If you are looking for some tips on how to successfully trade commodities, then this blog is for you. There are various commodity trading tips and tricks through which you can increase your chances of earning a profit while trading in commodities. You can make better commodity trading strategies by incorporating the tips discussed in this blog.

In this blog, we will give you an overview of five tips for successful commodity trading.

Check Out – Search and Filter Commodities

Here Are the 5 Tips for Successful Commodity Trading

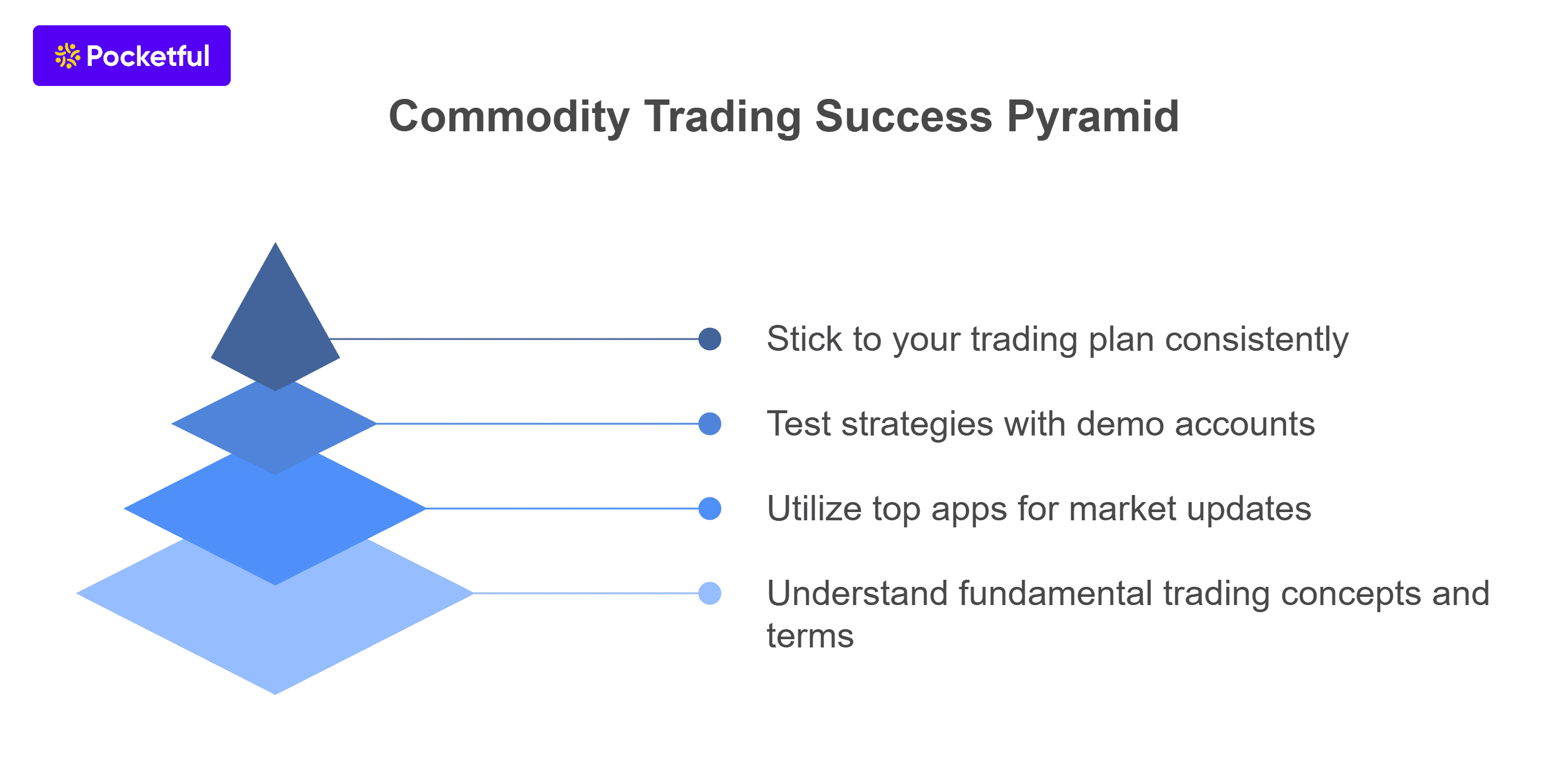

Commodity trading has gained popularity in recent years. Trading commodities can be difficult for a new trader, but to successfully negotiate the complexity of the commodities market, you must take calculated risks, and for this, you must have proper trading strategies. The following are the five key commodity tips for new traders that can help them succeed in commodity trading:

