A Demat account is an absolute must-have for holding shares and securities traded in the financial markets. Research shows that in 2024, there were 46 million more demat accounts.

In addition to this, people are now opting for a joint demat account. This allows multiple individuals to jointly hold and manage investments stored in a single demat account.

You can open a Demat account online. This reduces the ownership structure’s complexity and opens up more possibilities for families, business partners, or spouses wanting to pool together their investments.

What is a Joint Demat Account?

A joint demat account can be defined as an account that allows two or more individuals to jointly hold and manage securities. A joint bank account functions similarly by giving the account ownership of shares to several holders.

A joint Demat account can have up to three account holders. This includes one primary and two joint holders. The primary account holder is responsible for the account. Although the primary account holder is responsible for the account, all demat account joint holders have equal rights in managing the investments.

Prominent Features and Benefits of a Joint Demat Account

Some of the most common features and benefits of a joint demat account include:

1. Pooling Resources

Joint account holders can pool their funds and make shared investments with a joint demat account. This helps increase the overall investment amount, allowing joint holders to invest more effectively.

2. Reduced Maintenance Fees

A joint demat account allows everyone to split the maintenance costs. This reduces overall fees. This makes it an economical choice for those looking to manage investments together. Sharing these expenditures is much cheaper than keeping separate accounts for each member.

3. Smooth Estate Transfer

If one of the demat account joint holders dies, the surviving holder(s) will immediately take over the account. This simplifies and expedites the process of transferring assets. It eliminates the need for complex legal formalities.

Who Can Open a Joint Demat Account?

Joint demat accounts can be opened for anyone fulfilling depository participant (DP) criteria. Joint demat accounts can be opened by the following individuals:

- Residents of India above 18 years of age.

- NRIs that comply with applicable regulations.

The holders can be unrelated to each other: business partners, friends, family members, etc., can co-own a joint demat account. However, all holders must conform to KYC norms.

Documents Required for Opening a Joint Demat Account

When you open joint demat account online, it requires the following documents:

- PAN Card: A copy of the PAN card for each account holder.

- Photographs: Recent passport-size photos of all account holders.

- Proof of Identity: Documents like an Aadhaar card, Voter ID, passport, or driver’s license.

- Proof of Address: Documents such as an Aadhaar card, utility bill, or passport to verify the address.

- Bank Account Proof: A cancelled cheque or a recent bank statement of the primary account holder.

- Income Proof: A salary slip, bank statement, or income tax return acknowledgement.

