The cement industry is vital to India’s economy, contributing significantly to GDP through infrastructure development, housing, and employment. As the world’s second-largest producer, it supports key sectors like construction and manufacturing. Due to the critical nature of the cement sector, the companies operating in this sector are often considered by investors for investment.

If you are looking for penny cement stocks to add to your stock portfolio, then you have landed at the right place. This guide covers the top 10 cement penny stocks in India that are generally priced below ₹50. Such low-priced shares offer small investors a ticket into India’s blooming infrastructure space.

What are Cement Penny Stocks in India?

What are Cement Penny Stocks? Cement penny stocks are shares of small cement manufacturing firms that have their shares trading below ₹50, usually. These stocks provide investors with a means of investing in the cement sector without too much capital investment. These stocks can be extremely appealing due to the ongoing infrastructure development in India.

Top 10 Cement Penny Stocks in India (2026)

| Company | Current Market Price (₹) | Market Capitalization (₹ Crores) | 52 Week High (₹) | 52 Week Low (₹) |

|---|---|---|---|---|

| Sanghi Industries Ltd | 65.0 | 1,678 | 71.8 | 50.1 |

| Udaipur Cement Works Ltd | 36.2 | 2,031 | 38.0 | 23.0 |

| Shree Digvijay Cement Co. Ltd | 91.5 | 1,353 | 108 | 61.0 |

| Shiva Cement Ltd | 24.2 | 714 | 42.7 | 21.8 |

| Andhra Cements Ltd | 66.5 | 613 | 110 | 48.2 |

| Navkar Urbanstructure Ltd | 1.63 | 183 | 4.28 | 1.17 |

| Barak Valley Cements Ltd | 43.0 | 95.3 | 70.0 | 34.1 |

| Binani Industries Ltd | 7.00 | 22.0 | 23.6 | 6.41 |

| Burnpur Cement Ltd | 6.60 | 56.8 | 6.95 | 5.73 |

| Sri Chakra Cement Ltd | 67.8 | 61.0 | 99.3 | 8.03 |

Overview of Top 10 Cement Penny Stocks Companies in India

An overview of the top 10 cement penny stock companies in India is given below:

1. Sanghi Industries Ltd.

Sanghi Industries Ltd, a company that is part of Ambuja Cements Ltd as well as the diverse Adani Group, is among the leading Indian companies in the cement sector. This company has a clinker production capacity of 6.6 MMTPA (million tons per annum) and 6.1 MMTPA cement production capacity. In Kutch, Gujarat, the company has one of the largest single-location cement production plants in India. This is a fully integrated cement plant that has a thermal power plant, an all-season port, sea terminals located at Gujarat & Mumbai, and its own vessels to cater to its product demand.

Superior quality of mineral reserves and advanced manufacturing technology help the company manufacture high-grade cement while maintaining a low cost of production. The company is known for its world-class practices in environmental management and corporate management, resulting inan excellent company reputation.

2. Udaipur Cement Works Ltd

Udaipur Cement Works Limited (UCWL), an incorporated company that became a public limited company on March 15, 1993, is based in Udaipur, Rajasthan. It functions as a subsidiary of JK Lakshmi Cement Limited, which has been an institution in the Indian cement industry for over 40 years. UCWL belongs to the reputed JK Organisation, which has a glorious business legacy of over 135 years. UCWL, which makes and sells cement and related materials, operates only in India and has its shares listed on BSE. Its products are sold under the brand names of “Platinum Heavy Duty Cement” and “Platinum Supremo Cement” for individual house builders, masons, and other business associates.

3. Shree Digvijay Cement Co. Ltd

Established on November 6th, 1944, Shree Digvijay Cement Company Limited is one of the initial companies to start cement production in India. This company has a manufacturing plant located at Sikka in Jamnagar District of Gujarat. The company has been producing blocks of cement branded as “KAMAL” since 1949. Shree Digvijay Cement specializes in blended cements such as Ordinary Portland Cement (OPC), Portland Pozzolana Cement, among others.

4. Shiva Cement Ltd

Shiva Cement Limited, established in 1985, is an India-based company involved in the production and sale of cement and its allied products. The company serves domestic markets and produces Portland Slag Cement (PSC), Portland Pozzolana Cement (PPC), clinker, and limestone chips. This company is a strategic investment made by JSW Cement as it is a key player in eastern India with a stronghold through consistent demand. It has facilities at strategic locations to tap huge raw material availability to cater to markets in Odisha, West Bengal, Jharkhand, and Bihar.