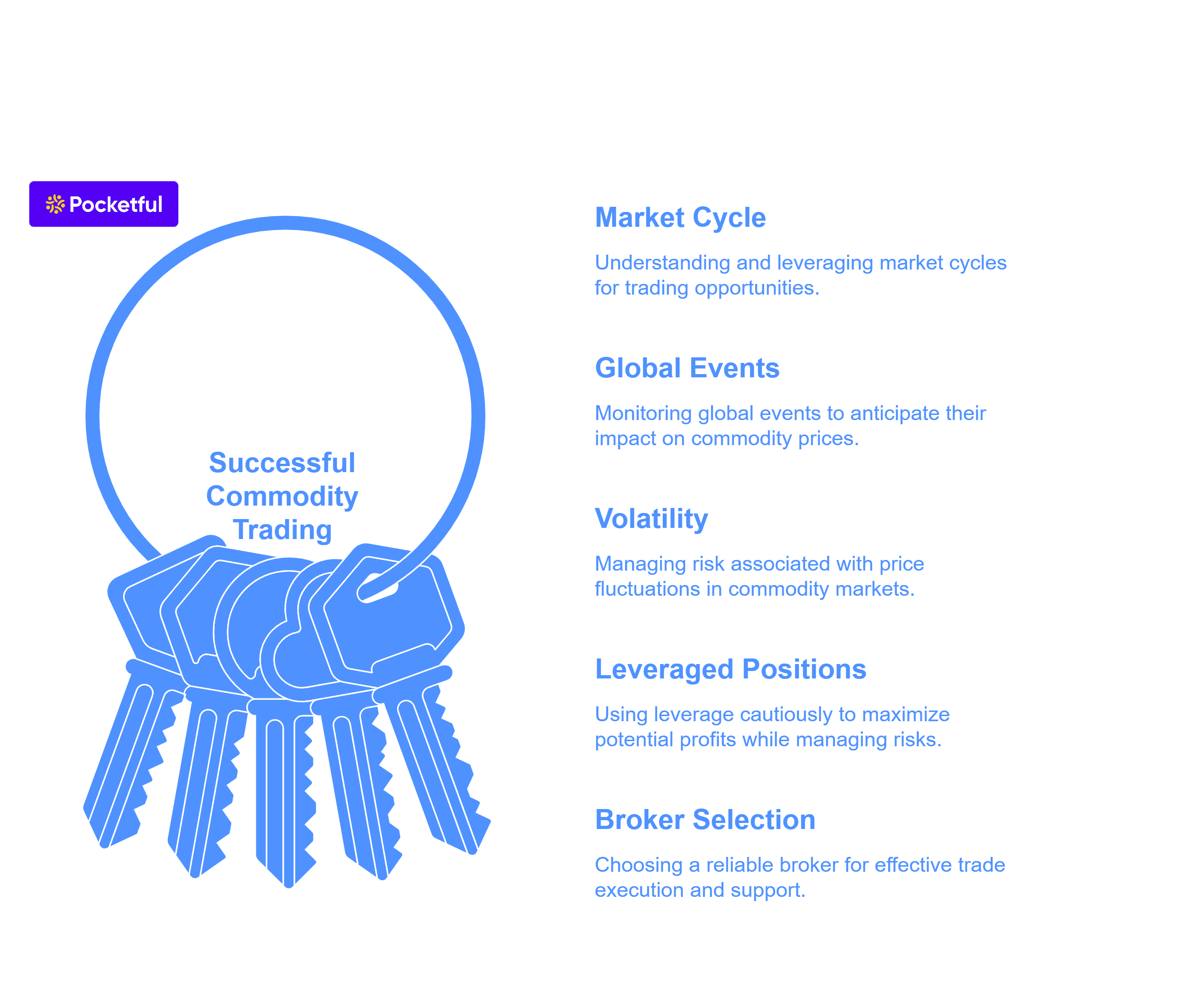

1. Market Cycle

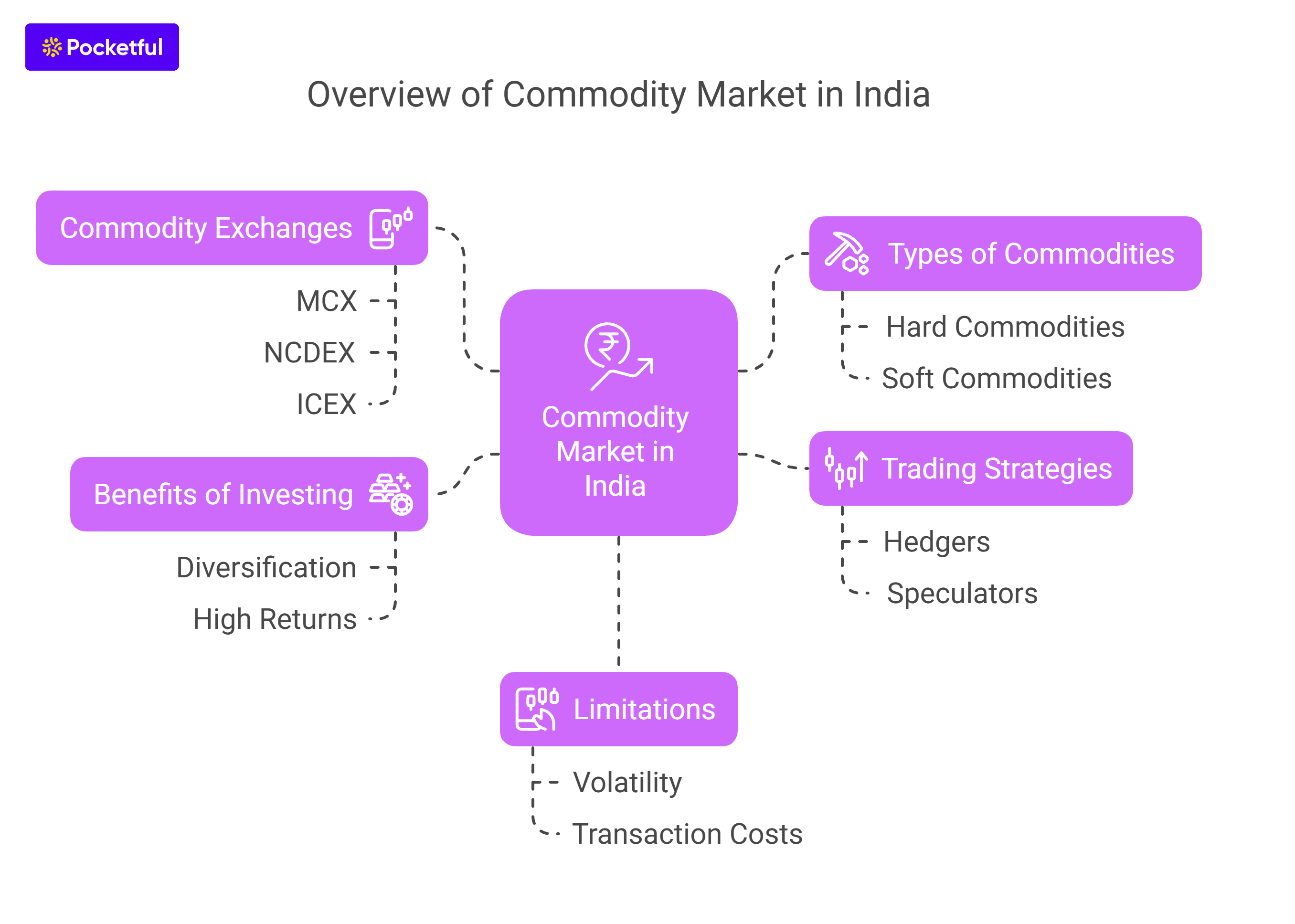

Similar to other financial markets, the commodities market likewise goes through cycles. The commodity market cycle is affected by various elements, including industrial, geopolitical, and economic.

