With a population exceeding 140 crores and a steadily rising middle class, India is one of the fastest-growing consumer markets in the world. Higher disposable incomes, urbanization, and changing lifestyles are fueling demand across sectors like FMCG, retail, and consumer durables. As a result, companies in the consumption space are becoming key drivers of the country’s economic growth.

In this blog, we will give you an overview of the top consumption companies in India along with the benefits of investing in them and the factors which one should consider before investing in any consumption stocks.

What are Consumption Stocks?

Consumption stocks refer to those companies that primarily engage in the manufacturing and distribution of goods and services that households consume on a daily basis. Some companies focus on producing everyday essentials, while others specialize in crafting luxury items. These companies are directly linked to the country’s growth.

Top 10 Consumption Stocks in India

Top 10 consumption stocks in India based on market capitalization are mentioned below:

- Titan Limited

- Polycab India Limited

- Hindustan Unilever Limited

- ITC Limited

- Nestle India Limited

- Britannia Industries Limited

- Dabur India Limited

- Marico Limited

- Godrej Consumer Products Limited

- Colgate Palmolive India Limited

Read Also: Top 10 Best Summer Stocks in India

Market Information of Top 10 Consumption Stocks

| Company | Current Market Price (in ₹) | Market Capitalisation (in ₹ crores) | 52-Week High (in ₹) | 52-Week Low (in ₹) |

|---|---|---|---|---|

| Hindustan Unilever Limited | 2,390 | 5,61,766 | 2,660 | 2,044 |

| ITC Limited | 325 | 4,07,137 | 472 | 321 |

| Titan Company Limited | 4,019 | 3,56,696 | 4,312 | 2,925 |

| Nestle India Limited | 1,306 | 2,51,956 | 1,333 | 1,055 |

| Britannia Industries Limited | 5,940 | 1,43,141 | 6,337 | 4,506 |

| Godrej Consumer Products Limited | 1,246 | 1,27,465 | 1,309 | 980 |

| Marico Limited | 752 | 97,649 | 780 | 578 |

| Polycab India Limited | 6,999 | 1,05,397 | 7,948 | 4,555 |

| Dabur India Limited | 525 | 93,093 | 577 | 420 |

| Colgate Palmolive (India) Limited | 2,180 | 59,300 | 2,975 | 2,032 |

Best Consumption Stocks in India – An Overview

A brief overview of the best consumption stocks in India is given below:

1. Hindustan Unilever Limited

The company was founded in the late 1980s by the Lever Brothers. They launched their first product in India as a sunlight soap. The first company launched by Unilever in India was Hindustan Vanaspati Manufacturing Company in 1931. Later in 2007, the company changed its name to Hindustan Unilever Limited to match the name of its parent company. The company’s headquarters are in Mumbai.

Read Also: Hindustan Unilever Case Study

2. ITC Limited

ITC was originally known as Imperial Tobacco Company of India. It was founded in 1910. The company changed its name to Indian Tobacco Company in 1970, and later in 1974, it changed it to ITC Limited. The company is operating in various sectors, including FMCG, hospitality, packaging, etc. The company’s headquarters are located in Kolkata.

Read Also: ITC Case Study

3. Titan Company Limited

Titan Limited was founded in 1984 as a part of the Tata Group. It was incorporated as a result of a joint venture between the Tata Group and the Tamil Nadu Industrial Development Corporation (TIDCO). The company offers various products like jewellery, watches, eyewear, fragrance, etc. The company has performed exceptionally well in the past and is carrying the legacy of the Tata Group. The company’s headquarters are situated in Bengaluru.

Read Also: Titan Case Study

4. Nestle India Limited

Nestle India Ltd, the world’s biggest food and beverage company, has a long and illustrious history that began in the 1860s. The narrative begins with the formation of the Anglo-Swiss Condensed Milk Company in 1866, which produced ground-breaking milk products. Simultaneously, a German pharmacist, Henri Nestle, invented “Farine Lactee” to lower the newborn death rates. These businesses were successful because of their creative milk products, which catered to urban consumers with shifting lifestyles. The two businesses merged in 1905 to form Nestle. The headquarters of the company are situated in Gurgaon.

Read Also: Nestle India Case Study

5. Britannia Industries Limited

Britannia Industries LtdThe company was founded in 1892 by British entrepreneurs and was initially known as Britannia Biscuit Company Limited. Later in 1979, its name was changed to Britannia Industries Limited. Bombay Burmah Trading Corporation, which is a part of the Wadia Group, owns a majority stake in this company. In 1986, the company launched the Good Day biscuit brand and became a household name. It was the first company to introduce sliced, wrapped breads in India. The company has its headquarters situated in Kolkata.

Read Also: Britannia Industries Ltd Case Study

6. Godrej Consumer Products Limited

Godrej Consumer Products Ltd The company was established in 2001 as a result of a demerger from Godrej Soaps Limited. Being a part of the renowned Godrej Group and due to their popular products like Godrej Soap, hair colours like Godrej Expert, etc., it soon became a household name in India. The company has aggressively expanded globally and has a strong presence in Asian and African countries. The company’s headquarters are situated in Mumbai.

