Have you ever wondered how the products you order while lounging on your couch get delivered in a matter of hours? The journey of a product from the factory to consumers is taken care of by the logistics companies. These companies play a crucial role in ensuring seamless delivery, making them some of the best logistics companies in India.

In this blog post, we will provide an overview of the logistics sector and the top 5 companies based on market capitalization and 1-year return.

Overview of Logistics Industry in India

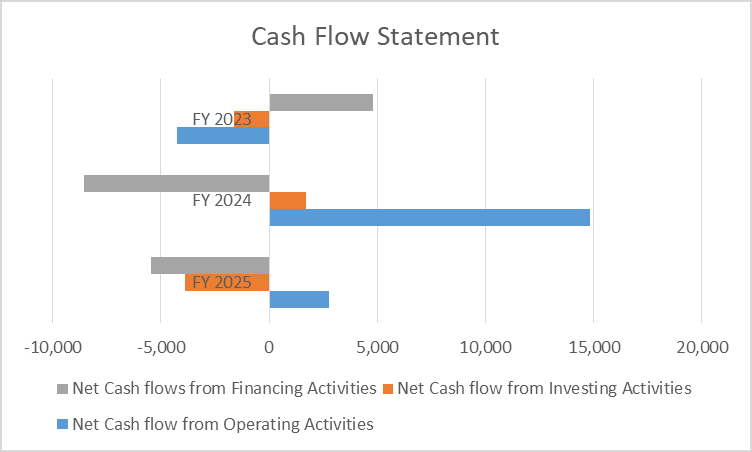

The logistics industry plays an important role in providing a facility for the movement of goods and services in commerce and trade. The companies in this sector provide services such as transportation, warehousing, freight forwarding, management of inventory and supply chain, etc. India’s freight and logistics market is currently valued at $317.3 billion and is expected to reach a valuation of $545.6 billion by 2030. This industry requires adequate infrastructure, technology, skilled labor, etc., to grow at a higher pace.

Top Logistics Stocks Based on the Market Capitalization

The top logistics stocks in India are:

| S.No. | Logistics Stocks |

|---|---|

| 1 | Container Corporation of India Ltd. |

| 2 | Aegis Logistics Ltd. |

| 3 | Delhivery Ltd. |

| 4 | Blue Dart Express Ltd. |

| 5 | TVS Supply Solutions Ltd. |

The logistics stocks have been listed in descending order based on their market capitalization in the table below:

| Company | Market Capitalization (In Crores) | Share Prices (In INR) | 52 Week High Price | 52 Week Low Price |

|---|---|---|---|---|

| Container Corporation of India Ltd. | 39,452 | 518 | 653 | 473 |

| Delhivery Ltd. | 33,187 | 444 | 490 | 237 |

| Aegis Logistics Ltd. | 24,177 | 689 | 946 | 639 |

| Blue Dart Express Ltd. | 13,996 | 5,898 | 7,225 | 5,190 |

| TVS Supply Chain Solutions Ltd. | 4,485 | 102 | 160 | 92.2 |

Read Also: List of Best Monopoly Stocks in India

5 Best Logistics Stocks in India Based on Market Capitalization – An Overview

The best logistics stocks in India are given below, along with a brief overview:

1. Container Corporation of India Ltd.

The company was incorporated in 1988 and is a public-sector undertaking under the Ministry of Railways. The company focuses on containerized delivery and handling services. Container Corporation of India, or CONCOR, has been given the status of Navratna. It began working in 1989 by taking over 7 Inland Container Depots (ICDs) from the Indian Railways. The company operates on a vast network of ports across India and provides logistic solutions for air cargo complexes.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -11.60% | 7.05% | 34.22% |

2. Aegis Logistics Ltd.

The company was incorporated in 1956, and initially, the company was engaged in manufacturing chemicals. Later, it shifted its focus to providing logistic facilities for liquid chemicals, petroleum products, and LPG. They operate storage facilities at major ports such as Mumbai, Haldia, Kochi, etc. The company’s headquarters is situated in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -9.02% | 85.94% | 131.58% |