For example, depending on the needs of the area, the demand for fossil fuels for heating purposes may increase in the winter, causing their prices to rise.

These short-term cycles offer trading opportunities; however, it is required to manage your risk efficiently.

2. Tracking the Global Events

The prices of commodities are dependent on various international events. A trader must keep track of these events to see patterns and make wise judgments. For example, a rise in geopolitical tension or political instability can cause the demand for safe havens such as gold and silver to rise, resulting in an increase in the price of gold.

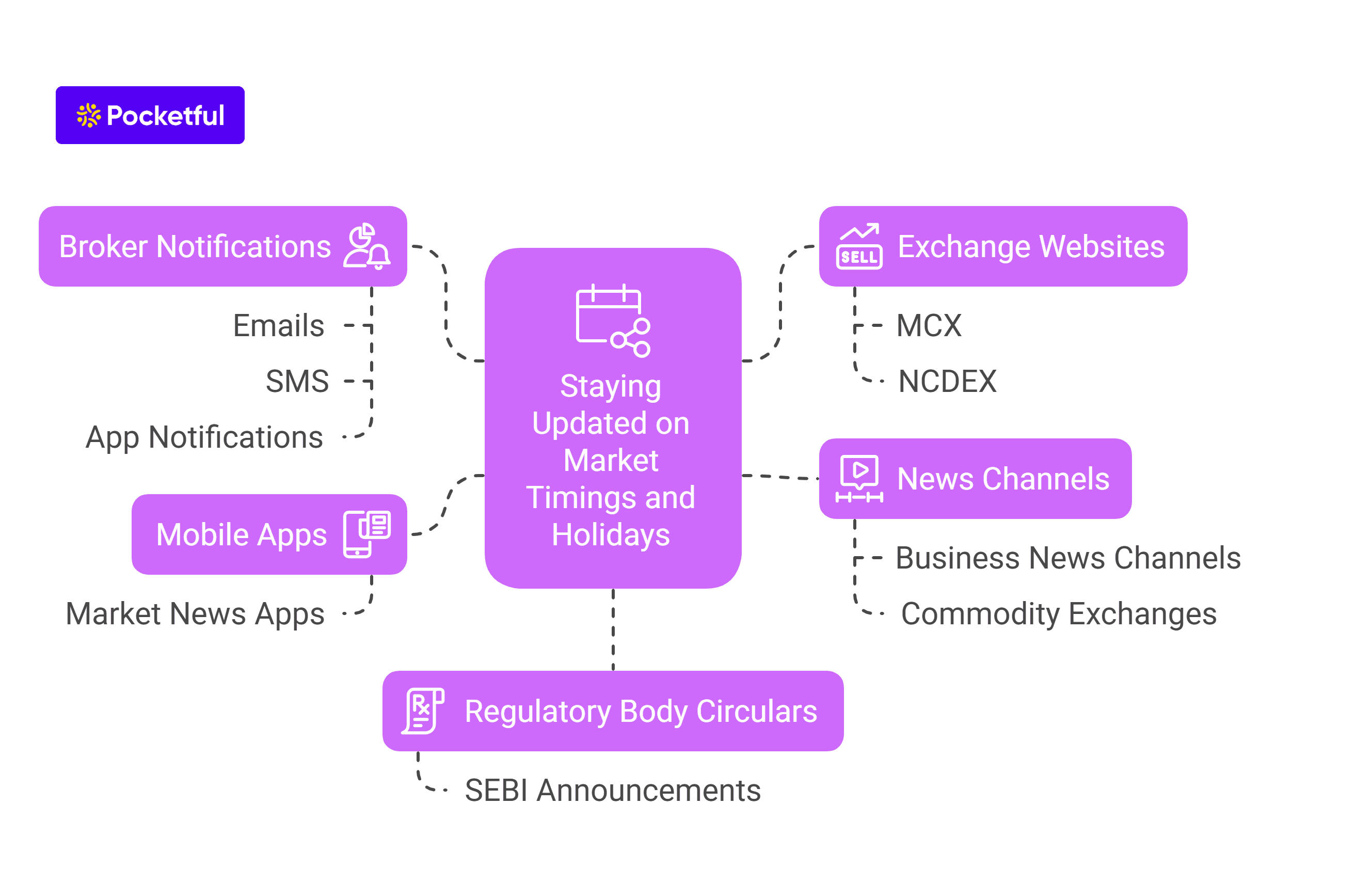

Reuters, Bloomberg, and other platforms are available to track world events. In addition, several government organizations disclose various kinds of data on a weekly or monthly basis, which must also be monitored. The performance of a specific commodity is directly impacted by such news and data.

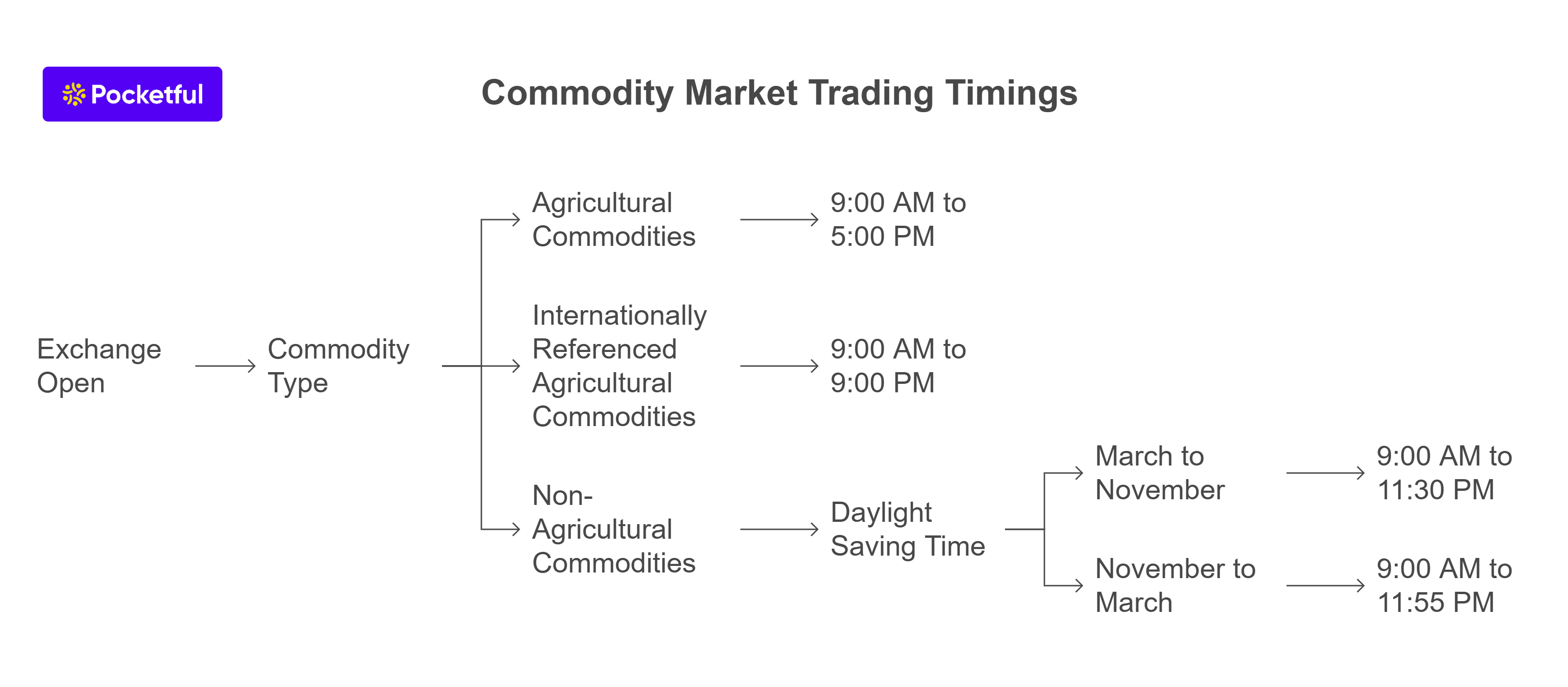

Read Also: What is the Timing for Commodity Market Trading?

