In options trading, it’s often the case that even if the price goes up slightly, your option’s premium still declines due to decay. This is where most beginners get confused. What exactly happened? Essentially, time decay in options, or Theta, is an invisible force that erodes the value of your option with each passing day. In this blog, we’ll explain in simple terms what time decay is in options, how it works, and how to protect yourself from it.

What Is Time Decay in Options?

Time Decay, also known as Theta in the options Greek, is the rate at which an option’s premium declines as time passes. In India’s options market whether it’s Nifty, Bank Nifty, or Stock Options every option has a time-based value, called extrinsic value. This value decreases every day, and this process is called time decay in options or premium decay.

How Time Decay Works ?

The simplest way to understand Time Decay is to assume that the option’s value erodes slightly each day. However, this eroding speed varies from option to option. Below are the main factors that determine how quickly your premium will decline.

1. Time to Expiry

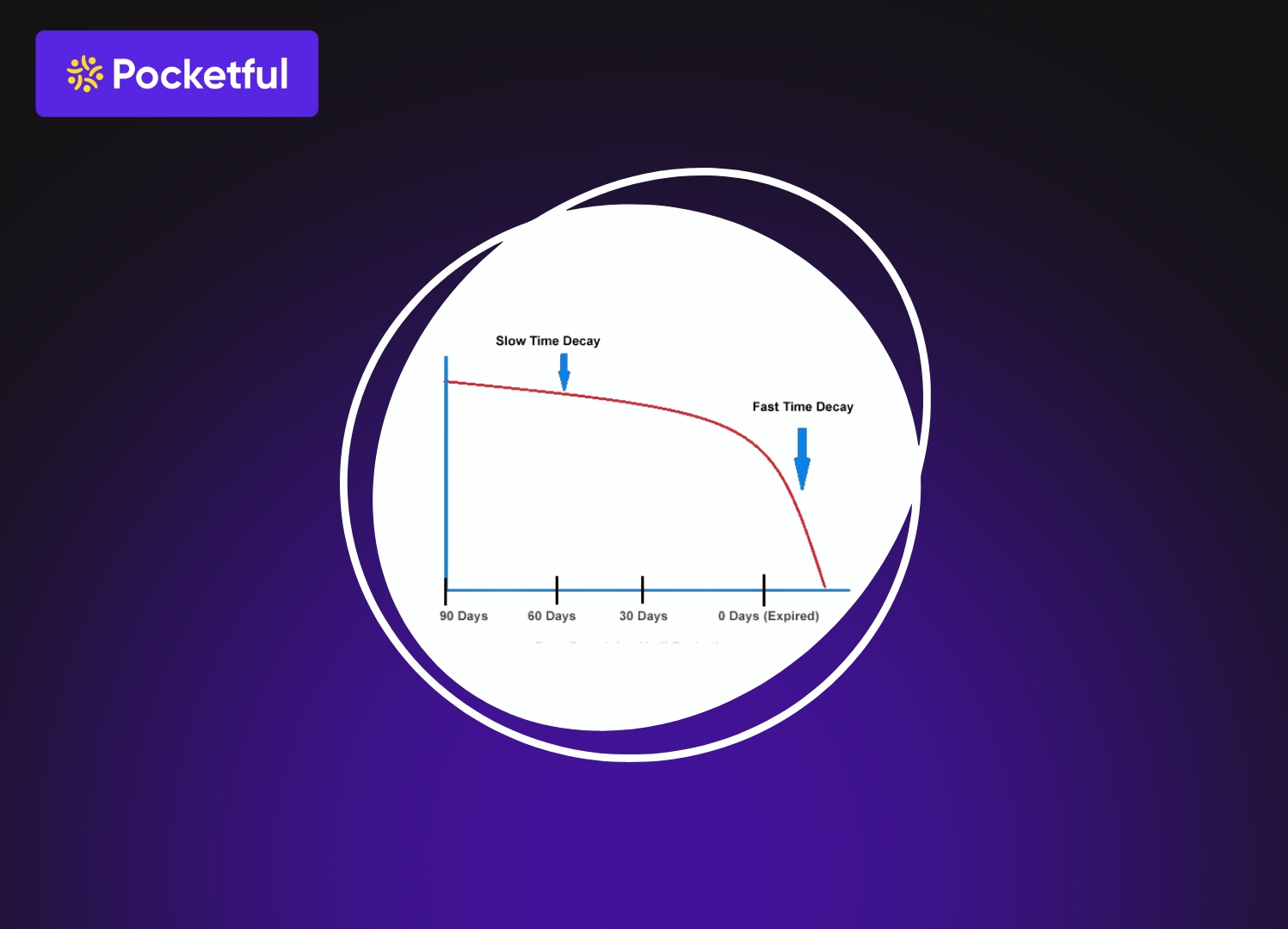

The closer the expiry approaches, the faster Theta works.

- Options with longer expiries decay slowly,

- While the decay accelerates sharply during the expiry week.

Example : If an option has 10 days left until expiry, it might decline by ₹3 daily. But two days before expiry, the same option might decline by ₹10-₹15 daily even if the price stays the same.

2. Intrinsic Value

ITM options are more stable, OTM options melt faster

- ITM options have intrinsic value, so the effect of time decay is less.

- OTM options operate entirely on extrinsic value, so their decay is the fastest.

Example : Nifty is trading at 26,200.

- 26,000 CE (ITM) : Fairly stable because it has intrinsic value.

- 26,500 CE (OTM) : Based solely on expectations, so the premium falls quickly.

3. Volatility

If the market has high implied volatility, the option premium doesn’t fall quickly because the market anticipates an imminent price movement.

- High IV : Higher premium, slower decay

- Low IV : Lower premium, faster decay

Volatility increases before events like the Budget, RBI Policy, and Elections, so the premium doesn’t fall as quickly during those times.

4. Interest Rates

As interest rates rise, the time value of OTM calls decreases slightly, especially for OTM call options. This is because the future payoff becomes less attractive as the time value of money increases.

