The evolution of the Indian financial market has been extremely interesting to witness. Now, after the introduction of Demat accounts in 1996, one can imagine how the investment world has changed from the earlier system of dealing with physical share certificates at the risk of being stolen, forged, or even damaged. Nowadays, electronic holding and trading of securities through a Demat account ensures security. For anyone wanting to invest in the Indian stock markets or any other security, having a Demat account has become a necessity.

This doesn’t mean you just have a single type of Demat account; depending on whether you are a resident Indian, an NRI (Non-Resident Indian), or owing to specific financial objectives, there are different types of Demat accounts. The article covers everything you want to know regarding these different types of Demat accounts, what they offer, and how to choose the right one for you.

What is a Demat Account?

A Demat account, short for a Dematerialized account, stores financial securities in electronic form. Whether it is stocks, bonds, mutual funds, or even exchange-traded funds, it is very easy to track and manage investments with a Demat account.

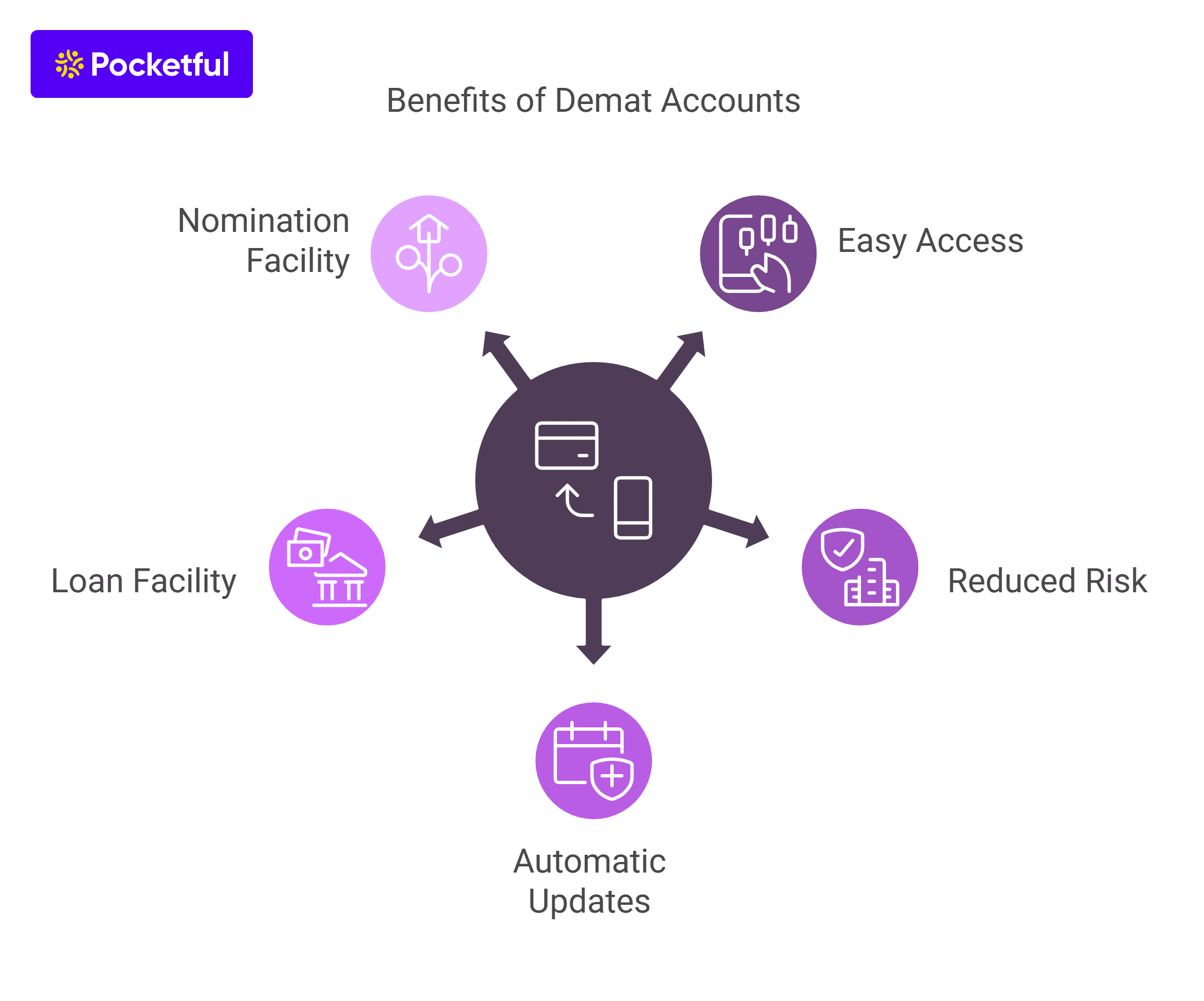

Benefits of a Demat Account

The benefits of a Demat account are:

- No Risks of Physical Certificates: The physical share certificates pose risks like loss, theft, or damage. A Demat account removes these risks by storing securities in an electronic form.

