Are you aware that leading FMCG Companies in India produce the products you use daily, such as body wash, toothpaste, and fruit juice? As an FMCG company, HUL and ITC are the names with which almost every household is familiar.

In this blog, we will compare Hindustan Unilever Ltd. (HUL) and India Tobacco Company Ltd. (ITC).

ITC Ltd. Overview

ITC Ltd. was established in 1910 and was then known as the Imperial Tobacco Company of India Limited. The business changed its name thrice: first as Indian Tobacco Company in 1970, then as I.T.C. Limited in 1974, and was finally renamed as ITC Limited in 2001. The company’s headquarters are in Kolkata.

Over the last 10 years, the firm has developed a wide range of over twenty-five premium Indian brands. Their “Nation First: Sab Saath Badhein” ideology aims to create a prosperous and globally competitive enterprise. ITC Limited has been using renewable sources of energy to meet nearly 50% of its energy needs. The company began operating in the hospitality industry in 1975, opening its first hotel in Chennai. In 2001, the company entered the branded packaged foods industry, selling items such as biscuits, noodles, and confectionery. Today, the company has been active in six different sectors, including FMCG, hotels, Agri Business, paperboards & specialty papers, information technology, and packaging.

Read Also: ITC Case Study

HUL Overview

The history of Hindustan Unilever dates back to 1888 when the individuals at the Kolkata harbor noticed crates of Sunlight soap bars. Sunlight soap was the first product that the Lever brothers, founded by William Hesketh Lever and James Darcy Lever, introduced in the Indian market. However, the soap had the label “Made in England by Lever Brothers” on it. In 1895, Lifebuoy and other famous brands like Pears, Lux, and Vim were launched soon after.

Hindustan Vanaspati Manufacturing Company, Unilever’s Indian subsidiary, was established in 1931. Soon, the Lever Brothers India Limited and United Traders Limited were established in 1933 and 1935, respectively. These businesses came together to form Hindustan Lever Ltd. in 1956. The company renamed itself Hindustan Unilever Limited later in 2007. The company’s headquarters is in Mumbai. In June 2023, Rohit Jawa replaced Sanjiv Mehta as CEO of Hindustan Unilever Limited.

In 2020, the firm bought GlaxoSmithKline Consumer Healthcare Limited, which helped them increase their market share and diversify their product line to include brands like Boost and Horlicks. HUL’s diverse product line includes personal care, beverages, packaged foods, water purifiers, and others.

