In the Indian stock market, blue chip stocks refers to shares of well-established and financially healthy companies which have performed well in the long term. These companies are considered the backbone of the economy as they operate in well-established and indispensable sectors.

They are like the “Tendulkars and Dhonis” of the stock market – trusted by millions and have maintained a consistent performance throughout. In this blog, we will give you an overview of the top 10 Blue Chip stocks trading at 52-Week low, along with their key features, advantages and disadvantages.

What Are Blue Chip Stocks at 52 Week Lows?

A blue chip stock is a share of a reputable company that performs consistently and has sound financials. Blue chip stocks trading at 52 week lows suggests that the stock is trading around its 1 year low (52 weeks), which can be a good opportunity to purchase these shares at a lower price than it was in the past year. This can happen simply due to market-wide corrections, issues pertaining to that specific sector, or company-specific news.

Top 10 Blue Chip Stocks at 52-Week Lows on NSE

Based on recent data, here are ten blue chip stocks on the National Stock Exchange (NSE) that are trading near their 52-week lows:

| S.NO. | Company Name | Current price (₹) | Market Cap (₹ Crores) | 52-Week High (₹) | 52-week Low (₹) | Sector |

|---|---|---|---|---|---|---|

| 1. | Reliance Industries Ltd | 1,393 | 18,85,614 | 1,612 | 1,115 | Conglomerate |

| 2. | TATA Consultancy Services | 3,108 | 11,24,520 | 4,191 | 2,867 | Information Technology |

| 3. | State Bank of India | 1,037 | 9,57,354 | 1,051 | 680 | Banking |

| 4. | Infosys Limited | 1,658 | 6,72,143 | 1,924 | 1,307 | Information Technology |

| 5. | Hindustan Unilever | 2,377 | 5,58,427 | 2,660 | 2,044 | FMCG |

| 6. | ITC Limited | 326 | 4,08,954 | 472 | 326 | FMCG |

| 7. | Adani Ports & SEZ | 1,369 | 3,15,389 | 1,549 | 1,011 | Infrastructure |

| 8. | Nestlé India | 1,295 | 2,49,688 | 1,333 | 1,055 | FMCG |

| 9. | TATA Motors | 432 | 1,59,206 | 451 | 306 | Automotive |

| 10. | Bajaj Auto | 9,176 | 2,56,481 | 9,888 | 7,088 | Automotive |

Read Also: 10 Best Copper Stocks in India

Overview of the 52 Week Low Blue Chip Stocks Companies

An overview of the Blue Chip companies mentioned in the table above is given below:

1. Reliance Industries Ltd (RIL)

RIL with its businesses in energy, petrochemicals, retail and telecommunications is the largest private sector enterprise in India with operations across the oil and gas value chain. Founded in 1973, RIL became the fastest company in the world to reach a market value of 100 billion dollars in 2007.

The company’s future prospects are further augmented by its focus on increasing value-added services through Jio Platforms and the initiative towards more sustainable energy solutions.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 5.81% | 12.52% | 37.77% |

2. Tata Consultancy Services (TCS)

As one of the first institutions in the field of consultancy and IT, TCS was founded in 1968. Today, as a global leader in IT services and business solutions, TCS works with some of the biggest players in the market. TCS is a result of constant innovations and a strong presence worldwide. As they intend to increase investments in emerging technologies, TCS will further advance towards global leadership in digital transformation.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -25.12% | -7.75% | 5.07% |

3. State Bank of India (SBI)

Over 200 years of deep-rooted heritage makes SBI through its subsidiaries making it the biggest commercial bank in India alongside a wide array of banking services. Among its various applications, SBI has demonstrated resilience and recorded substantial growth.

Economic growth of India as a whole enables the bank to enrich its regions along the lines of economic & technological advancement alongside SBI’s own enhancement. Together, these factors contribute to a milestone increase in deposits and advances.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 34.43% | 74.10% | 245.98% |

4. Infosys Ltd

Founded in 1981, Infosys is a global leader in next-generation digital services and consulting, enabling clients in over 55 countries to navigate their digital transformation.

