In the world of financial markets, there are various investment options available. If an investor is looking to diversify their portfolio and has a limited amount of capital, they can consider investing in ETFs or Exchange Traded Funds. They are passively managed funds offered by various AMCs. But do you know which ETFs have been top performers in recent years?

In this blog, we will give you an overview of the top 10 ETFs in India, along with the factors to consider before investing in them.

What is an ETF?

An ETF or Exchange Traded Fund is a passive investment tool that predominantly invests the capital in a basket of stocks, commodities, etc. ETFs are generally traded on the stock exchange like any other ordinary stock; therefore, to buy and sell ETFs, you are required to have a demat and trading account.

List of Best ETFs in India

The following are the best ETF to invest in 2026:

| ETF Name | Symbol | 5-Year Return |

|---|---|---|

| Kotak NV 20 ETF | KOTAKNV20 | 203.26% |

| Kotak Nifty Bank ETF | BANKNIFTY1 | 196.54% |

| SBI NIFTY NEXT 50 ETF | SETFNN50 | 186.79% |

| Nippon India ETF Junior BeES | JUNIORBEES | 184.70% |

| Bandhan NIFTY ETF | IDFNIFTYET | 181.53% |

| Quantum Nifty ETF | QNIFTY | 180% |

| Motilal Oswal M50 ETF | MOM50 | 175.04% |

| Invesco India NIFTY ETF | IVZINNIFTY | 171.90% |

| SBI NIFTY 50 ETF | SETFNIF50 | 167.28% |

| Invesco India Gold ETF | IVZINGOLD | 95.16% |

Overview of the Best ETFs in India

An overview of the top ETFs in India is as follows:

1. Kotak NV 20 ETF

This ETF invests in Nifty 50 Value 20 index stocks. These stocks represent companies with strong fundamentals and attractive valuations. It primarily tracks share prices of 20 companies with low PE, low PB and high dividend yield. It is managed by Kotak AMC.

2. Kotak Nifty Bank ETF

This ETF, launched by Kotak Mutual Fund, tracks the Bank Nifty index and provides investors with an exposure to the top 12 banking stocks. Investors who wish to make a tactical allocation in the banking industry can opt to invest in Kotak Nifty Bank ETF.

3. SBI Nifty Next 50 ETF

The SBI Nifty Next 50 ETF was launched by SBI Mutual Fund and tracks the Nifty Next 50 Index. It is also a good investment option for investors who want to participate in the growth of the next 50 companies.

4. Nippon India ETF Junior BeES

This ETF primarily invests in the Nifty Next 50 Index, or the next 50 companies after Nifty 50 companies by market capitalisation. The stocks in which this ETF invests belong to the large and mid-cap segments. They are managed and operated by Nippon AMC and are suitable for investors seeking growth.

5. Bandhan Nifty ETF

The Bandhan Nifty ETF also invests in Nifty 50 stocks. Earlier, it was launched by IDFC mutual fund, which was later taken over by Bandhan AMC. Therefore it is known as Bandhan Nifty ETF.

6. Quantum Nifty ETF

This ETF, launched by Quantum AMC, tracks the Nifty 50 Index and offers similar exposure to large-cap stocks of India as specified by the Nifty 50 index. It is another ETF that invests in the Nifty 50 index that has generated substantial returns in the recent past.

7. Motilal Oswal M50 ETF

For investors who wish to invest in the Nifty 50 index ETF, Motilal Oswal M50 is another option as it offers exposure to the top 50 companies of India. This ETF has also given tremendous returns over the past 5 years.

8. Invesco India Nifty ETF

This ETF is managed by Invesco India Asset Management Company. It primarily invests in the top 50 companies listed on the National Stock Exchange based on market capitalisation. Those 50 companies have exhibited strong performance over many years.

9. SBI Nifty 50 ETF

As the name indicates SBI Nifty 50 ETF tracks the Nifty 50 Index and is managed by SBI. It is highly liquid in nature and is often used as an investment option by EPFO and other institutional investors.

10. Invesco India Gold ETF:

This ETF tracks the domestic price of Gold and allows the investor exposure to Gold digitally. It is also known as commodity ETF, and can be used as a hedge against inflation and currency fluctuations.

