Investing in copper stocks in India stands out as an attractive investment opportunity aligned with the country’s growing industrial and infrastructural advancement. For diversification purposes, the best copper stocks in India need to be carefully selected due to the increasing demand for copper.

Copper is more than just a metal; it is the backbone of the electronics industry, construction industry, and green energy projects. If you are exploring the stock market, investing in Indian copper stocks can be beneficial. Renewable energy as well as the infrastructure sector have a growing need for copper. In this guide, we’ll go through the top 10 best copper stocks in India that you need to keep an eye on and their performance in the market.

This blog assists every type of investor, from beginners to experts, in gaining knowledge about copper shares in India. Further, you can also download the Pocketful app, where you can easily invest in and track these copper-related stocks.

What Are Copper Stocks in India?

Copper stocks refer to the shares of companies that are engaged in the mining, processing, or trading activities of copper and copper-based products. In India, these companies significantly contribute to power transmission, electricals, infrastructure, and renewable energy sectors.

By investing in copper related stocks, you gain access to the price appreciation in copper, the primary material necessary for manufacturing of electric vehicles, solar powered panels, and electrical wires.

Read Also: Top 7 Lithium Mining Stocks to Watch in India

Top 10 Copper Stocks in India

Here are some of the best copper stocks in India.

| Company Name | Current Price (₹) | Market Capitalization (₹ Crores) | 52 Week High (₹) | 52 Week Low (₹) |

|---|---|---|---|---|

| Adani Enterprises India | 2,171 | 2,48,518 | 2,613 | 1,965 |

| Vedanta Limited | 627 | 2,38,495 | 630 | 363 |

| Hindustan Copper Ltd | 540 | 50,377 | 575 | 184 |

| Precision Wires India Ltd | 227 | 4,147 | 277 | 118 |

| Bhagyanagar India Ltd | 167 | 526 | 186 | 65 |

| Rajputana Industries Ltd | 81 | 180 | 102 | 70.0 |

| Madhav Copper Ltd | 70.87 | 202 | 82.85 | 39.6 |

| Cubex Tubings Ltd | 122 | 174 | 144 | 67.1 |

| Parmeshwar Metal Ltd | 149 | 228 | 158 | 47.8 |

| Bonlon Industries Ltd | 55.4 | 78.6 | 65.0 | 22.5 |

With the Pocketful app, investing in these copper stocks becomes convenient. The app provides stock analysis tools and up-to-date information, all in real-time.

Read Also: List of Best Metal Stocks in India

Overview of the Best 10 Copper Stocks in India

An overview of the best 10 copper stocks in India is given below:

1. Adani Enterprises India

Adani Enterprises Ltd is the main company of the Adani Group. It helps build India’s metals and resources industry. Although it doesn’t mine copper itself, the company is deeply involved in areas that use copper – such as infrastructure, energy, and industrial development.

Adani’s work in renewable energy, power transmission, electric vehicles, data centers, and green hydrogen increases copper use, since copper is essential for these technologies. As India moves toward more electricity use and clean energy, Adani Enterprises is well-placed to gain from the growing need for copper, both in India and worldwide. This makes the company an important player in the long-term shift toward electrification and sustainable energy.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 16.77% | 8.66% | 30.66% |

2. Vedanta Limited

Vedanta Limited is one of India’s biggest companies in natural resources. It works in areas like metals, mining, oil and gas, and power. The company has long been an important part of India’s copper industry, handling smelting and refining to supply copper for things like power lines, construction, electronics, and renewable energy projects.

In recent years, Vedanta’s copper business has faced some regulatory issues, but copper still plays a key role in its plans. With India growing fast in electricity use, green energy, and electric vehicles, copper demand is set to rise. If Vedanta restarts or expands its copper operations, it could benefit a lot from this growing demand — improving its long-term growth and investment potential.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 46.17% | 95.67% | 249.02% |

3. Hindustan Copper Ltd

Hindustan Copper Ltd is a public sector unit and the sole integrated copper miner and producer in India. It engages in all activities related to copper, including mining, smelting, refining, and casting refined copper. Additionally, it operates major mines like Khetri, Malanjkhand, and Taloja.

