You save a lot of money and put in a lot of work, but you need help determining where to keep it. It is only possible to retain some of your hard-earned savings at home; opening a bank account is your only option. You might be surprised to hear that banks where you have accounts allow you to invest in their business.

This blog post will compare HDFC Bank and Axis Bank.

HDFC Bank Overview

HDFC Bank was established in 1994 as a subsidiary of HDFC Ltd. The Reserve Bank of India granted it a banking license in January 1995. In November 1995, the bank launched its Initial Public Offering (IPO) and became a listed company on the Bombay Stock Exchange and the National Stock Exchange. In 2000, the Times Bank merged with HDFC Bank. HDFC Bank acquired Centurion Bank of Punjab to increase its branch network and clientele. The bank’s business philosophy is based on five core values: Operational Excellence, Customer Focus, Product Leadership, People, and Sustainability.

HDFC Ltd. or Housing Development Finance Corporation Ltd. was merged with HDFC Bank in 2023, The merger officially came into effect on July 1,2023 it’s India’s largest-ever M&A deal. The bank provides a wide range of financial products and services, such as retail banking, wholesale banking, loans, credit cards, savings accounts, current accounts, investment products, etc. The company’s headquarters is in Mumbai.

Read Also: HDFC Bank Case Study

Axis Bank Overview

Axis Bank was initially established as UTI Bank by a joint venture between the Life Insurance Corporation of India, Unit Trust of India (UTI), and other business houses. UTI Bank’s operations started in 1994 when the first branch in Ahmedabad was opened. In 2007, UTI Bank was renamed “Axis Bank”. It soon became a well-established and recognized bank in the Indian Banking sector. This was a turning point in the history of Axis Bank because it became an aggressive player with a focus on branch expansion and innovation. Additionally, Axis Bank consistently made an effort to diversify its product portfolio. The bank now offers a variety of financial products, including credit cards, savings accounts, current accounts, brokerage facilities, and retail banking..

Read Also: Axis Bank Case Study

Company’s Comparative Study

| Particular | HDFC Bank | Axis Bank |

|---|---|---|

| Current Share Price | INR 983 | INR 1,186 |

| Market Capitalization (in INR Crores) | 15,10,635 | 3,68,133 |

| 52 Week High Price | INR 1,018 | INR 1,247 |

| 52-Week Low Price | INR 812 | INR 933 |

| FIIs Holdings (%) | 41.91 | 42.36 |

| DIIs Holdings (%) | 31.41 | 39.85 |

| Book Value per Share | INR 337 | INR 604 |

| PE Ratio (x) | 9.85 | 12.15 |

Financial Statements Comparison

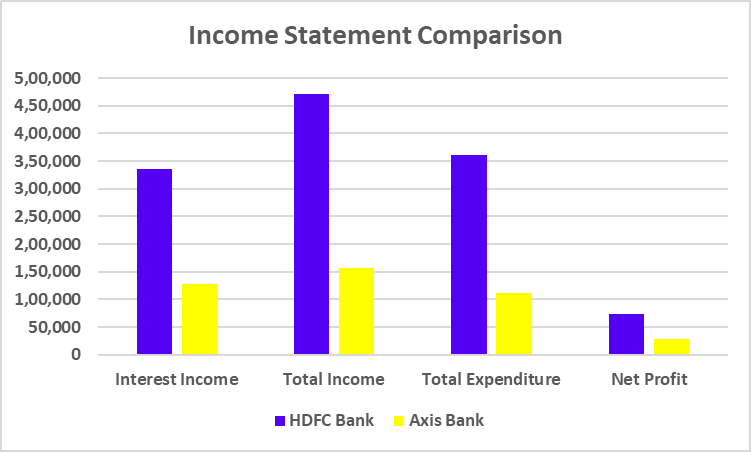

Income Statement Comparison (FY 2025)