Example : If interest rates rise, buying the stock directly becomes slightly more attractive to traders than buying the option. This causes the extrinsic value of an OTM call to decline more quickly.

Example: How does Time Decay work in Nifty Option?

Let’s assume the current Nifty price is 26,200 this week, and the weekly expiry is on Tuesday. Now, let’s just understand how time decay affects the premium if the market remains roughly the same.

Scenario (trades taken on Monday) :

- Nifty Spot: 26,200

- Option Bought: 26,300 CE (OTM Option)

- Expiry: Tuesday of this week

- Days to Expiry: 2 days

- Monday Premium: ₹85

- Approx Theta: 14 per day

| Day | Nifty Price | Days Left | Premium (INR) | What happened |

|---|---|---|---|---|

| Monday | 26,200 | 2 Days | 85 | Trade Entry |

| Tuesday Morning | 26,200 | 1 Day | 71 | Effect of time decay |

| Tuesday Afternoon (Near Expiry) | 26,200–26,210 | Few Hours | 52 | Decay faster in the last hours |

| Tuesday Closing (Expiry) | 26,200 | 0 | 35–40 | Maximum premium decay |

Nifty didn’t experience any significant decline or rise, yet the option premium declined from ₹85 to around ₹40 simply because of time. This is the true power of time decay in options.

Read Also: Call and Put Options: Meaning, Types, Difference & Examples

Factors That Influence Time Decay

The Effect of Implied Volatility (IV) on Time Decay

Implied volatility directly controls the option premium and its decay rate. When IV is high, the premium is already high, so time decay appears relatively slow. Conversely, when IV is low, the premium decays rapidly, and premium decay becomes very rapid. In practice, option buyers often suffer more losses from a sudden drop in IV (IV crush) than from Theta.

The Role of Moneyness (ITM, ATM, and OTM)

The effect of time decay also depends on whether the option is in-the-money, at-the-money, or out-of-the-money. ATM options have the highest extrinsic value, so they are most affected by Theta. Due to the intrinsic value of ITM options, the premium remains somewhat stable, which slows down the decay rate. OTM options, on the other hand, are based entirely on extrinsic value, so their premiums decline the fastest.

Relationship between Volatility Events and Time Decay

Volatility increases before the Budget, RBI Policy, Earnings, or any major global event, adding expectation to the option premium and temporarily slowing time decay. However, as soon as the event ends, volatility drops sharply, and the premium declines sharply. This is the phase where buyers see the greatest losses and sellers the greatest profits.