The company significantly contributes to India’s copper needs for renewable energy, railways, construction, and power transmission sectors. The company stands to benefit significantly as global demand for copper rises due to green energy and electric vehicles. There has also been sporadic interest from investors owing to the government’s privatization policies.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 133.25% | 331.34% | 740.93% |

4. Precision Wires India Ltd.

Precision Wires India Ltd is the country’s leading producer of motor, transformer, and other equipment winding wires. They produce enamelled copper wires, paper-covered wires, and CTCs. They serve clients across the electrical, automotive, and white goods industries as well as infrastructure. Precision Wires holds a strong domestic market share as well as a presence in international markets such as Europe and Southeastern Asia.

The increasing consumption of electrical machines and power makes demand consistent for Precision Wires products. This company is able to adapt and upgrade technologically due to the emphasis placed on R&D.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 48.27% | 189.13% | 978.08% |

5. Bhagyanagar India Ltd

Bhagyanagar India Ltd is a diversified company with a focus on manufacturing copper products, such as copper rods, wires, pipes, strips, and other products. Over the years, it has expanded its operations in solar energy infrastructure and even the real estate sector. Nevertheless, the copper business remains the dominant segment due to a stable revenue stream.

The company caters to clients available in the construction, HVAC, power, and electrical markets. Its vertically integrated infrastructure provides an advantage in the copper processing industry in India. Investors appreciate its solid business model and history of paying dividends.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 88.55% | 244.48% | 387.11% |

6. Rajputana Industries Ltd

Rajputana Industries Ltd specializes in the production and trade of copper wires, rods and sheets, serving local industry and small manufacturers. The company’s stock has a small market capitalization, yet, has been recording consistent revenue increases in the past few quarters.

The company takes advantage of heightened demand in the regional industrial belts where price and delivery schedules are important. However, it is slowly diversifying its product portfolio. Interest from investors is increasing as the firm sustains low debt levels and tries to improve operating margins. In the copper space, it is often considered a high risk high reward play.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -.0.63% | 10.11% | 10.11% |

7. Madhav Copper Ltd

Madhav Copper Ltd is an emerging player in the manufacturing of copper products, focusing on enameled copper wires, copper rods, strips, and paper covered wires. The company’s products target the power generation, electrical equipment, transformers, and motors market.

The company is relatively young, but gaining recognition alongside the Make-in-India initiative for focusing on OEM and B2B markets. Its stock witnessed decent movement due to increasing demand in the electrical sector. The company is actively investing in automation and new facilities which enhances the production capacity.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 55.42% | 126.78% | -27.61% |

8. Cubex Tubings Ltd

Cubex Tubings Ltd is involved in the manufacturing of copper alloy tubes, pipes, and coils. It caters to grade “A” industries including oil refineries, power plants, railways, and defense. The corporation has earned an industrial grade reputation for successfully exporting copper tubes across the globe, especially to the Middle East and Europe.

Their products are used in air conditioning, refrigeration, and heat exchangers, etc. Cubex Tubings is known for its strong export profile and technical know-how. The specialized nature of this company’s operations and products offers investors an edge in premium applications of copper.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 15.69% | 190.47% | 532.77% |

9. Bonlon Industries Ltd

Bonlon Industries Ltd is a new copper industry player that produces copper and brass pipes, wires, rods, and other related goods. The company serves the plumbing, construction, and electrical sectors, as well as B2B distribution. Bonlon has plans to increase sales and expand to Northern and Western India. Although in early stages of growth, Bonlon’s emphasis on demand driven by infrastructure development is promising.

The company has also maintained low price levels to appeal to mid-size industrial customers. Investors consider Bonlon an appealing investment in the copper industry, even with scale-related risks.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 82.69% | -19.90% | 240.00% |

10. Parmeshwar Metal Ltd

Parmeshwar Metal Ltd focuses primarily on the recycling of metals, especially copper and copper alloys. Its business activities include the production of copper rods and copper billets from scrap (retrievable copper) which are sold to component, wire, and cable manufacturers. The business model of the company is eco-friendly and sustainable, which is a growing trend globally. Recycling copper has favorable environmental impacts making it sustainable for the business.

