When we talk about India’s biggest business conglomerates, Tata Group and Reliance Group always appear at the top of the list due to their strong market presence in different industries. One is a pioneer in IT, steel and electric vehicles, shaping India’s technology, infrastructure and automobile sector. The other is a powerhouse in energy, telecom, and retail, changing how India shops, connects, and consumes.

Both belong to legendary business families and are building the future in their way. In this blog, we will break down how Tata Group and Reliance Group have evolved over time, how their journeys have been different, what lies ahead, and what it means for India’s economy and for you as an investor or consumer.

Tata Group : An Overview

Tata Group represents an iconic group of companies in India, not just due to its size but also due to the values and vision it brings to all its endeavours. In 1868, Jamsetji Tata laid the foundation of a vision — to build a self-reliant India that would earn respect and recognition on the world stage. It has been close to 150 years now, and that dream is still going strong in most industries. The presence of the Tata brand in our daily lives is more than we can ever imagine.

Here is a glimpse of what they’re into:

- Technology – Tata Consultancy Services (TCS) is a global leader in providing software solutions.

- Automobiles – Tata Motors makes everything from family cars to trucks and owns luxury brands like Jaguar and Land Rover.

- Metal – Tata Steel is one of the top steelmakers in the world.

- Consumer Products – From Tata Salt and Tata Tea to Himalayan Water and Tetley, you’ll likely find something related to the Tata brand in your kitchen.

- Watches, Fashion & Retail – Titan (watches, jewellery, eyewear) and Trent (Westside, Zudio) bring style to your wardrobe.

- Power & Infra – Tata Power and Tata Projects are helping build infrastructure that powers the future.

- Hospitality – The Taj Hotels brand, run by IHCL, is all about luxury.

- Telecom & Media – Tata Play (formerly Tata Sky) and Tata Communications provide DTH services and keep people connected.

One of the most unique things about the Tata Group is that it’s not just about profits. Around 66% of Tata Sons (the holding company) is owned by charitable trusts, like the Tata Trusts. That means a large chunk of what the company earns goes into health, education, rural development, and social upliftment initiatives. Ethics, trust, and long-term thinking are core to how Tata runs its businesses.

Business Model

1. Decentralised Structure: Each Tata company, like TCS, Tata Motors, Titan, or Tata Steel, operates independently. They have their separate boards, CEOs, and decision-making power. But they are all connected to Tata Sons, the main holding company, which owns significant stakes in most of them and helps guide the overall direction.

2. Diversified Business Portfolio: Tata Group companies are spread across multiple sectors, as already mentioned above, ensuring stable revenues in different economic conditions.

Read Also: Tata Motors Case Study: Business Model, Financials, and SWOT Analysis

Reliance Group : An Overview

Whenever you think of big business in India, it’s impossible to forget Reliance. Originally a small textile firm in the 1960s, it has now become one of the largest conglomerates in India. It all began with Dhirubhai Ambani, a visionary entrepreneur who transformed a small yarn-trading business into a vast empire. Today, Reliance Industries Limited (RIL), under the leadership of his son Mukesh Ambani, continues to shape India’s telecom, retail, energy, and other key sectors.

Additionally, back in 2005, the Reliance empire was split between the two Ambani brothers:

- Mukesh Ambani took charge of Reliance Industries Limited (RIL), the one you hear about the most today. This includes business related to oil and gas to telecom (Jio), retail, media, and green energy sectors.

- Anil Ambani formed Reliance ADA Group, with businesses in power, infrastructure, finance, and communication sectors, out of which, many companies have struggled financially over the years.

Business Model

The Reliance Group does not just stick to one business, they build entire ecosystems. That is why you will see Reliance everywhere, from the fuel you put in your car to the internet you use and even the groceries you buy.

- Energy & Petrochemicals: Reliance started with oil refining and petrochemicals. Even today, it is a massive part of their business.

- Telecom & Digital: They launched Jio to help in the evolution of the telecom industry, and it worked.

- Retail: Groceries, fashion, electronics, Reliance Retail sells it all.

