Ever heard of a company delisting itself from the stock market on purpose? That is precisely what is happening to the ICICI Securities. In March 2024, the minority shareholders showed their support by voting in favour of ICICI Securities’ delisting, and to merge with its parent company, ICICI Bank. But before you jump to conclusions, this was not bad news. It was a strategic move by ICICI Bank to simplify its structure and create a more robust financial force.

In this blog, we will explore the reasons behind the proposed delisting of ICICI Securities, the process, and how this decision could benefit both ICICI Bank and its shareholders.

ICICI Securities – Brief

ICICI Securities is a listed company founded in 1995 as ICICI Brokerage Services Limited and is a subsidiary of ICICI Bank. The company embraced technology and launched a revolutionary online brokerage platform, ICICIdirect.com, in 2000 and pioneered online investment opportunities in mutual funds and government bonds. It expanded its reach through physical ICICI direct branches across India in 2005 and diversified services by offering health and life insurance products by 2006. The company name was officially changed to ICICI Securities in 2007.

On November 9, 2023, the Reserve Bank of India approved ICICI Bank’s request to establish full ownership of ICICI securities. About 71.9% of the brokerage’s minority shareholders approved the delisting, which is higher than the regulatory requirement of a two-thirds majority.

The ICICI Bank is offering 67 shares of ICICI Bank for every 100 shares of ICICI Securities held by the shareholders. However, there was some disagreement among investor groups. Institutional shareholders, who have a more significant stake, supported the delisting, while some retail investors opposed it.

Additionally, the Quantum Asset Management Company (QAM), with a 0.21% stake in ICICI Securities, voted against the deal. According to QAM, ICICI’s offer for the stake is undervalued. It should be priced at approximately INR 940 per share, considering the lowest multiple among its comparable peers in the market. This valuation is significantly higher than the current offer on the table by the ICICI Bank.

Why Retail Investors are not in favour of Delisting

A few Retail Investors are opposing the delisting of ICICI Securities because of the Swap Ratio concern:

Swap Ratio Concern – Retail investors felt that the exchange rate offered by ICICI Bank (67 shares of ICICI Bank for every 100 shares of ICICI Securities) undervalued the ICICI Securities. They believe that their holdings are worth more than the offered price, and the swap ratio would not translate to the same potential growth as holding separate stocks.

If you’re not familiar with Swap Ratio, it refers to the exchange rate at which shares of the acquiring company (ICICI Bank in this case) are offered for shares of the target company (ICICI Securities). It establishes the percentage of ownership a target company shareholder will receive in the new or surviving company.

Read Also: Delisting Of ICICI Securities : Reasons and Brief Explanation

Reasons for Delisting of ICICI Securities

ICICI Securities is proposed to become a wholly-owned subsidiary of ICICI Bank, which would give ICICI Bank complete ownership and control over ICICI Securities.

The Bank believed that merging the two entities would improve efficiency and allow it to offer a broader range of financial products and services under one roof. The Delisting would also allow for streamlining operations and decision-making processes within the bank.

Delisting – An Overview

The Delisting refers to removing a company’s stock from a stock exchange, i.e., NSE and BSE in India. This means the stock can no longer be traded on an exchange. The companies might delist their shares for several reasons, such as mergers and acquisitions, non-compliance with listing requirements, financial distress, etc. Generally, the delisting can be classified as voluntarily or involuntarily.

- Voluntary Delisting

A company might choose to go private or get acquired by another company. In this case, the company will generally offer shareholders a way to sell their shares before the delisting happens. ICICI securities is a case of voluntary delisting.

- Involuntary Delisting

This happens when a company does not follow the stock exchange listing requirements. There are different requirements a company needs to meet to stay listed, such as maintaining a specific price or filing several reports on time. The exchange can delist, if a company does not meet the listing requirements.

You must wonder what happens to the shares after the company is delisted, particularly in case of Involuntary delisting. Even though delisting makes things trickier, you still own a stake in the company, as indicated by your shares. Let’s have a quick overview:

- Once the company is delisted, you can no longer trade it on the stock exchange. This significantly reduces liquidity, meaning finding a buyer for your shares might be challenging.

- You might be able to sell your shares on the Over the counter (OTC) market, which is essentially a network of dealers who trade securities outside of exchanges. However, OTC markets are less regulated and generally have wider bid-ask spreads than the stock exchange.

