Purchasing a diamond is a wish of every individual, but due to its cost, it is not affordable for everyone. But because of companies that grow diamonds in labs, it is now affordable for everyone, making luxury accessible, sustainable, and budget-friendly without compromising on quality or brilliance.

In today’s blog post, we will give you an overview of the best Lab-grown diamond stocks in India, along with the key benefits of investing in these stocks.

What are Lab-Grown Diamond Stocks?

Lab-grown diamond stocks are the shares of companies primarily involved in the production, processing, and sale of diamonds created in a laboratory. The diamonds created using advanced technologies are similar to natural diamonds. Nowadays, these types of diamonds are gaining popularity because of their affordability and eco-friendliness, as they are processed in a controlled environment.

Top Lab-Grown Diamond Stocks to Buy in India

- Titan Company Limited

- Trent Limited

- International Gemmological Institute (India) Limited

- SKY Gold & Diamonds Limited

- Senco Gold Limited

- Goldiam International Limited

- Renaissance Global Limited

- Mini Diamond Limited

- Dev Labtech Venture Limited

| Company | Current Market Price (INR) | Market Capitalisation (in INR crore) | 52-Week High | 52-Week Low |

|---|---|---|---|---|

| Titan Company Limited | 3,898 | 3,46,090 | 3,955 | 2,948 |

| Trent Limited | 4,250 | 1,54,962 | 7,490 | 4,236 |

| International Gemmological Institute (India) Limited | 328 | 14,194 | 642 | 282 |

| SKY Gold & Diamonds Limited | 330 | 5,121 | 489 | 246 |

| Senco Gold Limited | 312 | 5,109 | 598 | 228 |

| Goldiam International Limited | 398 | 4,498 | 569 | 252 |

| Renaissance Global Limited | 119 | 1,282 | 207 | 102 |

| Mini Diamond Limited | 140 | 330 | 233 | 97.5 |

| Dev Labtech Venture Limited | 77.58 | 87 | 94 | 52 |

Read Also: Best Diamond Stocks in India

Overview of the Best Lab-Grown Diamond Stocks

1. Titan Company Limited

The Tata Group founded Titan Limited in 1984. It was incorporated because of a joint venture between the Tata Group and Tamil Nadu Industrial Development Corporation Limited. Titan offers various products such as jewellery, watches, eyewear, etc. It also engaged in the manufacturing of lab-grown diamonds. Titan has performed exceptionally well in taking the legacy of the Tata Group. The company’s headquarters is situated in Mumbai.

2. Trent Limited

Trent is also a part of the Tata Group. It was founded when the Tata Group sold 50% stakes of Lakme, and the proceeds were utilised to set up Trent. It also entered the supermarket business and later launched Zudio as a fashion brand. In October 2024, the company launched a lab-grown diamond brand called Pome. The company’s headquarters are situated in Mumbai.

3. International Gemmological Institute (India) Limited

The International Gemological Institute was incorporated in Belgium in 1975. However, their Indian business was incorporated in February 1999. It started certifying lab-grown diamonds in 2005. The company was acquired by Blackstone, and since then, it has started expanding its business very aggressively. The company’s head office is situated in Mumbai.

4. SKY Gold & Diamonds Limited

The company was incorporated as a result of a partnership in 2005, and later it changed its name to Sky Gold Private Limited in 2008. In 2018, the company converted into a public limited company and got itself listed on the BSE SME platform. Later in 2023, it migrated into a mainboard IPO. Currently small portion of the company’s revenue comes from lab-grown diamonds, but it wishes to increase it significantly in future. The company’s headquarters is situated in Mumbai.

5. Senco Gold Limited

The company was incorporated in 1994 and was initially known as Senco Gold Private Limited. Later in 2007, the company converted into a public limited company. It has various retail stores spread across the country. Senco Gold is entering the lab-grown diamond industry, and the company expects that lab-grown diamonds will contribute 3-4% of its overall business. The company’s headquarters is situated in Kolkata.

6. Goldiam International Limited

Goldiam International Limited company was incorporated in 1986 as an exporter of polished diamonds. The company has done a capex of around 100 million to enhance its lab-grown diamonds. And currently it contributes around 30-40% in companies overall revenue. The company has launched its own lab-grown diamond retail brand named ORIGEM. The head office of the company is situated in Mumbai.

7. Renaissance Global Limited

The company was incorporated in 1989 as Renaissance Jewellery Limited and started as a jewellery exporter and manufacturer. And in 2019, the company changed its name to Renaissance Global Limited. Based on the recent filing by the company, it has reported that 30-35% of the company’s total revenue is from the lab-grown diamonds segment. The company’s headquarters is situated in Mumbai.

8. Mini Diamond Limited

Mini Diamond Limited company was incorporated in 1987 and was focused on importing and exporting diamonds. The company has launched an e-commerce website to sell lab-grown jewellery under the name Namra Jewels. In 2025, the company signed an MOU with Unique Lab Grown to produce lab-grown diamonds to increase its production. The company’s headquarters is situated in Mumbai.

9. Dev Labtech Venture Limited

The company was incorporated in 1993, as was initially named Gandhinagar Plastronics Private Limited. Then, in 2022, it was finally renamed to Dev Labtech Venture Limited. The company is engaged in the manufacturing and marketing of both natural and lab-grown diamonds. It uses microwave plasma chemicals to grow diamonds. The company got itself listed on the BSE SME exchange in March 2023. The company’s headquarters is situated in Gujarat.