| Particular | HDFC Bank | Axis Bank |

|---|---|---|

| Interest Income | 3,36,367 | 1,27,374 |

| Total Income | 4,70,915 | 1,55,916 |

| Total Expenditure | 3,60,499 | 1,11,024 |

| Net Profit | 73,440 | 28,115 |

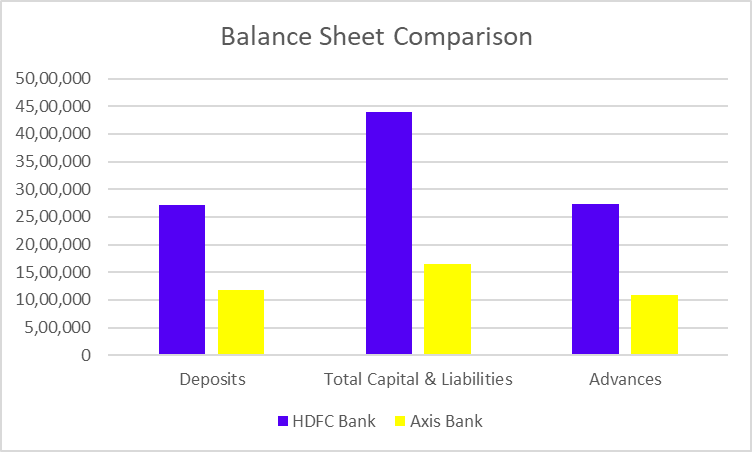

Balance Sheet Comparison (FY 2025)

| Particular | HDFC Bank | Axis Bank |

|---|---|---|

| Deposits | 27,10,898 | 11,70,920 |

| Total Capital & Liabilities | 43,92,417 | 16,56,962 |

| Advances | 27,24,938 | 10,81,229 |

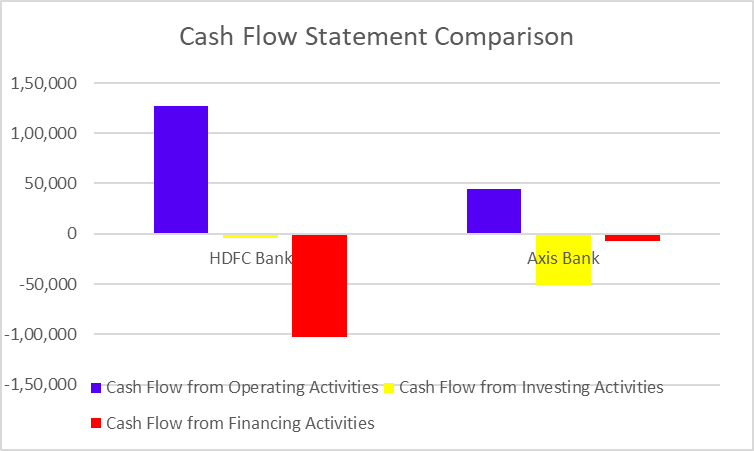

Cash Flow Statement Comparison (FY 2025)

| Particular | HDFC Bank | Axis Bank |

|---|---|---|

| Cash Flow from Operating Activities | 127,241 | 44,383 |

| Cash Flow from Investing Activities | -3,850 | -51,215 |

| Cash Flow from Financing Activities | -102,477 | -7,000 |

Read Also: Best Trading Apps in India

Key Performance Indicators

| Particular | HDFC Bank | Axis Bank |

|---|---|---|

| Net Interest Margin (%) | 3.47 | 3.40 |

| Net Profit Margin (%) | 21.83 | 22.07 |

| ROCE (%) | 2.62 | 2.84 |

| Capital Adequacy Ratios (%) | 19.55 | 17.07 |

Read Also: ICICI Vs HDFC Bank

Conclusion

The comparison of India’s biggest private sector banks presented above leads us to conclude that while HDFC Bank has more revenue and profits overall, Axis Bank posts higher net profit margins even with less revenue. Although every bank has something special to offer, we always advise speaking with an investment expert before making investment decisions.

Frequently Asked Questions (FAQs)

Which person oversees HDFC Bank as managing director?

The managing director of HDFC Bank at the moment is Mr Sashidhar Jagdishan.

In India, which private bank has the largest market capitalization?

HDFC Bank has the largest market capitalization of all the private banks in India.

Which bank has a larger market capitalization: Axis Bank or HDFC Bank?

Compared to Axis Bank, HDFC Bank has a larger market capitalization.

Which bank is more profitable: HDFC Bank or Axis Bank?

Axis Bank has a slightly higher net profit margin of 22% compared to 21% for HDFC Bank.

Who is the CEO of Axis Bank?

Amitabh Chaudhry is the CEO of Axis Bank.