7. Marico Limited

The company was founded in 1988 and started manufacturing hair oil and edible oil named Parachute and Saffola. Initially, the company was named Marico Foods Limited, and later in 1989, it changed its name to Marico Industries Limited. It has established a manufacturing plant in Kerala to produce coconut oil. To expand its operations, the company raised capital through an IPO in 1996 and became a publicly listed company. The company’s headquarters are situated in Mumbai.

Know the Returns:

8. Polycab India Limited

Polycab India Ltd was founded in 1964 as Sind Electric Store, a dealer of electrical products. Later, in 1996, it was incorporated as Polycab Wires Private Limited. Today, the company has a market share of around 25% in the Indian electrical market and offers products like fans, LED lighting, switches, switchgear, solar products, etc. It has its headquarters in Mumbai.

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -18.59% | 175.64% | 660.96% |

Read Also: Polycab Case Study

9. Dabur India Limited

Dabur India Limited was founded in 1884 by Dr. S.K. Burman. The company established its first production unit in Garhia. The company launched the digestive tablet Hajmola, which became very popular among Indian households. Later in 1997, the company entered into the fruit juice business and in 2003, the company demerged its pharma business into a separate entity. The product portfolio consists of health supplements, digestives, oral hygiene, skin care products, etc. The company’s headquarters are situated in Ghaziabad.

Read Also: Dabur Case Study

10.Colgate Palmolive (India) Limited

Colgate Palmolive Limited was founded as a unit of the international FMCG brand. In 1954, the company opened its first manufacturing unit in Mumbai and launched its first product called Colgate. Later in 1970, the company expanded its product portfolio and launched various other products such as oral care and home care items. It has expanded its distribution network over time. The headquarters of the company is situated in Mumbai.

Read Also: Colgate Palmolive India Case Study

Key Performance Indicators (KPIs)

| Company | Operating Profit Margin (%) | Net Profit Margin (%) | ROE (%) | ROCE (%) | Debt to Equity |

|---|---|---|---|---|---|

| Hindustan Unilever Limited | 22.99 | 16.91 | 21.55 | 22.91 | 0 |

| ITC Limited | 35.66 | 46.38 | 49.61 | 36.41 | 0 |

| Titan Company Limited | 9.07 | 5.51 | 28.70 | 36.93 | 0.88 |

| Nestle India Limited | 21.24 | 15.99 | 79.98 | 57.17 | 0.19 |

| Britannia Industries Limited | 17.28 | 12.19 | 50.01 | 59.40 | 0.28 |

| Godrej Consumer Products Limited | 21.47 | 12.89 | 15.43 | 24.21 | 0.32 |

| Marico Limited | 20.02 | 15.30 | 40.99 | 36.90 | 0.10 |

| Polycab India Limited | 12.80 | 9.12 | 20.55 | 27.96 | 0.01 |

| Dabur India Limited | 19.26 | 13.84 | 16.36 | 20.31 | 0.07 |

| Colgate Palmolive (India) Limited | 32.02 | 23.78 | 86.32 | 111.06 | 0 |

Read Also: Top 10 Sectors in the Indian Stock Market

Benefits of Investing in Consumption Stocks

There are significant benefits of investing in consumption stocks, a few of which are as follows:

- Stable Demand: The products manufactured by consumption companies generally have a stable demand even during economic slowdowns.

- Growth Potential: The company, which primarily operates in the consumption sector, tends to have a strong growth potential due to rising income levels.

- Diversification: One can easily diversify their portfolio and reduce the risk in it.

- Low Debts: Consumer companies generally have a strong balance sheet and low debt. They also tend to have stable cash flows.

