Have you ever thought how investors earn steady income from bonds, even before the bond maturity date? Let’s introduce you to the world of coupon bonds where you can invest and grow your wealth for decades. Coupon bonds are a type of debt instrument where the bondholders get regular periodic interest payments known as coupon payments, representing consistent income at regular intervals.

In this blog, we will discuss coupon bonds, its working, advantages, disadvantages and factors to consider before investing in these bonds.

Brief Introduction to Bonds

Bonds are fixed income instruments through which you can lend money to an organisation, like a company or government. In return, they promise to pay you regular interest payments for a specific period (say annually or semi-annually) and at maturity, you get your original investment amount back.

In India, there are many institutions that issue bonds, such as PSUs, corporates, RBI on behalf of Govt., etc. to raise money. Bonds can be bought through banks, brokers, or online platforms. They are a safe way to earn passive income but one should always keep in mind that income earned from these bonds are usually taxable, so one should keep all the factors in mind before investing. Now let’s understand Bond coupons in more detail.

What is Coupon Bond?

A coupon bond is a subtype of bond that pays fixed coupon payments at regular intervals over the lifetime of the bond. The bond’s face value or the principal amount is returned at the time of maturity (pre decided maturity date). The term “coupon” is a term that was used back in times when physical bond certificates had detachable coupons, and payments were made after presenting these bonds physically to the issuer. However, today the interest payments or coupon payments related to the bond are made electronically.

Read Also: What are Bond Yields?

Understanding Important Terms Related to Coupon Bond

Before investing in a coupon bond, it is important to understand its structure. The following terms related to bonds are explained in detail:

1. Face Value (Par Value or Principal)

The amount of money the bondholder will receive back at the time of bond maturity.

Let’s look at the bond with ₹1,000 par value and a coupon rate of 7%. The bondholder will receive ₹70 annually until maturity and then receive the principal amount.

Importance: The face value of a bond is fixed while the market price of the bond tends to change due to interest rate fluctuations as well as credit reassessment.

2. Coupon Rate

The coupon rate is the annual interest rate stated on a bond, expressed as a percentage of the bond’s face value.

If the coupon rate is set at 6% per year and the face value of the bond is ₹10,000, then the annual coupon payment will be ₹600, these payments are usually made semi-annually, annually, or even quarterly.

3. Coupon Payment

This represents the bond’s interest payment and is the actual amount that is paid to the holder of the bond at pre designated intervals (annual, semiannual or quarterly) based on the coupon rate and the bond’s face value.

Coupon Payment = Face Value x Coupon Rate ÷ Number of Payments per Year

A ₹1,000 bond with a coupon 6% paid out semi annually will yield ₹30 every 6 months. Payments are usually made directly into the investor’s registered bank account.

4. Maturity Date

The particular point in time when the bond will mature and the issuer pays the bond holder the face value of the bond.

Maturity Range: This could be short-term, medium term or long-term. In general, short term is less than 1 year, medium term is 1-10 years and long term is 10-30 years or longer.

The time to maturity of a particular bond determines its exposure to interest rate risk, i.e., when bonds with longer maturity experience greater fluctuation due to changes in interest rates. Knowledge about the maturity dates also facilitates financial planning as certain bonds maturing 5, 10, or 20 years down the line can assist in planning for education or retirement funding.

5. Fixed vs Floating Coupon Bonds

In a fixed-rate bond, the interest rate is pre-determined and it remains the same due to its fixed nature till the maturity of the bond.

A floating-rate bond’s coupon payment changes according to some benchmark, such as RBI repo rate.

Read Also: What Are Corporate Bonds?

How Coupon Bonds Work?

When you purchase a coupon bond:

- You’re giving your investment amount to the issuer, which can be a government, municipality, or corporation.

- The issuer pays you interest or coupon payments at a specified rate and frequency, usually semi-annually or annually.

- You receive the principal amount after the bond maturity.