Infosys has shown constant progress financially, because of how innovative and client-centric the company is. The purpose for this organization is to augment human abilities and create further opportunities and benefits for individuals, businesses, and society.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -9.25% | 7.57% | 25.28% |

5. Hindustan Unilever Limited (HUL)

Hindustan Unilever Ltd. has maintained a strong presence in the Indian market for over 90 years, the longest for any fast-moving consumer goods company. With more than 50 brands offered under its portfolio, HUL aims to drive incremental growth through digital transformation and increased personalization.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 1.06% | -6.59% | 1.06% |

6. ITC Limited

Formed in 1910, ITC also has various diversified businesses like FMCG, hotels, paperboards and packaging, agri-business, and information technology.

The company has accomplished remarkable achievements financially. As part of ITC’s future strategy, they plan on bolstering their catalog of fast moving consumer goods and further launching sustainable initiatives.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -25.71% | 1.76% | 49.27% |

7. Adani Ports & Special Economic Zone (APSEZ)

Currently sitting as the largest commercial ports operator in India, APSEZ is responsible for nearly one-fourth of the country’s cargo movement, operating a network of ports scattered in seven maritime states.

From a financial standpoint, the company has performed strongly and plans to improve its positioning in the market by expanding its port infrastructure and logistics capabilities.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 17.37% | 77.27% | 160.04% |

8. Nestle India

Operating since 1912, Nestle India is a subsidiary of Nestlé S.A. and handles brands like NESCAFÉ, MAGGI, and MILKYBAR. Demonstrating steady growth, the company focuses on long-term sustainable growth and shareholder satisfaction. As part of its growth strategy, Nestlé India will continue expanding its product portfolio and enhancing its manufacturing capabilities.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 16.85% | 31.90% | 45.96% |

9. Tata Motors

As part of the Tata Group, Tata Motors is a leading global automobile manufacturer selling cars, utility vehicles, buses, trucks, and even defense vehicles.

The firm has a strong international footprint and is working toward providing safer, smarter, and greener mobility solutions. Tata Motors intends to spearhead innovation in electric vehicles and increase its share in the domestic and international markets.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 27.76% | 27.76% | 27.76% |

10. Bajaj Auto

Bajaj Auto is one of the leading producers of motorcycles, three wheelers, and quadricycles, with operations in more than 70 countries.

The firm achieved record revenue and profit on the back of strong retail sales domestically and internationally. Bajaj Auto intends to maintain its emphasis on new developments and furthering its presence around the world.

These companies are among the most well-known blue chip stocks in India, all having sound policies and visions for long-term growth and value creation.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 6.70% | 156.11% | 125.10% |