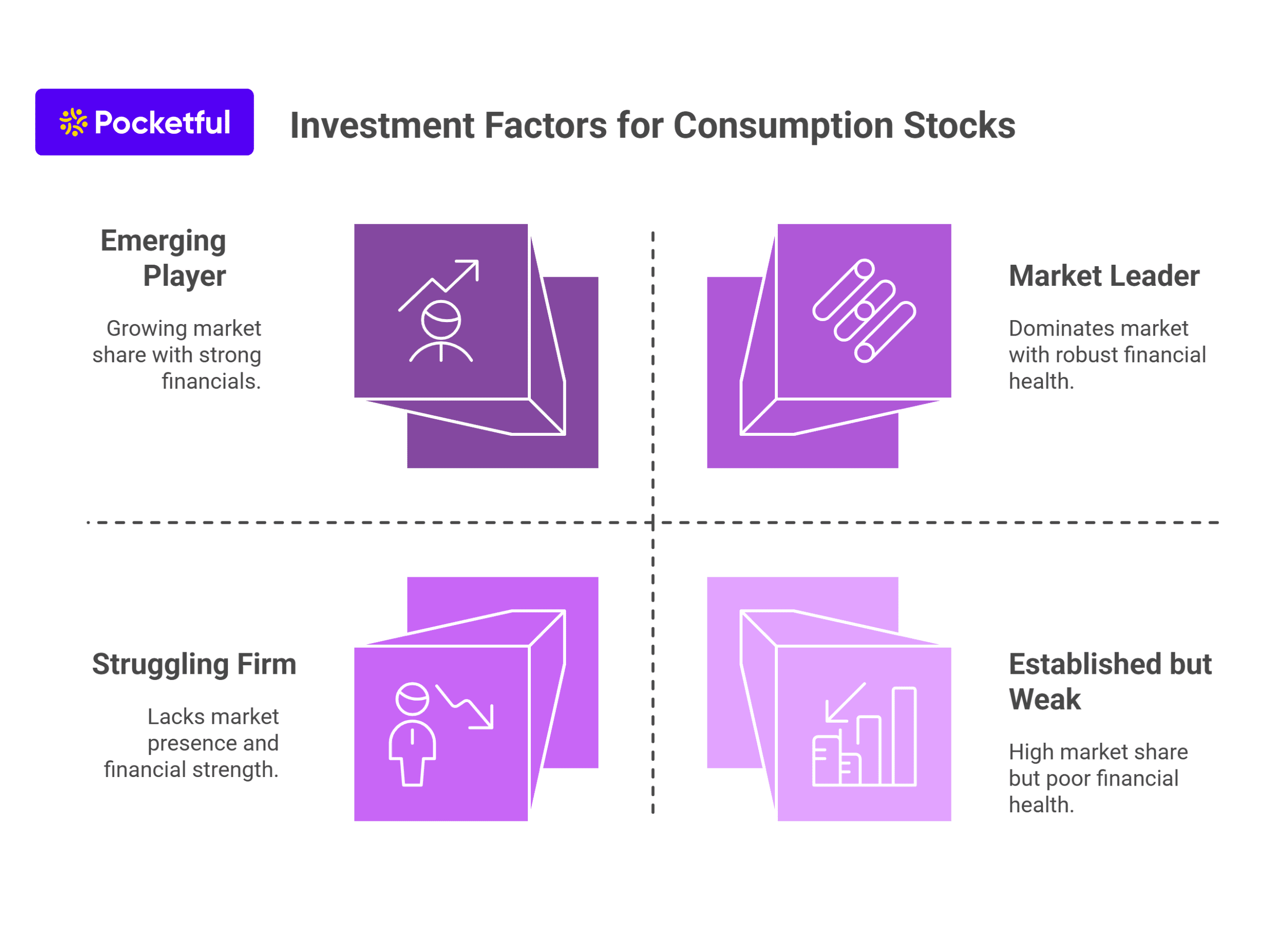

Factors to be Considered before Investing in Consumption Stocks

The key factors which one should consider before investing in consumption stocks are as follows:

- Market Share: One should need to consider the market share of the company; companies which have higher market capitalisation tend to have stable growth.

- Financial Performance: The companies with higher profit margins and net profit, and low debt, are preferred by the investors.

- Corporate Governance: The company with strong corporate governance policies and capable management team are preferred by investors.

- Dividends: Consumption stocks generally declare dividends regularly, which are suitable for investors who want passive income.

Read Also: 10 Best Copper Stocks in India

Future of Consumption Stocks

The Indian consumption sector has a very bright future, which is primarily driven by demographic diversification, urbanisation, etc. With the rise of disposable income, the demand for consumer goods will increase. Also, with the rise of e-commerce platforms and digital transformation, the demand for consumption sector products will increase. However, with the increase in competition, the profit margins of the company will be affected. It is also expected that India’s consumer market will grow by 46% by 2030.

Conclusion

On a concluding note, the Indian consumption industry has performed exceptionally well in the recent past because of increasing consumer income, and the consumption is expected to rise further in future. However, there are certain factors that one should keep in mind before investing in consumption stocks. The factors include financial performance, market share, profit ratio, etc. Therefore, it is advisable to consider your risk profile and consult your investment advisor before making any investment decision.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | List Of Best Healthcare Stocks in India |

| 2 | List of Best Telecom Stocks in India |

| 3 | List Of Best Footwear Stocks in India |

| 4 | List Of Best Logistics Stocks in India |

| 5 | List of Best Liquor Stocks in India |

Frequently Asked Questions (FAQs)

How can I invest in consumption stocks?

To invest in consumption stocks, one needs to have a demat and a trading account. Now with Pocketful, you can easily open a demat account online without paying any fees.

Which stocks are the top consumption stocks in India?

The top consumption stocks in India are Titan Limited, Polycab India Limited, Dabur India Limited, Marico Limited, Britannia Industries Limited, Hindustan Unilever Limited, etc.

What are the major factors which can affect the performance of consumption stocks?

The major factors that can affect the performance of consumption stocks are economic conditions, demand, financial performance, etc.

Are consumption stocks considered a defensive investing option?

Yes, consumption stocks are considered defensive stocks because the demand for such products is not affected by economic downturns.

Do consumption stocks pay dividends?

Yes, consumption stocks tend to declare high dividends regularly, which can be a suitable option for investors seeking passive income.