Welcome to yet another blog. Hope, you enjoyed our Satyam Scam case study. Today, we bring you the success story and market strategy of another giant business in India. Guess??

Yes, you guessed it right. It’s Coca-Cola, the most loved soft drink in human history. The black drink has its journey to motivate you.

In today’s blog, we will be focusing on some of the below-mentioned points:

- How does Coca-Cola originate?

- With changing times, what business model was opted by the company to keep the business going at the same pace?

- And lastly, how does the black soft drink never miss a chance to make its consumers happy?

So be it your kid’s 1st birthday celebration or, the 25th anniversary of your parents or your friend’s promotion party, coca-cola is the first thing to cross our minds when it comes to aerated drinks.

Over the past few years, coca-cola has captured the market with some of the best advertising techniques and has a monopoly in this sector.

Now without wasting much time let’s start our today’s blog.

First of all, we need to know what was the idea behind Coca-Cola and who started it

Introduced almost 120 years back, coca-cola is the most widely used beverage of all time.

It is currently consumed in more than 200 countries. It is the world’s largest manufacturer of non-alcoholic drinks.

History of Coca-Cola

Coca-Cola was founded by a pharmacist Dr. John S. Pemberton from Atlanta. He wanted to make a different-tasting soft drink that could be sold. He made a flavoured syrup and mixed it up with carbonated water. Later on, his partner Frank M. Robinson named that water-mixed drink Coca-Cola. The first newspaper ad for Coca‑Cola soon appeared in The Atlanta Journal.

Dr. John gradually sold his business in portions and before he died in 1888, Coca-Cola was finally sold to Asa G. Candler.

Starting from 9 servings in a day, now it serves around 1.9 billion drinks per day.

Read Also: Varun Beverages Case Study: Business Model, Financials, and SWOT Analysis