- Easy Transactions: It is easy to buy and sell shares as transactions can be conducted electronically, which does not require any paperwork.

- Centralized Portfolio: It allows investors to hold a range of financial assets like stocks, bonds, ETFs, and mutual funds, all under one account.

- Quick Access to Investment Details: Using a Demat account, investors have easy access to assets in their portfolio, previous transactions, and other details that make the process of managing investments easier.

- Reduced Transaction Cost: With the Demat account, the paperwork and transfer costs associated with the physical certificates are removed or avoided, making the whole process cost-effective.

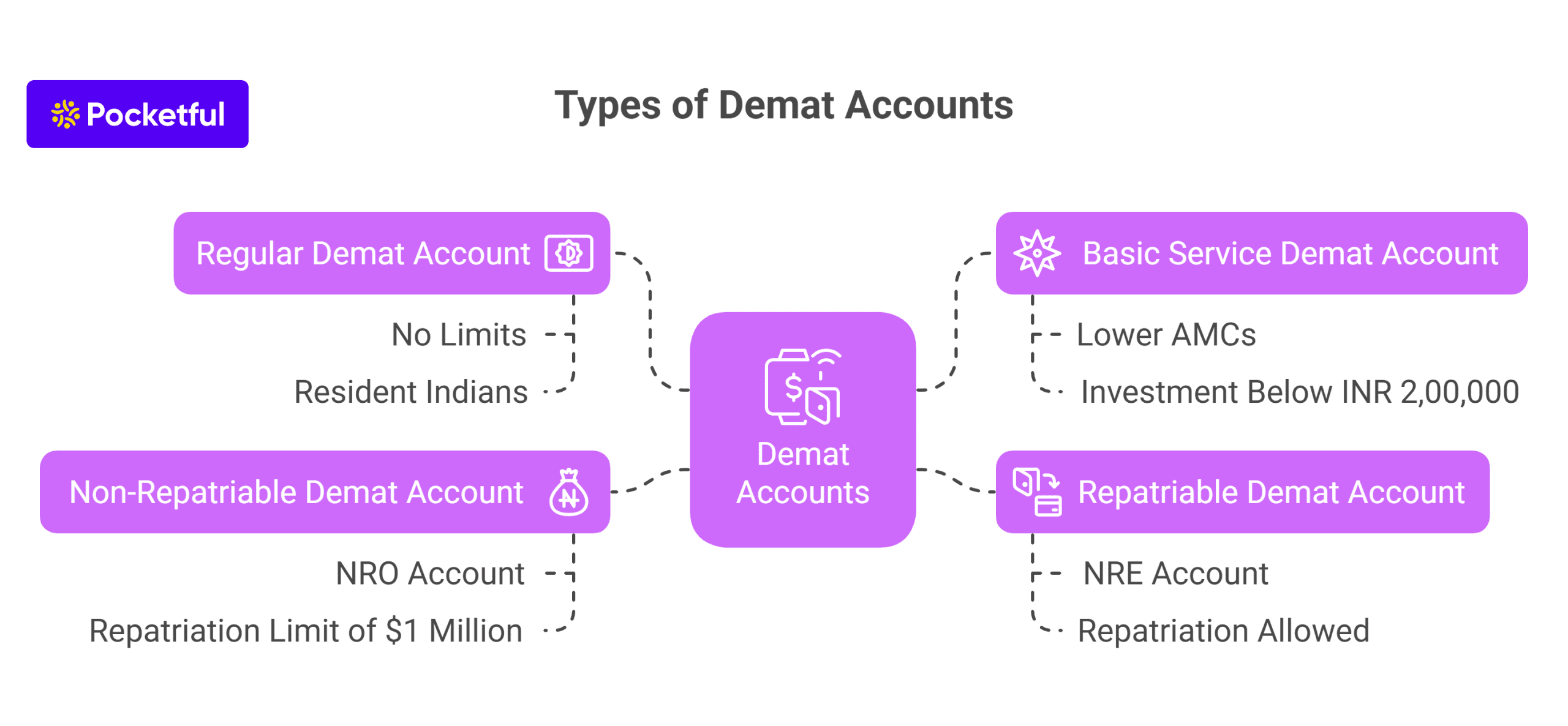

Types of Demat Accounts

There are three fundamental types of Demat accounts based on residency and fund repatriation requirements as follows:

1. Regular Demat Account (For Resident Indians)

A Regular Demat Account is a Demat account that can be opened by an Indian resident. It holds securities in electronic form. Moreover, there is no limit on the number or value of securities an investor can hold.

- Objective: It keeps electronic records of all shares and other kinds of securities.

- For Whom: Resident Indian investors.