Read Also: List of Top 10 Blue Chip Stocks in India with Price

Key Features of Blue Chip Stocks in India

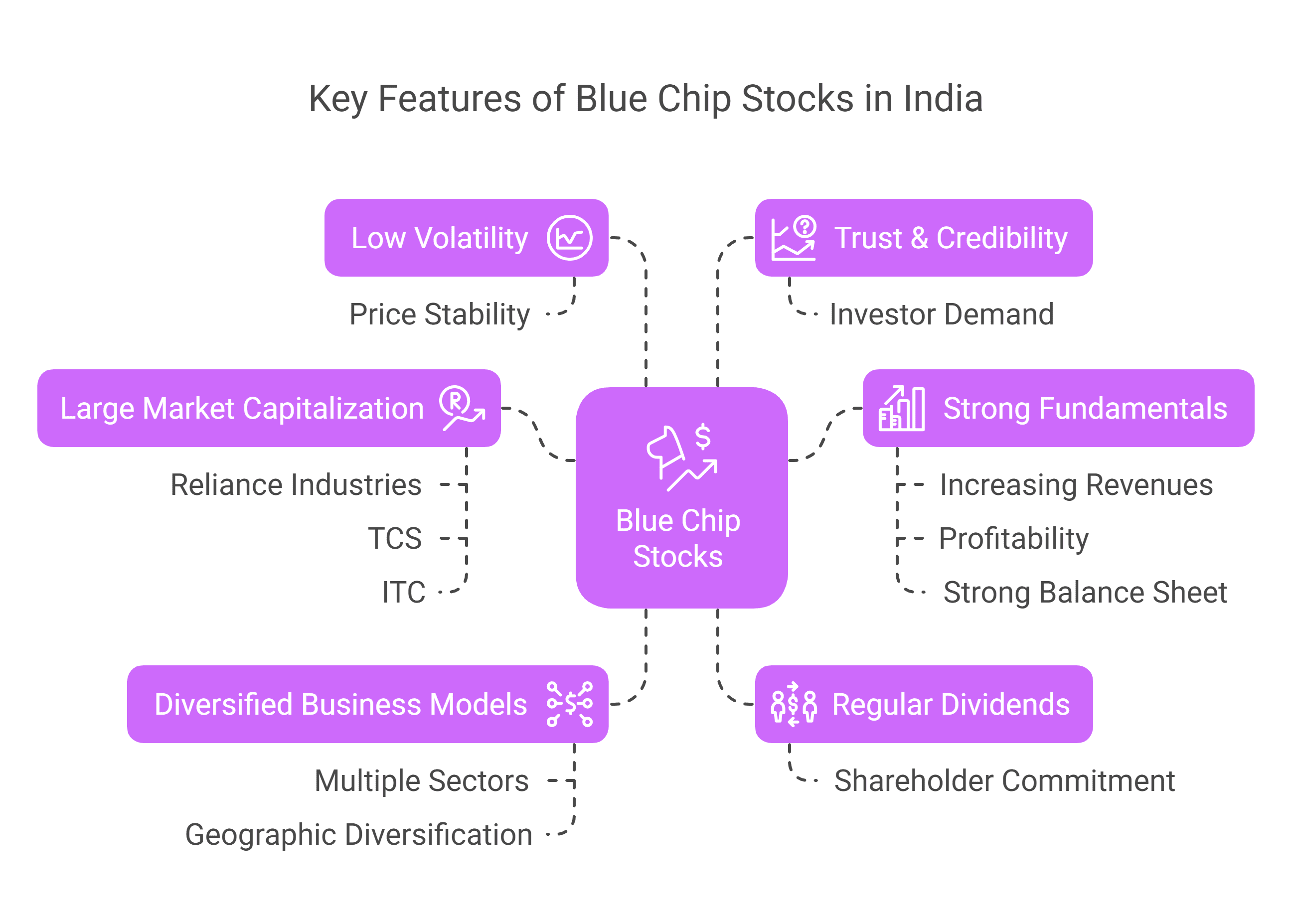

Some of the key features of Blue Chip stocks in India are:

- Large Market Capitalization: These companies have a market capitalization running into lakhs of crores. Example: Reliance Industries, TCS, ITC, etc.

- Strong Fundamentals: Increasing revenues, profitability and a strong balance sheet are common characteristics among these companies.

- Regular Dividends: A majority of blue chip companies pay dividends to shareholders, reflecting their commitment towards their shareholders.

- Low Volatility: While all financial instruments carry some measure of risk, blue chip stocks are the least prone to severe fluctuations in pricing.

- Trust & Credibility: These stocks are highly credible and are therefore in high demand by the majority of investors across India.

- Diversified Business Models: Reduces risks due to operations in multiple sectors or geographies.

Buying blue chip stocks during their 52-week lows can enable investors to take advantage of well-established companies for much lower than the actual price. A well-known company might experience a price slump due to several factors. In this article, we will discuss the blue chip stocks which are trading around their 52-week low level.

Factors to Consider Before Investing in Blue Chip Stock at a 52-Week Low

If you are investing in the blue chip stock at 52 week low, ensure you analyze company-specific terms as well as industry-specific terms. Some of the key factors

- Check Fundamentals: Before investing, you should consider whether the fall in share price is related to short term factors or long term issues. Positive signs include strong fundamentals like consistent dividends, stable earnings, and low debt.

- Macroeconomic Environment: Broader economic issues like inflation, interest, and geopolitical conflicts tend to negatively impact stock prices. Understand how these macro factors influence the sector.

- Industry Specific Matters: A blue chip stock can be impacted by sector specific regulations or a decline in demand. For example, IT stocks may fall if there are signs of recession in the USA as the majority of their revenues are from the USA.

