Not every investor is looking for extraordinary returns. For a lot of people, the most important thing is to keep their money safe, grow it steadily, and avoid stress. That is what Fixed Income Mutual Funds are for. These funds don’t put your money into the stock market. Instead, they invest in safer options, such as government bonds, corporate bonds, and treasury bills. The goal is simple, and that is to offer investors peace of mind, stability, and steady growth.

If you’ve ever thought, “I want my money to grow, but I don’t want to face the highs and lows of the stock market,” fixed income funds might be the right choice for you. In this blog, we will learn in detail about the intricacies of the fixed-income mutual fund and whether they are a good fit for you.

Fixed Income Mutual Fund – An Overview

Fixed-income mutual funds are mutual fund schemes that invest in fixed-income securities like government bonds, debentures, corporate bonds, and other money market instruments. People also call these funds “debt funds.” There are many types of fixed income funds, such as corporate bond funds, banking and PSU debt funds, gilt funds, and liquid funds.

Features of Fixed Income Mutual Fund

- Steady and Predictable – These funds give you a more stable return, mostly through interest income, contrary to the ups and downs of the stock market.

- Less Risk – They are usually safer than equity funds, but keep in mind that they are not risk-free.

- A Lot of Options – You can choose from short-term bond funds to long-term gilt funds, depending on what you want to invest in.

- Related to Interest Rates – The value of these funds can go up or down when interest rates change.

- Easy to Withdraw Funds – Unlike a fixed deposit, you can usually get your money whenever you want to.

- Expertly Managed – You do not need to keep track of every bond yourself because a professional fund manager does the hard work for you.

- Built-in Diversification – Your money is allocated across several bonds and securities, which lowers the risk.

Read Also: Types of Mutual Funds in India

Types of Fixed Income Mutual Fund

1. Gilt Funds

Your money is invested in government bonds through these funds. Since the government backs these securities, credit risk is extremely low. While they are considered a safe option, the returns can still fluctuate with changes in interest rates.

2. Corporate Bond Funds

These funds invest in bonds issued by corporations. They carry higher credit risk than government bonds, but typically offer higher potential returns.

3. Short Duration Fund

These funds focus on bonds that mature in one to three years and are less susceptible to fluctuations in interest rates, making them ideal for short-term, conservative investors.

4. Long Duration Funds

Invest in bonds with maturities of at least seven years. They react more quickly to changes in interest rates, but they may offer higher returns. Ideal for long-term, patient investors.

5. Money Market Funds

Invest in short-term securities such as deposits, commercial papers, and treasury bills. These funds are liquid, safe, and convenient for keeping extra cash that you might need in the near future.

6. Dynamic Bond Funds

Depending on the conditions of the market, these funds shift between short-term and long-term bonds rather than sticking to a single strategy.

7. Credit Risk Funds

To seek greater returns, you can invest money in credit risk funds that invest in corporate bonds with lower ratings. This increases your risk because some businesses may fail. It may be suitable for those who are prepared to assume greater risk in exchange for the possibility of greater rewards.

How do Fixed Income Mutual Funds work?

Fund Managers pool money from a bunch of investors and invest in fixed-income financial assets.

1. Earning Interest

The bonds in the fund pay interest regularly. The majority of your returns come from this steady source of interest.

2. Buying and Selling Bonds

Bond prices have an inverse relationship with interest rates. When interest rates decline, existing bonds with higher coupon rates become more valuable, allowing the fund manager to potentially earn capital gains by selling them. Conversely, if interest rates rise, the market value of existing bonds falls, which can reduce the fund’s returns.

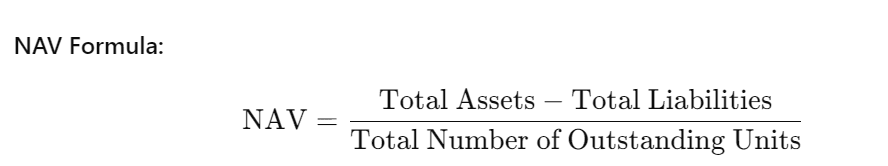

3. The Value of Your Fund (NAV)

NAV, or net asset value, is the value of your investment. It changes every day based on how well the fund’s bonds are doing.