3. Delhivery Ltd.

The company was founded in 2011 and was initially focused on offering delivery services for local restaurants and offline stores in Gurgaon. The next year, they shifted their business to provide e-commerce logistic facilities across the nation for parcel delivery. Through its strategic partnership with FedEx, the business grew and offered more services, such as cross-border logistics and freight services. In 2022, the company came up with an IPO to raise capital. Its headquarters is situated in Gurgaon, Haryana.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 35.01% | 46.37% | -10.44% |

4. Blue Dart Express Ltd.

The company was established in 1983 by Tushar Jani, Khushroo Dubash, and Clyde Cooper. The company was focused on providing courier services in India and abroad. The company also has a subsidiary named ‘Blue Dart Aviation,’ which operates as a cargo airline in South Asian countries. In 2002, DHL Express acquired a majority stake in the company. The company’s headquarters is situated in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -9.05% | -3.68% | 32.90% |

5. TVS Supply Chain Solutions Ltd.

The company was established in 2004 as TVS Logistics Services Limited. Later, the company made various acquisitions, including companies in the UK and USA, to increase its geographical reach. In 2009, the company acquired Multipart Holding, a major logistics player in the UK. In 2019, the company changed its name to TVS Supply Chain Solutions Limited. The company was listed on the Indian stock market in August 2023. The company’s headquarters is situated in Chennai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -28.26% | -50.83% | -50.83% |

Top Logistics Stocks Based on 1-Year Return

The logistics stocks have been listed in descending order based on their 1-year returns in the table below:

| S.No. | Logistics Stocks | 1 Year Returns (%) |

|---|---|---|

| 1 | Navkar Corporation Ltd. | 16.18% |

| 2 | DJ Mediaprint and Logistics Ltd. | 89.06% |

| 3 | AVG Logistics Ltd. | 81.65% |

| 4 | North Eastern Carrying Corporation Ltd. | 80.70% |

Read Also: List of Best Recycling Stocks in India

Best Logistics Stocks in India Based on 1-Year Return – An Overview

The overview of best logistics stocks according to 1-year return is given below:

1. Navkar Corporation Ltd.

This company was founded in 2008 by the conversion of an existing partnership firm named Navkar Infra and Logistics Corporation. In 2015, the company went public on the Indian Stock Exchange. The company offers extra services, including cargo customizing, labeling, packaging, and logistic services. The company’s headquarters are located in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 16.18% | 69.75% | 143.96% |

2. DJ Mediaprint and Logistics Ltd.

DJ Corporation was the name under which the company was founded in 1999 as a sole proprietorship. The company started concentrating on courier and logistical services, but in 2000, it also started offering bulk mailing services. The business renamed itself DJ Logistics Solutions Private Limited in 2009, and in 2022, it filed for an initial public offering (IPO) to raise money for expansion. The organization’s head office is in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -41.72% | 95.56% | 39.09% |

3. AVG Logistics Ltd.

AVG Logistics Private Limited was founded in 2010. In 2018, the company became a publicly traded company and went public. The company offers a variety of services, including completely and partially loaded trucks, cold chain logistics, and warehouse facilities. Coca-Cola, Mother Dairy, Ultratech Cement, MRF, and other companies are some of the company’s main clients. Its headquarters are situated in New Delhi.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -50.33% | 18.02% | 247.15% |

4. North Eastern Carrying Corporation Ltd.

North Eastern Carrying Corporation Limited was established in 1984. The corporation initially operated as a transporter in the northern and eastern parts of India. Today, the company provides services in India, Nepal, Bangladesh and Bhutan. The company went public in 2012. The company recently bagged an order from the Gas Authority of India. Its main office is located in New Delhi.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -53.89% | -37.07% | 59.81% |