- Management Quality: Look into recent investor presentations, earnings calls, or governance reports. Having capable and transparent leadership can help the company recover faster.

- Valuation Metrics: Using the Pocketful app, check the valuation ratios P/E, EV/EBITDA, and Price-to-Book to analyze if the stock is truly undervalued or if the decline in price makes sense.

- Dividend History: Check the dividend yield of the company, if even in challenging times, a blue chip company is paying dividends, then it is a positive sign.

- Volume and Liquidity: Although very rare, blue chip stocks with lower trading volumes can be difficult to buy or sell. Invest in blue chip stocks which are high in liquidity.

Thorough research before investing in Blue Chip stocks at 52 week low levels will help avoid common mistakes while confidently capturing long-term opportunities.

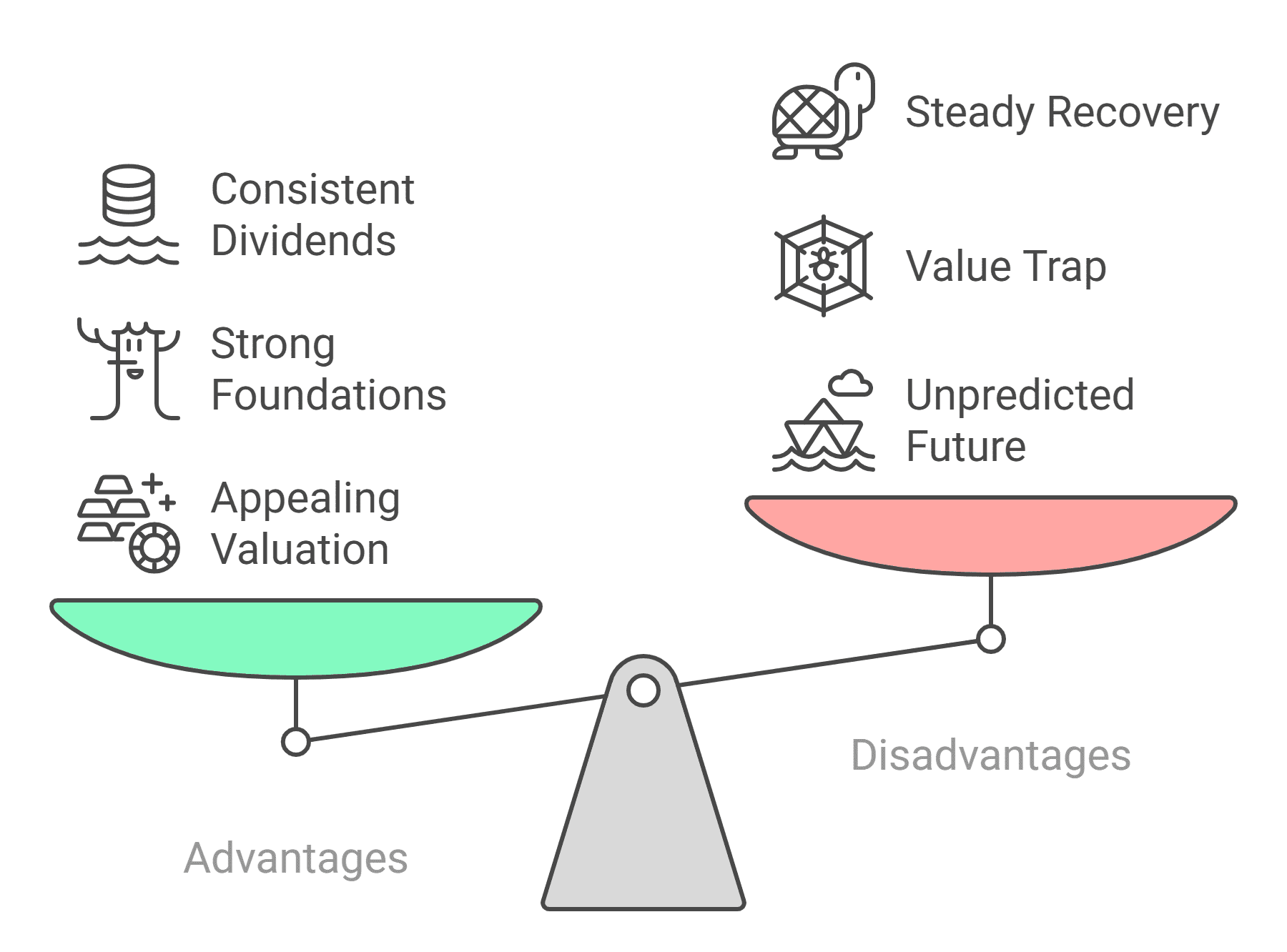

Advantages of Investing in Blue Chip Stocks

Advantages of investing in Blue Chip stocks are:

- Appealing Valuation: Buying a stock at its 52-week low refers to a situation where you can buy a blue chip company’s stock at a discounted price.

- Strong Foundations: Companies like Infosys, TATA consultancy services have strong business models making them more reliable to invest.

- Consistent Dividends: Blue chip companies stocks pay regular and steady dividends offering investors passive income even during downturns.

- Future Potential: Short term lows can be a significant entry point for long-term wealth generation.

Disadvantages of Investing in Blue Chip Stocks

Disadvantages of investing in Blue Chip stocks are:

- Unpredicted future: Stocks near their 52-week low is not an indication that stock price will not fall any further; it can still fall due major sector specific reasons.

- Value Trap: Blue chip stocks valuation may be low for reasons such as strict regulations, high competition, etc. making their value stagnant for a period of time.

- Steady Recovery: Even fundamentally strong companies can take time to recover, especially if the world economy faces major issues.

Read Also: Penny Stocks vs. Blue-chip Stocks – What’s the Difference?

Conclusion

Investing in quality blue-chip companies at low prices is all about getting value, but great investors ensure that they verify the fundamentals before making any investments. They always look at more than just the number, i.e. 52 week low, rather they also examine the financials, the business model, the overall market sentiment, and other relevant factors.