Difference in Time Decay between Weekly and Monthly Options

In the Indian market, time decay in weekly options is extremely rapid because expirations are very close, and extrinsic value erodes quickly. In contrast, the decay in monthly options is more balanced and predictable because they have a longer time horizon and the premium declines more slowly. For this reason, short-term traders prefer weekly options, and positional traders prefer monthly options.

How Option Buyers Should Manage Time Decay

- Early Entry and Timely Exit : When buying options, one should strive to enter trades well in advance of expiry and exit before the last 1-2 days. Time decay accelerates as expiry approaches, which can quickly erode even a substantial premium.

- Avoid Buying in Low Volatility : When implied volatility is very low, option premiums fall rapidly. Buying options at such times results in rapid premium decay losses. Therefore, buyers should enter only when they see signs of increasing volatility.

- Wisdom in Strike Selection : Time decay has the greatest impact on ATM and OTM options, so strikes should not be selected solely based on a low premium. Buyers should choose strikes where there is a clear potential for price movement.

- Risk-Control Strategy Instead of Naked Buying : Employing strategies like debit spreads instead of simply buying a call or put can significantly limit the impact of time decay and keep risk more manageable.

Read Also: What is an ITM (In The Money) Call Option?

How Option Sellers Benefit From Time Decay

- Benefit from Daily Premium Erosion : The biggest advantage an option seller receives is that the premium automatically decreases each day due to time decay. If the market remains calm and there are no sharp movements, the seller can gradually move towards profit without any action.

- Steady Earnings in a Range-Bound Market : When the market moves within a limited range, the premium in option buying continues to erode, and selling strategies consistently work. In such an environment, time decay becomes a natural edge for the seller.

- Faster Theta Gain in Weekly Expiry : Weekly expiry is very close to expiry, so the premium decay speeds up significantly. This is why short-term option selling offers the seller the potential for better returns in a short period of time.

- Limiting Loss with Risk Control : Option selling involves limited profits and high risks, so hedged positions, fixed stop-losses, and correct quantity selection are essential. Selling without risk control can be detrimental in the long run.

Misconceptions About Premium Decay

Misconception 1: Time Decay Only Hurts Buyers

It’s not entirely accurate to believe that time decay only affects option buyers. Under normal circumstances, sellers benefit from theta, but when implied volatility suddenly increases, the premium can rise again, leading to losses for the seller. This means that time decay favors sellers only when volatility is under control and the market doesn’t make sudden, sharp movements.

Misconception 2: Buying ATM Options is the Safest

Many people think that ATM options are safer, but the reality is that time decay works fastest on ATM options because they have the highest extrinsic value. If the market doesn’t make a strong move immediately, the ATM premium erodes very quickly. This is why buying ATM options without proper timing often proves to be a loss.

Misconception 3: Expiry Day Options Make Money Quickly

The option premium appears very cheap on expiry day, creating the illusion that money can be made quickly. In fact, both time decay and volatility are extremely rapid on expiry day, causing premiums to fall sharply in a matter of minutes. This makes expiry-day options more risky than opportune for beginners and only suitable for experienced traders.

Read Also: Option Chain Analysis: A Detail Guide for Beginners

Conclusion

Time decay in options is a factor that can be detrimental to any trader if ignored. It plays a significant role in determining both profits and losses, especially in the Indian market with weekly expiry. Option buyers should pay special attention to timing, volatility, and strike selection, while sellers should utilize the benefits of Theta with disciplined risk management. With proper understanding and the right strategy, time decay can be used as both a loss hedge and a source of income.

Frequently Asked Questions (FAQs)

What is time decay in options?

Time decay is the natural process in which an option’s premium gradually decreases each day.

Does time decay affect both call and put options?

Yes, time decay affects both call and put options equally.

Which options lose value the fastest due to time decay?

OTM options lose premium the fastest.

Is time decay faster in weekly options?

Yes, weekly options decay much faster as expiry approaches.

Do option sellers always make a profit from time decay?

Profits are often generated, but sudden market movements can also result in losses.