Metals generally do not grab headlines like stocks and gold, but they are also quite impactful in the economic development of a country. There are various metals, but copper is generally considered one of the most in-demand.

In today’s blog post, we will give you a copper price prediction for the next 5 years in India, along with the historical trend and how you can invest in it with the Pocketful trading application.

Historical Trend of Copper Price in India

The long-term historical trend of copper prices in India is as follows:

- 2015-2020: Before 2020, copper prices were relatively stable, traded within a certain range. The prices traded in the range of INR 350 – 450 per kg, and the high was made because of increased demand from China. Additionally, the demands remain stable because of traditional construction and the power sector.

- Time of COVID: During the COVID-19 period, the copper prices fell to INR 330 per kg due to the lack of demand owing to the countrywide lockdown and suspension of infrastructure-related activities.

- Post-COVID Recovery: After the lockdown was removed, the economic activities recovered, and the prices of copper did as well. Electric vehicles also consume copper as an important material, and this is another factor that is causing the copper price to rise.

- 2021-2025: The prices of copper were on the higher side, but fluctuated due to global demand and supply dynamics. In 2025, the copper prices made a new high because of green energy demand, mine disruption and limited inventory. AI-driven data centres also help in increasing the price of copper.

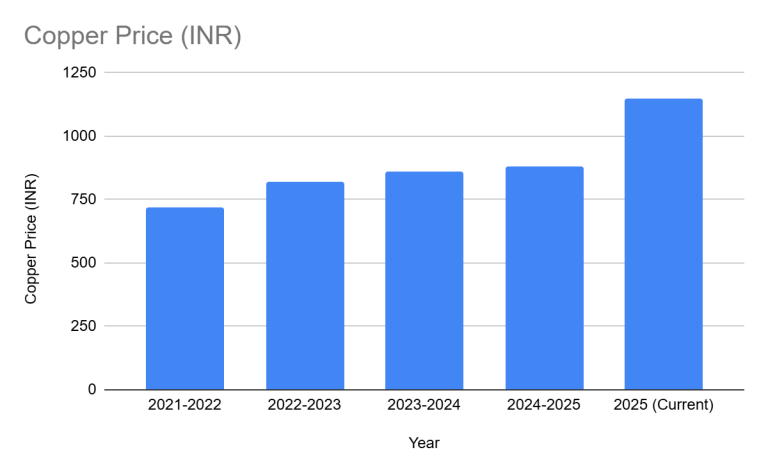

Past 5 Years Copper Returns

| Year | Copper Price (INR) |

|---|---|

| 2021-2022 | 720 |

| 2022-2023 | 820 |

| 2023-2024 | 860 |

| 2024-2025 | 880 |

| 2025 (Current) | 1150 |

Next 5 Years Outlook of Copper Prices in India

The next 5-year outlook of copper prices in India is as follows:

| Year | Expected Price (INR/KG) | Outlook | Key Factor |

|---|---|---|---|

| 2026 | 1013 | Surge in Demand | Due to strong demand from various sectors, including renewable energy, power, and infrastructure, the price of copper is expected to rise. |

| 2027 | 1038 | Supply Constrain | It is expected that in 2027, due to ageing mines, the supply will be on the lower side. |

| 2028 | 963 | Increasing Supply | The supply of copper will increase by 2028, and higher recycling will ease pressure on copper prices. Also, the adoption of EVs is expected to peak in 2028, which requires a huge amount of copper for batteries and charging stations. |

| 2029 | 992 | Consolidation | With renewed demand from different cities and urban mining will become a major influencer of price in 2028 as primary mining capacities will reach their limit. |

| 2030 | 1087 | Rebound | Long-term structural demand for copper will support its price to make new highs. Also, the energy transition and EV penetration will act as a catalyst for copper demand and price. |

Importance of Copper Prices in the Economy

Copper is a crucial metal for the economy as it is widely used in different industries such as power generation, wiring, electronics, construction, etc., hence it directly affects the production cost across these sectors. It also affects the profitability of companies engaged in different sectors. Rising copper prices reflect the growth of the country. Also, the demand for copper is linked to various factors such as urbanisation, electrification, industrial growth, etc.

Read Also: Steel Price Predictions for the Next 5 Years in India

Factors Affecting Copper Prices

- Economic Growth: The demand for copper rises with the economic growth of the country due to different factors such as urbanisation, construction, etc.

- Mining Outputs: Declining production level will lead to supply constrain, eventually impacting the prices positively.

- Electric Vehicles: Due to the increasing concern about environmental issues, there is a transition towards electric vehicles, thus leading to enhanced demand for copper due to its excellent conductive properties of electricity.

- Inventory: The Inventory of copper has a direct impact on the prices of copper; that is, a low inventory level increases the prices, and a high inventory level lowers the prices.

- Government Regulations & Policies: Good government policies and trade laws influence the prices and supply of copper.

- Renewable Energy: There will be a shift to renewable energy sources such as solar, wind, and power grid infrastructure, which will result in a growing demand of copper long-term.

Read Also: Gold Rate Prediction for Next 5 Years in India (2026–2030)

Should You Invest in Copper Companies

One should invest in copper companies because of the following reasons:

- Rise in Demand: Copper is used as an essential raw material for different sectors such as power transmission, renewable energy, electric vehicles, etc. Therefore, the demand for copper tends to increase over time.

- Use of Green energy: Globally, due to environmental concerns, people are shifting towards green and renewable sources of energy, such as electric vehicles, which gradually increases copper consumption.

- Diversification: One can reduce the risk of their portfolio by investing in companies engaged in the production and mining of copper.

Read Also: Silver Rate Prediction for the Next 5 Years in India

Conclusion

To sum up, the prices of copper are expected to increase in the coming years in India due to several factors, among which are the increased demand and the transition to renewable energy. This, therefore, gives investors a good chance to earn wealth through investing in companies involved in copper production, marketing and distribution. One needs a demat and trading account to make the investment, which can be opened without any charges with Pocketful, and it also provides free delivery trade brokerage. But you should still seek advice from your investment advisor before investing. However, it is advisable to consult your investment advisor before making any investment.

Frequently Asked Questions (FAQs)

What industries will be impacted by the copper price fluctuations?

Power, electrical equipment, renewable energy, and electric vehicles are the most impacted sectors by changes in copper prices.

Is now the right time to invest in companies that deal with copper?

This is indeed a good time to invest in copper-related businesses because demand for infrastructure and green energy is likely to push copper prices high.

What will be the effect of government expenditure on the price of copper in India?

The demand for copper will increase as more government money is spent on infrastructure, rail and power-grid projects, and this may lead to an increase in copper prices in the long run.

Which are some of the copper-related companies in India?

Some of the copper-related companies in India are Hindustan Copper Limited, Hindalco Industries Limited, Precision Wires India Limited, Madhav Copper Limited and others.

How much can we expect to pay for copper in five years?

Within the next five years, copper prices will be in the range of 1,000 to 1,200 INR per kilogram, but this can be affected by other factors.