Key Performance Indicators (KPIs)

| Company | ROE (%) | ROCE (%) | Debt to Equity | P/E | P/B |

|---|---|---|---|---|---|

| Container Corporation of India Ltd. | 10.66 | 13.36 | 0 | 47.34 | 5.05 |

| Aegis Logistics Ltd. | 14.61 | 13.89 | 0.43 | 44.06 | 6.63 |

| Delhivery Ltd. | -2.72 | -1.40 | 0.01 | -133.33 | 3.12 |

| Blue Dart Express Ltd. | 22.01 | 23.89 | 0.19 | 65.74 | 14.10 |

| TVS Supply Chain Solutions Ltd. | -5.57 | 6.38 | 0.44 | 67.79 | 3.05 |

| Navkar Corporation Ltd. | -0.08 | 1.22 | 0.11 | 359 | 1.02 |

| DJ Mediaprint and Logistics Ltd. | 15.02 | 21.11 | 0.46 | 67.48 | 10.13 |

| AVG Logistics Ltd. | 15.96 | 16.89 | 0.44 | 20.47 | 3.27 |

| North Eastern Carrying Corporation Ltd. | 7.13 | 6.55 | 1.06 | 24.11 | 1.44 |

Benefits of Investing in Logistics Stocks

There are various benefits of investing in logistics stocks, a few of which are mentioned below:

- Growth Potential – With the expansion of e-commerce, there will eventually be a greater need for logistics services, which will present an investment opportunity for investors.

- Demand for Product – The need for logistical infrastructure is growing as disposable income rises, and so is the demand for products.

- Government Support – The Indian government introduced the ‘National Logistics Policy’ in 2020 for the development of the logistics sector.

- Innovations – The businesses in this industry are embracing new technologies, which will allow them to achieve efficiency.

Factors to Be Considered Before Investing in Logistics Stocks

There are various factors that one should consider before investing in logistics stocks:

- Efficiency of company – It is necessary to evaluate the business’s efficiency in terms of asset utilization, cost-effectiveness, and technology use, among other things. Companies need to make use of the newest technologies on the market to increase productivity.

- Network – The business with wider geographic operations will be at a competitive advantage over rivals.

- Client Base – A business with a large client base and good customer retention rates will have a more reliable revenue stream.

Future of the Logistics Industry in India

In India, the logistics sector has a lot of room to grow. India is ranked 38th out of 139 nations in the World Bank’s Logistics Performance Index for 2023. According to other reports, the logistics business in India is projected to expand at an annualized rate of 9.46%. At this rate, the industry is estimated to reach a valuation of around 545.6 billion USD by 2030 from its present value of 317.3 billion USD. This implies that there is a lot of room for growth in this market going forward.

Read Also: List of Top 10 Blue Chip Stocks in India with Price

Conclusion

The development of a nation is significantly influenced by the logistics sector. People purchase more products as their disposable income rises, and this industry makes it easier for them to buy those goods whenever and wherever they want. Nevertheless, before making any investments, one should take into account the possible risks associated with the logistics industry, which include operating and regulatory changes, economic downturns, and more.

Frequently Asked Questions (FAQs)

What are the main business of logistics sector companies?

Logistics companies are generally involved in supply chain management, transportation of goods, inventory management, warehouse-related services, etc.

Is there any difference between transportation and logistics stocks?

There is a slight difference between transportation and logistics companies; transportation companies are generally engaged in moving goods and people from one place to another, whereas logistics companies also offer additional services like warehouses for storing goods, supply chain management, etc., along with the transportation of goods.

What are the prominent players in the Indian logistics sector?

The major players in the Indian logistics sector are Container Corporation of India Limited, Aegis Logistics Ltd., Delhivery Limited, Blue Dart Express Limited, TVS Supply Chain Limited etc.

What is the meaning of cold chain logistics?

Cold chain logistics refers to storing and transporting temperature-sensitive products such as pharmaceuticals, perishable foods, ice creams, etc.

Is it good to include logistics stocks in your portfolio?

Including logistics stocks in your portfolio provides you with the benefit of diversification and reduces the overall risk. However, you must consult your investment advisor before making any investment decision.