Have you ever wondered where your files or google photos are stored? Or how these days you can watch hundreds of movies on different OTT platforms? The answer to this is Cloud. If you are using these services then you are already using cloud computing services.

Here there are no personal spaces that everyone requires, companies can plug into cloud computing services, use what they require and pay the bill. Instead of buying and managing their own expensive servers (think huge, powerful computers), companies can just “plug in” and rent computing power, storage, or software over the internet. They pay for what they use, just like you pay for electricity.

Top 10 Cloud Computing Stocks in India

| Company Name | Market Price (₹) | Market Cap (₹ Cr.) | ROCE (%) | ROE (%) | 52 Week High (₹) | 52 Week Low (₹) |

|---|---|---|---|---|---|---|

| Tata Consultancy Services (TCS) | 3,203 | 11,58,946 | 64.6 | 52.4 | 4,191 | 2,867 |

| Infosys Ltd. | 1,685 | 6,83,151 | 37.5 | 28.8 | 1,924 | 1,307 |

| HCL Technologies Ltd. | 1,684 | 4,57,049 | 31.6 | 25.0 | 1,831 | 1,303 |

| Wipro Ltd. | 268 | 2,81,101 | 19.5 | 16.6 | 325 | 225 |

| LTIMindtree Ltd. | 6,294 | 1,86,607 | 27.6 | 21.5 | 6,380 | 3,802 |

| Tech Mahindra Ltd. | 1,646 | 1,61,311 | 18.6 | 14.6 | 1,736 | 1,209 |

| Persistent Systems Ltd. | 6,413 | 1,01,160 | 30.4 | 24.1 | 6,599 | 4,149 |

| Oracle Fin. Serv. Software Ltd. | 7,908 | 68,814 | 40.6 | 29.3 | 10,265 | 7,038 |

| Coforge Ltd. | 1,723 | 57,731 | 20.3 | 16.0 | 1,994 | 1,191 |

| Mphasis Ltd. | 2,920 | 55,640 | 22.7 | 18.2 | 3,078 | 2,025 |

Overview of Top Cloud Computing Stocks in India

1. Tata Consultancy Services (TCS)

It is one of the IT giants in India and also known as the key player in the Indian IT sector. TCS plays a major role in providing cloud computing services like cloud strategy and transformation, migration, managed multi-cloud, and hybrid cloud services to some of the biggest companies in the world and helping them in shifting their operations to the cloud. TCS partners with all the major cloud providers like AWS, Google Cloud, and Microsoft Azure, acting as a one-stop-shop for their clients’ cloud needs.

2. Infosys Ltd.

It has a powerful cloud platform known as Infosys Cobalt, that provides cloud migration, managed services, cloud native development, data and AI services and also security posture management across public, private and hybrid cloud ecosystems. Infosys has a collection of over 300 tools that help companies and businesses to move to cloud faster and manage their services easily. The main focus of Infosys is to modernize the primitive systems and make them more advanced, efficient applications as per the needs of the changing market.

3. HCL Technologies Ltd.

HCLTech has positioned itself as a strong player in cloud transformation by offering end-to-end services such as cloud consulting, engineering, and operations management. The company leverages AI-driven tools to help enterprises optimize cloud usage, control costs, and improve efficiency, making cloud adoption more strategic and cost-effective.

4. Wipro Ltd.

Wipro Ltd. provides cloud computing services through its integrated cloud platform FullStride Cloud Services and provides services like cloud migration, modernization management, and consulting. Wipro is a top-tier partner for Amazon Web Services (AWS), the world’s biggest cloud provider. This shows their deep expertise and they also help clients migrate their apps, manage their cloud resources, and build new solutions designed to run perfectly on the cloud.

5. LTIMindtree Ltd.

LTIMindtree’s platform gives users a simple dashboard to manage their multi-cloud ecosystem, which is generally a complex structure in most of the companies like AWS, Google, and Microsoft. LTIMindtree specializes in managing this complexity as it provides services like cloud transformation solutions, hybrid cloud management and multi-cloud support.

6. Tech Mahindra Ltd.

Tech Mahindra acts as a strategic guide for businesses on their cloud journey. Their Cloud BlazeTech platform helps companies create a clear roadmap, from planning the move to managing the operations efficiently, with a special focus on controlling costs. Tech Mahindra provides extensive cloud computing services like cloud transformation and migration, and even cloud consulting for hybrid and multi cloud environments.