2. Basic Service Demat Account (For Resident Indians)

A Basic Service Demat Account (BSDA) is similar to a regular Demat account in most aspects and can be opened by investors residing in India. An investor with BSDA incurs lower Annual Maintenance Charges (AMC) than a regular demat account.

- Objective: It is used to store securities in electronic form and was introduced for investors with a total value of their demat account holdings of less than INR 2,00,000.

- For Whom: Resident Indian investors with a total investment value below INR 2,00,000. An investor incurs a cost of INR 100 per year if the value of holdings is between 50,001 and INR 2,00,000. Moreover, if the holding value is INR 50,000 or lower, the investor is exempt from AMC.

3. Repatriable Demat Account (For NRIs)

This account is suitable for all the NRIs who want to invest in Indian financial markets and repatriate their earnings to their country of residence. This Demat account must be a linked Non-Resident External (NRE) bank account, allowing NRIs to repatriate their funds, i.e. deposits and interest earned on them abroad.

- Objective: Allows NRIs to repatriate their investment proceeds abroad.

- For whom: NRIs investing in Indian markets.

4. Non-Repatriable Demat Account (For NRIs)

The Non-Repatriable Demat Account is another kind of account for the NRIs, which restricts the repatriation of deposits to $1 million. However, interest earned on them is fully repatriable. Such an account will be necessarily linked with a Non-Resident Ordinary (NRO) account.

- Objective: Hold securities of NRI investors who do not intend to repatriate the fund abroad.

- For Whom: NRIs investing in India who do not want to repatriate more than $1 million worth of deposits.

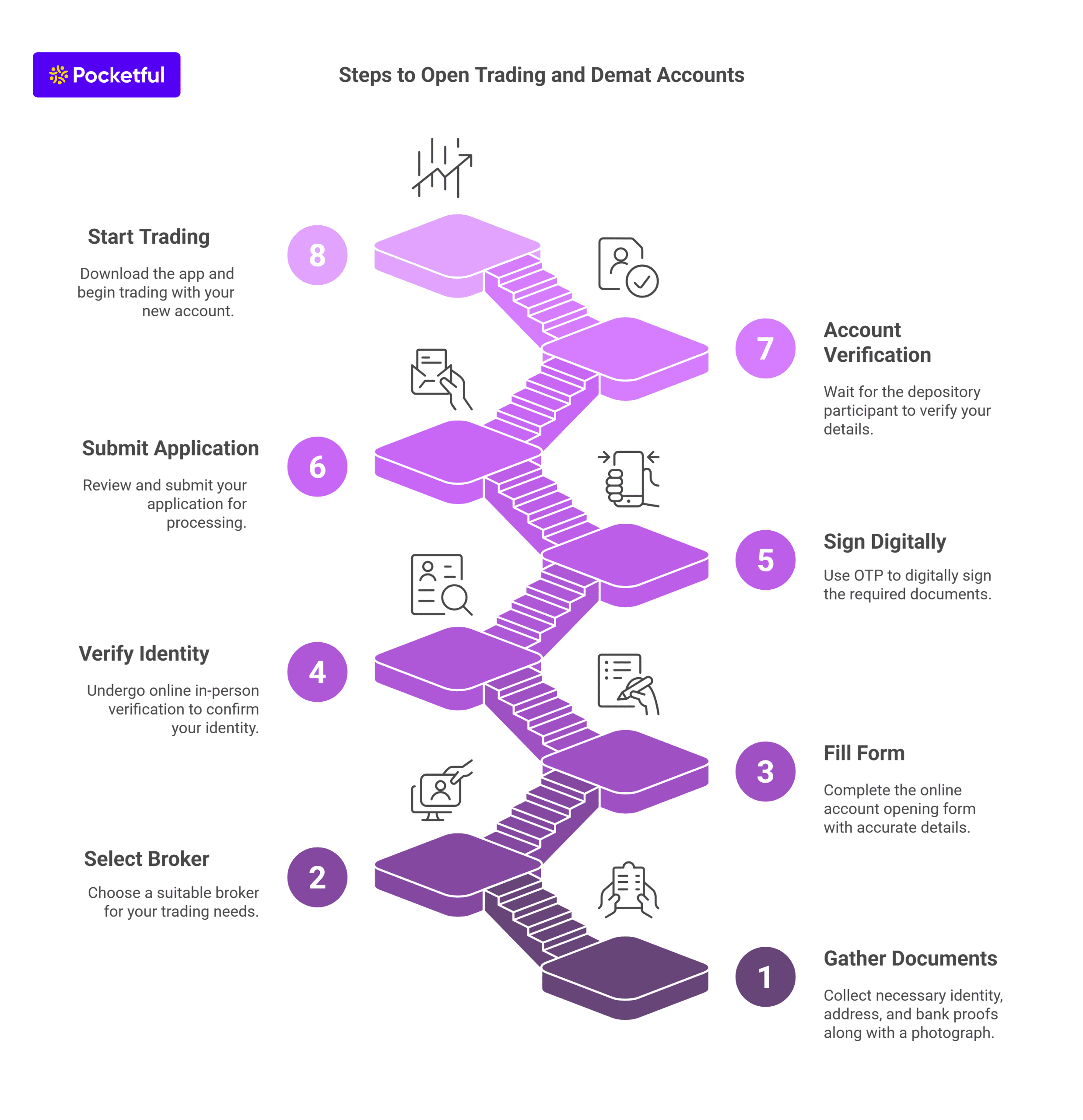

What are the Documents Required for Opening All Types of Demat Accounts?

