Are you curious about what is a share and how it forms the basis of the Indian share market? Shares are the backbone of stock market investments and play a crucial role in wealth creation. Understanding share in share markets is essential to making informed financial decisions and securing long-term financial stability.

In India, investing in shares has become a popular way to build wealth, as the stock market offers diverse investment opportunities across various industries. Shares allow individuals to participate in a company’s growth while earning potential dividends and capital gains. However, successful investing requires knowledge, patience, and a clear strategy.

This blog explains the definition of shares, how they work, their benefits, risks, and practical steps to start investing in India.

What is a Share?

A share represents a unit of ownership in a company. When you purchase shares, you become a shareholder, meaning you own a portion of the company and are entitled to a share of its profits.

Shares represent ownership in a specific company, whereas stocks refer to a collection of shares from one or more companies.

Types of Shares in India

Shares can be broadly classified into:

1. Equity Shares (Ordinary Shares)

These are the most common types of shares, giving shareholders voting rights in corporate decisions. Investors earn through capital appreciation and dividends, but equity shares come with risks, as market fluctuations can impact their value.

2. Preference Shares

These shares offer fixed dividends and have priority over equity shares in case of liquidation. However, preference shareholders usually do not have voting rights. They are a safer option for investors looking for stable returns rather than market-linked growth.

Read Also: What are the Different Types of Shares

How Does the Share Market Work in India?

Issuance and Trading of Shares

Companies issue shares to raise capital, which is done through an Initial Public Offering (IPO) or Follow-on Public Offer (FPO). Once listed, these shares are traded among investors in the secondary market, which includes stock exchanges like the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Investors can buy and sell shares through brokerage firms, using Demat accounts and trading accounts to facilitate transactions. The stock market functions based on the principle of supply and demand, impacting share prices in real-time.

Role of Shareholders

As a shareholder, you:

- Have partial ownership of the company.

- Can receive dividends, a portion of the company’s profits.

- Can participate in voting on company policies (for equity shareholders).

- Can earn capital gains by selling shares at a higher price than their purchase cost.

Example of Share Ownership

Suppose you buy 100 shares of a company at ₹200 per share, investing ₹20,000. If the share price rises to ₹250, your investment value increases to ₹25,000, generating a profit of ₹5,000. However, if the price drops to ₹180, your investment value decreases to ₹18,000, leading to a loss.

Read Also: What is Right Issue of Shares: Meaning, Examples, Features

Benefits of Owning Shares in India

The benefits of owning shares in India are:

1. Wealth Creation through Capital Appreciation

The stock market has historically provided better long-term returns compared to traditional investment options like fixed deposits. Over time, strong companies see their share prices rise, helping investors accumulate wealth.

2. Earning Dividend Income

Some companies distribute dividends to shareholders, offering an additional income stream apart from capital appreciation.

3. Liquidity and Flexibility

Shares of prominent companies can be easily bought and sold on stock exchanges, giving investors the flexibility to enter or exit the market as per their liquidity needs.

4. Portfolio Diversification

Investing in shares across different industries reduces risk and enhances the stability of an investment portfolio.

5. Ownership and Voting Rights

Equity shareholders get voting rights, allowing them to influence key company decisions and making them active stakeholders in the company’s future.

Risks Associated with Shares

The risks associated with owning shares are:

1. Market Volatility

Stock prices fluctuate based on economic conditions, company performance, and investor sentiment, which can lead to short-term losses.

2. Potential for Loss of Investment

Unlike fixed-income instruments, stock investments do not guarantee returns. If a company underperforms, share prices may decline, leading to losses.

3. Company-Specific Risks

Inefficient management, fraud, or declining business performance can lead to poor stock performance, impacting investor returns.

4. Economic and Political Factors

Government policies, interest rates, inflation, and global events affect stock markets, leading to fluctuations in share prices.

How to Start Investing in Shares in India?

You can start investing in shares in India by following the steps mentioned below:

Step 1: Educate Yourself

Understanding how the Indian stock market operates is crucial. Learning about fundamental and technical analysis can help you make better investment decisions.

Step 2: Define Your Investment Goals

Decide whether you are investing for short-term gains, long-term growth, or passive income. Your goal will determine your investment strategy.