3. Volatility

Commodity trading is characterized by significant volatility, which is caused by several variables, including supply and demand, global events, market liquidity, etc. Thus, it is crucial to understand volatility to effectively manage risk. The two main determinants of volatility are supply and demand; commodities with limited supply are typically more volatile, whereas those with abundant supply have low volatility. Due to their widespread use in various industries, base metals like copper and aluminium saw a sharp increase in price during periods of economic expansion.

4. Leveraged Positions

Leverage allows a trader to take on significant market positions with very little capital. This raises the possibility of increasing profit, but it also raises the risk. Borrowing money from the broker is known as leverage, and it is advantageous when the market is moving in your favour. If the market is moving against your trading position, the leveraged position increases your losses.

The commodity market is unpredictable, and any significant price change can result in margin calls and large losses for traders. These losses can cause emotional stress and make impulsive trading decisions that further increase losses. Therefore, it is advisable to use leverage with caution.

5. Selecting Broker

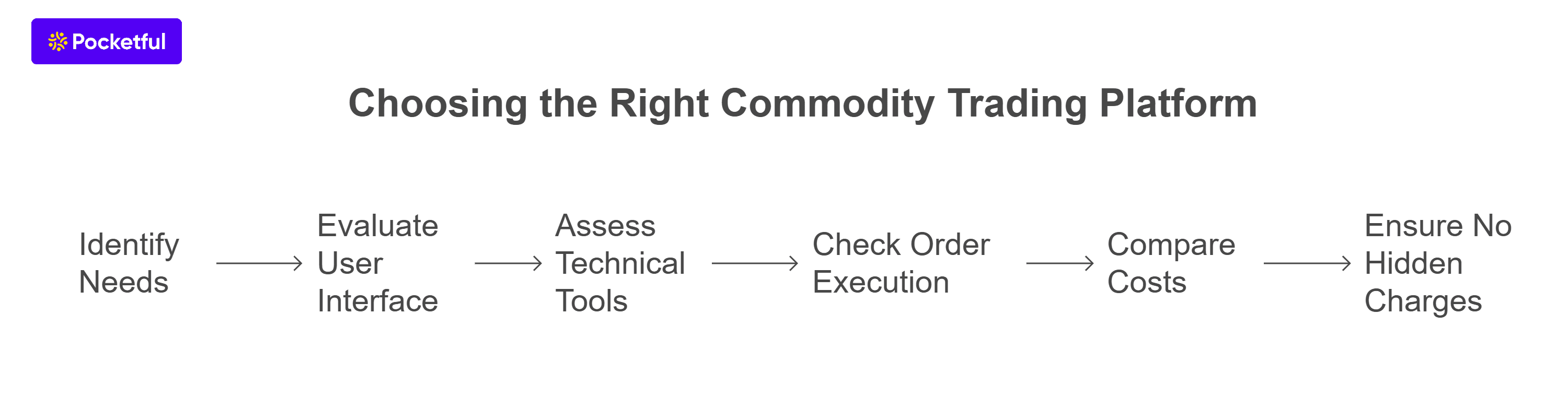

Even after designing a profitable trading strategy, you might face issues on how to execute it. There are various commodity trading platforms in the market offered by brokers; however, finding the right broker who offers smooth transaction execution at minimum cost should be one’s top priority. The commodity trading platform must be registered with regulatory bodies such as the Securities and Exchange Board of India. Furthermore, a good broker sends authentic research reports and related study materials to their traders.

Thus, pick a broker like Pocketful that offers you top-notch services at a low cost through their cutting-edge technology-driven platforms. In addition to this, they offer you a variety of tools and enable you to trade in all commodities at the lowest cost, which helps you maximize your profit.

Read Also: Best Commodity Trading Platforms in India

Conclusion

On a concluding note, using the above-mentioned tips, a trader increases his/her probability of being profitable in commodity trading, but doing so calls for self-control and the ability to make wise decisions. The likelihood of designing a profitable trading strategy can be increased by constantly learning new things as the market’s dynamics change so quickly, so it is necessary to be up to date on news and events when trading in the commodity market. If you miss any crucial updates, you could potentially lose money.

