You are not alone if you have ever looked at stock charts and wondered how traders determine whether a stock is “expensive” or “cheap” during the day. VWAP, or volume weighted average price, is one of the technical indicators that helps give an answer. Consider it the “true average price,” not just a simple average, where the majority of trading has actually occurred.

VWAP is widely used by day traders, swing traders, and institutional investors to evaluate price levels, identify entry and exit points, and benchmark trade execution quality. In this blog, we will discuss what VWAP is, how it is calculated, and how traders use it as part of their trading strategy.

Understanding VWAP

The Volume Weighted Average Price (VWAP) is a trading indicator that calculates the average price of a stock (or any security) throughout the day, while giving greater importance to price levels where higher trading volumes occurred.

Consider it this way – the VWAP will be closer to ₹100 because that is where the majority of the day’s buying and selling took place, despite the stock also touching ₹98 or ₹102.

How is VWAP Calculated?

It is calculated using this formula

VWAP = ∑(Price * Volume) / ∑ Volume

where,

Price = (High+Low+Close) / 3

Example

Suppose a stock trades in the first 3 hours in the following manner

| Time | Price (₹) | Volume (shares) | Price × Volume |

|---|---|---|---|

| 10:00 | 100 | 200 | 20,000 |

| 11:00 | 102 | 300 | 30,600 |

| 12:00 | 98 | 500 | 49,000 |

1. First, add the price * volume, which equals ₹99,600 (20,000 + 30,600, 49,000)

2. Now, add up the volume, which sums up to 1,000 shares (200 + 300 + 500)

3. Finally, apply the VWAP formula mentioned above,

= ₹99,600 / 1,000

= 99.6 (VWAP)

Inference

If the stock’s current price is ₹102, it is above VWAP and will be considered a bit expensive. But if the price of the stock is 98, it is below VWAP, which implies the stock is cheap and affordable.

Things to Consider

- Every morning, when the market opens, the VWAP is reset.

- It acts as a benchmark for traders to determine whether the current price is “expensive” (above VWAP) or “cheap” (below VWAP) for the day.

- When VWAP is above, buyers tend to be in control (bullish), and when VWAP is below, sellers are in control (bearish).

