Steel is a crucial raw material which drives the Indian economy. Steel is considered the backbone of major sectors such as construction, infrastructure, and the automobile etc. Understanding how the steel prices will behave next year is essential before making any investment in the Steel Industry.

In today’s blog post, we will give you a prediction about the steel price for the next 5 years in India.

Historical Trend of Steel Price in India

The historical trend of steel prices in India can be divided into the following three different parts:

- Pre-COVID period: During this period, the prices of steel tended to be stable and had seen cyclical fluctuations. Because government spending on infrastructure has increased, domestic steel prices have increased due to the demand in the automobile and capital goods, etc, which also acts as a catalyst.

- Pandemic and Recovery: The steel prices have shown immense volatility during the COVID period. As the nationwide lockdown happened, there was a sharp decline in industrial and infrastructure activities. The steel prices have seen a decline in the prices. However, once the lockdown was lifted, economic activities started and the steel prices saw a sudden spike in price because of robust demand. Also, at the same time, the global supply chain was disrupted, leading to an increase in the price of steel.

- Recent Scenario: Recently, in the last few years, the steel prices have been volatile because of inconsistent demand from different sectors and global tensions around the globe. However, various factors such as monsoon-related slowdown and cautious buying by the end user.

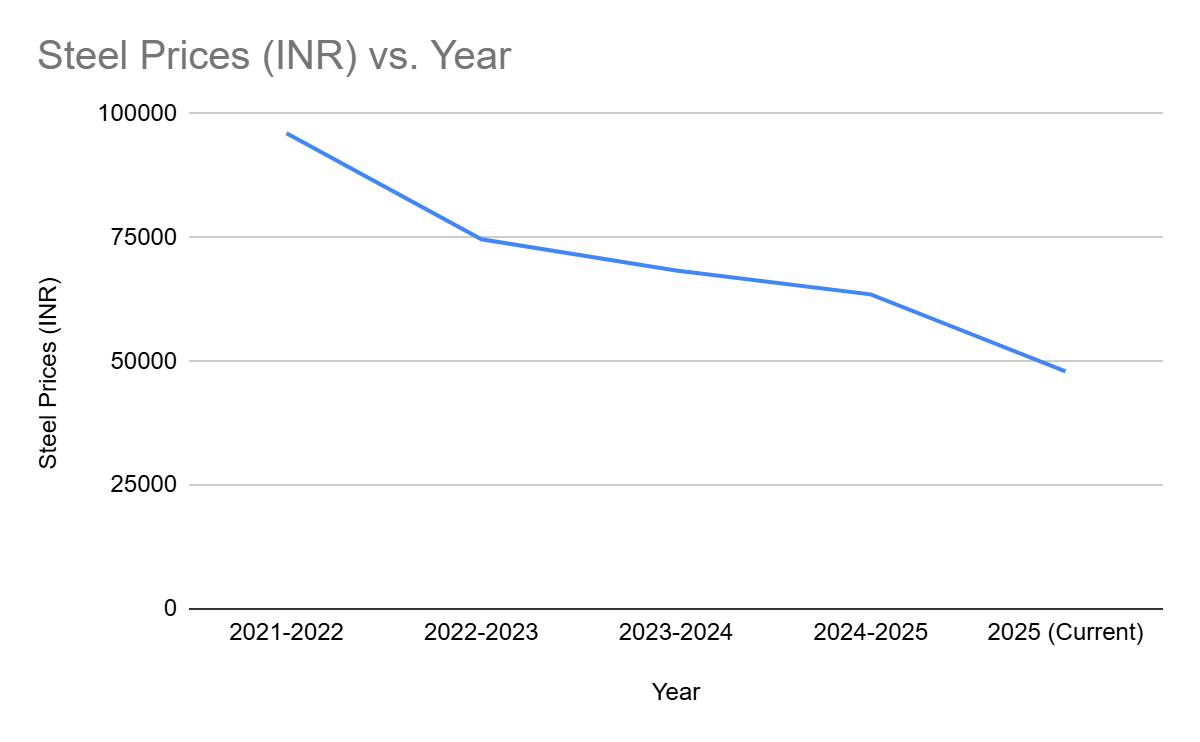

Past 5 Year Steel Returns

| Year | Steel Prices (INR) |

|---|---|

| 2021-2022 | 96079 |

| 2022-2023 | 74665 |

| 2023-2024 | 68365 |

| 2024-2025 | 63541 |

| 2025 (Current) | 48000 |

Steel Price Predictions for Next 5 Years in India

The yearly outlook of steel prices is mentioned in the table below:

| Year | Price of Steel (INR/Kg) | Outlook | Key Factor |

|---|---|---|---|

| 2026 | 50 | Bottoming Out | The prices of steel traded at a 5-year low because of various factors such as weak global demand and high imports. And it is expected that due to government policies, the steel prices will bottom out. |

| 2027 | 52 | Cyclical Movement | The steel prices are expected to increase and will make a new high because of favourable policies and intensive infrastructure spending by the government. |

| 2028 – 2029 | 55 | Correction | As the steel companies increase production, it will increase the supply of steel, easing the supply constraints. Hence, the steel prices might see a small correction. |

| 2030 | 60 | Premium | Because of the introduction of carbon taxes and green steel regulations, the prices of high-grade steel will increase. The whole phenomenon will reflect the cyclical nature of steel prices. |