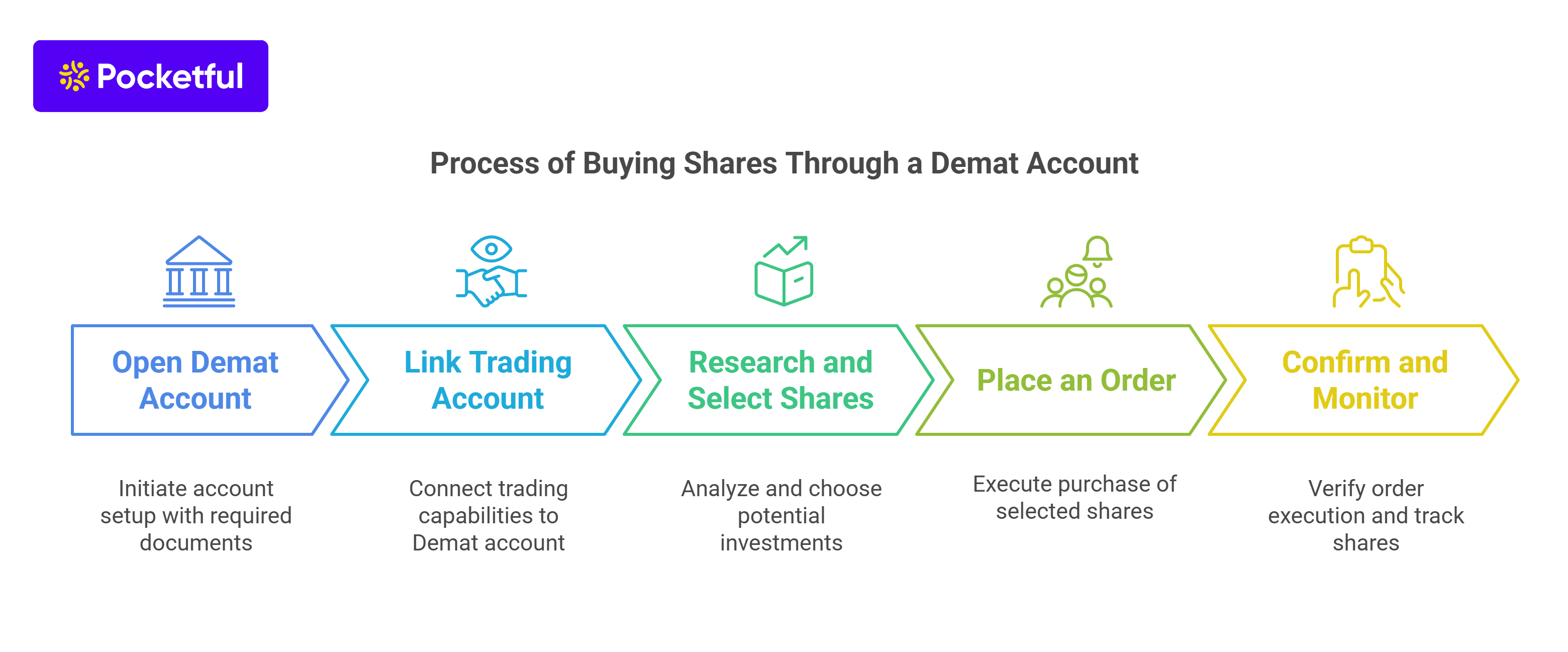

Step 3: Open a Demat and Trading Account

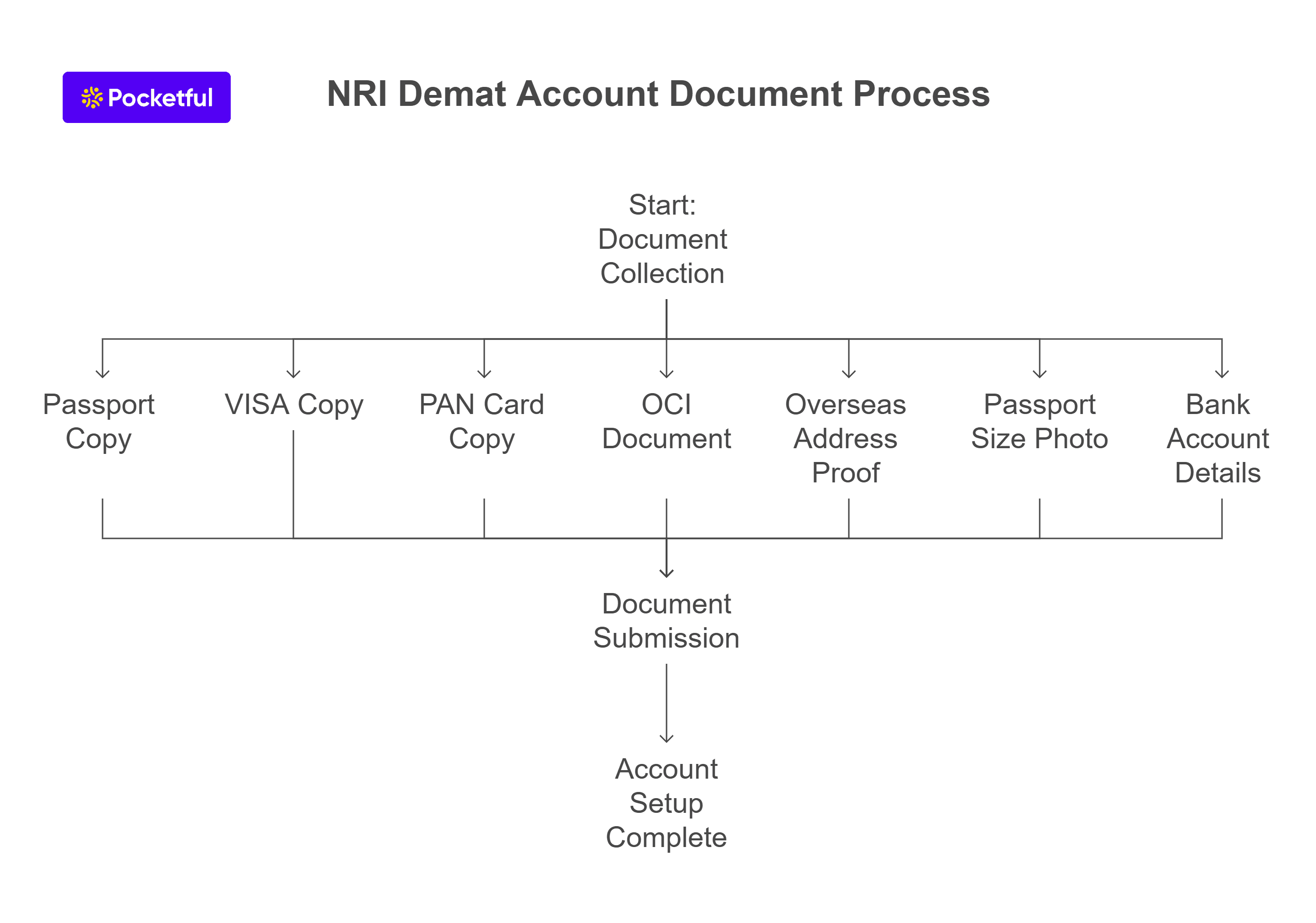

A Demat account is required to hold shares electronically, while a trading account facilitates buying and selling. Many brokerage firms offer easy-to-use investing platforms.

Step 4: Select a Reliable Brokerage Firm

Choose a brokerage based on factors such as fees, customer support, and available research tools. Some of the best brokers in India like Pocketful.

Step 5: Research and Pick Stocks Wisely

Before investing, analyze a company’s financial statements, business model, and industry trends. Blue-chip companies with consistent performance over the years are a good starting point.

Step 6: Diversify Your Portfolio

Don’t put all your money in one stock or sector. Diversification helps in managing risks better.

Step 7: Monitor Your Investments

Keep track of stock market trends and your investments. Adjust your portfolio based on market conditions and financial goals.

Read Also: How to Buy Shares through a Demat Account?

Personal Experience and Lessons Learned

When I began investing, I was tempted by short-term profits and often made impulsive decisions. However, I soon realized that patience and research are key elements for a profitable investment portfolio. By focusing on fundamentally strong companies and staying invested for the long term, I was able to see significant portfolio growth.

Key Takeaways:

- Start early to maximize compounding benefits.

- Avoid panic selling during market downturns.

- Review and rebalance your portfolio regularly.

Read Also: What is Earnings Per Share (EPS)?

Conclusion

Understanding what is a share in the share market is essential for making informed investment decisions. Investing in shares allows individuals to participate in a company’s growth, offering opportunities for capital appreciation and dividends. However, proper research, risk management, and a disciplined approach are key to successful investing.

With the right strategy, patience, and continuous learning, you can build a strong investment portfolio and achieve your financial goals. Start your investment journey today and take control of your financial future!

Frequently Asked Questions (FAQs)

How does investing in shares generate profits?

Investors earn profits through capital appreciation (rising share prices) and dividends distributed by companies.

What are the main types of shares?

The two main types are equity shares (offer voting rights) and preference shares (fixed dividends, no voting rights).

What are the risks of investing in shares?

Risks include market volatility, company-specific issues, economic factors, and potential loss of investment.

How can I start investing in shares in India?

Open a Demat and trading account, research stocks, diversify your portfolio, and monitor investments regularly.