- Media & Entertainment: Through Network18 and JioCinema, they are also working in this field.

- Green Energy: Reliance is now investing billions to establish itself as a leading player in solar, hydrogen, and clean energy solutions.

Furthermore, unlike many other big companies, Reliance prefers to own and control its ventures rather than just being a silent investor. That way, they can shape their business operations how they want.

Read Also: Reliance Industries Case Study: Marketing Strategy and SWOT Analysis

Comparative Analysis (from Screener, Refer Sample)

| Basis | Tata Group | Reliance |

|---|---|---|

| Business Focus | A diversified group with interests across different sectors such as IT, steel, automobiles, power, consumer goods, retail, hotels, and more. | A diversified giant with interests in energy, telecom , retail , and now aggressively expanding into green energy. |

| Growth Strategy | Actively expanding in green energy (Tata Power), electric vehicles (Tata Motors), consumer brands (Titan, Tata Consumer), and digital platforms (Tata Neu). | Expanding aggressively into green energy, 5G, retail dominance, and digital platforms. |

| Market Position | Known as one of India’s most trusted and respected business groups globally, with strong leadership, governance, and diversified revenue streams. | Known for scale and disruption. Jio changed the telecom game, and Reliance Retail is giving tough competition to global giants like Amazon and Walmart in India. |

| Leadership Style | Value-driven, conservative, and focused on long-term sustainable growth. Led by N. Chandrasekaran (Tata Sons Chairman) with a reputation for stability and ethics. | Bold, aggressive, and expansion-oriented, led by Mukesh Ambani, India’s richest man, who believes in scale and speed. |