To open a Demat account, various documents related to identity and address are required to be submitted. The following are the lists of documents required for a resident Indian citizen and an NRI.

Documents for Resident Indians

Resident Indians are required to submit the following documents:

- Proof of Identity: PAN card (mandatory), Passport, Voter ID or Aadhaar card.

- Proof of address: Aadhar card, Passport, Voter ID or utility bills like electricity, gas or telephone.

- Bank Account Proof: Canceled cheque or bank passbook.

- Income Proof: To trade in derivatives, IT returns, or payslips are required.

- Photographs: Passport-size photographs for identity reasons.

Documents for NRIs

Non-resident Indians are required to submit the following documents:

- Identity Proof: PAN card (mandatory) and valid Passport.

- Proof of Overseas Address: Utility bills, rent agreements, or foreign bank statements.

- Proof of Indian Address: Aadhaar card, Passport or driver’s license.

- Bank Account Proof: Canceled cheque or bank statement of NRE/NRO account.

- Income Proof: IT returns or salary slips as per the requirement of the account.

These documents will satisfy all the regulatory requirements of opening any Demat account as mandated by the SEBI.

Read Also: 15 Best Demat Accounts Apps for Traders and Investors in India

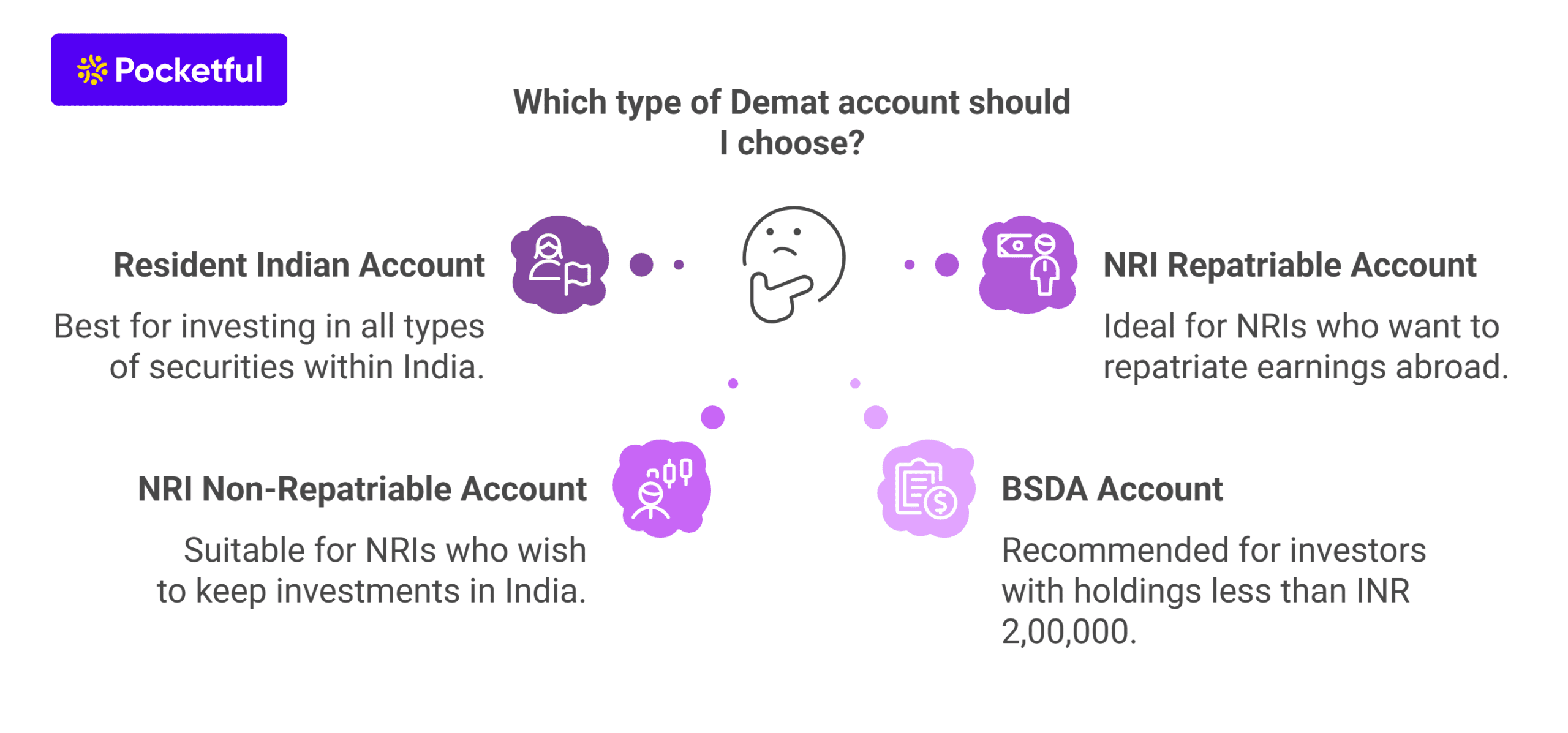

How to Choose the Right Type of Demat Account?

Choosing the correct type of Demat account is crucial as it must align with your investments and financial goals. This is how you make the right choice:

For Resident Indians: As a resident Indian, the regular Demat account is the best option as it allows you to invest in all types of securities. An investor can opt for a BSDA if the value of investment holdings is less than INR 2,00,000.

For NRIs: As an NRI, you must choose between Repatriable and Non-Repatriable demat account based on the following conditions:

- So, if you are an NRI and want to repatriate your earnings abroad, a Repatriable Demat Account is the best choice for you.

- If repatriation is not an issue and you wish to invest and keep your money in India, then a Non-Repatriable Demat Account is the appropriate demat account.

