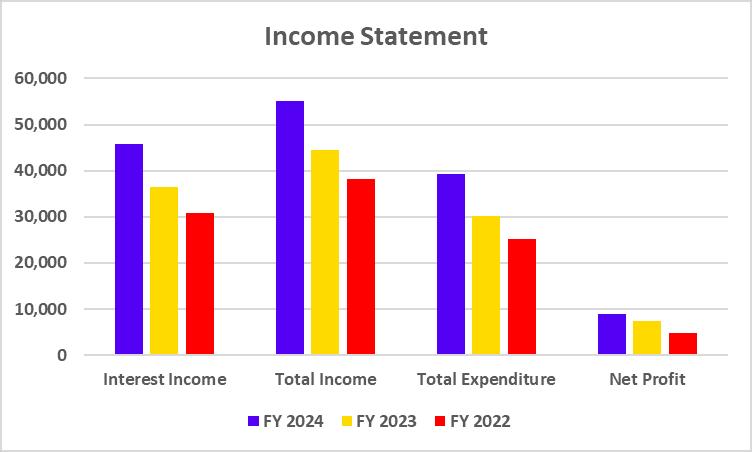

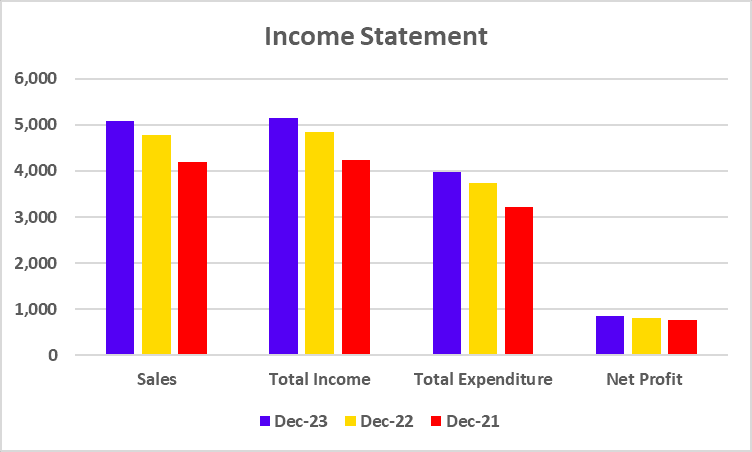

Income Statement

| Particulars | December 2023 | December 2022 | December 2021 |

|---|---|---|---|

| Sales | 5,074 | 4,774 | 4,192 |

| Total Income | 5,157 | 4,841 | 4,240 |

| Total Expenditure | 3,969 | 3,744 | 3,208 |

| Net Profit | 864 | 815 | 758 |

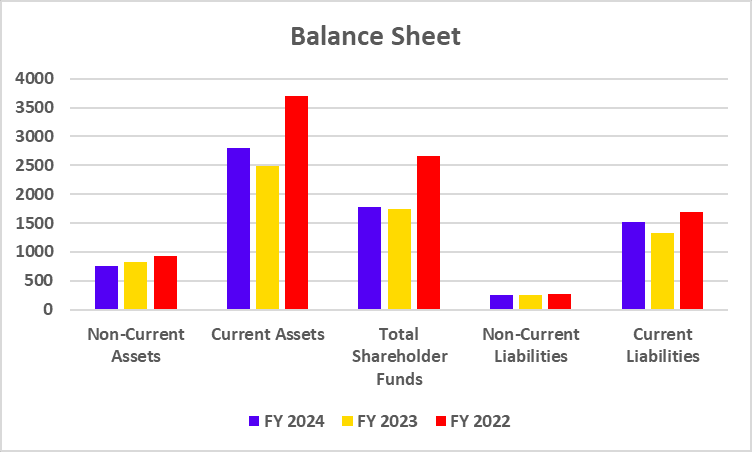

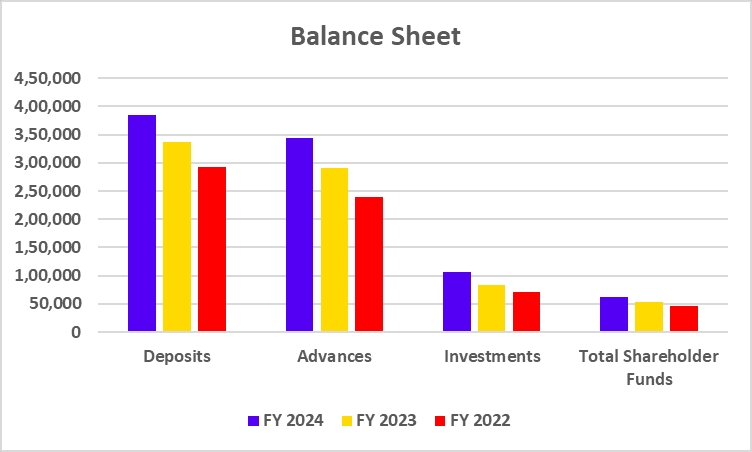

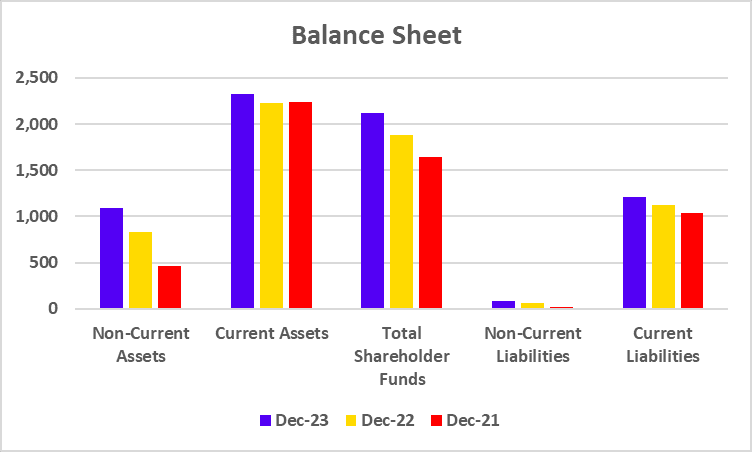

Balance Sheet

| Particulars | December 2023 | December 2022 | December 2021 |

|---|---|---|---|

| Non-Current Assets | 1,096 | 835 | 460 |

| Current Assets | 2,323 | 2,233 | 2,243 |

| Total Shareholder Funds | 2,121 | 1,886 | 1,645 |

| Non-Current Liabilities | 82 | 63 | 24 |

| Current Liabilities | 1,215 | 1,119 | 1,034 |

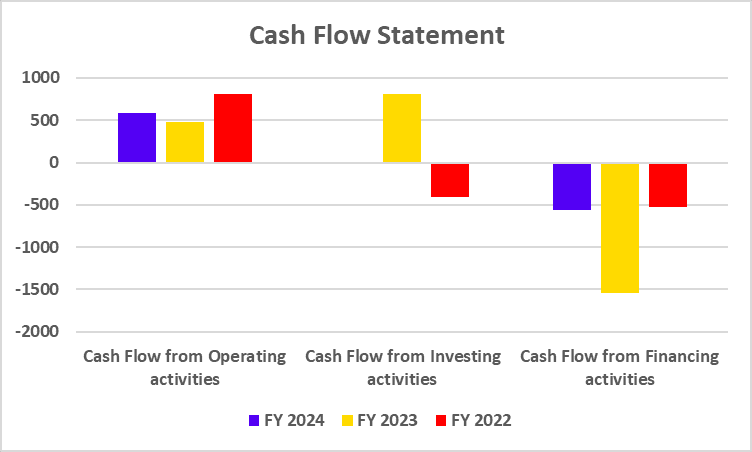

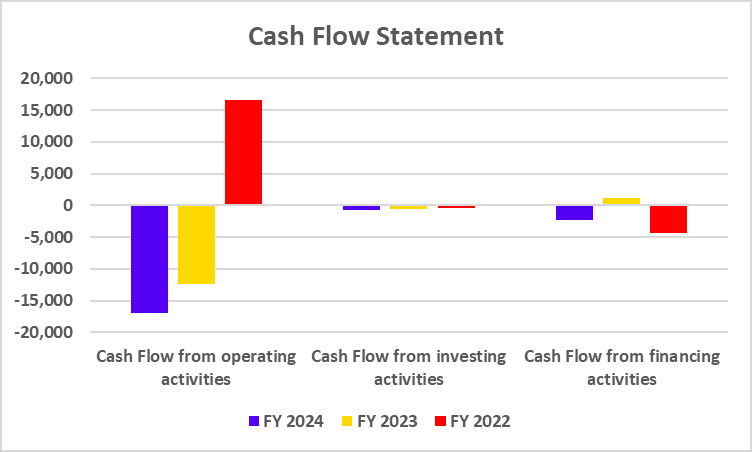

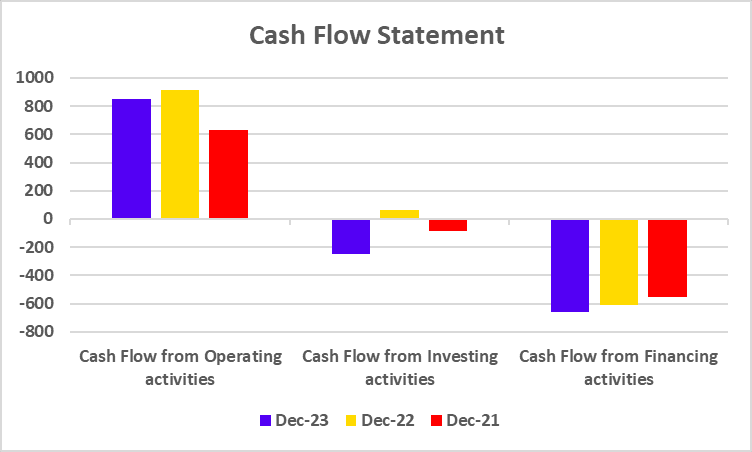

Cash Flow Statement

| Particulars | December 2023 | December 2022 | December 2021 |

|---|---|---|---|

| Cash Flow from Operating activities | 853 | 915 | 630 |

| Cash Flow from Investing activities | -251 | 61 | -83 |

| Cash Flow from Financing activities | -663 | -607 | -557 |

Key Performance Indicators (KPIs)

| Particulars | December 2021 | December 2022 | December 2021 |

|---|---|---|---|

| Operating Profit Margin (%) | 23.42 | 22.97 | 24.61 |

| Net Profit Margin (%) | 17.02 | 17.07 | 18.08 |

| ROE (%) | 40.72 | 43.22 | 46.07 |

| ROCE (%) | 53.91 | 56.24 | 61.78 |

| Current Ratio | 1.91 | 2 | 2.17 |

| Debt to Equity Ratio | 0 | 0 | 0 |

