For centuries, Gold has been considered an auspicious metal in India; whereas, in other countries of the world, it is primarily viewed as an investment option. In India, typically, people invest in physical Gold and purchase jewellery. But do you know, there are other investment options such as Gold ETF, which is a digital form of Gold that you can also hold in electronic form and is backed by physical gold.

In this blog, we will explain to you how to invest in Gold Exchange Traded Fund, along with the features and benefits.

What is a Gold ETF?

Gold ETF, also known as Gold Exchange Traded Fund, is a type of investment tool that tracks the price of physical Gold in the domestic market. It is a passive investment option whose performance depends on the Gold prices. By investing in Gold ETFs, an investor can have ownership in the physical Gold. They are traded like any other stock on a real-time basis. Gold ETFs are held in a dematerialised form in the demat account of the investor.

How to Buy Gold ETF in India

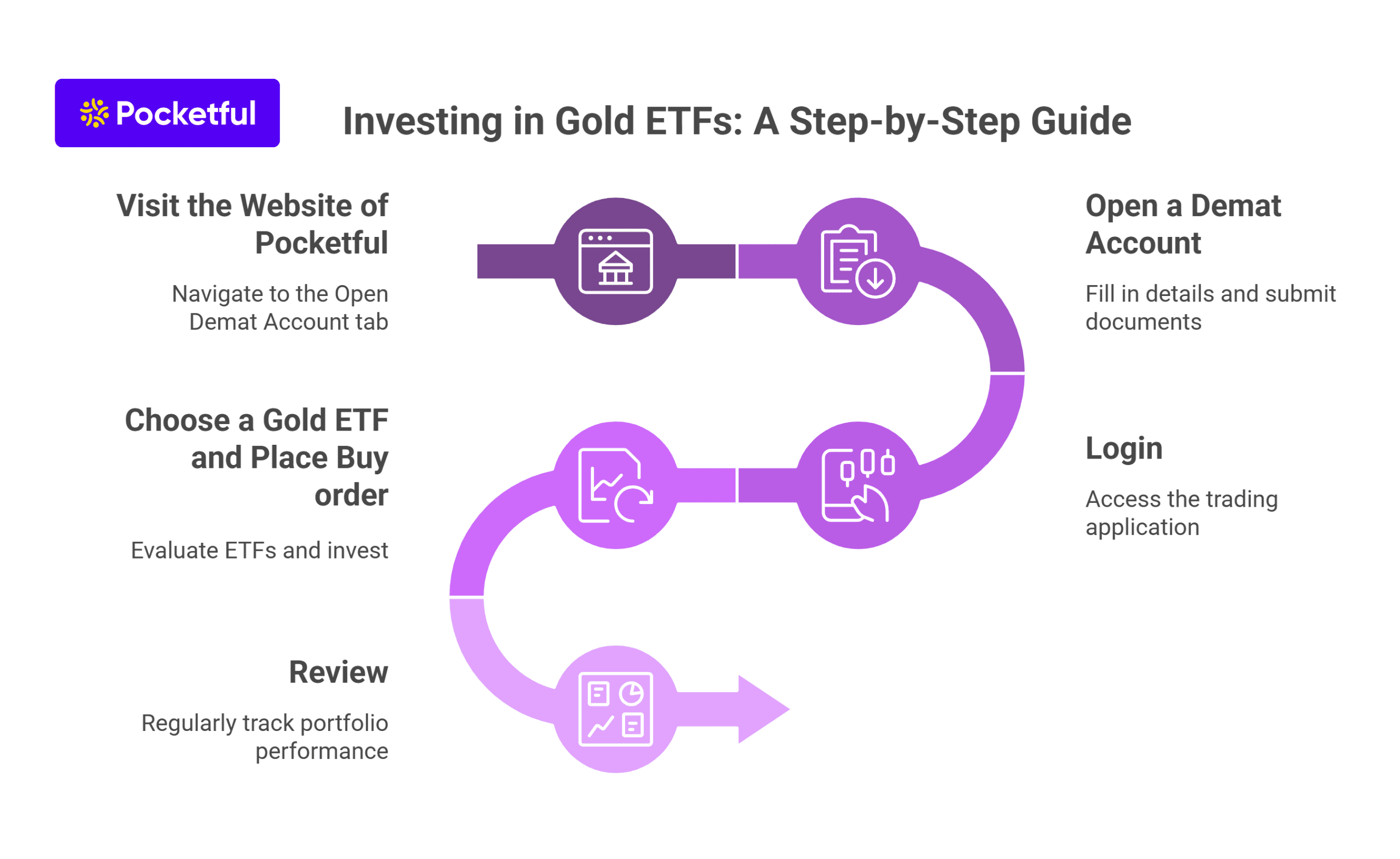

Investing in a Gold ETF is very easy nowadays. An investor is required to follow the steps mentioned below:

- Visit the Website of Pocketful: An investor is required to visit the website of Pocketful and click on the Open Demat Account tab.