5. Andhra Cements Ltd

Andhra Cements Ltd was established in December 1936, located in Andhra Pradesh with two of its biggest plants situated in Palnadu district known as Durga Cement Works (DCW), and also at Visakhapatnam, also known as Visakha Cement Works (VCW). The DCW plant consists of cement grinding machines with both OPC and PPC grade cement manufacturing, along with good rail, road, and sea transportation, making the business operations smooth with an opportunity to expand its operations easily in the future.

6. Navkar Urbanstructure Ltd

Navkar Urbanstructure Limited, which was formerly known as Navkar Builders Limited, is a Gujarat-based BSE-listed firm incorporated on June 2, 1992. The company holds more than 27 years of multidisciplinary experience in designing and executing challenging projects, from working on large sewage treatment plants to pumping stations and transmission pipelines. Apart from developing infrastructure pipes, the company also engages in the supplying of Reinforced Cement Concrete (RCC) pipes and Ready Mix Concrete (RMC) to construction sites. The company is also exploring the opportunities to expand in the cement industry globally. Navkar Urbanstructure’s technological prowess in structural design, project management, and budget procurement has been instrumental in the realisation of high standards in infrastructure projects.

7. Barak Valley Cements Ltd

Barak Valley Cements Limited, incorporated in 1999, is an India-based company involved in the manufacture and sale of cement of various grades. It sells its products under the brand name “Valley Strong Cement” in the North Eastern Region of India. The company offers a wide range of products including both Ordinary Portland Cement (OPC) and Portland Pozzolana Cement (PPC). The company is based in Karimganj, India.

8. Binani Industries Ltd

Founded in 1872, Binani Industries Limited is an Indian based company with a diversified business portfolio. Its main areas of interest include manufacturing of cement, zinc, glass-fiber, and downstream composite products. Starting from trading in metal utensils, the company has a rich history as it established units like Binani Metal Works in 1941. They are part of the Braj Binani Group, a well-diversified industrial house with a rich 136-year history.

9. Burnpur Cement Ltd

Burnpur Cement Limited is one of the oldest and most reputable fully integrated cement companies in the eastern region of India, commencing operations in 1986. Headquartered in Burnpur, West Bengal, the company has two plants, one in Asansol, West Bengal and the other in Patratu, Jharkhand. Burnpur Cement specializes in manufacturing Portland Slag Cement (PSC) and is recognized for its commitment to quality and innovation. The company’s Patratu plant uses sophisticated dry process technology to manufacture clinker and cement efficiently.

10. Sri Chakra Cement Ltd

Sri Chakra Cement Ltd is an India cement manufacturer as well as other construction material manufacturers. The firm mainly manufactures Ordinary Portland Cement (OPC) grades 53 and 43 along with Portland Pozzolana Cement (PPC). The company also installed captive solar power generation for all of its operations, moving towards a greener future.

Key Performance Indicators (KPIs)

