India is a mineral-rich country with an abundant supply of aluminium, copper, iron ore, manganese, etc. Mining companies extract minerals from the soil, process them, and provide them to various industries such as infrastructure, automotive, etc. These businesses generate employment and contribute to the nation’s manufacturing activity and GDP.

In this blog, we will provide an overview of Hindalco Industries Ltd., an Indian company that produces and manufactures copper and aluminium goods.

Hindalco Industries Ltd. Company Overview

The Aditya Birla Group founded the Hindalco Industries Ltd. company and began operations in 1958. They first worked with Kaiser Aluminum, USA, and later with the Bihar government to produce aluminium. The company established India’s first integrated aluminium facility in Renukoot, Uttar Pradesh, in 1962. Later, in 1980, they began diversifying their product portfolio and started smelting copper. Since 2000, the company has made several strategic acquisitions to strengthen its market position. The organisation’s headquarters is in Mumbai.

Business Model of Hindalco Industries

The Hindalco business model primarily operates through several key segments:

- Resource Mining: Hindalco has mines in Jharkhand, Chattisgarh, Maharashtra and Odisha and sources raw materials required for aluminium production from these mines.

- Alumina Refining: The company has refining facilities in Utkal, Renukoot, Muri and Belagavi that produce alumina. Alumina is utilised for our internal operations to manufacture aluminium, and the excess alumina is sold off to other industries.

- Aluminium Smelting: The company has four smelting facilities in Uttar Pradesh, Odisha and Madhya Pradesh that produce 1.3 million tons of primary aluminium annually.

- Aluminium Downstream: The company offers products in rolled products, extrusions, foil and packaging segments.

- Copper Smelting: Birla Copper, located in Gujarat, is the world’s largest copper smelter facility with integrated port facilities.

Product Portfolio of Hindalco Industries

The company has been primarily involved in three business verticals mentioned below:

- Aluminium: Primary aluminium, Metallurgical aluminium, and Aluminium value-added products.

- Copper: Cathodes, Continuous Cast Rods, By-Products

- Chemicals: Calcined alumina, Alumina hydrate

The products mentioned above are used in various industries such as automotive, aerospace, consumer durables, etc.

Market Details of Hindalco Industries Limited

| Current Market Price | INR 663 |

| Market Capitalization (In INR Crores) | 1,49,058 |

| Book Value | INR 472 |

| 52 Week High | INR 715 |

| 52 Week Low | INR 449 |

| P/E Ratio (x) | 13.6 |

Read Also: Amul Case Study, Business Model, And Marketing Strategy

Financial Statements of Hindalco Industries

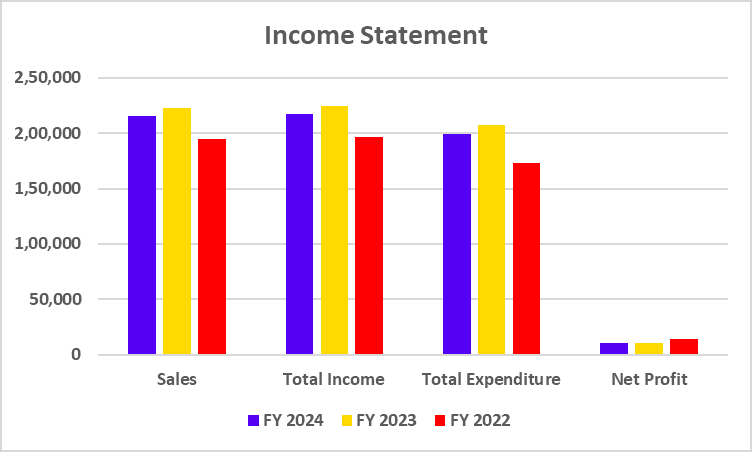

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 2,15,962 | 2,23,202 | 1,95,059 |

| Total Income | 2,17,458 | 2,24,459 | 1,96,195 |

| Total Expenditure | 1,99,590 | 2,07,581 | 1,72,859 |

| Net Profit | 10,153 | 10,088 | 14,195 |

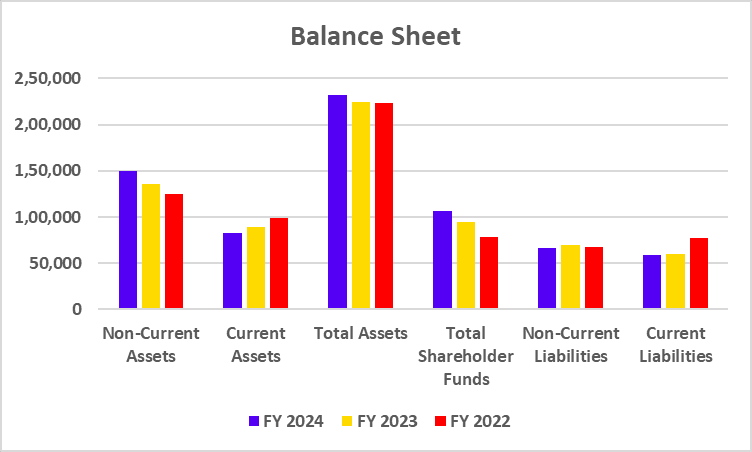

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Non-Current Assets | 1,49,564 | 1,35,506 | 1,24,519 |