(Source: Economic Times)

Current Steel Market Scenario

India has been experiencing strong momentum in steel prices. Currently, steel prices are trending at higher levels when compared to the start of the year due to strong domestic demand and a gradually improving global mood. This has been mainly due to infrastructure spends, strong construction activities, and government Capex plans in India.

Another factor supporting steel prices is the global supply situation. Production curbs in certain regions, higher raw material costs, and cautious output strategies by major producers have helped keep supply in check. At the same time, a relatively weaker rupee has made imports costlier, lending additional support to domestic prices.

Read Also: Gold Rate Prediction for Next 5 Years in India (2026–2030)

Importance of Steel Prices in the Economy

Steel is one of the most important components in an economy, as it is considered a major raw material for various sectors of the economy, such as infrastructure, automobile, capital goods, etc. The rise in steel prices acts as a barometer of economic growth. A rise in steel prices in the economy will benefit the steel producers and companies engaged in producing steel. As steel is the crucial raw material for different sectors, one can easily invest in steel companies through Pocketful, as it offers free brokerage on delivery trades.

Factors Affecting Steel Prices

The factors which affect the steel prices are as follows:

- Cost of Raw Materials: The production of steel depends on various raw materials, including iron ore, coking coal, and limestone. Any disruption in the supply chain or raw material prices can significantly impact the price of steel.

- Demand: The second factor which impacts the prices of steel is the domestic demand. If the demand for steel in different sectors like infrastructure, automobile etc. is on the higher side, the prices will increase and vice versa.

- Cost of Energy and Power: Producing steel requires a lot of energy and power. Increasing fuel and power prices can lead to an increase in the operating cost of steel-producing companies, which eventually increases the price of steel.

- Exchange Rates: If India’s currency gets weaker against the US dollar or other currencies, then it will make the import of coking coal, etc., expensive, leading to an increase in steel prices.

- Transportation Cost: The rate of diesel, freight, etc., can directly impact the availability of raw material and steel in different parts of the country. Any increase in transportation cost will increase the price of steel.

Should You Invest in Steel Companies

One should invest in steel companies because of the following reasons:

- Domestic Demand: The consumption of steel in India is expected to increase in the coming years due to increasing infrastructure spending by the government. This will push the steel prices up.

- Government Policies: The government of India is taking numerous steps to protect the Indian steel industry from cheaper imports by introducing anti-dumping duties.

- Capital Expenditure: The Indian steel companies are spending heavily in capital expansion and technological upgradation. This expansion will provide them with benefits from the expected increase in demand.

- Dividend Income: Most steel companies often distribute dividends to their shareholders along with the benefit of capital appreciation. This dividend income is suitable for conservative investors seeking regular income.

Read Also: Silver Rate Prediction for the Next 5 Years in India

Conclusion

On a concluding note, India is focusing on infrastructure development, which increases the demand for steel in the coming years, along with the steel prices. And at the same time, domestic steel companies are expanding their production capacity. In the next five years, the steel prices are expected to remain stable with moderate price fluctuations. Therefore, one can invest in the companies engaged in the manufacturing of steel by opening a lifetime free demat account with Pocketful, as it also offers an advanced trading platform, but one should consult their investment advisor before making any investment.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Best Material Stocks in India |

| 2 | List of Best Metal Stocks in India |

| 3 | Top 10 Steel Penny Stocks in India |

| 4 | Ashish Kacholia Portfolio 2025: Top Stocks & Strategy |

| 5 | Best Manufacturing Stocks in India |

Frequently Asked Questions (FAQs)

What are the key factors which affect steel prices?

The key factors which impact the steel prices include raw material cost, government spending on infrastructure, import duties, etc.

How does infrastructure spending impact steel prices?

Steel is the key component of infrastructure. Large-scale projects such as highways, railways, housing, etc., increase steel demand.

How can I invest in steel companies?

One can easily invest in steel companies by opening a lifetime free demat and trading account with Pocketful and then purchasing the stock of their choice.

How can renewable energy impact the steel price?

Transition toward green steel production can increase the cost due to capex in technology, hence increasing the steel price in the medium term.

Can I invest in steel companies for the long term?

Yes, one can invest in steel companies for the long term as the demand for steel in India is strong, and investors are required to invest in fundamentally strong companies only after consulting their investment advisor.