The stock market primarily features two types of market participants, i.e. investors and traders. Most of them are investors, but the number of traders is steadily increasing. Every day, countless people trade using different strategies, trying to make quick profits. Every trader has a different approach, i.e., some focus on small price movements throughout the day, while others stay invested in the same stock for months. In such a situation, it becomes important to understand which trading style will be right for you.

In this blog, we will talk about different trader types, their trading styles, and the characteristics of each. This will help you decide which trading strategy will be best according to your risk tolerance and financial goals.

Understanding Trader Classifications

Everyone wants to earn money in the stock market, but each individual’s approach towards markets is different. Some people buy and sell financial instrument every day, whom we call traders. These people try to make quick profits from small price movements, due to which one has to constantly keep an eye on the market movements.

On the other hand, there are market participants who think medium-term and are inclined to hold trading positions overnight ranging from a few days to a few months. The logic behind their positions is primarily based in technical analysis rather than fundamental analysis.

Active and Passive Trading Style

Two major categories of trading styles are: active and passive trading, which are explained in detail below:

- Active trading : In active trading, people buy and sell several times during a day taking advantage of small price movements. Such traders have an expertise in reading charts and taking quick action on every small change. In this, the chances of profit are higher, but the risk and stress are also significant. For example: scalper, day trading, etc.

- Passive trading : Passive trading is a much calmer approach to trading. In passive trading, people hold their trading positions from a few days to a few months trying to take advantage of price trends. This approach involves fewer transactions and much larger price movements. It is less risky and is less stressful, but profits come slowly. For example: position trading, swing trading, etc.

The amount of time you have and the risk you can take will determine which style is right for you. Now that we have understood the broad categorization of trading styles, let us understand their sub categories in detail.