Before making any investment decisions, it is advisable to speak with your investment advisor because commodity trading carries a high level of risk and may not be appropriate for all market participants.

You can open a free commodity trading account with Pocketful, which provides advanced charting tools for analyzing the commodity market.

Frequently Asked Questions (FAQs)

How much capital do I need to start trading in commodities?

The minimal amount of capital needed to begin trading in the commodity market depends on the commodity being traded. A commodity with a higher contract value requires more margin than a commodity with a lower contract value.

What commodities are best for beginners to start trading?

Beginners can begin trading in commodities such as crude oil, gold, copper, aluminium, etc.

What is commodity trading?

Commodity trading is the process of forecasting future price movements and creating long and short positions in commodities to make money.

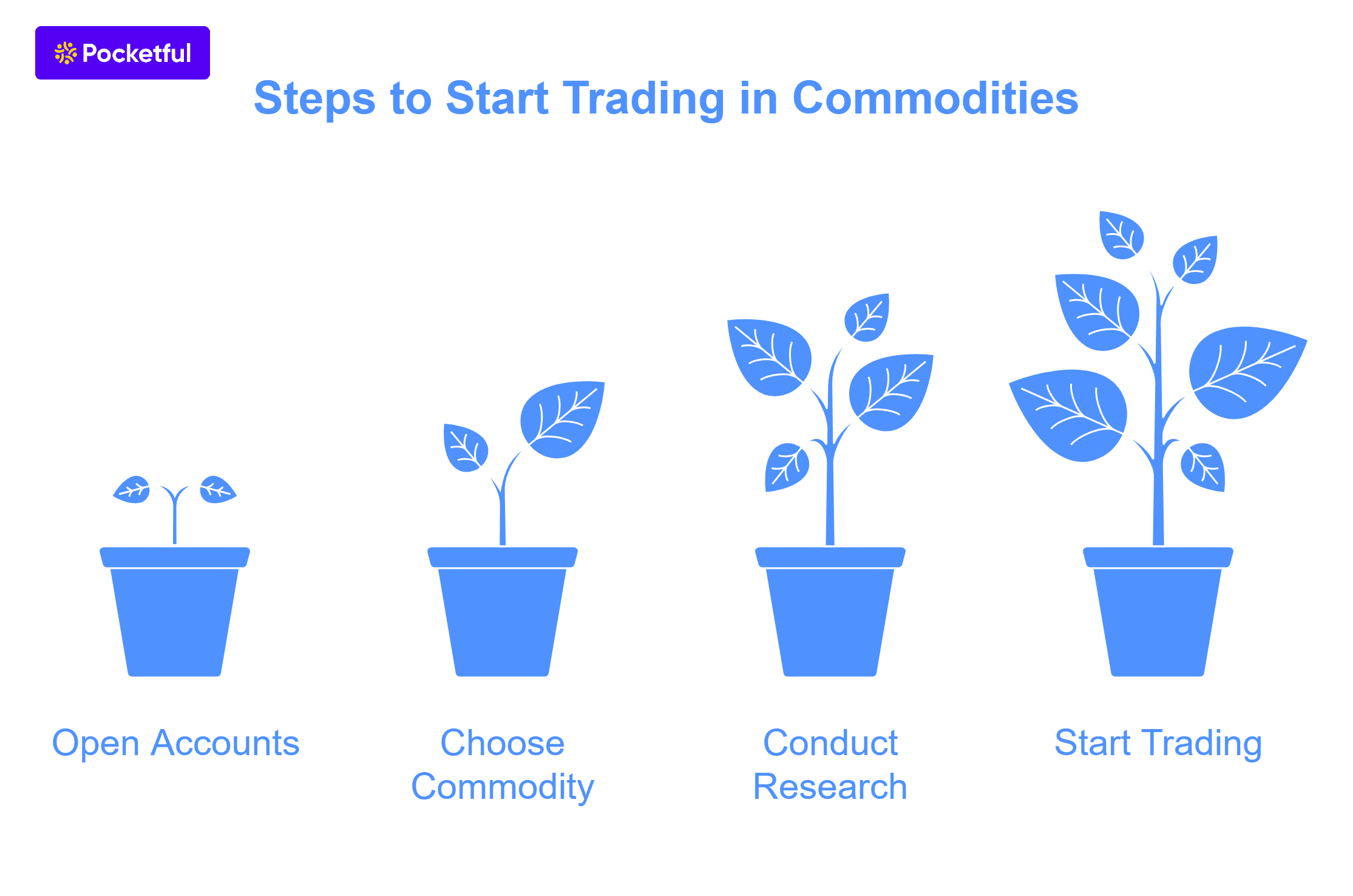

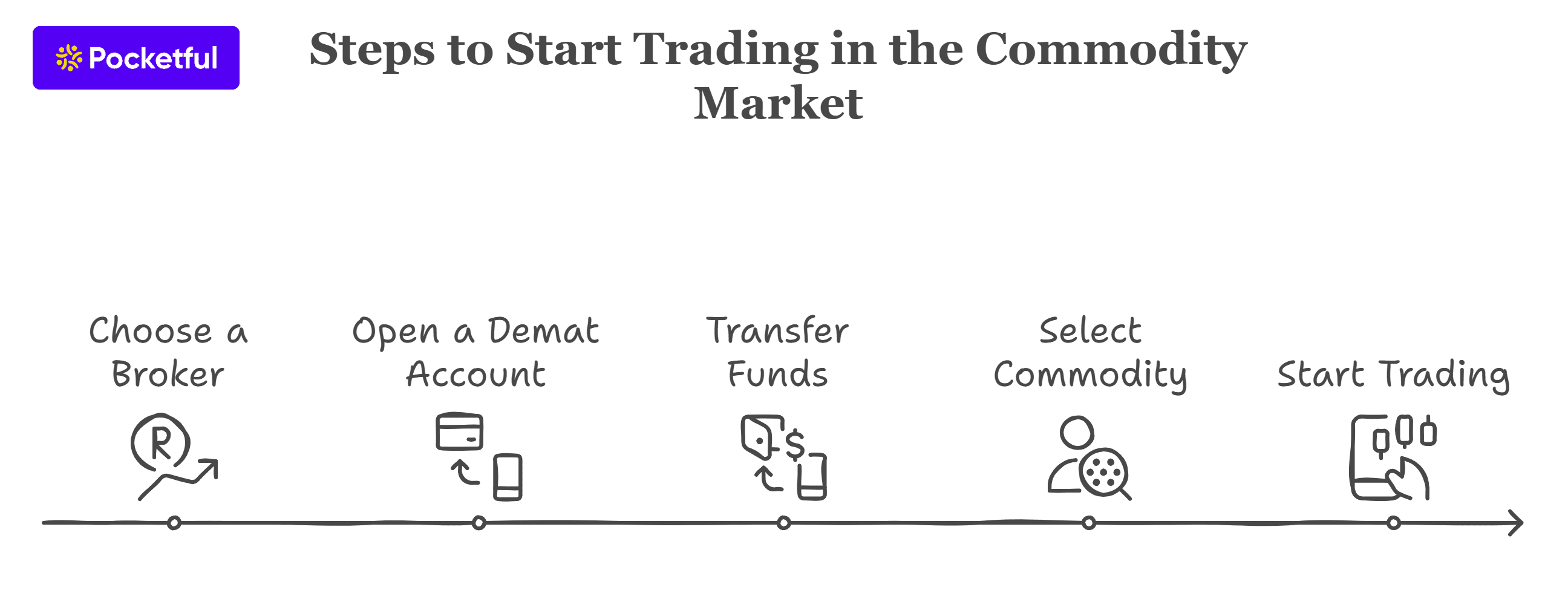

How to start commodity trading?

A commodity trading account is necessary to begin trading in commodities. There are various commodities trading platforms in the market, but Pocketful provides the best commodity trading platform with advanced research tools.

What are the most traded commodities in India?

The most common commodities traded by traders in India are gold, silver, and crude oil.