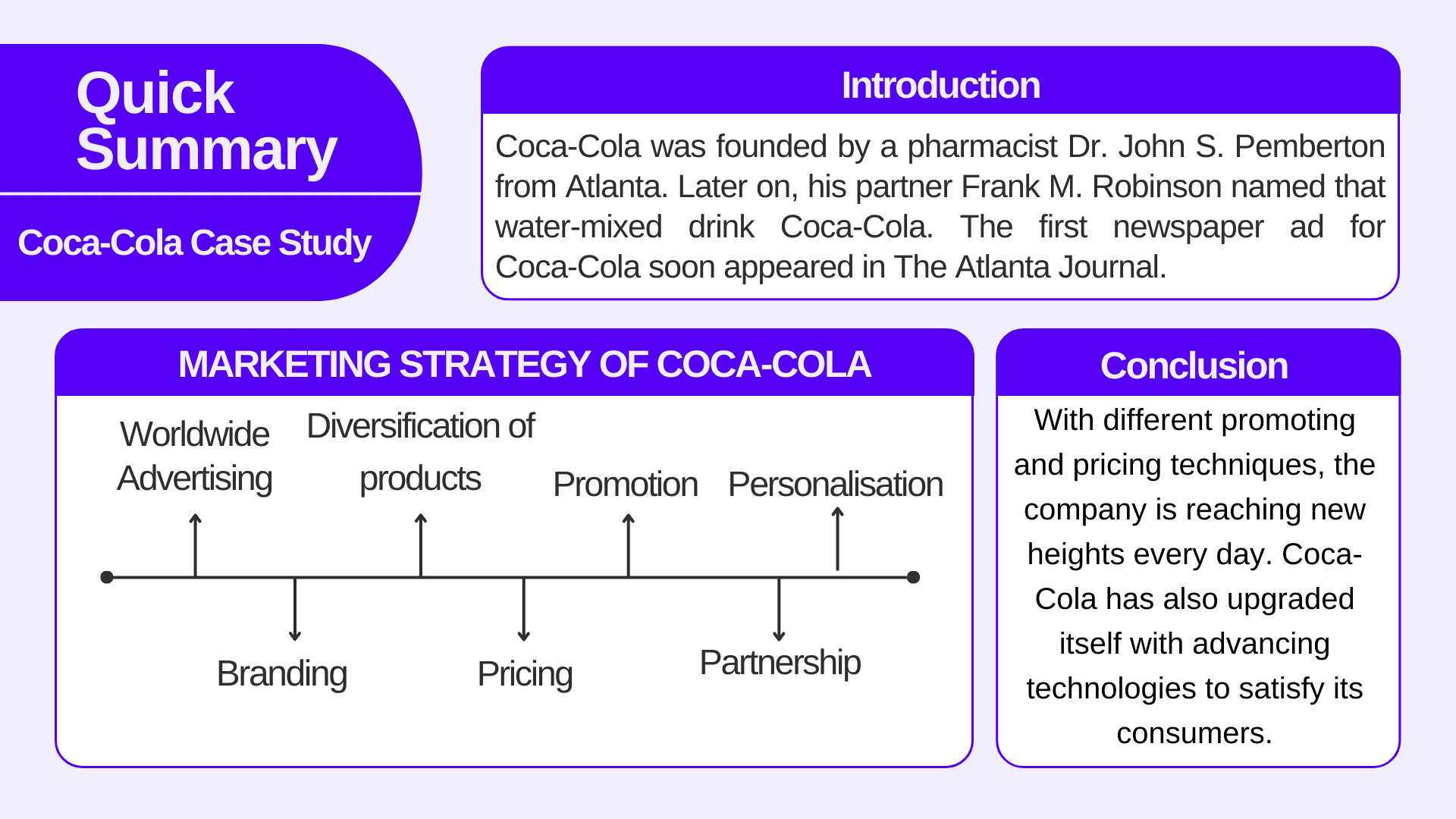

MARKETING STRATEGY OF COCA-COLA

Although every brand has its way of advertising its products, Coca-Cola has been one of the most recognizable brands now for over a century because the company first experiments with the strategy that it plans and then implements. For any strategy they make, customer satisfaction for the company comes first. Let’s discuss the widely used strategies in detail.

Worldwide Advertising

Coca-Cola every time comes up with a different and creative idea to advertise their product. At first, they analyse their global consumer base and their demands. For example, initially, coca-cola was sold through soda fountains but then two talented minds secured exclusive rights to selling coca cola in bottles. This eventually helped them to leave an imprint in their consumer’s minds since the bottles were sold globally and that too with labelling done in regional language.

Branding

Branding generally means how the consumers perceive the product visually i.e., identification of any product when first seen. Seems like Coca-Cola has already mastered the art of branding. The brand needs to maintain the logo that they are using and also update it from time to time as per the consumer’s taste and preferences. Coca-Cola did it so well by trademarking its logo.

Diversification of products

Coca-Cola does not limit itself after inventing one soft drink. They have expanded their bucket of products over the years. Some of the products of Coca-Cola are Sprite, Diet Coke etc. and companies like Maza and Fanta depended on Coca-Cola for their growth.

Pricing

With increasing recognition, more competitors came into the picture. Coca-Cola still kept their products cost-effective and maintained the quality of the product. This helped them in keeping their customers loyal and intact.

Promotion

Coca-Cola promoted its products through different advertising media such as newspapers, radio, television, billboards, banners, and magazine covers. The company also used artistic taglines like “Things go better with coke”.

Partnership

The company used partnerships as brand visibility to increase their market share and consumers. This helped them grow rapidly. Coca-Cola sponsored the Olympics, FIFA, Basketball tournaments and other reality shows such as American Idol. The company also bought various other businesses.

Personalisation

Coca-Cola always tries to connect with customers at a personal level.

Labelling their bottles in regional languages helped them increase their sales. They targeted their audience as per their age groups.

Secret of Coca-Cola’s Success

Before getting to any conclusion, you must know the secret of success for Coca-Cola’s marketing strategies. They follow a rule of 70:20:10 rule. As per this rule, 70% is the total allocation of the marketing budget of the coca-cola into their existing marketing strategies like Google ads and Facebook ads which are currently giving them good results, 20% is the allocation of the total marketing budget to the current trending marketing strategies like promoting their products on Instagram reels, YouTube shorts etc. remaining 10% they allocate into risky yet innovative marketing idea. Chances are likely that this 10% allocation will give them amazing results.

Read Also: Flipkart Case Study- Business Model and Marketing Strategy

Conclusion

By now you must have an idea of how Coca-Cola has placed itself differently in the market even after facing tough competition from competitors since its establishment. With different promoting and pricing techniques, the company is reaching new heights every day. Coca-Cola has also upgraded itself with advancing technologies to satisfy its consumers.

To conclude the iconic brand COCA-COLA is still in every heart, no matter how many competitors enter the market. Their efforts of “THANDA MATLAB COCA-COLA” are irreplaceable.

FAQs (Frequently Asked Questions)

When was Coca-Cola founded?

Coca-cola was founded in the year 1886.

Who founded Coca-Cola?

No, Coca-Cola is not an Indian brand. It is a USA-based brand.

How was Coca-Cola sold in the initial days?

Coca-Cola was sold through soda fountains initially.

How many drinks are served per day now?

1.2 billion drinks of Coca-Cola are served every day now.