Advantages of Coupon Bonds

Advantages of investing in coupon bonds are:

1. Stable & Predictable Income : Interest payments on coupon bonds are made during specified periods making them perfect for pensioners or people dependent on passive income streams. Compared to stocks, bonds are less volatile.

2. Lower Risk than Equities : Though subject to price volatility, regular interest payments and principal value is received at maturity (unless there’s a default). This statement is most applicable to sovereign or AAA-rated bonds.

3. Capital Preservation : Bonds that are held to maturity pay back the full principal amount. It enables capital preservation while maintaining a regular income stream.

4. Portfolio Diversification : Bonds are crucial in compensating for unpredictable equity markets. They have a low correlation to stocks, which mitigates overall portfolio risk.

5. Secondary Market Options : Bonds are also available for buying or selling on the secondary market, i.e. brokers, banks and digital platforms. The liquidity, however, is subject to change based on the availability of buyers and sellers in the market.

Disadvantages of Coupon Bonds

It is important to know the associated risks and limitations of coupon bonds as well:

1. Change in Interest Rate Risk : If interest rates go up, the bond prices will fall. This may lead to loss if the bond is sold before maturity. Bonds with longer durations are more sensitive to these interest rate changes.

2. Inflation Risk : Inflation may diminish the real value of the fixed coupon payments, reducing the purchasing power over time. With rising inflation the interest income may be less valuable as the general price level of goods and services across the economy rises.

3. Default Risk : Investors could incur losses if the issuer refuses to pay interest or principal amount owed. Credit default risk in government bonds is very low as they are backed by sovereign guarantee while corporate bonds carry higher default risk.

4. Liquidity Risk : Certain bonds are not actively traded on secondary markets. Hence, selling them at a fair price within a short period becomes difficult. So, sudden exit can lead to potential losses in illiquid markets.

5. Call Risk : An issuer tends to call a bond before its maturity date when interest rates decrease. They do this to issue further bonds at a reduced coupon rate.

Read Also: What Is Bowie Bond (Music Bonds) : History, Features, Advantages & Disadvantages