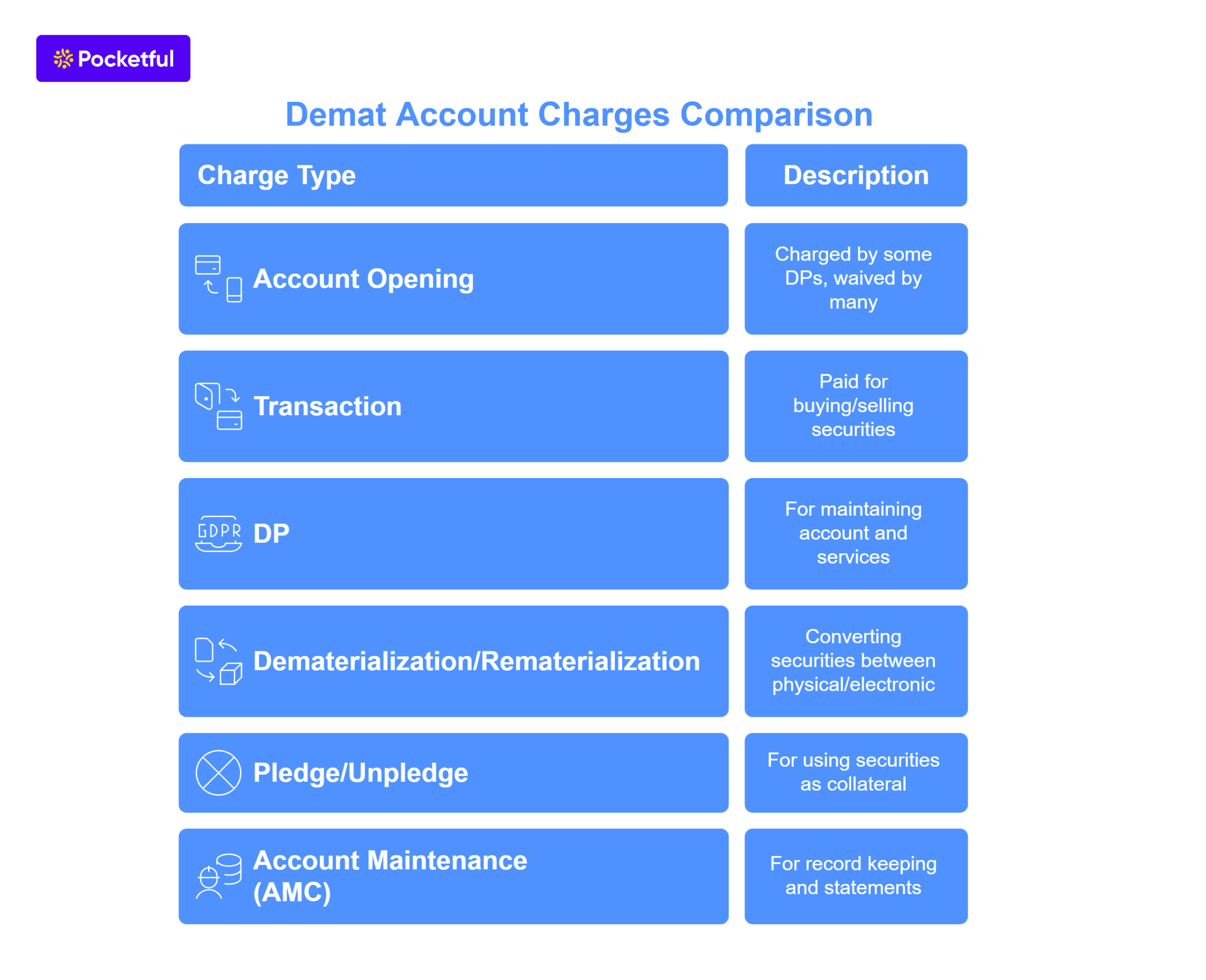

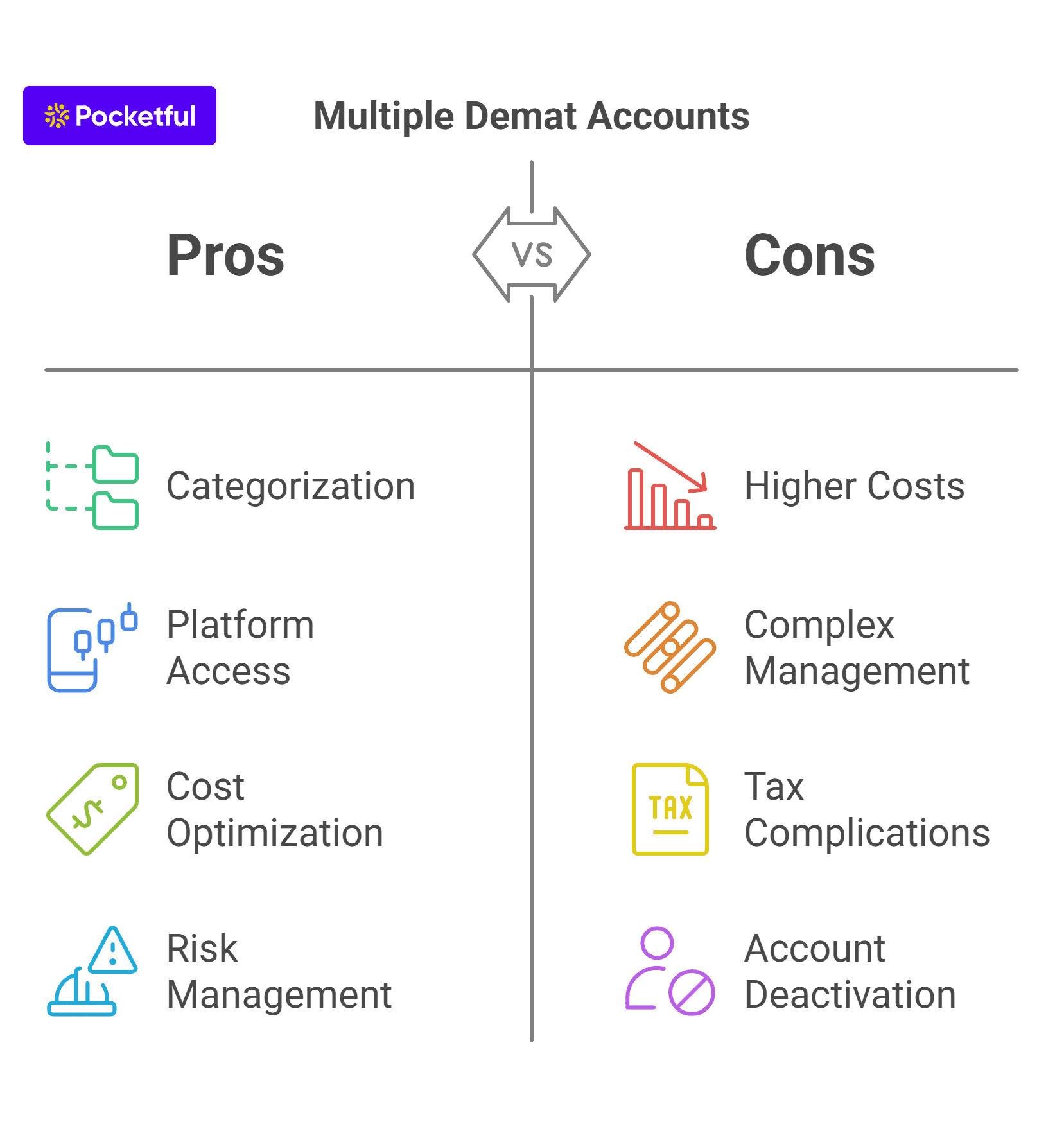

Fee Considerations: Different brokers charge different AMC, transaction fees, and other charges. If you are a long-term investor, go ahead with the broker who has the lowest AMC.

DR Demat Account – Types of DR Demat Accounts and Limitations

A DR Demat Account is a special type of Demat account that is used by investors who hold securities in the form of American Depository Receipts (ADRs) or Global Depository Receipts (GDRs) and want to transfer these securities from the overseas depository system to the Indian Depository system. There are two types of DR Demart Accounts:

- Resident DR Demat Account (for resident Indians)

- NRE DR Demat Account (for NRIs)

Upon successful transfer of ADRs or GDRs to the DR Demat Account, the securities are transferred to the Regular Demat Account of the investor and the DR Demat Account is closed.