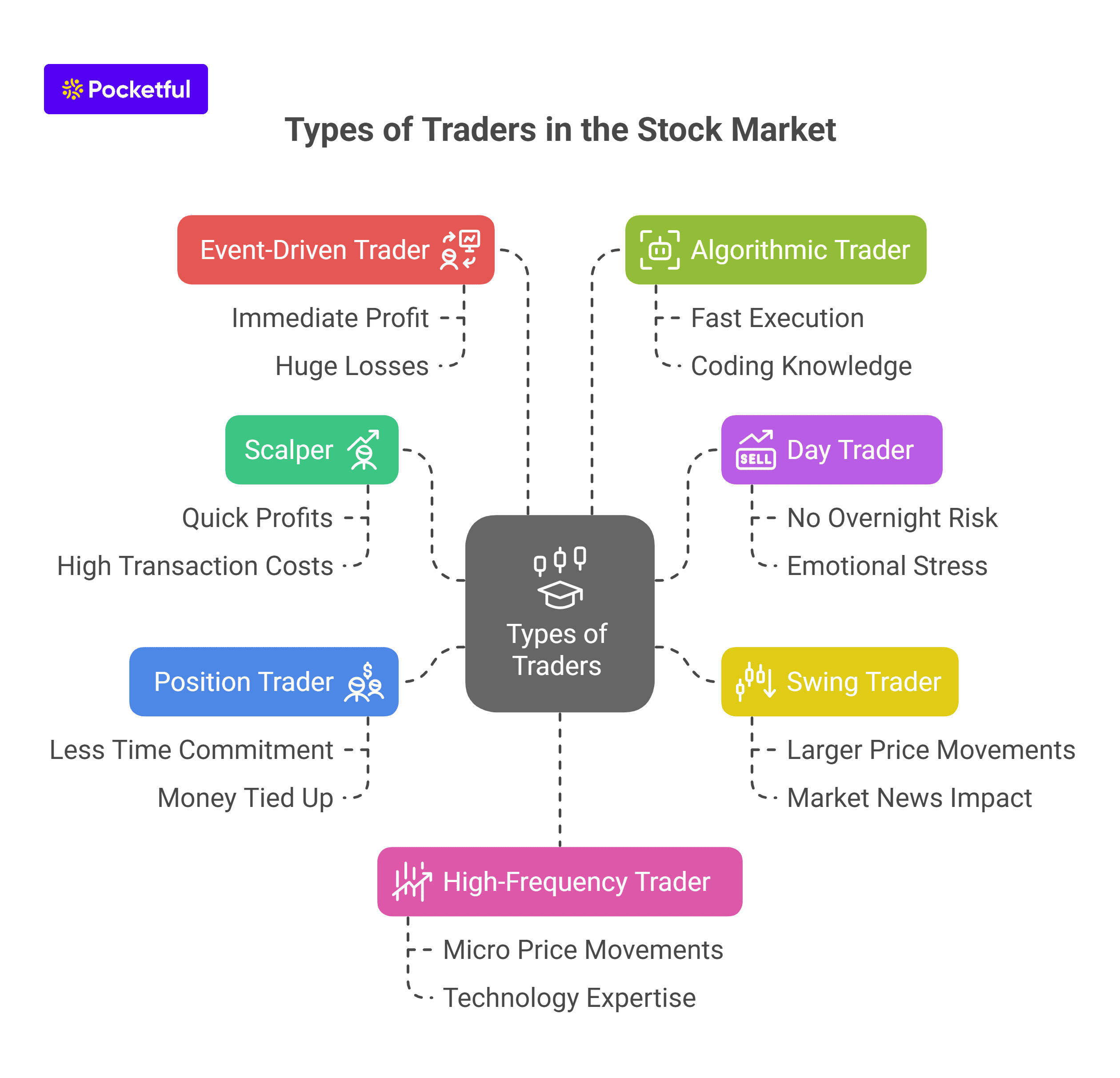

Types of Traders in the Stock Market

There are different types of traders in the stock market, who trade according to their own strategies and time frames. Each trading style has its own advantages and disadvantages, which is important for every trader to understand. Let us now know about the main trader types:

1. Scalper

Scalpers are traders who make a lot of small trades in a single day. Their aim is to catch small profits repeatedly. They open and close positions within seconds or minutes.

Advantages:

- Making quick and small profits

- Taking advantage of small price movements

Disadvantages:

- Requires a lot of attention and focus

- Transaction costs (brokerage) are high

- More stress

2. Day Trader

Day traders create market positions after market opening and close all their positions by the end of the day. They avoid overnight risk as they do not hold any position while the market is closed.

Advantages:

- Opportunity to earn every day

- There is no overnight market risk

Disadvantages:

- Have to keep an eye on the market throughout the day

- Involves emotional stress and volatility

3. Swing Trader

Swing traders hold their positions for a few days to a few weeks. These traders take advantage of short to medium term trends in the market.

Advantages:

- Larger price movements and low brokerage costs

- Ideal for part-time traders

Disadvantages:

- Trading positions can be affected by market news and unexpected global events

- Significant capital may be required

4. Position Trader

Position traders hold stocks for long periods of time, which can typically range from weeks to months. These traders rely on capturing large price movements based on market trends and technical analysis.

Advantages:

- Less time commitment and stress

- Low brokerage costs

Disadvantages:

- Money is tied up for a long time

- There is a risk of loss due to large market fluctuations

5. Event-Driven Traders

These traders trade based on global events as they react quickly to news in the market, company earnings reports, government policies or other significant events. These events cause significant price fluctuations in the market and traders following this approach try to take advantage of it.

Advantages:

- Opportunities to realise immediate profit

- Potential to deliver high returns

Disadvantages:

- Can result in huge losses if the market doesn’t react as expected

- Quick decision needed, otherwise the opportunity is lost

6. Algorithmic Trader

Algorithmic trading features automatic trades made using computer programs and algorithms. These algorithms analyze market data, buy and sell financial assets based on the trading strategy.

Advantages:

- Fast and accurate execution

- No interference of human emotions

- Decisions based on back-tested data

Disadvantages:

- Coding knowledge is required

- Risk of system or network failure

7. High-Frequency Trader

High-Frequency Trading (HFT) is a trading approach in which hundreds of trades are made in seconds using computers. In this, trading firms or large organizations use superfast computers and advanced trading algorithms.

Advantages:

- Taking advantage of micro price movements

- No human emotions are involved

Disadvantages:

- Requires large investment and technology expertise

- Coding knowledge is required

Read Also: 10 Top Investors In India And Their Portfolios

Trader vs. Investor: Key Differences

| Point | Trader | Investor |

|---|---|---|

| Holding Period | From a few minutes to a few months | Several months to years |

| Goal | Make profits in a short time | Build wealth over the long term |

| Decision making | Quick decision making is required | Decisions are taken based on thorough research |

| Method of analysis | Relies on technical analysis | Relies on fundamental analysis, industry insights, etc. |

| Risk Level | High | Low |

| Time Commitment | High as it is essential to make timely entries and exits | Time commitment is a lot less after the investing |

