Each metal plays a different role in the Indian metal industry and has its own importance. One of such metals is zinc, which is primarily used in the infrastructure sector for steel and iron galvanisation.

In today’s blog post, we will give you a zinc price prediction for the next 5 years in India, along with the historical trend and how you can invest in it with the Pocketful trading application.

Historical Trend of Zinc Prices in India

The long-term historical trend of zinc prices in India is as follows:

- Pandemic Era: During the pandemic era, the prices of zinc fell sharply because of reduced industrial demand.

- Recovery: Once the COVID period is over in 2021 and the economies reopen, the global demand improves, and zinc prices rise steadily.

- Consolidation: In early 2022, the zinc prices saw a strong upside movement, although the prices consolidated during the mid-year.

- Correction: After reaching a high in 2023, the prices of zinc corrected in 2023 because of the normalisation of demand and inventory.

- Recovery and Volatility: Towards the end of 2024, the prices of zinc showed volatility and reached the 3rd-highest annual levels seen in recent years.

- Steady Movement of Price: During the year 2025 zinc price saw a slightly lower price as compared to the highs of 2024, and it was influenced by global demand and supply.

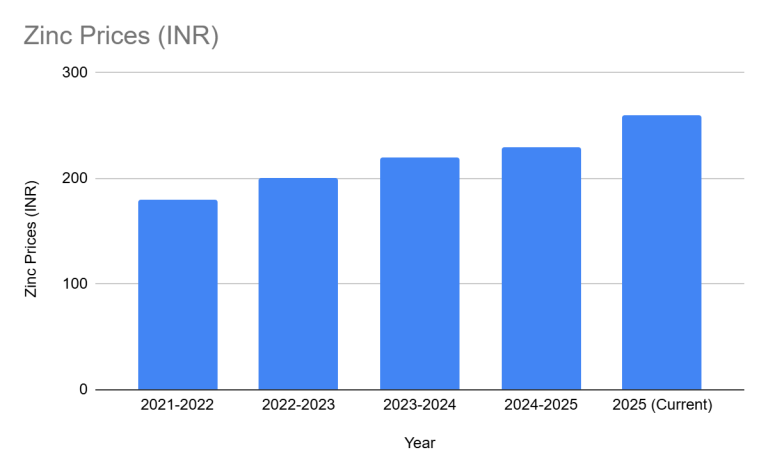

Past 5 Years Zinc Returns

| Year | Zinc Prices (INR) |

|---|---|

| 2021-2022 | 180 |

| 2022-2023 | 200 |

| 2023-2024 | 220 |

| 2024-2025 | 230 |

| 2025 (Current) | 260 |

Read Also: Silver Rate Prediction for the Next 5 Years in India

Next 5 Years Outlook of Zinc Prices in India

| Year | Expected Price (INR/KG) | Outlook | Key Factor |

|---|---|---|---|

| 2026 | 230 | Consolidation | As mining output increases, the world’s zinc supply is expected to remain strong, with a minor surplus. Demand is anticipated to recover slowly, and analyst projections indicate that prices will likely fall. |

| 2027 | 240 | Rebound | The demand for industrial and automotive galvanised steel is expected to increase, increasing prices as supply and demand ultimately balance. Infrastructure activity in the Asia-Pacific region, including India, is still strong. |

| 2028 | 260 | Increasing Price | Because of long-term structural demand due to urbanisation, the auto sector and supply constraints, zinc is expected to be costlier. |

| 2029 | 280 | Upside | Prices are inflated by demand from developing countries, increasing automotive galvanised steel usage, and higher infrastructure spending; weakening global zinc markets are expected. |

| 2030 | 300 | Upward Movement | Zinc has become more important in green technology and construction as a result of ongoing industrialisation and demand growth outperforming incremental supply expansion worldwide. |

Importance of Zinc Prices in the Economy

Zinc plays an important role in the economy as it is a key raw material for various industries such as infrastructure, construction, automobiles, and steel galvanisation. Lower zinc prices control the production and manufacturing cost of galvanised steel, which is used in different industries, and when the prices increase, it puts inflationary pressure on the economy. Zinc prices are also linked to the global commodity market; therefore, they also reflect industrial demand and trade activities, making them a major indicator of economic activities.

Read Also: Steel Price Predictions for the Next 5 Years in India

Factors Affecting Zinc Price

The key factor that affects the zinc prices in India is as follows:

- Demand and Supply: The prices of zinc depend upon the global demand and supply factors. Any deficit or surplus in supply can lead to volatility in the zinc prices.

- Infrastructure: The common use of Zinc is commonly used in galvanising steel to protect it from corrosion. Increased spending on infrastructure raises the demand for zinc in the economy, which eventually leads to an increase in the price of zinc.

- Mining Output: Production of zinc acts as a key factor in deciding the prices of zinc. Higher production will lead to a decrease in prices, whereas lower production will increase prices.

- Trade Policies: A certain portion of zinc is imported from other countries, hence any unfavourable trade policies can significantly impact the prices of zinc.

- Market Speculation: Investors’ expectations and speculative trading activities in the zinc market can lead to price volatility in zinc.

Should You Invest in Zinc Companies

One should invest in zinc companies because of the following reasons:

- Industrial Demand: Zinc is widely used for galvanising steel, which is primarily used in the infrastructure and construction sectors. Hence, any increase in these activities will push the demand high.

- Export: There are various producers of zinc in India who export zinc to the global market and have global exposure.

- Diversification: By investing in zinc-related companies, one can diversify their investment portfolio and reduce the risk in it.

- Government Policies: Due to the government spending on infrastructure-related activities and favourable trade policies, the companies engaged in distribution, production and marketing activities will benefit from such policies.

Read Also: Gold Rate Prediction for Next 5 Years in India (2026–2030)

Conclusion

On a concluding note, in India, zinc prices are expected to make new highs in the coming year, primarily driven by reasons like rising infrastructure activities, steel production, and increasing demand for galvanised products. While it might be possible that it may witness some volatility due to currency movements and other economic factors. One can invest in zinc companies for the long run by opening a lifetime free demat account with Pocketful, as it also offers zero brokerage on delivery trades. However, it is advisable to consult your investment advisor.

Frequently Asked Questions (FAQs)

How does the global zinc market affect prices in India?

India generally follows global zinc prices, based on the London Metal Exchange, and prices in India also include currency and logistics costs.

How can infrastructure activities affect zinc prices?

Steel is a key raw material for infrastructure activity, due to which the demand for zinc is increased as it is used in galvanisation.

What is the expected zinc price in India in 2026?

In 2026, zinc prices in India are expected to be around ₹230 per kg, with a consolidation trend due to increased global mining output and a slight supply surplus.

What is the expected zinc price in India in 2030?

The zinc price in India is expected to be around ₹300 per kg in 2030, supported by rising demand from infrastructure, construction, and green technology sectors, along with sustained industrial growth and relatively limited expansion in global zinc supply.

Is it a good time to invest in zinc companies?

Yes, it is a good time to invest in companies engaged in manufacturing, distribution of zinc, as the prices of zinc are expected to rise in the next five years.

Name some zinc-related companies in India?

Some of the zinc-related companies in India are Hind Zinc Limited, Vedanta Limited, Madhav Copper Limited, etc.

How to invest in zinc companies?

One can invest in zinc companies by opening a lifetime free demat account with Pocketful, as it also offers free brokerage on delivery trades along with advanced trading tools.