Read Also: Documents Required to Open a Demat Account

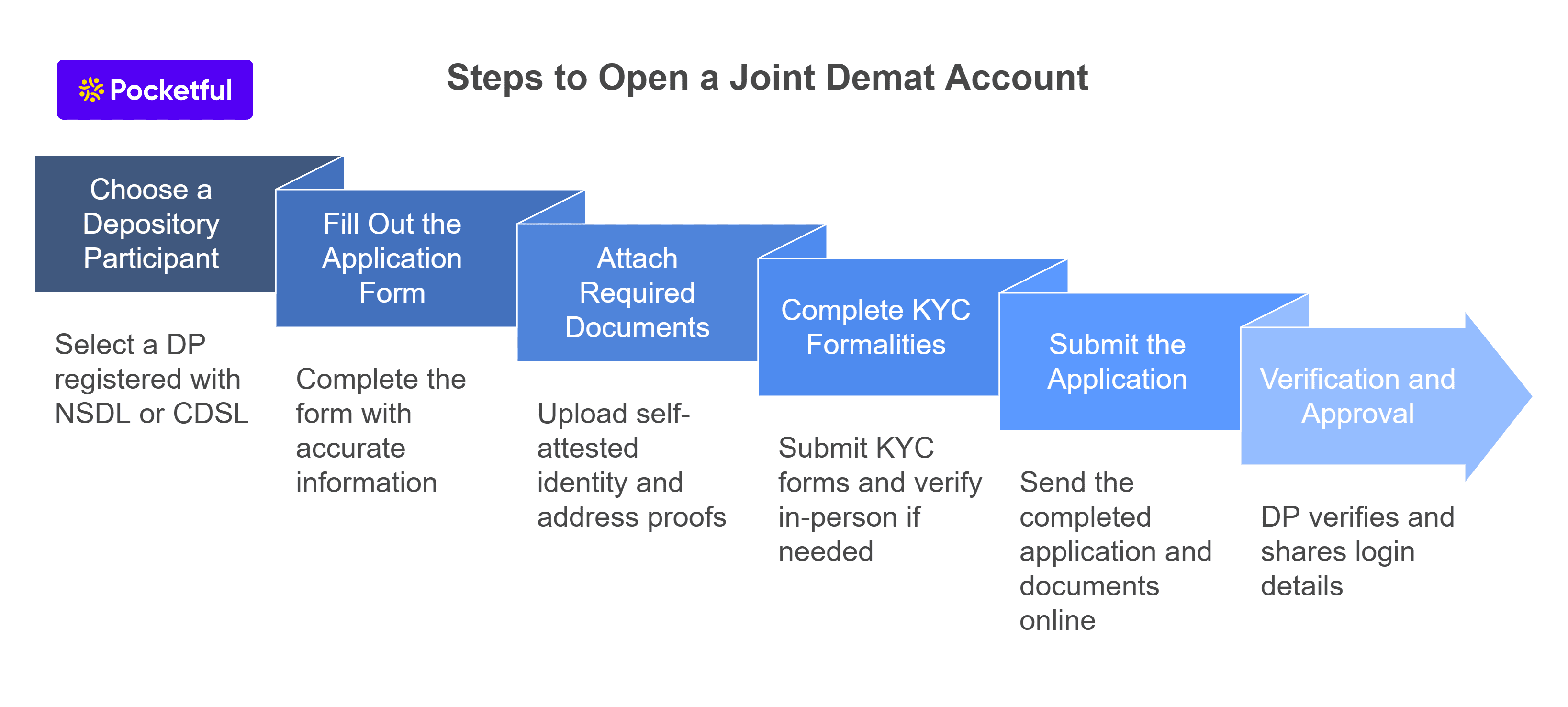

Steps to Open a Joint Demat Account

Here are the steps to open a joint demat account:

1. Choose a Depository Participant (DP)

Select a Depository Participant (DP) that is registered with the NSDL or CDSL.

2. Fill Out the Application Form

You can get the joint demat account opening form from the DP’s website. All account holders are required to disclose their information. Verify the accuracy of all the information.

3. Attach Required Documents

Upload scanned copies of the identity proofs, address proofs, bank proofs, and photographs of all the holders. These should all be self-attested by the holders concerned.

4. Complete KYC Formalities

All holders should submit KYC forms and complete in-person verification if needed.

5. Submit the Application

Submit the application and the documents in their complete form on the DP’s website.

6. Verification and Approval

After verifying the details submitted, the DP shares the login details and authorizes it.

Points to Consider Before Opening a Joint Demat Account

Here are the key joint demat account rules to consider before opening an account:

1. Approval of All Account Holders

Transactions in a joint demat account require approval from each account holder. The transaction is invalid if full consent is not obtained. This guarantees that everyone is aware of the activities occurring within the account.

2. No Changes to Account Holder Details

Once the joint demat account is opened, you cannot change details such as names or birth dates. If there is an error, you will have to create a new account. To avoid future account issues, make sure to double-check all information before applying.

3. Tax Responsibility

In a joint demat account, the primary account holder is liable for paying capital gains taxes. Despite the fact that there are several account holders, the principal holder is responsible for paying taxes.

4. One Trading Account Only

Only one trading account is connected to the joint demat account. This is usually held by the principal account holder. This main holder is the recipient of all messages pertaining to the account. This implies that they are in charge of overseeing the account. They also get information about all the activities occurring within the account.

5. Account Changes after Opening

You cannot convert an individual Demat account into a joint one. To open a joint account, you must apply from the start.

Read Also: How to Open a Demat Account Online?

Conclusion

By now, you must have understood how to open joint demat account. Understanding the principles and techniques can help you maximize your money. It’s an excellent choice for anyone wishing to invest jointly.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Features and Benefits of Demat Account |

| 2 | Lifetime Free Demat Account (AMC Free) |

| 3 | How Do You Open a Demat Account Without a Broker? |

| 4 | Demat Account Charges Comparison 2025 |

| 5 | Types of Demat Accounts in India |

Frequently Asked Questions (FAQs)

Can I add or remove joint holders after opening a joint Demat account?

No, once a joint Demat account is opened, you cannot add or remove joint holders. If any changes are required, you will have to close the existing account and open a new one.

Is it possible to convert an individual Demat account into a joint Demat account?

No, an individual Demat account cannot be converted into a joint Demat account. You must apply separately for a joint account from the beginning.

Who is responsible for taxation in a joint Demat account?

The primary account holder is responsible for paying capital gains tax, even though the account has multiple holders. Tax liabilities are calculated based on the transactions made in the account.

Can all joint account holders access the trading account linked to the joint Demat account?

No, only the primary account holder has access to the trading account linked to the joint Demat account. The principal holder also receives all transaction-related notifications.

What happens to a joint Demat account if one of the account holders passes away?

In case of the demise of one of the joint holders, the surviving holder(s) continue to manage the account. The account is seamlessly transferred without complex legal formalities.