- Open a Demat Account: On the page, you are required to fill in your details and submit all the required documents.

- Login: Once your demat and trading account is opened successfully, you are required to log in to the trading application provided by Pocketful and transfer funds needed to purchase Gold ETFs

- Choose a Gold ETF and Place Buy order: There are multiple Gold ETFs offered by various fund houses. Evaluate all the ETFs on various parameters such as tracking error, expense ratio, etc. After choosing the Gold ETF of your choice you can place a buy order with the number of units depending upon investment amount.

- Review: Regular tracking of your portfolio is required to monitor the performance of your Gold ETF.

Features of Gold ETF

The key features of Gold ETFs are as follows:

- Physical Gold: The Gold ETFs are backed by physical Gold, which causes their performance to match with returns of physical gold.

- Real-Time Trade: The ETFs are traded in real time, hence, an investor can buy and sell the ETFs during the trading hours.

- No Physical Storage: In the case of physical Gold, there is a storage cost, and in an ETF there is no need for physical storage and thus no risk of theft.

- Transparency: ETF reflects the real-time prices of physical Gold; hence, it is easy for an investor to track the movement of the ETF.

Benefits of Investing in Gold ETF

The significant benefits of investing in Gold ETFs are as follows:

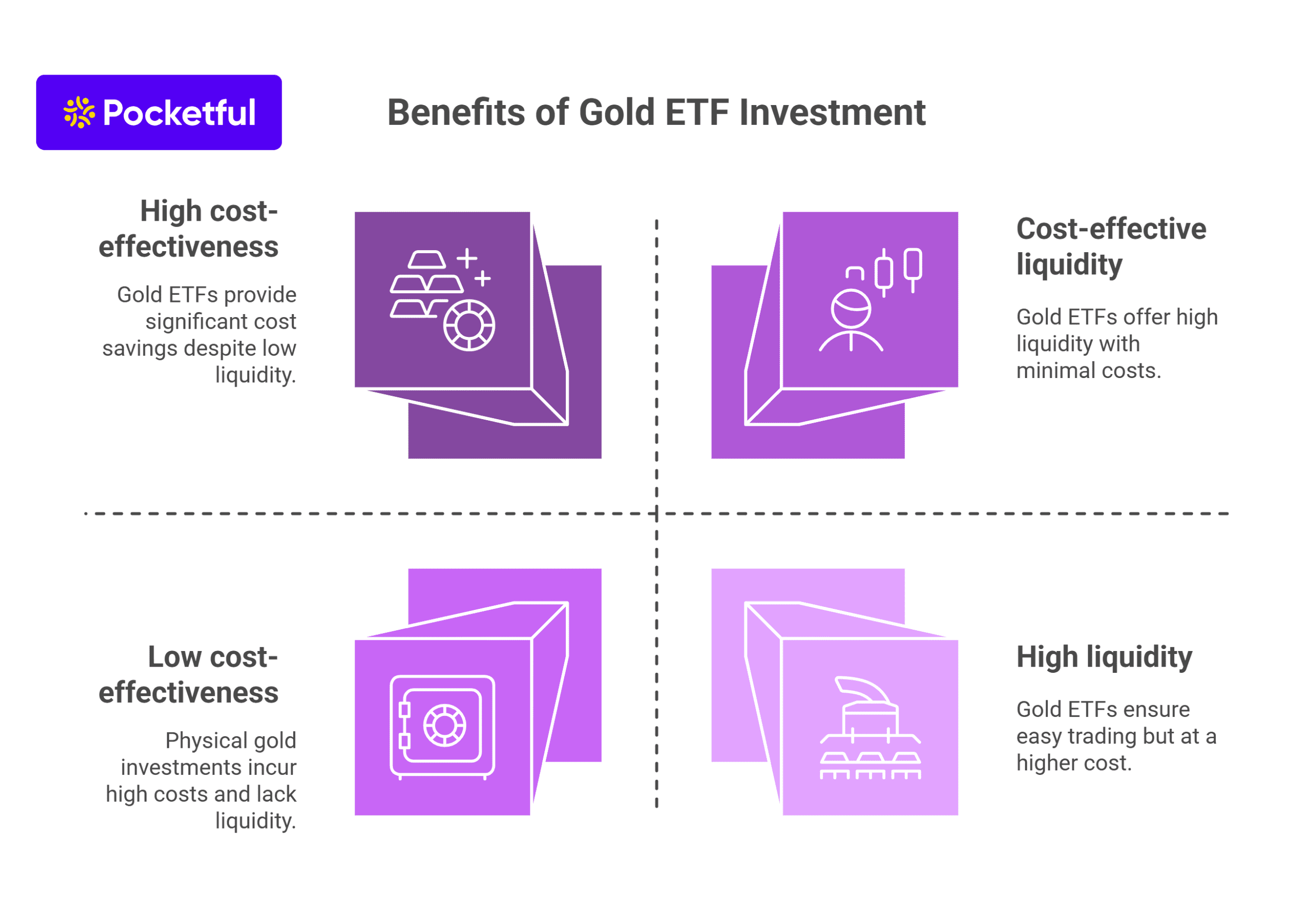

- Liquidity: Gold ETFs can be bought and sold on the stock exchange anytime during the trading hours; therefore, they provide higher liquidity than physical Gold.

- Cost Effective: If you wish to invest in physical Gold, there will be various charges, including GST, etc. However, in the case of the Gold ETF, there are no such charges and investors must only pay a nominal expense ratio.

- Safety: If you are investing in a Gold ETF, there will be no risk of theft and physical storage costs, as you can hold it in electronic form.

- Purity: Investment in Gold ETFs are backed by physical Gold having a purity of 99.5%; therefore investors are assured that they are investing in high-quality Gold.

Risk of Investing in Gold ETF

There are several risks associated with investing in Gold ETFs, which are as follows:

- Volatility: The prices of Gold ETFs fluctuate very rapidly based on the market price of physical Gold, which are influenced by various factors such as economic conditions, foreign currency fluctuations and geopolitical events.