The company is also looking at expanding capacity through advanced recycling technologies. Though the company is still at a smaller scale, its impact in the copper industry is appreciated by investors.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 101.61% | 91.07% | 91.07% |

Check Out: List of Copper Sector Stocks

Key Performance Indicators

| Company Name | Net Profit Margin (%) | ROE (%) | ROCE (%) | Debt to Equity Ratio |

|---|---|---|---|---|

| Hindustan Copper Ltd | 17.22 | 12.92 | 15.74 | 0.10 |

| Precision Wires India Ltd | 2.20 | 14.38 | 25.51 | 0.19 |

| Bhagyanagar India Ltd | 3.19 | 23.64 | 27.31 | 0.52 |

| Cubex Tubings Ltd | 1.80 | 5.76 | 9.85 | 0.22 |

| Madhav Copper Ltd | 3.45 | 2.99 | 3.86 | 0.32 |

| Rajputana Industries Ltd | 1.57 | 15.73 | 27.99 | 0.90 |

| Bonlon Industries Ltd | 0.53 | 2.94 | 5.52 | 0.38 |

| Parmeshwar Metal Ltd | 0.65 | 19.40 | 29.52 | 0.59 |

| Shree Metalloys Ltd | 0.53 | 5.76 | 8.52 | 0.00 |

| RCI Industries & Technologies | -120.80 | 00.00 | 69.56 | -1.92 |

(Before investing in any stock, make sure to consult a financial expert or a SEBI-registered advisor.)

Factors to Consider Before Investing in Copper Stocks

Various factors of consider before investing in copper stocks are:

- Global Copper Demand: One should analyze the global demand associated with industrial activity, new EV developments, and green energy projects.

- Company Fundamentals: One shall study companies debt, profitability, and revenue trends.

- Government Policies: Changes in the labour policy and taxes in addition to mining regulations and export rules have an impact on stock performance.

- Commodity Prices: The prices of copper are subject to global supply and demand cycles, meaning they are always influenced by global changes.

Tip: Look at stocks metrics, such as ROCE, ROE, and other relevant news, using the Pocketful app to analyze and compare copper stocks.