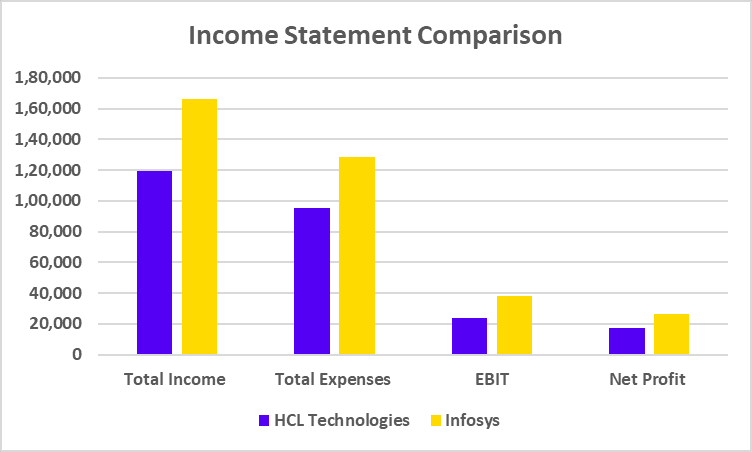

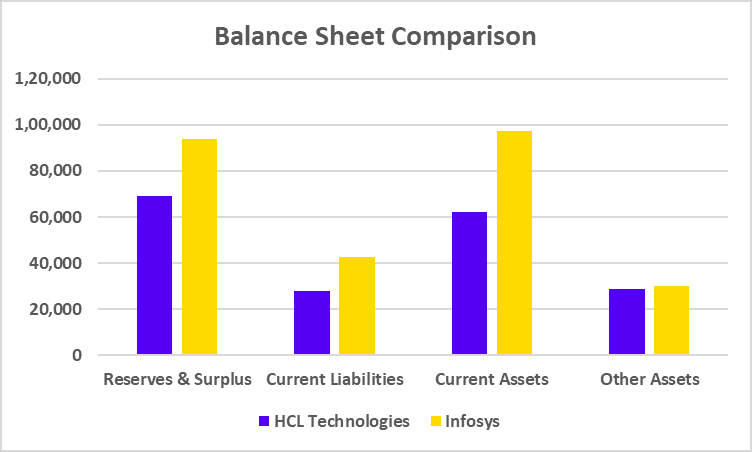

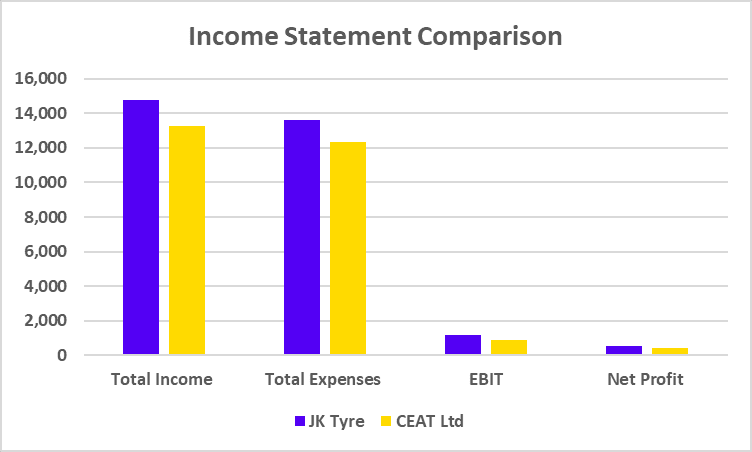

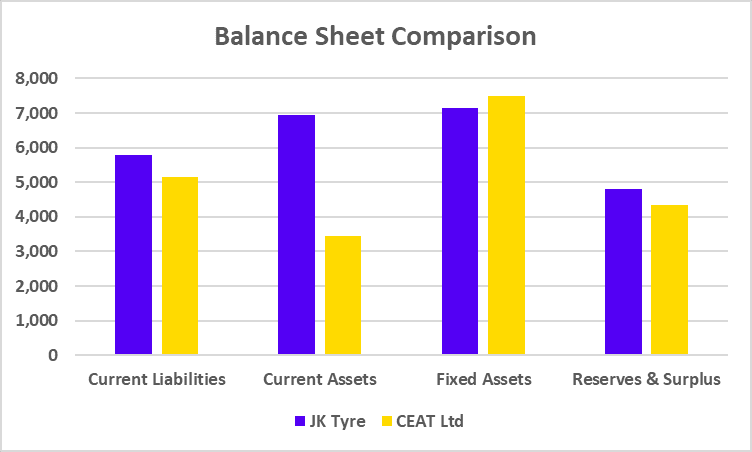

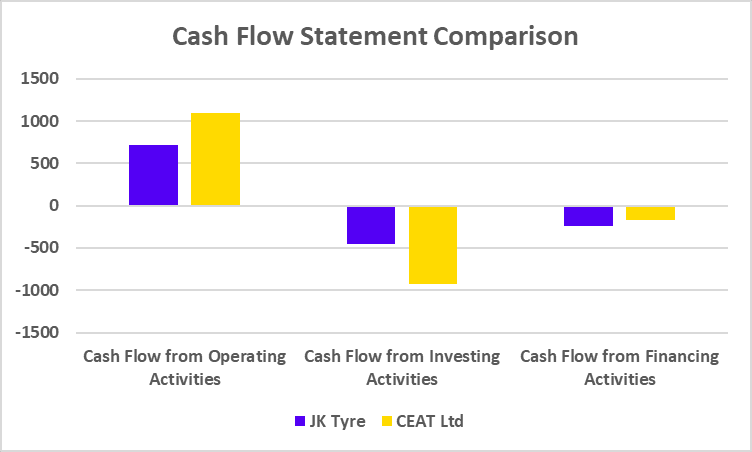

Financial Position of Tata vs Reliance Group

To understand how the two groups are doing, we cannot just look at brand names; we need to understand their financial positions. As some of the companies under the two groups are private, it is impossible to determine the accurate financial standing of both groups. However, based on the financial information available of publicly listed companies related to the groups, we can get a good idea about the financial position of both companies.

Tata Group

1. Revenue

Tata Group makes money from all kinds of businesses, including technology, steel, cars, jewellery, tea, you name it. Together, their companies generate over ₹10 lakh crore in revenue annually. TCS, Tata Steel, Tata Motors, Titan, and Tata Consumer Products bring in the most revenues.