7. Persistent Systems Ltd.

Persistent Systems is a fast-growing IT services company with deep expertise in cloud and software engineering They have a very strong partnership with Google Cloud. This company provides cloud managing services, cloud migration, modernization, and optimization that helps businesses in modernizing their data centers and use the power of cloud-based data analytics to innovate faster.

8. Oracle Financial Services Software Ltd.

Oracle is a bit different from mainstream cloud computing companies as the company provides essential cloud computing services related to banking and financial software directly through the cloud. It mainly focuses on banking cloud services, risk and finance cloud services, financial crime and compliance management, cloud infrastructure and cloud migration services. Banks use their platform for critical tasks like accounting and risk management.

9. Coforge Ltd.

Coforge focuses on creating industry-specific cloud solutions rather than providing one-size-fits-all services. With strong expertise in sectors like travel, transport, and financial services, the company offers cloud advisory, migration, and cloud-native development services tailored to client needs. For example, they might help an airline modernize its booking system, giving them a strong competitive edge.

10. Mphasis Ltd.

Mphasis helps big companies modernize their old, clunky applications for the cloud by providing cloud strategy, migration and management services. Their main goal is to help clients upgrade their entire technology setup, from the customer-facing apps to the core systems in the back, making them faster and more customer-friendly.

Read Also: Best Data Center Stocks in India

Key Factors to Consider in best cloud computing services stocks in India

One should be excited to invest in these cloud computing stocks in India but first a smart investor shall always do their homework and look for the right data on the Pocketful app.

- Company’s Debt: One should always look for Debt-to-Equity (D/E) ratio of the company. As a low number (less than 1) is usually a good sign, as it means the company doesn’t rely too much on loans or is debt free.

- Profitability: Look at the Return on Equity (ROE) to see how effectively the company is using shareholders’ money. A higher ROE is usually a positive sign of profitability.