Read Also: Hindustan Unilever Case Study

Company’s Comparative Study

| Particular | ITC Ltd. | HUL |

|---|---|---|

| Current Share Price | INR 399 | INR 2,495 |

| Market Capitalization (In INR Crores) | 4,99,832 | 5,86,247 |

| 52-Week High Price | INR 499 | INR 2,805 |

| 52-Week Low Price | INR 390 | INR 2,136 |

| FIIs Holdings (%) | 37.97 | 10.18 |

| DIIs Holdings (%) | 46.93 | 16.07 |

| Book Value Per Share | INR 60.08 | INR 210.26 |

| PE Ratio (x) | 14.74 | 69.84 |

Financial Statements Comparison

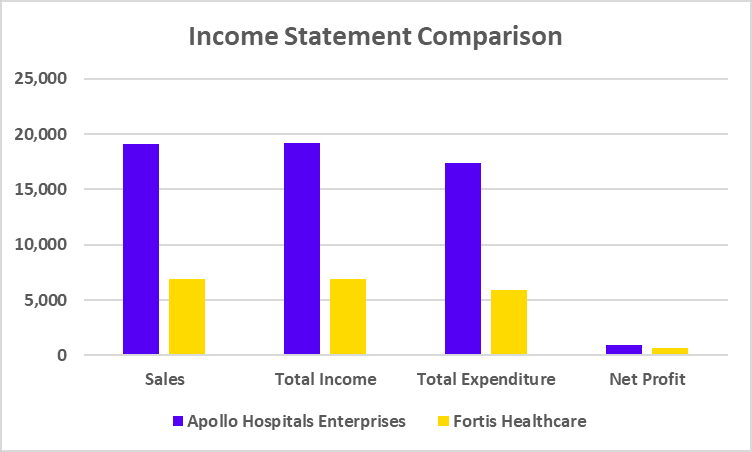

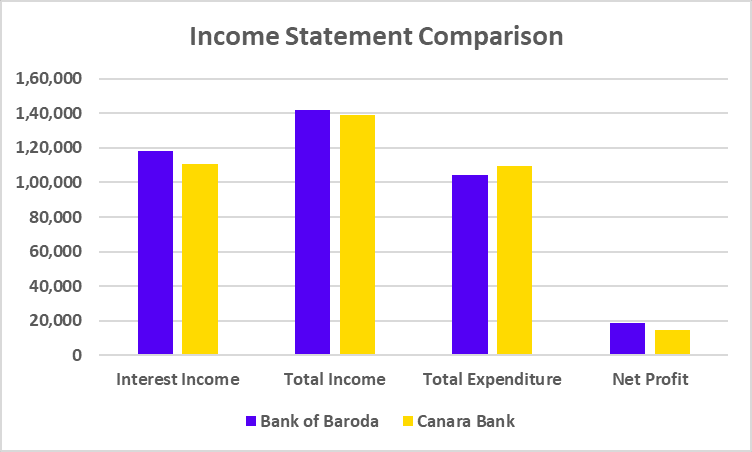

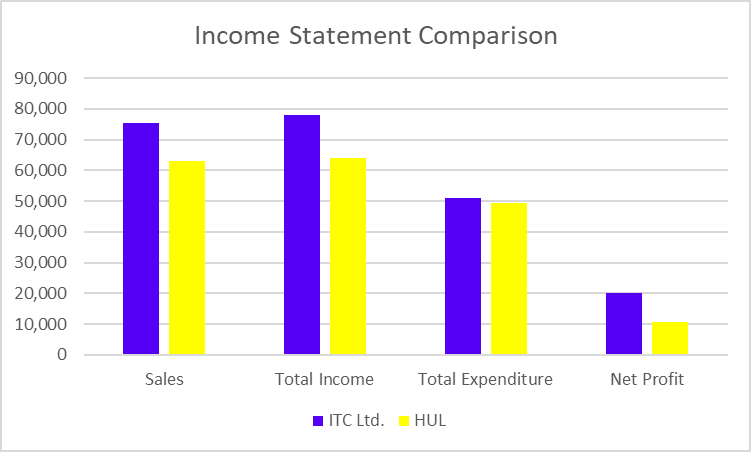

Income Statement Comparison (FY 2025)