Read Also: How to Invest in Gold ETF – Benefits, Risks and Charges

Factors to Consider before Investing in an ETF

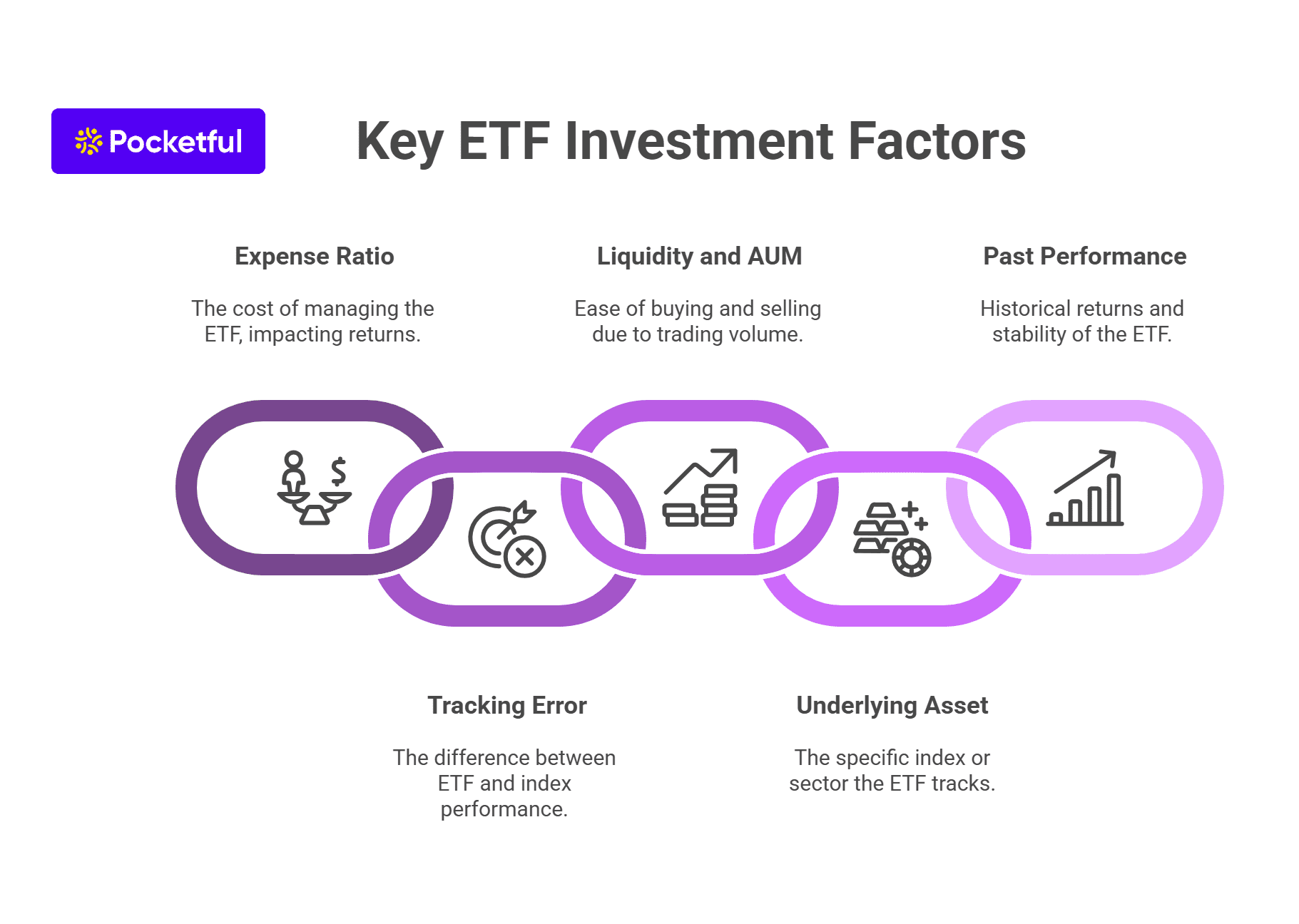

The key factors which an investor should consider before investing in an ETF are as follows:

- Expense Ratio: The expense ratio plays a major role when choosing an ETF for investment; the lower the expense ratio, the higher the returns.

- Tracking Error: A tracking error defines the difference between the performance of an ETF and the index which it replicates; the lower the tracking error, the better the returns.

- Liquidity and AUM: Check the trading volume and the assets under management (AUM) of the ETF. A high trading volume and larger AUM generally indicate better liquidity, which makes it easier to buy and sell an ETF.

- Underlying Asset: There are various ETFs available in the market tracking the different indices; therefore an investor should choose the ETF based on their investment objective.

- Past Performance: This is one of the key factors to be considered before choosing an ETF for investment. ETFs which have posted consistently higher returns with low tracking errors should be considered for investment.

Know More: Calculate returns on ETF investments.

Which ETF is suitable for you?

The amount to be invested in the ETF depends on various factors such as your existing financial conditions, debt level, your investment objective, and your risk tolerance. If you are an aggressive investor and want to invest in a specific sector for a higher return, then you can opt for sectoral ETFs. However, if you are a conservative investor, then you can opt for investing in equity-oriented ETFs, which primarily invest in the top 50 or 100 companies. Alternatively, if you are looking to diversify your portfolio and wish to invest in Gold and other commodities, then you can invest in commodity ETFs.

Read Also: What is Gold ETF? Meaning & How to Invest Guide

Conclusion

On a concluding note, there are various categories of ETFs available in India, and if someone is looking to invest passively, ETFs are a good option. However, ETFs generally have a slight tracking error, due to which their returns are approximately similar to that of the indices they follow. Hence, an investor must compare the tracking error of the ETFs investing in the same underlying asset to select the best ETF among them before investing. Among the various ETFs available in India, one must consider the ETF which suits their risk profile and always invest in an ETF after consulting with their investment advisor.

To invest in an ETF one can easily open a lifetime free demat and trading account with Pocketful, as it offers free brokerage on delivery based trades, along with an advanced trading platform.

Frequently Asked Questions (FAQS)

Are ETFs active or passive funds?

ETFs are passively managed funds as they replicate the index that they follow.

What is the minimum amount one can invest in an ETF?

The minimum amount that an investor can invest depends on the price of the ETF; there are various ETF prices which start from as low as ₹50.

Which type of tax applies to ETFs?

Capital Gain Tax is applicable on ETFs, depending on whether it is an equity, debt or gold ETF.

How can I buy an ETF in India?

To purchase an ETF in India, one must have a trading and demat account with a broker. If you have one, you can buy it like any other stock.

What are the risks associated with investing in ETFs?

ETFs generally carry lower risk than other asset classes. However, there are tracking errors, due to which the returns of ETFs can be lower than the index they follow.