- Shareholders might find it challenging to sell their shares as there may be limited buyers in the OTC market.

- In case of voluntary delisting, the acquirer provides the buyback window. The shareholders can sell their holdings to the promoters before delisting.

Read Also: ICICI Bank Case Study: Financials, KPIs, Growth Strategies, and SWOT Analysis

Conclusion

The delisting of ICICI Securities will mark a turning point for the company and ICICI Bank. While some retail investors expressed concerns, the goal is to create a more efficient financial institution. Only time will tell the impact of this strategic move. The company may be delisted, but the decision positions them for future growth as a part of a stronger financial entity.

Additionally, the delisting will pave the way for a more streamlined and competitive financial giant. This could be a positive development for ICICI Bank and the Indian financial landscape. Also, SEBI is currently reviewing multiple complaints regarding the delisting. Upon the collection of substantiated evidence, the SEBI will initiate an investigation. The actions that SEBI may take remain uncertain.

Frequently Asked Questions (FAQs)

Why ICICI Securities is getting delisted?

The purpose of delisting is to simplify ICICI Bank’s structure, and achieve better integration between the two entities.

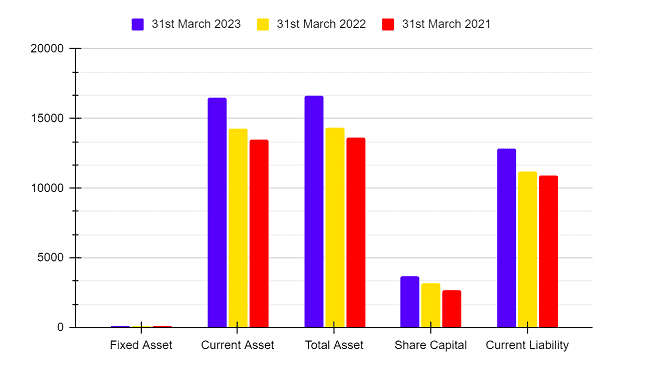

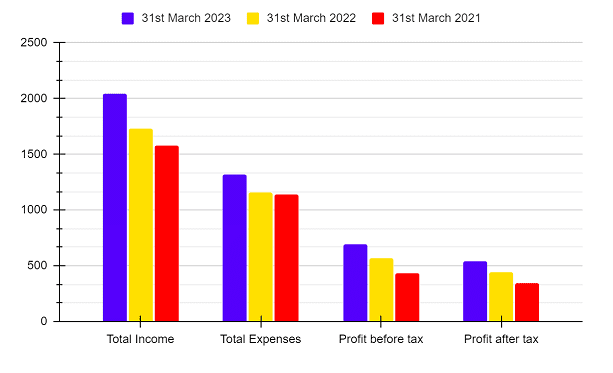

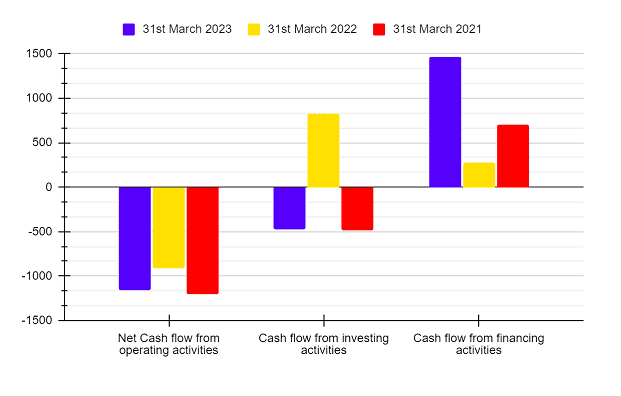

Did ICICI Bank take this decision because of the poor performance of ICICI Securities?