| Current Assets | 82,343 | 89,311 | 98,543 |

| Total Assets | 2,31,907 | 2,24,817 | 2,23,062 |

| Total Shareholder Funds | 1,06,142 | 94,802 | 78,187 |

| Non-Current Liabilities | 66,399 | 69,543 | 67,587 |

| Current Liabilities | 59,351 | 60,457 | 77,273 |

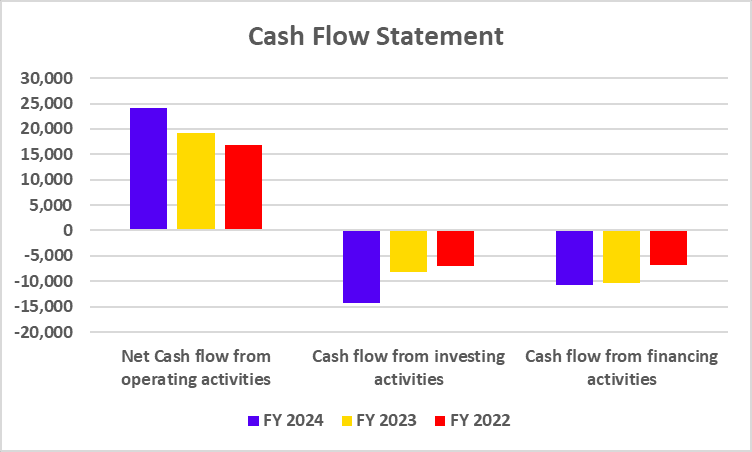

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Net Cash flow from operating activities | 24,056 | 19,208 | 16,838 |

| Cash flow from investing activities | -14,276 | -8,121 | -7,074 |

| Cash flow from financing activities | -10,817 | -10,345 | -6,765 |

Key Performance Indicators (KPIs)

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Operating Profit Margin (%) | 8.26 | 7.54 | 11.66 |

| Net Profit Margin (%) | 4.70 | 4.51 | 7.03 |

| Return on Net Worth/Equity (%) | 9.56 | 10.65 | 17.56 |

| Return on Capital Employed (%) | 10.34 | 10.24 | 15.60 |

| Current Ratio | 1.39 | 1.48 | 1.28 |

| Debt to Equity Ratio | 0.51 | 0.62 | 0.81 |

SWOT Analysis of Hindalco Industries

Strength

- Brand Image – Hindalco is the metals flagship company of the Aditya Birla Group and thus has a significant market share in the copper and aluminium industry.

- Diversification – The company offers its clients a wide range of products, such as copper rods, foils, and aluminium rolls, in addition to other by-products like phosphoric acid and sulfuric acid.

- Geographical Reach – With its presence in over ten nations, the company can continue to rely on a steady income stream.

Opportunities

- Technological Advancement – The company will be able to lower production costs by integrating the latest technologies into the process.

- Strategic Partnership – The business can form strategic alliances with foreign businesses to increase its market share.

- Product Diversification – The company can enhance its revenue by diversifying into other metal products, thereby expanding its product portfolio.

Threat

- Competition – A pricing war amongst competitors can result in a decline in the company’s profit margin.

- Global Demand – The demand for aluminium products can decrease in the event of a downturn in the economy, which will immediately affect the company’s sales and revenue.

- Environmental Concern – Manufacturing aluminium and copper causes a lot of pollution; hence, the corporation is compelled to spend on decreasing its carbon footprint.

Weaknesses

- Competition – Due to the intense competition in the aluminium market, the company’s market share may be impacted by the entry of new competitors.

- Business Cycle – Because the copper and aluminium industries are cyclical, there will inevitably be periods of consolidation. These changes could affect the company’s profit margins.

- Prices of Commodities – Changes in commodity prices will directly impact the company’s financial performance.

Read Also: Case Study on Procter & Gamble Marketing Strategy

Conclusion

In conclusion, government policies and the emphasis on infrastructure development have a positive impact on the metal sector in India. The corporation has a global presence and is among the biggest manufacturers of copper and aluminium in the nation. The need for metals like copper and aluminium will increase as the country develops. However, there are several risks associated with this growth narrative, so it is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

Who is the owner of hindalco?

Hindalco Industries is a part of the Aditya Birla Group, and its chairman is Kumar Mangalam Birla, the owner and leader of the group.

Where are the major plants of Hindalco Industries Limited located in India?

Hindalco Industries Limited’s major plants are in West Bengal, Maharashtra, Karnataka, Gujarat, etc.

Where is the headquarters of Hindalco Industries Limited?

The headquarters of Hindalco Industries Limited is situated in Mumbai.

Is Hindalco Industries Limited a profitable company?

Yes, Hindalco Industries Limited is a profitable company. It has reported a net profit of INR 10,153 crores for FY 2024 and a profit of 10,088 crores for FY 2023.

Which group owns Hindalco Industries Limited?

Hindalco Industries Limited is a subsidiary company of the Aditya Birla Group.