- Tracking Error: Because of expenses, operational inefficiencies, etc., the returns of Gold ETFs can slightly vary from those of physical Gold.

- Demat Charges: The Demat Account, which is mandatory to invest in Gold ETF, involves annual maintenance charges which are to be borne by the investor.

- Intangible: The Gold ETFs are intangible in nature, therefore it does not provide mental peace of owning physical Gold.

Gold ETF vs Physical Gold

The difference between Gold ETF and Physical Gold is as follows:

| Particulars | Gold ETF | Physical Gold |

|---|---|---|

| Holding | Gold ETFs are held in electronic form in your demat account. | They are held in physical or tangible form. |

| Safety | They are comparatively safer than physical Gold as they are held in electronic form. | There is always a risk of theft, or damage to physical Gold. |

| Liquidity | They are highly liquid as they can be sold at any time during trading hours on the stock exchange. | The liquidity of physical Gold depends on the availability of buyers and sellers. |

| Charges | Investing in Gold ETFs requires investors to pay fees known as expense ratio. | Buying physical Gold attracts GST and other making charges in the case of jewelry. |

| Storage Cost | It requires no storage cost. | Physical Gold is usually stored in bank lockers, which attract additional charges. |

Conclusion

On a concluding note, if you wish to invest in Gold, there are various options available; however, people prefer to invest in physical Gold because Gold ETFs are not very popular among investors. There are significant benefits of investing in Gold ETFs when compared to investment in physical Gold, such as it requires no storage cost, there is no risk of theft, etc., but for Gold ETF, you are required to have a demat account. It is advisable to consult your investment advisor before making any investment in Gold.

Frequently Asked Questions (FAQS)

Is it mandatory to have a demat account to invest in Gold ETFs?

Yes, having a demat and trading account is mandatory to invest in a Gold ETF.

Can I convert my Gold ETF units into physical Gold?

No, it is not possible to convert your Gold ETF units into physical Gold. For this, you can sell your Gold ETF and purchase the physical Gold from any jewellery shop.

How can I start investing in a Gold ETF?

Open a demat account with Pocketful and then search for the gold ETF you want to invest in. Enter quantity and price and click on buy.

Where does the Gold ETF invest my money?

Gold ETF invests your money in physical Gold having 99.9% purity.

What is the full form of Gold ETF?

The full form of Gold ETF is Gold Exchange Traded Fund.