2. Profit

Most of the profits come from TCS, the biggest company under the Tata Group. Brands like Titan (watches & jewellery) and Tata Consumer (Tata Salt, Tata Tea, etc.) are also great profit-makers. Some businesses, like Tata Motors and Tata Steel, have their ups and downs but are getting stronger due to increased adoption of EVs and growing infrastructure requirements.

3. Debt

A few Tata companies, especially Tata Steel and Tata Motors, do carry moderate to high debt, mostly because of focus on expansion and big global deals. The good part? TCS is debt-free and helps keep the overall group financially stable. Furthermore, the group has been actively working on reducing debt.

Reliance Group

1. Revenue

Reliance earns money from a wide range of industries — including oil & gas, telecom (Jio), retail (Reliance Retail), digital services, and green energy. Together, these businesses generate annual revenues of over ₹10 lakh crore. The traditional oil-to-chemicals (O2C) business is a major revenue driver, alongside Reliance Retail and Jio.

2. Profit

The bulk of Reliance’s profits still come from its legacy oil-to-chemicals business. However, Jio and Reliance Retail have become highly profitable in recent years, thanks to their massive user base and nationwide presence. The company continues to invest in new sectors like green energy, which could fuel future profits.

3. Debt

Reliance has taken on significant debt in the past, especially while building Jio and expanding retail operations. However, the company made headlines by becoming net debt-free in 2020 after raising capital from global investors. While current expansion in green energy and digital infrastructure may increase liabilities slightly, the group remains financially strong with healthy cash flows and a robust balance sheet.

Read Also: Tata Steel Case Study: Business Model, Financial Statements, SWOT Analysis

Future Plans – TATA vs RELIANCE

When it comes to shaping the future of India, Tata Group and Reliance Industries are two of the biggest players. Both are household names and giants in their respective sectors, but their future business plans are different as mentioned below. Let us have a quick glimpse of where these two groups are headed:

1. Green Energy & Sustainability

Tata Group’s company, Tata Power is already involved in developing innovative solutions to harness solar and wind energy, whereas Tata Motors is leading India’s EV revolution (Nexon EV, Tiago EV).

Reliance is also betting big on clean energy through investment in solar plants, green hydrogen, and the massive Giga Complex in Gujarat. Moreover, their aim to be net-zero by 2035 will contribute substantially to sustainability.

2. Retail & Consumer Business

Tata group owns Tata Neu, fashion brands like Westside and electronics stores like Croma.

On the other hand, Reliance is aggressively building India’s largest retail empire through Reliance Retail, JioMart, luxury brands, and quick commerce.

3. Global Footprint

Tata already has global brands like Jaguar, Land Rover, Tetley, and Taj Hotels, focusing on steady, sustainable global growth.

Reliance is actively expanding globally, especially in energy, retail tie-ups, and tech ventures.

Read Also: Reliance Power Case Study: Business Model, Financial Statements, And SWOT Analysis

Conclusion

Both Tata Group and Reliance Group are powerhouses driving India’s economic growth, each with its distinct approach. Tata stands for legacy, values, and long-term stability, with strong global presence across industries like IT, autos, and consumer goods. Reliance, on the other hand, represents bold ambition and rapid expansion, dominating sectors like telecom, retail, and energy. While their strategies differ, both are innovating, investing in sustainability, and playing a crucial role in shaping India’s future, making them equally important from both an economic and investor perspective.

Frequently Asked Questions(FAQs)

Which group is bigger, Tata or Reliance Industries?

Both groups are huge and it is difficult to specify which group is bigger as some of their companies are private. However, based on market capitalization of listed companies, the Tata Group is much bigger.

When was Tata Motors established?

Tata Motors was established in 1945.

Which one is better for long-term investment?

Investing in Tata Group companies is great if you believe in the growth potential of technology, infrastructure, and EV sectors. Reliance offers a more diversified bet across sectors.

Can I invest in companies of both groups?

Yes, you can! Many investors diversify their investment portfolio by holding shares of both the Tata Group and Reliance Group.

Which company has more profits: Reliance Industries or Tata Motors?

Reliance Industries has more profits than Tata Motors.