Read Also: 10 Best Paper Trading Apps in India

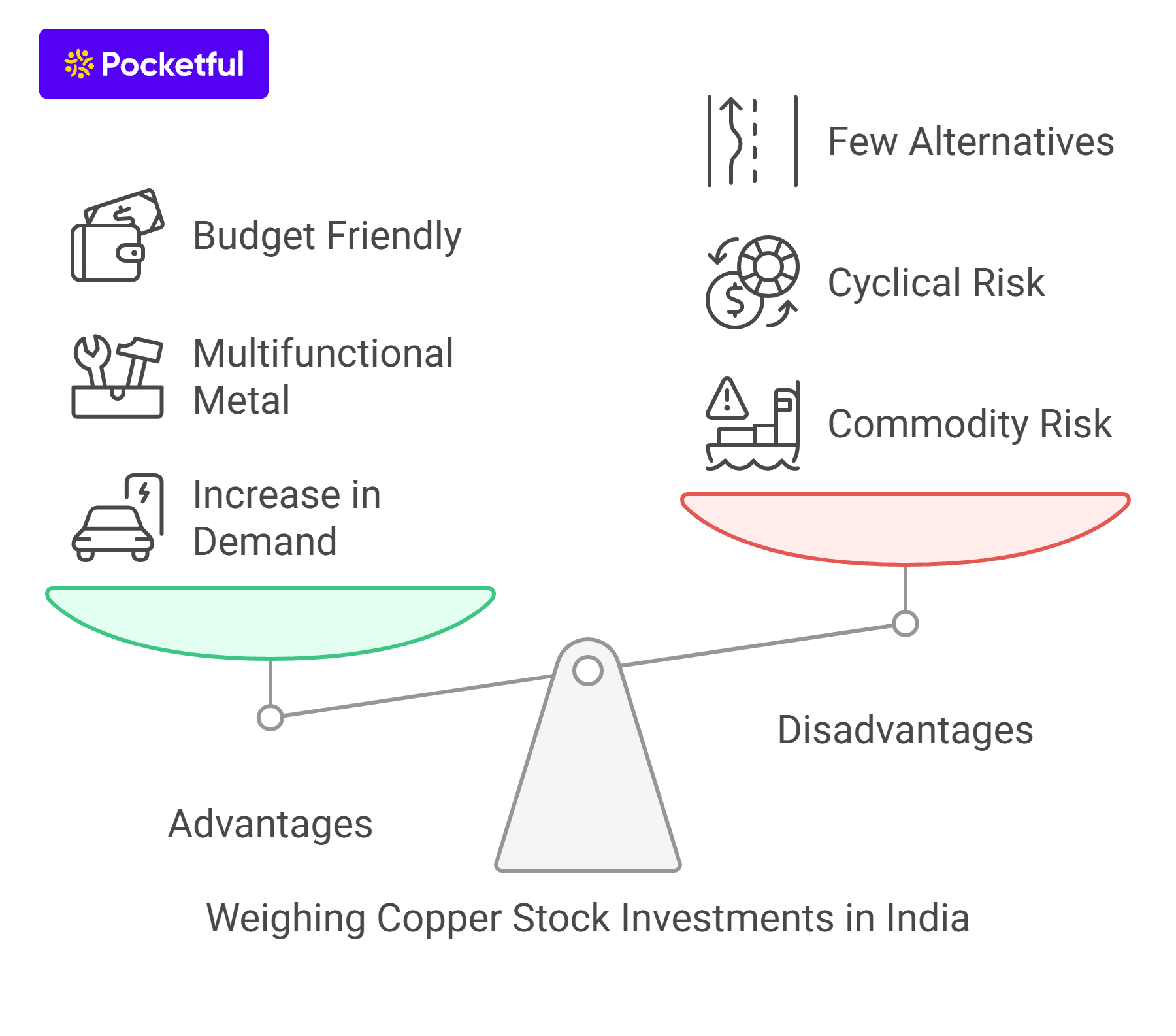

Advantages and Disadvantages of Buying Copper Stocks in India

Advantages

- Increase in Demand: More copper will be required in electric vehicles, solar energy and in infrastructure development of the country.

- Multifunctional Metal: Copper is widely used in electronic devices and heavy duty machines resulting in wider usage.

- Budget Friendly: Some copper shares are priced below ₹100. Thus, small investors can also buy these stocks.

Disadvantages

- Commodity Risk: Price of copper is volatile, thus profit margins might fluctuate.

- Cyclical Risk: These stocks are sensitive to global economic activities, which makes investing in these shares riskier during downturns.

- Few Alternatives: There are limited copper mining companies based in India, resulting in fewer options to invest in.

Read Also: List of Top 10 Blue Chip Stocks in India with Price

Conclusion

In conclusion, the copper stocks in our country give an excellent opportunity to investors as we are moving towards electrification, infra development, and renewable energy. Either you want to invest in a large-cap stock like Hindustan Copper or a small-cap stock like Madhav Copper, each has its own unique set of opportunities and challenges.

However, as the name suggests, copper stocks fall in the commodity sector (base metal), therefore, it is crucial that you should monitor global market trends, relevant commodity data, and fundamentals of the company before making the investment decision.

To make things easy for you, the Pocketful app provides an easy to use platform for discovering, comparing, and investing in the best Indian copper stocks. So, take your time and conduct thorough research before investing in copper stocks.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | List Of Best Healthcare Stocks in India |

| 2 | List of Best Telecom Stocks in India |

| 3 | List Of Best Footwear Stocks in India |

| 4 | List Of Best Logistics Stocks in India |

| 5 | List of Best Liquor Stocks in India |

| 6 | Top 10 Option Trading Books in India |

| 7 | Best Air Purifier Stocks in India |

Frequently Asked Questions (FAQs

Why should I consider investing in copper stocks?

Copper is essential in industries such as electronics, construction, power grids, and electric vehicles. With India’s goals of developing advanced infrastructure and green energy projects, the copper stocks are expected to perform well in the future.

Are copper stocks safe for beginners?

Some mid and small cap copper companies can be volatile in comparison to established firms like Hindustan Copper which possess better stability. It is advised to consult a financial advisor before investing in copper stocks.

What are the key drivers of copper stock prices?

Copper stock prices can be influenced by the prices of copper in the world, which is influenced by supply and demand dynamics. Some of the key drivers of supply and demand are government infrastructure spendings, mining policies & environmental regulation policy changes.

Where can one find investing opportunities in copper stocks in India?

Investing can be done through commodity mutual funds or ETFs holding copper stocks or directly in copper stocks through stock trading applications such as Pocketful.

What are the future predictions for Indian copper stocks?

Investing in India copper stocks may provide significant returns over the next decade. Long term growth seems promising with the heightened need for electric vehicles (EV), power transmission devices. However, the future is uncertain and it is best to consult a financial advisor before investing.