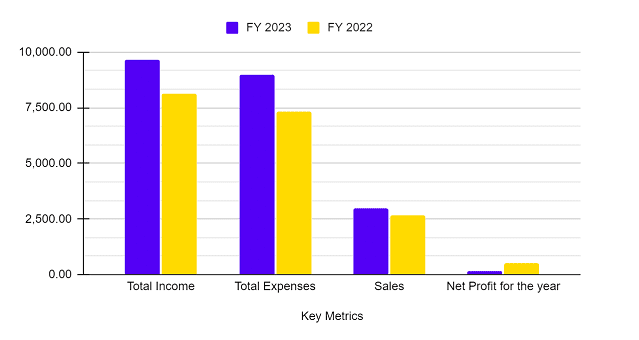

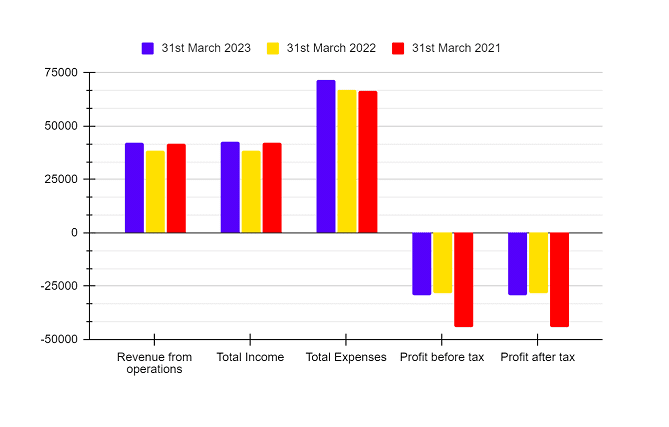

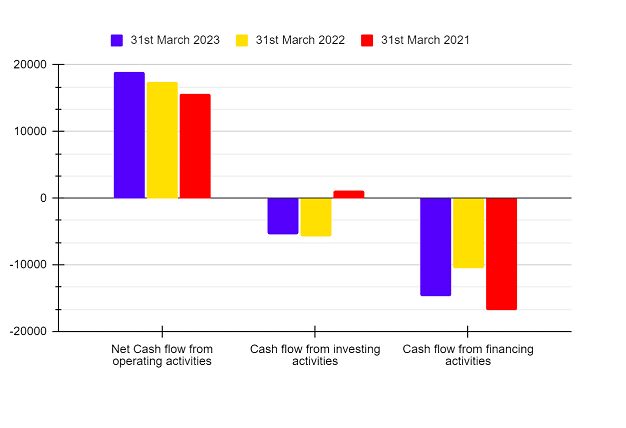

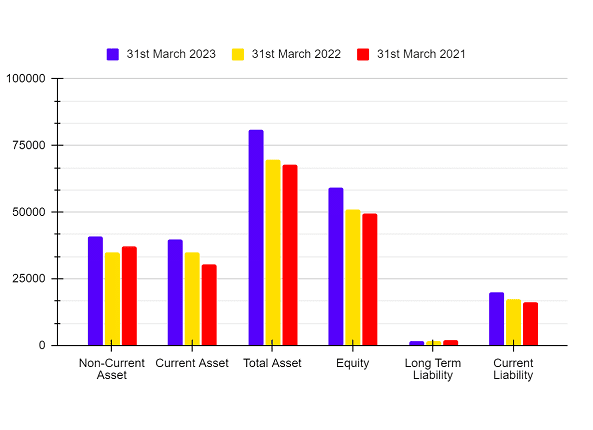

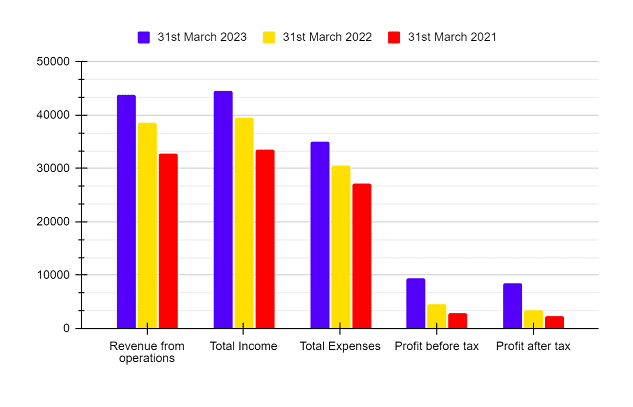

No, it was a strategic decision to delist ICIC Securities, and not due to negative performance of the company.

Did everyone agree with the delisting?

The institutional investors favoured the delisting; however, a few retail investors opposed it.

What will happen to the shareholders of ICICI Securities?

The shareholders of ICICI securities will receive the ICICI Bank shares in exchange for their holdings.

Will this delisting affect the stock price of ICICI Bank?

The long-term impact remains to be seen, but the move overall aims to strengthen the banking operations.