Read Also: Best Jewelry Stocks in India

Key Performance Indicators (KPIs)

The key performance indicators of the best Lab-Grown Diamond Stocks to buy in India are as follows:

| Company | Debt to Equity | ROE (%) | ROCE (%) | Operating Profit Margin (%) | Net Profit Margin (%) |

|---|---|---|---|---|---|

| Titan Company Limited | 1.56 | 28.70 | 36.96 | 9.07 | 5.51 |

| Trent Limited | 0.09 | 28.31 | 28.09 | 12.14 | 8.45 |

| International Gemmological Institute (India) Limited | 0 | 40.20 | 49.45 | 56.36 | 40.57 |

| SKY Gold & Diamonds Limited | 0.88 | 19.39 | 30.25 | 6.16 | 3.73 |

| Senco Gold Limited | 0.89 | 8.33 | 16 | 5.74 | 2.64 |

| Goldiam International Limited | 0.01 | 15.81 | 22.55 | 22.13 | 14.99 |

| Renaissance Global Limited | 0.37 | 5.47 | 8.71 | 6.59 | 3.54 |

| Mini Diamond Limited | 0.03 | 5.47 | 11.37 | 1.76 | 0.84 |

| Dev Labtech Venture Limited | 0.02 | 3.14 | 4.63 | 3.75 | 2.46 |

Benefits of Investing in Lab-Grown Diamond Stocks

The key benefits of investing in Lab-Grown Diamond Stocks are as follows:

- Increasing Demand: Because of the affordable prices of lab-grown diamonds, the demand is increasing across the world, which will benefit the companies engaged in the production of such diamonds.

- Government Support: The Indian Government is promoting the lab-grown diamond through various subsidies and other incentive plans, which will directly benefit these companies.

- Lower Cost: Lab-grown diamonds can be produced at a very low cost, and because of operational efficiency, they have high operating profit margins.

Factors to Consider Before Investing in Lab-Grown Diamond Stocks

The key factors to consider before investing in Lab-Grown Diamond Stocks are as follows:

- Pricing Concern: Due to an increase in manufacturers of lab-grown diamonds and the adoption of new technology, the pricing also varies very rapidly.

- Currency Fluctuation: Diamond companies majorly export their products to different countries such as Europe and the US, and a change in currency rate could significantly impact their revenue.

- Company’s Financials: Before considering Lab-grown diamond stocks for investment, one should check the company’s financials. Companies with higher profit margins and revenue can be considered as an investment option.

Read Also: Top Biotech Companies Stocks in India

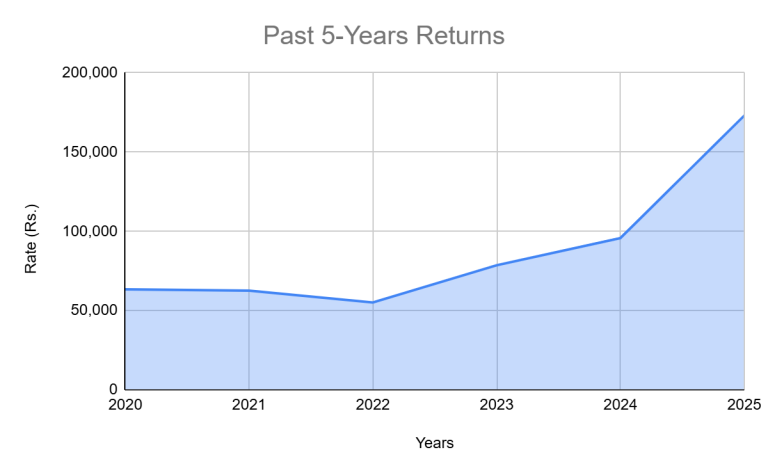

Future of Lab-Grown Diamond Stocks

The future of Lab-grown diamonds is very bright in India, because of various incentive plans by the Government of India to support this industry. As per the reports, India has produced over 3 million lab-grown diamonds in 2023, which accounts for 15% of global output. According to IBEF, this industry is expected to grow at a CAGR of 14%. Hence, one can consider investing in lab-grown diamond stocks.

Conclusion

On a concluding note, the Lab-grown diamond industry is expanding very rapidly, because of government support and a technology-driven industry. The recent rise in demand for Lab-grown diamonds across the world has well-positioned the stocks of these companies. However, there are certain risks involved while investing in the companies engaged in the manufacturing of lab-grown diamonds, such as currency exchange rate, competition, etc. Therefore, it is advisable to consult your investment advisor before making any investment in stocks of Lab-grown diamond companies.

Frequently Asked Questions (FAQs)

What are lab-grown diamonds?

Lab-grown diamonds are diamonds which are not mined from the earth; instead, they are created in labs under controlled environments using advanced techniques. They look like real diamonds but are comparatively cheaper in price.

Why is the demand for lab-grown diamonds increasing in India?

The demand for lab-grown diamonds is increasing in India because of their affordable price and eco-friendly substitute for real diamonds.

Which Indian companies are engaged in creating lab-grown diamonds in India?

In India, companies like Titan Limited, Senco Gold Limited, SKY Gold & Diamonds Limited, Goldiam International Limited, etc., are engaged in creating lab-grown diamonds.

What are lab-grown diamond stocks?

Lab-grown diamonds are the shares of companies which are engaged in producing diamonds in labs using advanced techniques.

Are lab-grown diamonds cheaper than real diamonds?

Yes, lab-grown diamonds are comparatively 30-70% cheaper than real diamonds.