Limitations of DR Demat Account

The limitations of a DR Demat Account are:

- High Costs: The transaction and maintenance costs of DR Demat accounts are high.

- Complexity: Transferring DR securities to a DR Demat account involves handling foreign tax regulations, currency exchange rates, etc.

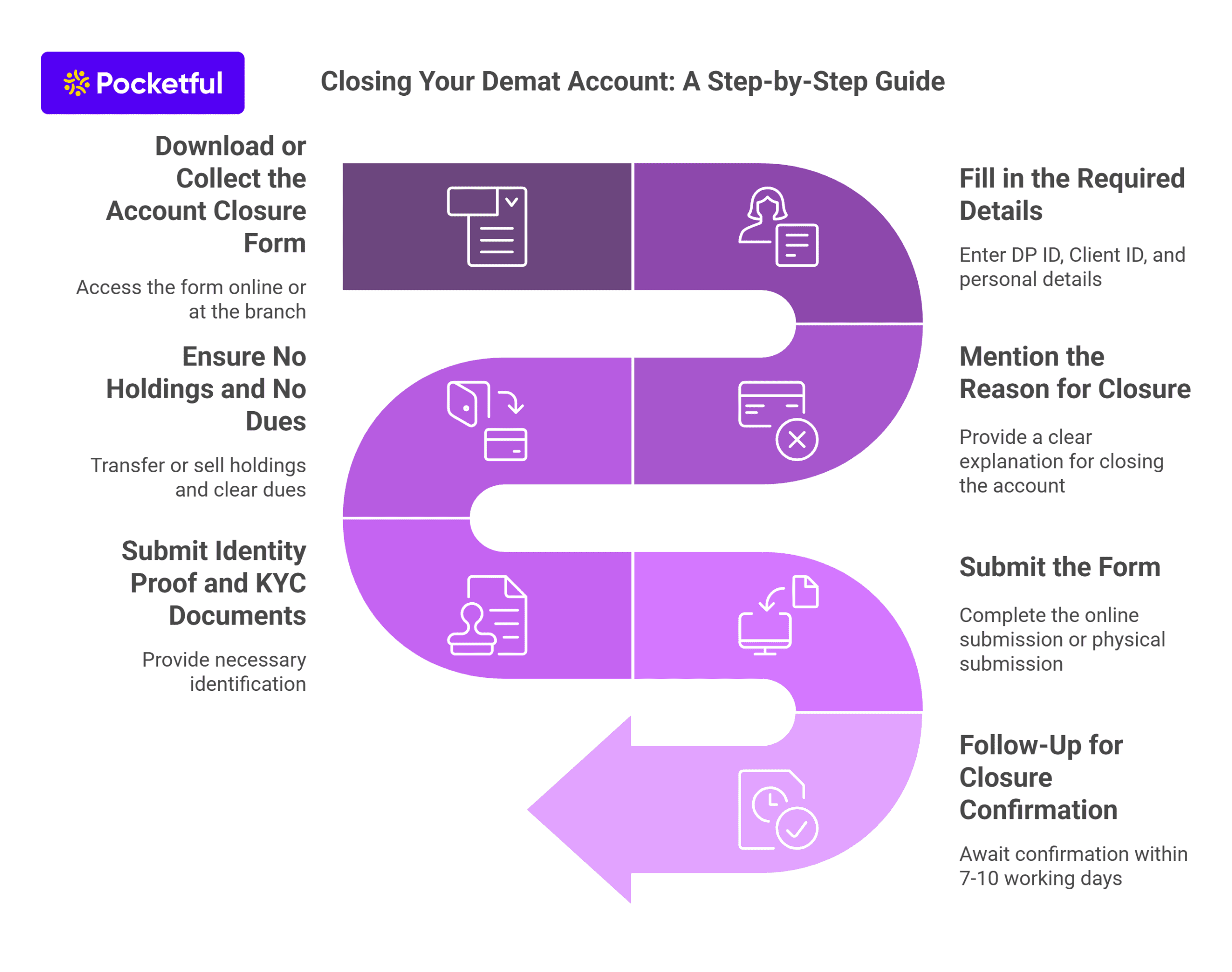

Read Also: How to Close Your Demat Account Online?

Conclusion

Understanding the types of Demat accounts is crucial for Indian investors, NRIs, and institutional investors while planning their financial portfolios. Each account type is meant to perform a different role – whether it’s a resident Indian who plans on actively investing in stocks or an NRI managing investments from outside the country.

The most commonly used Demat account for most of the Indian investors is a Regular Demat Account while NRIs have to choose between Repatriable and Non-Repatriable Demat accounts.