| Company Name | EPS (₹) | ROE (%) | ROCE (%) | Debt to Equity Ratio |

|---|---|---|---|---|

| Sanghi Industries Ltd | -17.37 | -40.40 | -5.58 | 1.87 |

| Udaipur Cement Works Ltd | 1.25 | 7.88 | 6.73 | 1.57 |

| Shree Digvijay Cement Co. Ltd | 6.01 | 23 | 30.30 | 0 |

| Shiva Cement Ltd | -3.51 | 0 | 0.78 | -7.43 |

| Navkar Urbanstructure Ltd | 0.05 | 0.84 | 0.99 | 0.11 |

| Barak Valley Cements Ltd | 3.27 | 6.02 | 12.84 | 0.40 |

| Burnpur Cement Ltd | -11.51 | 0 | 6.59 | -0.91 |

| Binani Industries Ltd | -2.28 | 0 | 3.70 | -0.89 |

| Sri Chakra Cement Ltd | -11.83 | -23.44 | -8.23 | 0.52 |

Read Also: Top 10 Steel Penny Stocks in India

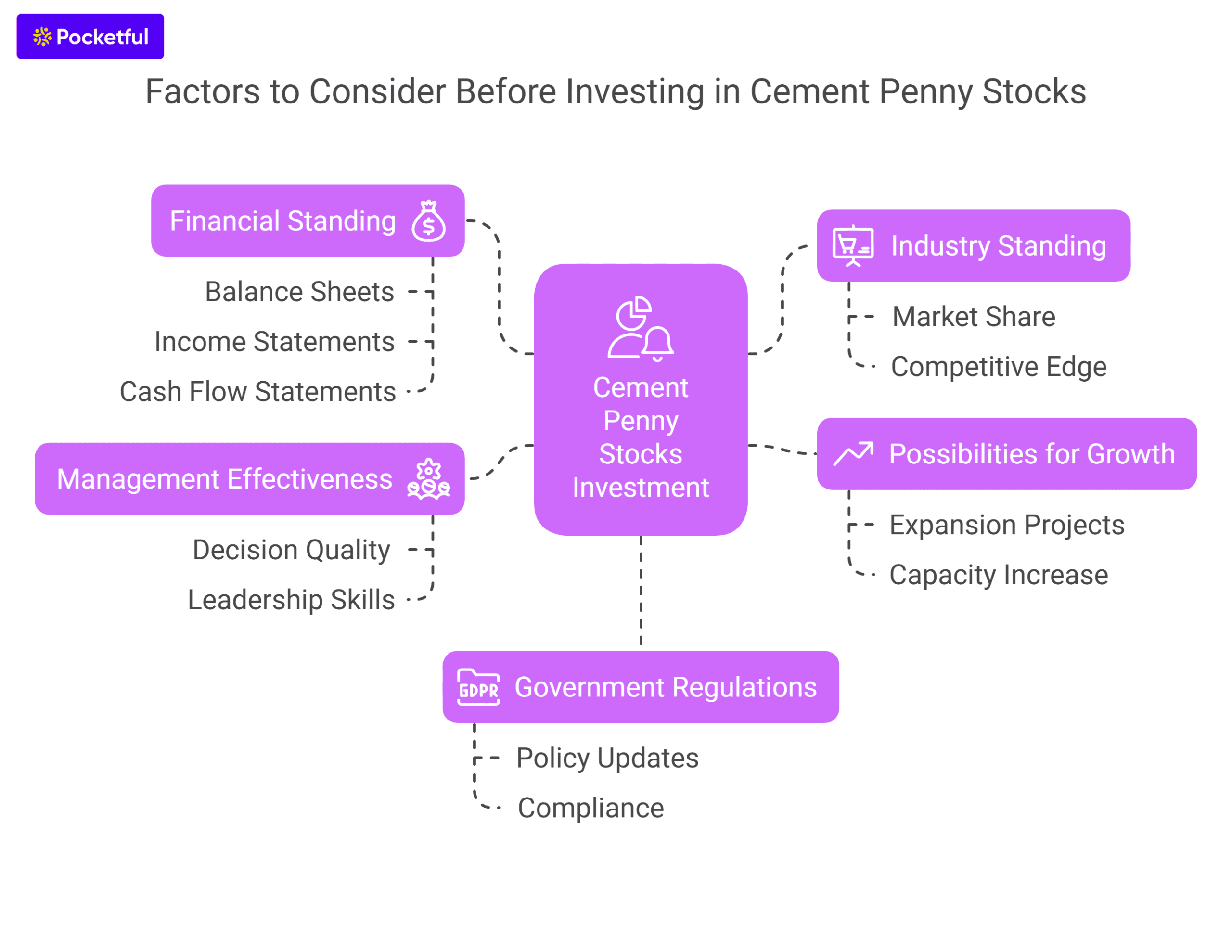

Factors to Consider Before Investing in Cement Penny Stocks in India

While considering the cement ‘penny stocks for investment, you must keep the following factors in mind:

- Financial Standing: It is crucial to evaluate the company’s balance sheets, income and cash flow statements.

- Industry Standing: Determine the market share of the company and its edge over the competition.

- Possibilities for Growth: Conduct research to identify future potential, expansion projects and plans for increasing capacity.

- Management Effectiveness: The performance of a company depends on the decisions of the management.

- Government Regulations: Be updated with the policy changes regarding the legislations relevant to the cement industry.

Positive Aspects of Investing in Cement Penny Stocks in India

Some of the advantages of investing in cement penny stocks are listed below:

- Affordable: Cement ‘penny’ stocks are generally priced less than ₹100 or even ₹50 which lets even small investors to purchase these stocks. There is no substantial investment amount required to begin investing in these stocks.

- Growth Opportunities: As these businesses are of a smaller size as compared to other established companies, they have greater potential than the established players. If the company grows or optimizes its operations, the increase in stock price could be significant.