| Particular | ITC Ltd. | HUL |

|---|---|---|

| Sales | 75,323 | 63,121 |

| Total Income | 77,853 | 64,138 |

| Total Expenditure | 50,991 | 49,320 |

| Net Profit | 19,926 | 10,679 |

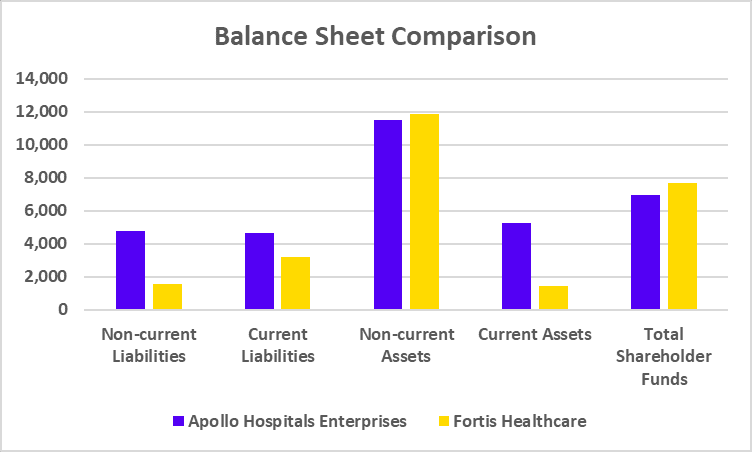

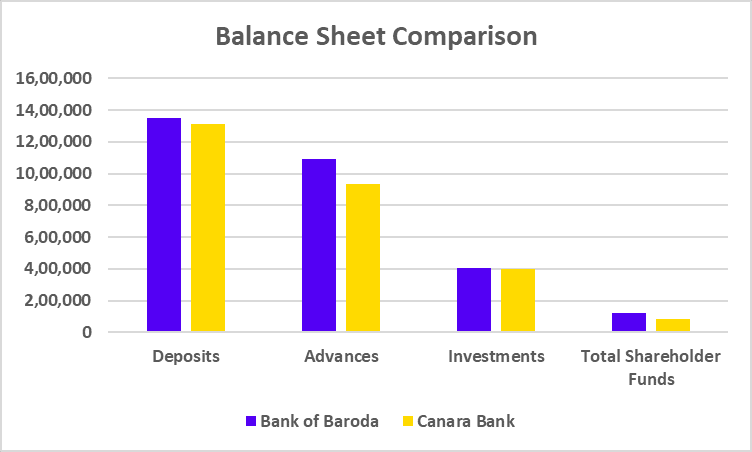

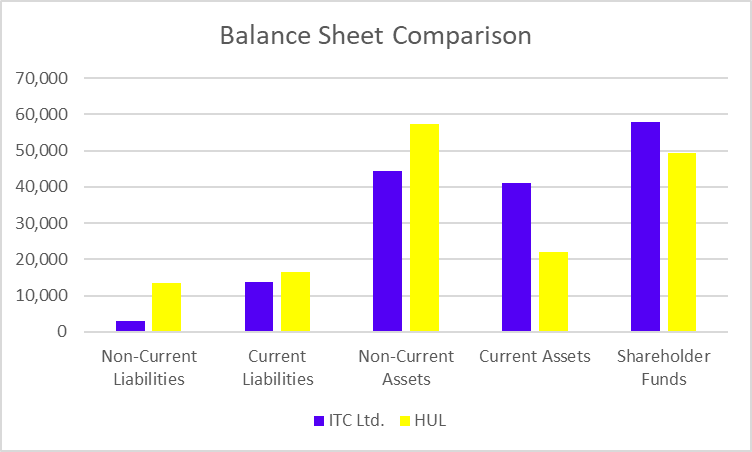

Balance Sheet Comparison (FY 2025)

