The presence of silver in Indian households is nothing new; we have always carried an affinity towards silver. However, in recent times, silver has attracted people by becoming more than just something that is traditionally owned. As silver continues to gain popularity, it’s now becoming one of the top choices for those wanting to invest in the future.

In this blog, we will take a simple, easy look at silver’s journey so far, what is pushing its price right now, and what the next five years might look like.

Historical Trend of Silver Prices in India

- In the 1980s and 1990s, silver prices in India were low and rose slowly. In 1981, it stood at about ₹2,700 per kg; however, by the early 1990s, it had risen to about ₹8,000 per kg. The 1990s were a mix of positive and negative developments.

- In the early 2000s, things indeed started to improve. By 2004, prices had risen to over ₹11,000 per kilogram, and the metal started to adapt more to the declining rupee, the expansion of technology, and global demand.

- The real action took place from 2006 to 2012. The price of silver increased dramatically, reaching ₹17,000 per kilogram in 2006 and then nearly ₹57,000 per kilogram in 2011. This was one of India’s major silver price increases. Following the peak, prices decreased and, by 2014, they were stable at ₹43,000 per kilogram.

- Silver remained relatively stable between 2015 and 2019. Demand was steady but not particularly high.

- In the 2020s, the momentum returned. By 2023, silver was trading at nearly ₹67,000 per kilogram, driven by the pandemic’s renewed interest in precious metals. Prices increased mainly because of rising consumption of solar panels, electronics, and electric vehicles.

- Silver took off once more by 2024 and 2025. In 2024, prices exceeded ₹95,000 per kg. Even though silver has experienced enough instances of abrupt dips and sharp spikes over the years, the metal has generally trended upward.

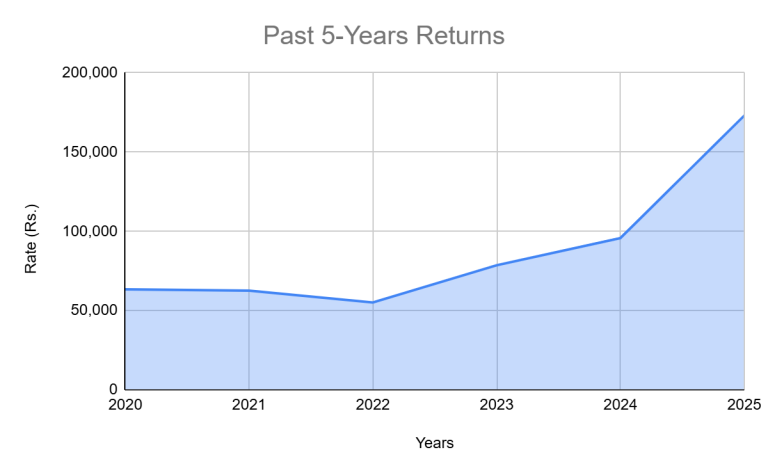

Past 5-Year Silver Returns

| Year | Rate (Rs.) |

|---|---|

| 2020 | 63,435 |

| 2021 | 62,572 |

| 2022 | 55,100 |

| 2023 | 78,600 |

| 2024 | 95,700 |

| 2025 | 173,000 |

Read Also: Gold Rate Prediction for Next 5 Years in India (2026–2030)

Factors Affecting Silver Prices

- An increasing use of technology – There is silver in phones, laptops, electric vehicles, solar panels, and even 5G towers. So, as these industries grow, so does the need for silver, which naturally drives up prices.

- People Buying Silver as Investments – People look for safer places to keep their money when the economy is weak or prices are going up. Silver becomes one of the preferred investment avenues, and prices usually go up when more people want to buy it.

- Rupee–Dollar Movement – Since silver is priced in US dollars, any change in how strong or weak the rupee is affects its price in India. If the rupee falls, silver becomes more expensive for all of us, even if global prices stay the same.

- Uncertainty in geopolitics – Wars, political tensions, and problems with the global economy make investors anxious. When things like this happen, people rush to buy precious metals, which drives up the price of silver.

- Taxes on Imports and Government Rules – Most of India’s silver comes from other countries. So, if taxes or import duties go up, the price of silver also rises. Alterations in policy can quickly change prices.

Read Also: Steel Price Predictions for the Next 5 Years in India

Current Silver Market Scenario

India has been experiencing a good rise in silver prices. Silver is currently worth approximately ₹1.67 lakh per kg, which is far greater than its position at the beginning of the year. The rise has been largely attributed to a combination of the international demand, a weaker rupee and increased industrial use.

The other factor that is causing silver to perform well is the overall market mood. Investors have been seeking safer investments, and silver has taken advantage of this. Analysts on the global side are discussing a potential shortage of supply, and this is making it bullish.

The market is not, however, entirely one-way. There are also reports that industrial demand might ease slightly, so the rally might decelerate. Nonetheless, on the whole, silver remains in a good position and has numerous positive aspects.

Silver Price Prediction

According to a recent outlook, silver is entering a strong multi-year uptrend. It is believed the metal could touch ₹2,45,000 per kilo by 2026- 27 in India. This rise is not just because silver prices are rising globally; the weakening rupee also plays a big role in lifting prices here at home.

The international silver prices are expected to head towards $75–77 per ounce by 2027, up from the $50-range right now. But the bigger story is the demand side. Silver is not just for jewellery anymore; it is used in electric vehicles, solar panels, batteries, and 5G technology is growing quickly. Since a lot of silver is produced as a by-product of mining other metals, supply cannot easily ramp up even when prices rise.

On average, silver can swing almost 1.7 times more than gold, which means higher upside but more volatility too. But for now, the bigger trend is still positive.

In simple words, if the rupee continues to weaken and global demand stays strong, silver prices in India could see some major highs over the next five years

Should You Invest in Silver

Silver can be a great addition to your investment mix, but it depends on the kind of investor you are. On the positive side, its demand is rising because of its industrial use. And during times when inflation is high, or the global economy is a bit off track, silver often behaves like a safety blanket, just like gold.

But the truth is, silver is volatile. It moves faster than gold, so you will need a bit of patience. If sudden price swings make you anxious, you might find silver a little too unpredictable.

If you are investing with a long-term mindset and you are fine with some bumps along the way, adding a small portion of silver to your portfolio can work well; even 5 -10% through silver ETFs, digital silver, or physical silver can help diversify your investments.

Read Also: Copper Price Predictions for the Next 5 Years in India

Conclusion

Silver’s price story has been full of twists. The outlook ahead looks positive, but it is still a market that can move quickly, both up and down. Just take it slow, stay informed, and invest in a way that suits your comfort level. Silver does have a bright future, but the best results come when you balance patience with good decisions.

Frequently Asked Questions (FAQs)

Is silver a good investment in 2025?

Yes, silver seems like a promising investment option because of rising demand.

Will silver prices rise in the next 5 years?

Most analysts expect silver to trend upward, possibly touching new highs by 2026-2030.

Is silver more volatile than gold?

Yes, usually silver swings more than gold.

Is physical silver better than a silver ETF?

For convenience and safety, ETFs are easier; physical silver is preferred if you do not have storage& liquidity issues.

Can silver prices drop suddenly?

If you are investing for the long term and can handle some ups and downs, starting now can be a good idea.