Read Also: Gillette India Case Study: Business Model, SWOT Analysis, and Financial Overview

SWOT Analysis of Castrol India

Strength

- Brand Reputation – The company has a strong brand image and is known globally for its products.

- Strategic Partnership – The company has stable revenue streams due to partnerships with several automobile companies.

- Advanced R&D Capabilities: The company invests in R&D to develop superior products and is a market leader in its industry.

Weakness

- Limited Focus – A significant amount of the company’s revenues comes from the automotive sector.

- Dependence on Oil Prices – An increase in crude oil prices can increase the cost of raw materials and product prices. A rise in the price of the product can affect sales and profitability.

- Environmental Concerns – The company uses fossil fuels in manufacturing its products, which makes it a major contributor to pollution.

Opportunities

- Digital Inclusion – The business can boost sales by using new marketing strategies.

- Growing Industry – Castrol India Ltd. has the potential to take advantage of this growing automobile sales due to the rise in disposable incomes.

- Industrial Lubricants – The corporation can concentrate more on industrial lubricants.

Threat

- Crude Oil Prices – The profit margin of the business could be impacted by any increase in crude oil prices.

- Economic Slowdown – Every type of economic downturn has the potential to adversely affect the automobile sector’s demand for lubricants.

- Shift Towards EV – The need for conventional engine oil will decline as the popularity of electric vehicles increases.