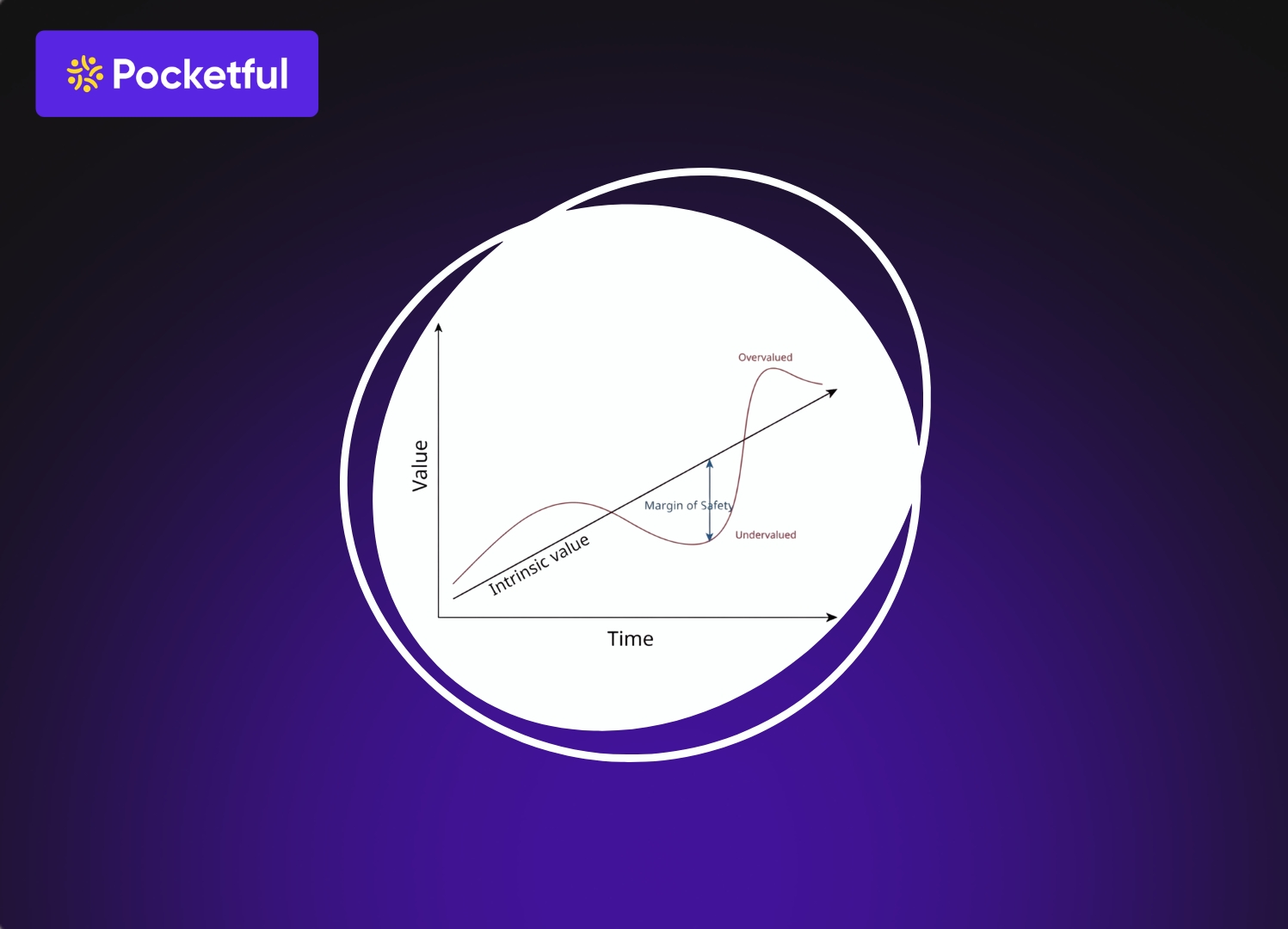

- Valuation: Price-to-Earnings (P/E) ratio gives investors a hint that the stock is too expensive or not. One should always compare the P/E of a company with others in the same industry to see if the prices are fair or not.

- Future Business: Investors shall also look at the Total Contract Value (TCV) as it helps in giving us the picture if the company has some new deals or not as a dedicated growth plan and new deals are a good sign for future growth.

Future of Cloud Computing Companies in India

India is moving towards a great digital boom with cloud computing services expanding rapidly. A key driver of this growth is the government’s Digital India push and with this program the government is also initiating in bringing high-speed internet to villages and moving government services online via cloud computing services.

From online banking to e-commerce platforms, nearly all new digital services rely on cloud infrastructure to function efficiently. This surge in demand has attracted the attention of investors seeking opportunities in the fast-growing Indian cloud computing sector.

Read Also: Best Midcap IT Stocks

Factors to Consider Before Investing in Cloud Computing Stocks

- Need of the Hour: From banks securing your money to e-commerce sites handling festival sales, almost every industry is moving to the cloud. This means a constantly growing customer base for every cloud computing company in India.

- Government’s Support: Initiatives like Digital India creates a steady and reliable demand for cloud services, making the sector demand more stable. This is a positive sign for anyone looking at Indian cloud computing companies listed on Stock Exchanges.

- Potential Future: Cloud adoption is shaping the future of business operations. As India’s economy grows, the reliance on cloud services will increase, making this sector a promising long-term investment theme.

Read Also: Best Metaverse Stocks in India

Conclusion

Most of the big Indian IT companies are not the ones building the giant data centers, like Amazon or Google. Instead, think of them as expert architects. They help other big businesses design, build, and manage their operations on the cloud.

The move to the cloud is one of the biggest tech shifts of our time. India, with its booming digital economy, is right at the center of this revolution. For investors, this offers a powerful, long-term opportunity to a stabilized and centralized storage and service. As an ideal investor you can research and track all these companies on the Pocketful platform as you get simple tools for your analysis and comparison to help you make smarter decisions.

Frequently Asked Questions (FAQs)

What are cloud computing stocks?

These are stocks of companies that provide cloud computing services, data storage and software over the internet. In India, this mostly includes large IT companies that help other businesses use the cloud.

Do cloud marketing have a potential future in India?

The future of cloud marketing is evolving and backed by the government’s ‘Digital India’ program, and is best suited for businesses wanting to save costs, and the rise of new technologies like AI that need the cloud to work.

Are these Indian companies the same as Amazon AWS or Google Cloud?

No, Amazon and Google have their own data centers but the Indian companies are mostly expert partners that help businesses to use their platform.

What is the biggest risk when investing in these stocks?

A global economic slowdown is a key risk that can be faced by such companies as Indian IT companies earn their money from clients in the US and Europe and a recession can slow down their potential growth.

Which Platform shall be used for investing in cloud computing stocks?

One can just start by opening a Demat account and use a platform like Pocketful where you can open an account online in minutes and use their tools to research stocks, track them, and invest with just a few clicks.