- Risk Diversification: Investing in cement penny stocks diversifies your portfolio, especially if your holdings only include large publicly traded companies. This aids in diversifying risk across different sectors and company sizes.

- Riding the Infrastructure Boom: Increasing infrastructure development in India should lead to higher demand for cement. If these smaller companies are able to capitalize on this opportunity, they can substantially increase their revenue and market capitalization over time.

- First Mover Benefit: Because these stocks are not regularly tracked by analysts, spotting a solid company early could allow you to reap substantial gains later as they mature and gain market attention.

Read Also: 10 Best FMCG Penny Stocks in India

Disadvantages of Cement Penny Stocks in India

Some of the disadvantages of investing in cement penny stocks are listed below:

- Unpredictability: Due to low liquidity and speculative trading, cement penny stocks face sharp price swings. Due to low volume or stock related news, prices can rise or fall drastically.

- Limited Information: Small companies usually do not publish detailed reports on their business activities or financial statements like big firms do. Because of this, investors cannot have a very easy time assessing the company’s performance and making investment decisions.

- Liquidity Issues: Due to lower trading volumes of these stocks, it is not easy to buy or sell in large quantities without affecting the stock price. Also, getting out of a position may take longer than expected if one wants to do so at a specific price.

- Risks Related to Corporate Governance: Lack of strong corporate governance practices makes penny stock companies prone to mismanagement, legal problems, or other issues. This brings greater risk for retail investors.

- Uncertain Financial Stability: Thin profit margins or heavy reliance on debt are common with most of these companies. If the market takes a downturn or if poor management decisions are made, it can quickly lead to poor financial performance, eroding investor capital, or both.

Read Also: 10 Best High Volume Penny Stocks In India

Conclusion

In India, cement penny stocks present a remarkable investment opportunity for retail investors who want to capitalize on the country’s booming infrastructure and construction sectors without investing significant capital. Most of the cement penny stocks trade below ₹50, and if selected intelligently, these stocks may deliver robust profits in the future. But as we have seen, they come with risks of their own such as extreme price fluctuation, limited trading activity, and scant financial information made available to the public.

That’s why these investors need to analyze the company based on the latest financial metrics, company news, relevant sector information, and perform thorough due diligence before investing. Staying updated with the metrics like EPS, PE ratio, and return on equity would help make wiser decisions.

To make this easier, the Pocketful app allows users to track stock performance by setting alerts or perusing fundamental data concerning cement penny stocks listed on the Indian stock exchanges. The application comes with a user-friendly interface, making it suitable for novice as well as pro investors.

Regardless of your experience level, Pocketful simplifies stock investing and trading. So if you are thinking of entering the stock market and investing in cement penny stocks, let Pocketful guide you through every step of the way.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | 10 Best Bank Penny Stocks List |

| 2 | Top 10 Highest Dividend Paying Penny Stocks in India |

| 3 | 5 Top Artificial Intelligence Penny Stocks in India |

| 4 | Best EV Penny Stocks India |

| 5 | Reliance Penny Stocks List in India |

Frequently Asked Questions

What are cement penny stocks and what is the hype surrounding them in the market?

Cement penny stocks are shares of smaller, lesser-known cement companies that trade at a market price lower than ₹100. These stocks are sought out by investors for their potential high returns while needing relatively lower initial investment. If purchased at the right time, these stocks can turn out to be extremely profitable multi baggers in the future.

Is it safe to invest in cement penny stocks?

Cement penny stocks have the possibility of delivering higher returns, but could also come with greater risk due to illiquidity and inconsistent financial track record. It is crucial to assess the fundamentals such as market demand and trends of the industry for each company individually.

How to analyze and invest in cement penny stocks in India?

Use financial portals, company reports, or read blogs that may contain the information you need regarding cement penny stocks for analysis. To streamline the investment process, check out Pocketful, which allows users to search for cement penny stocks, monitor their real time performance, and purchase them via easy-to-use mobile application.

What are the growth prospects of cement penny stock companies in India?

The infrastructure and real estate boom in India will result in strong cement demand which will enable even smaller cement companies to expand. Initiatives from the government such as PM Awas Yojana and the Smart Cities Mission may further enhance the market prospects of these companies.

Can I invest in these cement penny stocks through the Pocketful platform?

Investing in a wide array of stocks, including those of cement penny stocks, is made easy by Pocketful. Pocketful’s intuitive interface coupled with its research tools and stock screener makes it the perfect stock broker.