With apps that provide real-time stock information such as Pocketful, data as well as stock charts and other research tools are readily available. You can track blue chip stocks at NSE 52-week low and filter using different valuation and performance evaluation metrics.

If you are a beginner or an experienced trader, Pocketful is the best broker. You can explore, evaluate, and execute, all from the same platform. Remember, even the most renowned blue-chip stocks have their bad days. What is important is if they have the potential to recover. And that is where you gain an advantage as an investor.

Also, buying blue-chip stocks when everyone is rushing to sell does not mean those stocks will appreciate immediately. Exercise patience. Regularly monitor the KPIs as well as sector trends that could influence performance. Don’t invest your entire investment capital into one or two securities regardless of how appealing they might seem and diversify.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | List Of Best Healthcare Stocks in India |

| 2 | List of Best Telecom Stocks in India |

| 3 | List Of Best Footwear Stocks in India |

| 4 | List Of Best Logistics Stocks in India |

| 5 | List of Best Liquor Stocks in India |

Frequently Asked Questions (FAQs)

What are blue chip stocks?

Stocks considered blue chip are shares of large and well-established companies that are financially sound, portray steady growth, and pay regular dividends. Examples of blue-chip stocks in India are Reliance, TCS, and ITC.

Is it wise to purchase blue-chip stocks at their 52-week low?

You can opt for a blue chip stock at a 52-week low if a stock’s fundamentals are solid and the reason for a decline is macroeconomic factors alongside temporary negative sentiment in the market, and not problems with the company in the long term. It often presents a chance to acquire something that is undervalued.

How do I distinguish if a 52-week low is an alert or an opportunity for a purchase?

A deep dive into a company’s earnings, its debt, growth prospects, and the rationale for the price drop alongside the price itself is essential. Use a blend of fundamentals and technicals like relative strength index for better decisions.

Will blue-chip stocks always recover from the 52 week low?

Not all the time. Most blue chip stocks recover over time, while others may face prolonged struggles. It is essential to look at the specific factors of the company and its industry trends before making investment decisions.

What is the optimal investment period for purchasing blue-chip companies at a bargain?

In general, investing for 3-5 years or even more is recommended, particularly when making purchases during market dips. To withstand sudden market shifts and harness compounding advantages, remaining invested is critical.