Conclusion

In conclusion, Castrol India Ltd. is a prominent producer of engine oil lubricants in India, with a history spanning more than a century. The company may see a decline in revenues due to the growing popularity of electric vehicles in the short term. However, they have begun to broaden their product line and produce e-lubricants specifically for electric vehicles. It is advised to speak with an investment advisor before investing.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Hindustan Unilever Case Study |

| 2 | Elcid Investments – India’s Costliest Stock |

| 3 | Reliance Power Case Study |

| 4 | Burger King Case Study |

| 5 | Zara Case Study |

Frequently Asked Questions (FAQs)

Where is the headquarters of Castrol India Ltd.?

The headquarters of Castrol India Ltd. is in Mumbai.

Is Castrol India Limited a large-cap or mid-cap company?

Castrol India Limited is classified as a mid-cap company as it has a market capitalization of INR 25,183 crores as of 17 September 2024.

Who founded Castrol?

Charles Wakefield was the founder of CC Wakefield & Company. The company was renamed as Castrol Ltd. in 1960.

Is Castrol India Ltd. a profitable company?

Castrol India Ltd. is a profitable company as it has reported a net profit of 864 crores and 815 crores in the last two fiscal years.

Is it good to invest in Castrol India Ltd.?

Castrol India can be a good investment opportunity as it has generated profits in the last three years. However, an individual should analyze the financial statements or consult a financial advisor before making any investment decisions.