4. Risks Associated

- Credit Risk: The fund loses money if a company can’t pay back its debt.

- Interest Rate Risk: Because rates and bond prices move in opposite directions, changes in rates can affect your returns.

5. Your Role

You do not have to worry about paperwork or keep track of each bond; the fund manager does it for you.

Read Also: Debt Mutual Funds: Meaning, Types and Features

Advantages of Fixed Income Mutual Fund

- Steady Returns – These funds are less volatile than equity funds and provide predictable returns.

- Capital protection – Good for investors who do not want to lose too much of their principal.

- Diversification – These funds invest money into a combination of bonds, government securities, and money market instruments.

- Liquidity – It is easier to redeem than fixed deposits, and the money usually comes back in one to two business days.

Disadvantages of Fixed Income Mutual Fund

- No guaranteed returns – The returns may vary, unlike FDs.

- Interest rate risk – When interest rates go up, bond prices go down, which can change the value of the fund.

- Credit risk – The fund could lose money if the bond issuer fails to pay.

- Lower Returns – Returns are lower than stocks, which is good for safety, but will not beat inflation in the long term.

Read Also: How Interest Rates Impact Mutual Funds in India

Who Should Invest of Fixed Income Mutual Fund

1. Risk-Averse Investors

These funds are a better choice if you get stressed by the ups and downs of the market. They have more stable returns.

2. People who are retired or want a steady income

This is a great way to make money without taking too much risk.

3. Short to Medium Term Investors

Great for goals you want to reach in the next one to five years, like saving money for school fees, a vacation, or an emergency fund.

4. People with FDs Exploring More Options

Debt funds are worth looking into if you like the safety of fixed deposits but wish you could get access to your money more easily.

Fixed Income Funds vs. Fixed Deposits

| Basis | Fixed Income Mutual Funds | Fixed Deposits (FDs) |

|---|---|---|

| Definition | A pool of money invested in bonds, treasury bills, and other debt instruments. Returns change with market conditions. | A simple savings product where you park your money with a bank for a fixed time at a fixed interest rate. |

| How you earn | Returns come from the interest bonds pay and any gains/losses from changes in bond prices. | The interest rate is locked in on day one and stays the same till maturity. |

| Risk level | Carry interest rate risk (prices move opposite to rates) and credit risk (if a borrower defaults). | Very safe, backed by banks, and up to ₹5 lakh per person per bank is insured. |

| Guarantee of capital | No guarantee. The value (NAV) can go up or down slightly. | Your principal and interest are guaranteed (within insurance limits). |

| Liquidity (easy access) | Usually 1–2 working days to get your money back; some funds allow instant redemption up to a limit. | You can break an FD before maturity, but you’ll usually pay a penalty or get a lower interest rate. |

| Costs | Comes with a small expense ratio (management fee). | No ongoing charges, only a penalty if you break early. |

| Taxes | Taxed only when you redeem. From April 2023, all gains are taxed at your income tax slab. Dividends, if chosen, are also taxed at the slab. | Interest is taxed every year at your income tax slab. TDS applies if interest crosses the limit. |

| Transparency | You can see where your money is invested; NAV is published daily. | The bank tells you the rate and tenure upfront. |

| Best for | Investors who want a balance of safety and slightly better returns, and don’t mind small ups and downs. | Those who want guaranteed returns and peace of mind. |

Conclusion

Fixed-income mutual funds might not be as rewarding as individual stocks, but that is what makes them great: they keep things steady. They are ideal if you want a steady income, less risk, and a great way to balance out the riskier parts of your portfolio.

These funds can help you with that, whether you are retired and need a steady stream of income, planning for short-term goals, or just want a safe place to keep your money. Consider fixed-income mutual funds as the basis that keeps your financial journey steady while the market evolves.

Frequently Asked Questions (FAQs)

Are fixed-income mutual funds risk-free?

No, they are safer than equity funds but still carry some interest rate and credit risk.

How do these funds make money?

These funds make money through interest earned on bonds and small gains when price increases.

What is the general return range?

Usually 6% to 9% per year, depending on the type and market conditions

Are these funds good for short-term goals?

Yes, especially liquid funds and short-duration funds.

Can NRIs invest in fixed-income funds?

Yes, most AMCs allow it, though some restrictions apply depending on the country of residence.