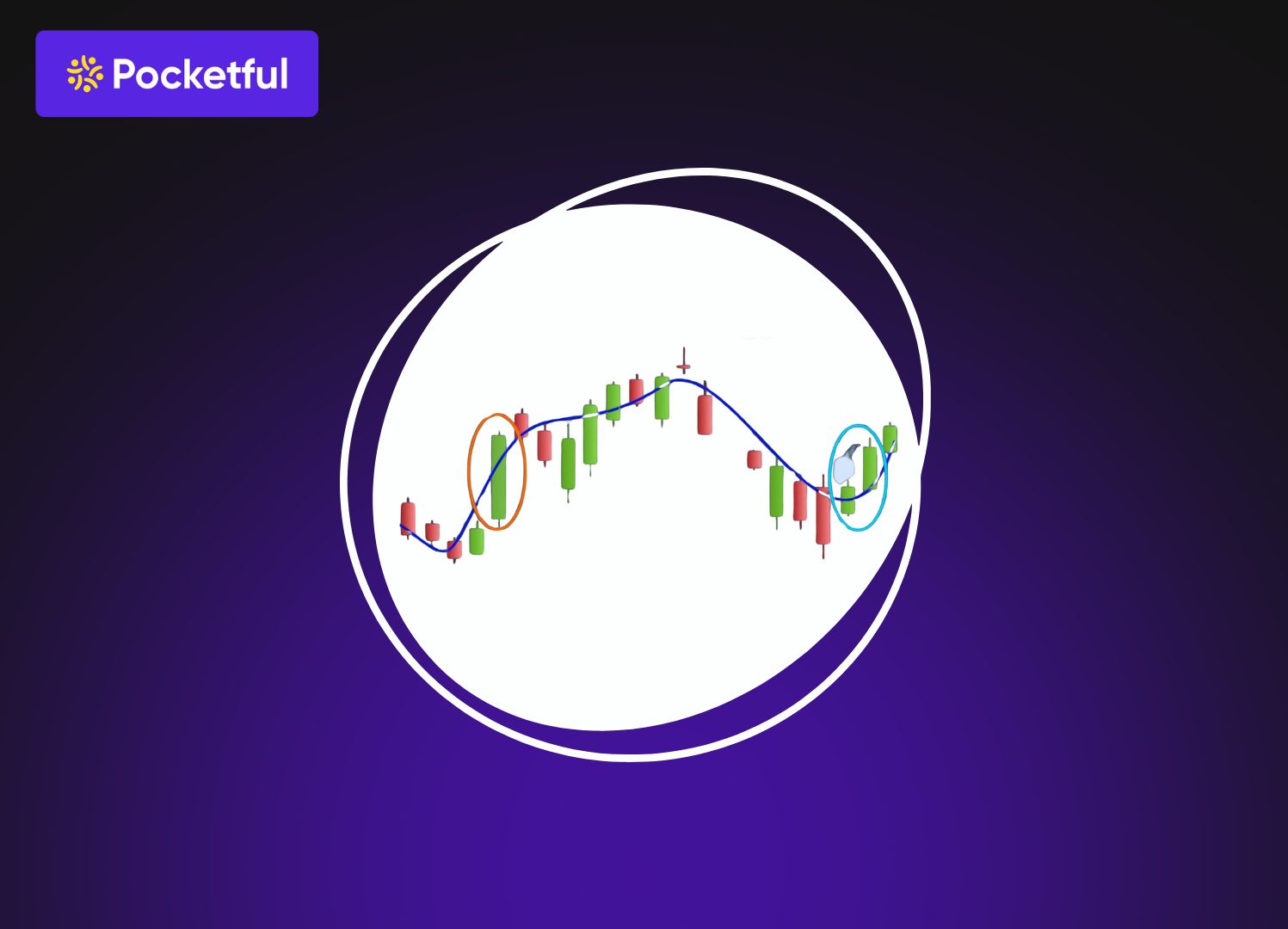

How the VWAP Strategy Works?

The VWAP line acts like the day’s “fair price” guide. To determine whether to buy, sell, or wait, traders keep an eye on the current price in contrast to the VWAP.

1. Buying Below VWAP

- The stock can often be bought at a discount to the day’s average if it is trading below VWAP.

- If the trend appears to be strong, traders view this as a buying opportunity.

2. Selling Over VWAP

- It indicates that the stock is becoming more expensive than its average when the price rises above VWAP.

- A lot of traders use this as an opportunity to book profits or even think about shorting.

3. Role of Support and Resistance

- VWAP may act as an invisible resistance or support line.

- Traders use the VWAP level for entries and exits because the price frequently bounces off it.

Advantages of VWAP

1. Offers a Benchmark for fair prices

VWAP is more accurate than a simple moving average because it provides the average price weighted by volume.

2. Helps in Identifying Trend Direction

Price above VWAP suggests that buyers are in charge (bullish). Sellers are stronger (bearish) when the price is below VWAP.

3. Excellent for Intraday Trading

Intraday traders use VWAP as a reference for entries and exits because it resets daily.

4. Institutions Also Use VWAP

Small traders can “follow the big money” because big funds execute trades around VWAP to prevent excessive market movement.

Limitations of VWAP

1. Only Works Well During the Day

VWAP is not very helpful for swing trading or long-term investing because it resets every day.

2. Lagging Indicator

VWAP responds slowly in quick-moving, volatile markets because it is based on averages. A little bit of the move may have already vanished by the time it validates a trend.

3. Not a Standalone Tool

Using VWAP alone can be risky. For confirmation, traders usually combine it with price action, MACD, or RSI.

4. Less effective for stocks with low volume

VWAP may not accurately reflect a “fair price” if trading volume is low.

Conclusion

VWAP is more than just a line on your chart. If you use it wisely, it can help you find entry and exit points, figure out how strong a trend is, and even trade like institutions do. But keep in mind that no single indicator can guarantee profits. When used alongside other tools and good risk management, VWAP works best. If you trade during the day, adding VWAP to your indicators kit could be a simple but effective way to help you make better market decisions.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | What Is The Gap Up And Gap Down Strategy? |

| 2 | Options Trading Strategies |

| 3 | Top 10 Intraday Trading Strategies & Tips for Beginners |

| 4 | What is MACD: Definition, Meaning, Uses and Strategy |

| 5 | What is Scalping Trading Strategy? |

Frequently Asked Questions (FAQs)

Is VWAP a lagging or leading indicator?

Due to its dependence on historical prices and volumes, VWAP is a lagging indicator.

Is VWAP sufficient on its own?

No, it performs best when paired with trendlines, RSI, or MACD, among other indicators.

Is VWAP suitable for long-term investments?

Not really, VWAP works best for daily, short-term trading.

Does VWAP reset daily?

Indeed, VWAP gets started fresh at the opening bell of every trading session.

What distinguishes VWAP from a simple average?

VWAP is more accurate because it gives prices with higher trading volume more weight.