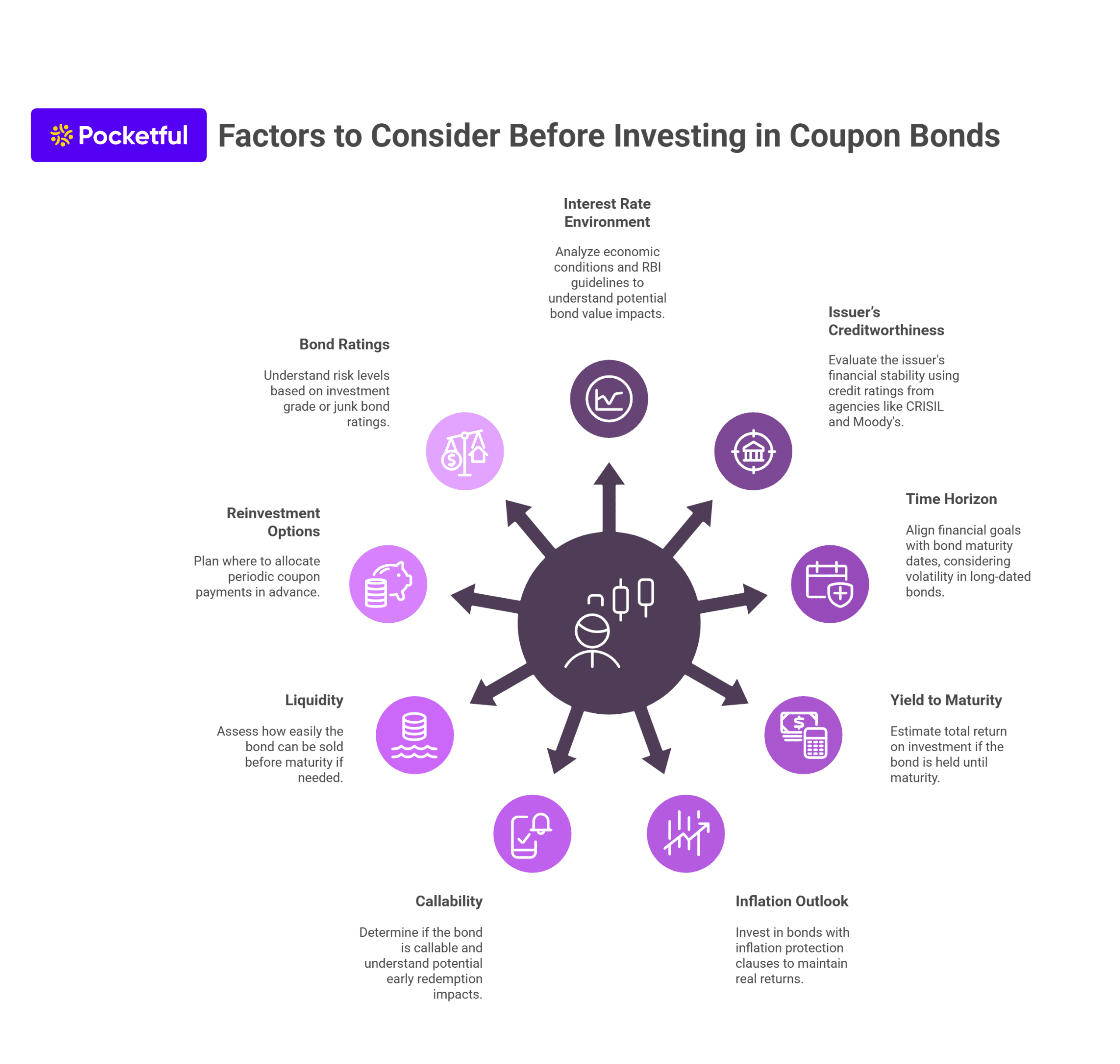

Factors to Consider Before Investing in Coupon Bonds

Various factors to consider before investing in coupon bonds are:

- Interest Rate Environment : Bonds values are negatively affected by an increase in interest rates, so check analyze economic conditions and RBI guidelines.

- Issuer’s Creditworthiness : Check CRISIL, ICRA, Moody’s or S&P rating of the bond issued and evaluate the issuer’s financial position.

- Time Horizon : Align your financial objectives with the bond maturity date. Long-dated bonds have greater price volatility due to changes in interest rates.

- Yield to Maturity (YTM) : An indicator which estimates the total return on investment if the bond is held till maturity.

- Inflation Outlook : Real returns = Nominal returns – Inflation. Invest in bonds that have an inflation protection clause attached.

- Callability : Verify if the bond is callable, if yes determine what call provisions may be attached. Early redemption of a callable bond adversely impacts returns.

- Liquidity : Ponder on the considerations of how simply the bond can be sold before the maturity date if the need arises.

- Reinvestment Options : Contemplate the possibilities where you intend to allocate the periodic coupon payments ahead of time.

- Bond Ratings : Bonds that are rated investment grade (BBB or above) are less risky, while those graded junk (BB or below) carry higher risk, but yield higher returns.

Read Also: Benefits of Investing in Bonds

Conclusion

Coupon Bonds are integral to the fixed income market as they provide a reliable income stream, preservation of capital, and diversification benefits. Though they are deemed safer than equities, one must appreciate the many factors and risks associated with these types of investments, such as, coupon rate, inflation, and credit risk of the issuer.

Assessing your financial objectives, income tax bracket, risk appetite, and the prevailing market conditions determine if coupon bonds are suitable for your investment portfolio or not. It is also important to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

How are coupon payments made?

Payments are transferred directly into the bank account of the investor on predetermined days.

Do coupon bonds give guaranteed returns?

If kept till maturity, coupon bonds offer regular interest payments and issuers also return principal back at maturity, given that the issuer doesn’t default.

Can coupon bonds be sold prior to maturity?

Sure, they can be sold in the secondary market, but their prices depend on prevailing economic conditions.

Are coupon bonds better than FDs?

Usually they provide better returns than FDs; however, they entail more risk than conventional fixed deposits.