Choosing the right Demat account is based on various factors like charges for the account, frequency of trading, and even the status of residency. With a suitable Demat account, an investor is all set to begin his journey in the Indian stock market.

Frequently Asked Questions (FAQs)

Can I have more than one Demat account?

Yes, you can have multiple Demat accounts with different Depository Participants.

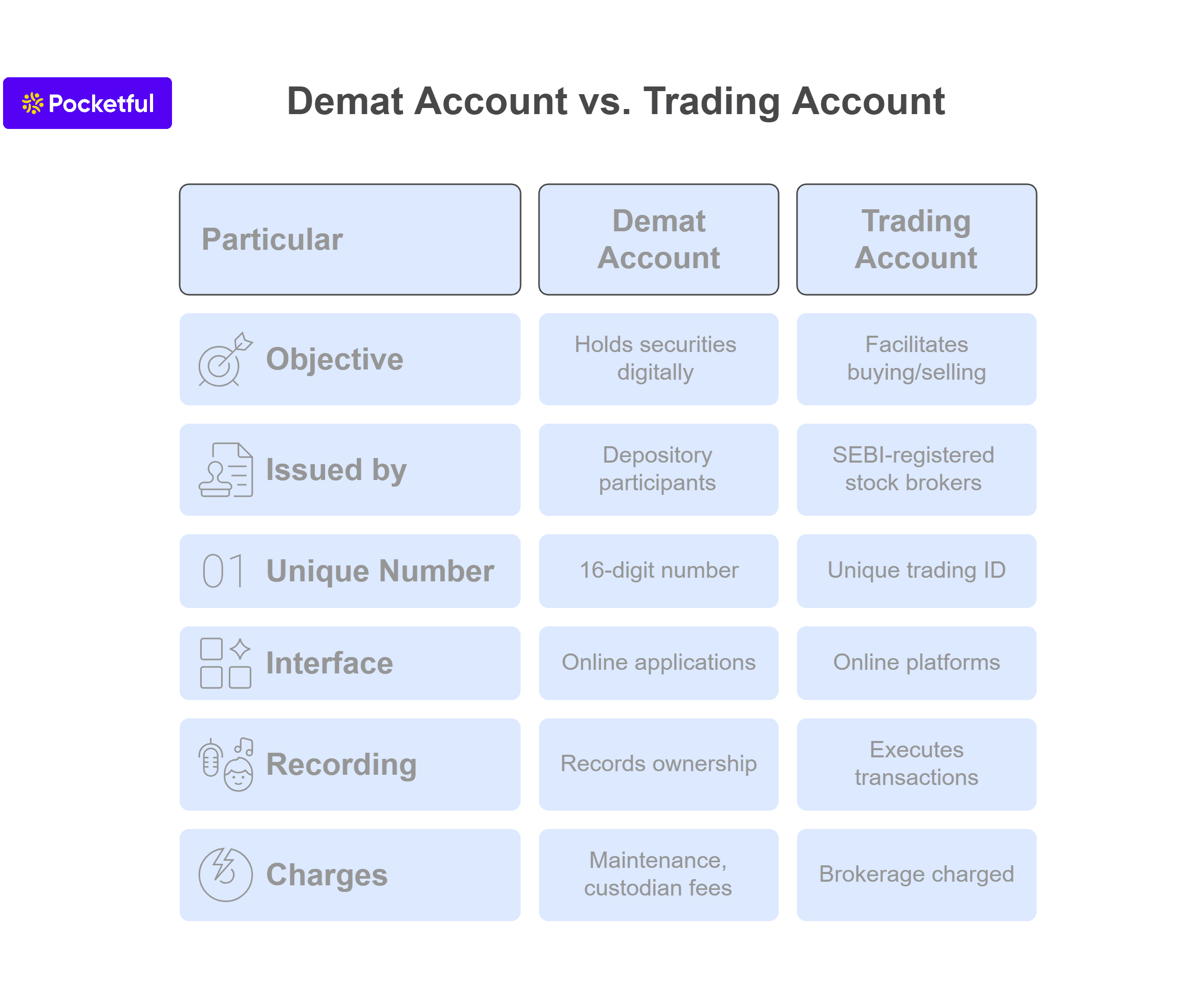

Is it mandatory to keep a trading account linked to a Demat account?

It is mandatory to link a Demat account with a trading account for smooth transactions in the stock market.

Is there an annual maintenance charge (AMC) for a Demat account?

Yes, most DPs charge an annual maintenance fee. However, this charge varies across different DPs.

Are NRIs allowed to have a Regular Demat Account?

No, NRIs cannot open a Regular Demat Account. They have to open either a Repatriable or Non-Repatriable Demat Account.

What happens if I don’t use my Demat account for a long time?

The Demat account can become dormant if the investor doesn’t make any transactions for 12 months. In such a case, the Demat account must be reactivated by completing the KYC and In-Person Verification again.