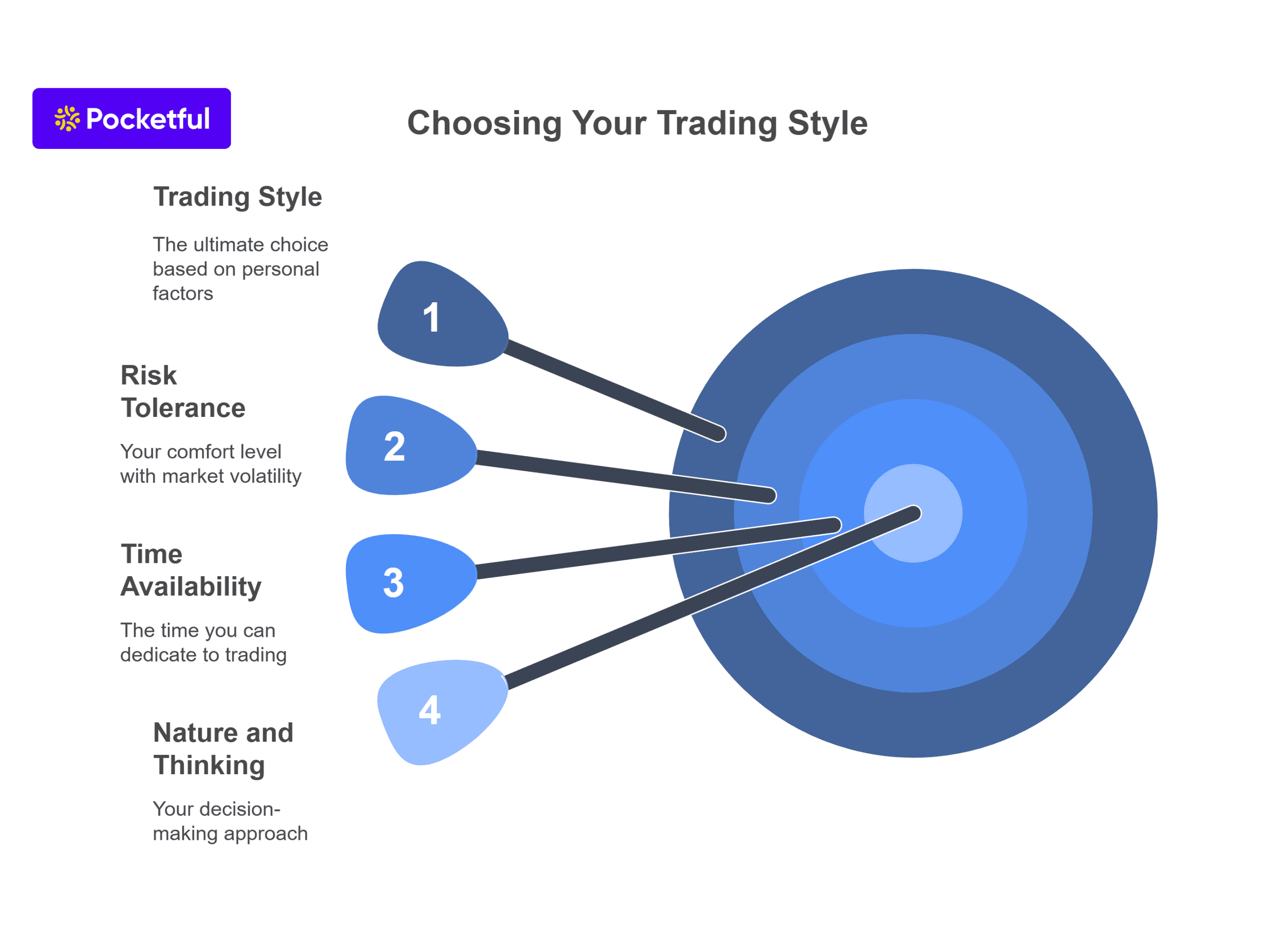

How to Choose the Right Trading Style?

Everyone has a different risk appetite and time commitment. Hence, trading styles vary for everyone. Ask yourself the following questions and decide your trading style accordingly:

- Risk tolerance : If you are not afraid of volatility and can handle the emotional stress of frequent profits and losses associated with scalping and day trading, then active trading is for you. But if you prefer to play it safe, then passive trading such as swing trading, position trading will be the right choice.

- Time availability : Can you track the market all day? If yes, then adopt the active trading style. Otherwise, passive trading will fit better into your daily routine.

- Nature and thinking : If you are adept at taking quick decisions, then active trading is better. But if you are patient and believe in gradual growth, then choose the passive trading style.

Tips for Beginners:

- Start with one style and practice paper trading first.

- Gain experience slowly and make small trades using small capital while learning.

- It is important to learn from your mistakes and improve your strategy over time.

Read Also: 10 Best Trading Apps in India

Conclusion

Every trader has a unique approach towards the market. Some want quick profits while others trade larger market trends. It is not important to know the characteristics of each trading approach and then determine which suits you the best, according to quick decision making ability, time commitment and risk taking capacity. Success in trading is not achieved overnight. But if you trade with the right approach and patience, then you will definitely get good results with time.

Frequently Asked Questions (FAQS)

Which trading style is best for beginners?

Swing Trading or positional trading is better for starters as it doesn’t involve quick decision making, making it less risky.

What is the difference between Scalping and Day Trading?

In scalping, trades are made in seconds or minutes, whereas in day trading, trading positions can be kept for a few hours but are closed before the market closes.

Can I follow more than one trading style?

Yes, but it’s better to focus on one style initially and master it.

Is algorithmic trading suitable for retail traders?

If you have coding experience then yes, otherwise avoid it as small errors in strategy’s code can result in huge losses.

Is Swing Trading suitable for beginners?

Yes, because it doesn’t require you to monitor markets continuously.

How risky is trading based on news?

Trading based on news can be quite risky as the market reacts very quickly to the news.