| Particular | ITC Ltd. | HUL |

|---|---|---|

| Non-Current Liabilities | 2,987 | 13,488 |

| Current Liabilities | 13,690 | 16,537 |

| Non-Current Assets | 44,253 | 57,414 |

| Current Assets | 41,065 | 22,051 |

| Shareholder Funds | 57,950 | 49,402 |

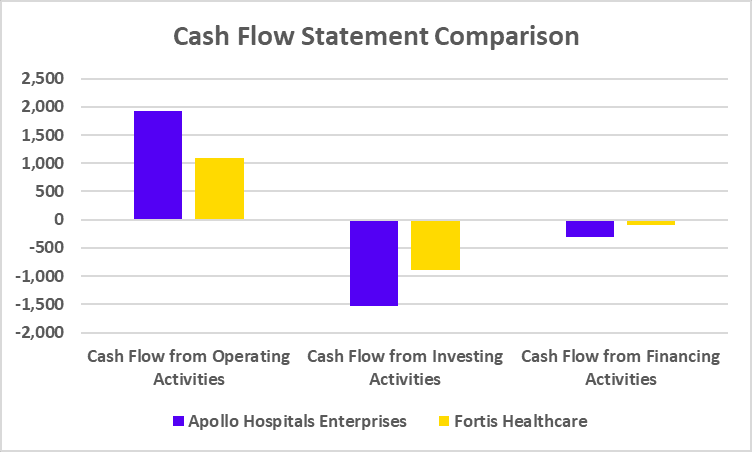

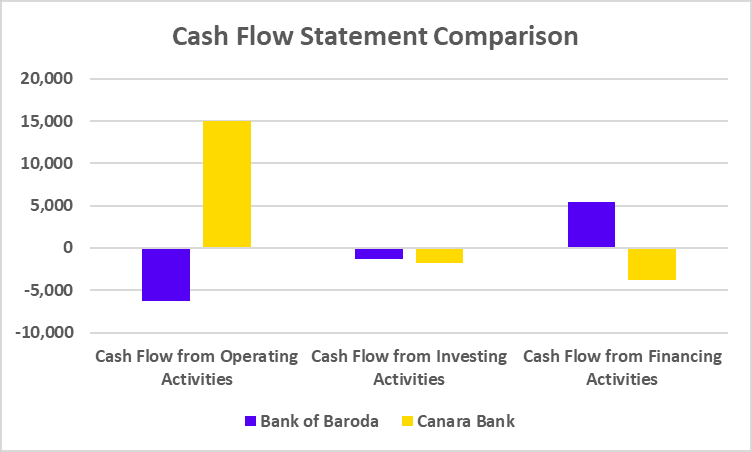

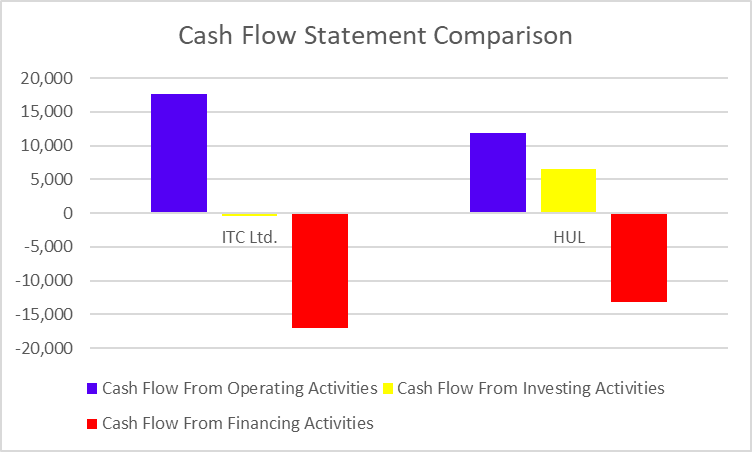

Cash Flow Statement Comparison (FY 2025)

| Particular | ITC Ltd. | HUL |

|---|---|---|

| Cash Flow From Operating Activities | 17,627 | 11,886 |

| Cash Flow From Investing Activities | -395 | 6,473 |

| Cash Flow From Financing Activities | -17,037 | -13,101 |

Key Performance Indicators

| Particular | ITC Ltd. | HUL |

|---|---|---|

| Net Profit Margin (%) | 46.38 | 16.91 |

| ROE (%) | 49.61 | 21.55 |

| ROCE (%) | 36.41 | 22.91 |

| Current Ratio | 3.06 | 1.33 |

| Debt to Equity Ratio | 0 | 0 |

Conclusion

To sum up, ITC and HUL are well-known FMCG companies with a diverse range of products. To expand their market share, both companies have bought several local competitors. The demand and earnings for fast-moving consumer goods (FMCG) remain stable and will rise in tandem with population growth and an increase in disposable income. Before making any investing decisions, it is advised to consult a financial advisor.

Frequently Asked Questions (FAQs)

Among HUL and ITC Ltd., which company has the larger market capitalization?

HUL has a higher market capitalization than ITC Ltd.

What is the full form of HUL and ITC Limited?

The full form of HUL is Hindustan Unilever Limited, and ITC Limited refers to the Indian Tobacco Company.

Which company is more profitable: HUL or ITC Limited?

HUL has posted a net profit of 10,649 crores, whereas ITC Limited has reported a profit of 35,196 crores for the FY 2025, indicating that ITC Limited is more profitable.

Does ITC Ltd. have hotels?

ITC Ltd. operates more than 140 hotels at more than 90+ destinations.

Where is the headquarters of Hindustan Unilever located?

The headquarters of Hindustan Unilever is located in Mumbai, India.