The Indian healthcare industry is booming, and in this dynamic landscape, EHSL has emerged as a major player in healthcare product distribution. The ongoing IPO subscription has drawn significant attention from investors and has sparked questions about their growth potential in the highly competitive market.

In today’s blog, we will explore the company and dive deep into the business model and the key IPO details.

Company Overview

The company was incorporated on January 10, 2018, as Entero Healthcare Solutions Private Limited by Prabhat Agarwal and Prem Sethi to create an organised, technology-driven, pan-India distribution platform for integrated healthcare products.

Entero is one of India’s largest and fastest-growing healthcare distribution platforms, with an operational presence across 495 districts through physical warehouses in 37 cities in 19 states and union territories.

Over the Financial Years 2021 to 2023, the company saw consistent growth, initially serving 39,500 retail and 1,600 hospital customers. By 2022, these numbers rose to 64,200 and 2,500, respectively. Furthermore, in 2023, they expanded their reach to 81,400 retail and 3,400 hospital customers, illustrating a steady increase in customer engagement.

Currently, the company operates in cities like Amritsar, Dehradun, Lucknow, Gurgaon, Jaipur, Guwahati, Hyderabad, Bombay etc.

IPO Details

- Entero Healthcare Solutions is a book-built issue of INR 1600 crore.

- The issue is a combination of a fresh issue of 1000 crore shares and an Offer For Sale (OFS) of 600 crore.

- The bidding for the IPO opened for subscription on February 9, 2024, and will close on February 13, 2024.

- The allotment is expected to be finalised on Wednesday, February 14, 2024.

- The temporary listed date is fixed as Friday, February 16, 2024, with a price band of INR 1195 to INR 1258 per share.

- The minimum lot size for an application is 11 shares with a minimum investment amount for retail investors standing at INR 13,838.

- The issue includes a reservation of up to 70,625 shares for employees offered at a discount of Rs 119 to the issue price.

- The company will utilise the IPO proceeds from the fresh issue.

- To partially or fully repay or prepay the borrowed amount.

- Fulfill the working capital requirements.

- General corporate purposes.

- ICICI Securities, JM Financial, and Jefferies India Private Limited are the book-running lead managers.

| IPO Date | February 9, 2024 to February 13, 2024 |

| Expected Listing Date | 16th February, 2024 |

| Price Band | INR 1195 to INR 1258 |

| Total Issue Size | 1,27,18,600 shares |

| Employee Discount | INR 119 per share |

| Listing at | BSE and NSE |

| IPO Type | Mainboard IPO |

| Issue Type | Book-Built Issue |

| Initiation of refunds | Thursday, February 15, 2024 |

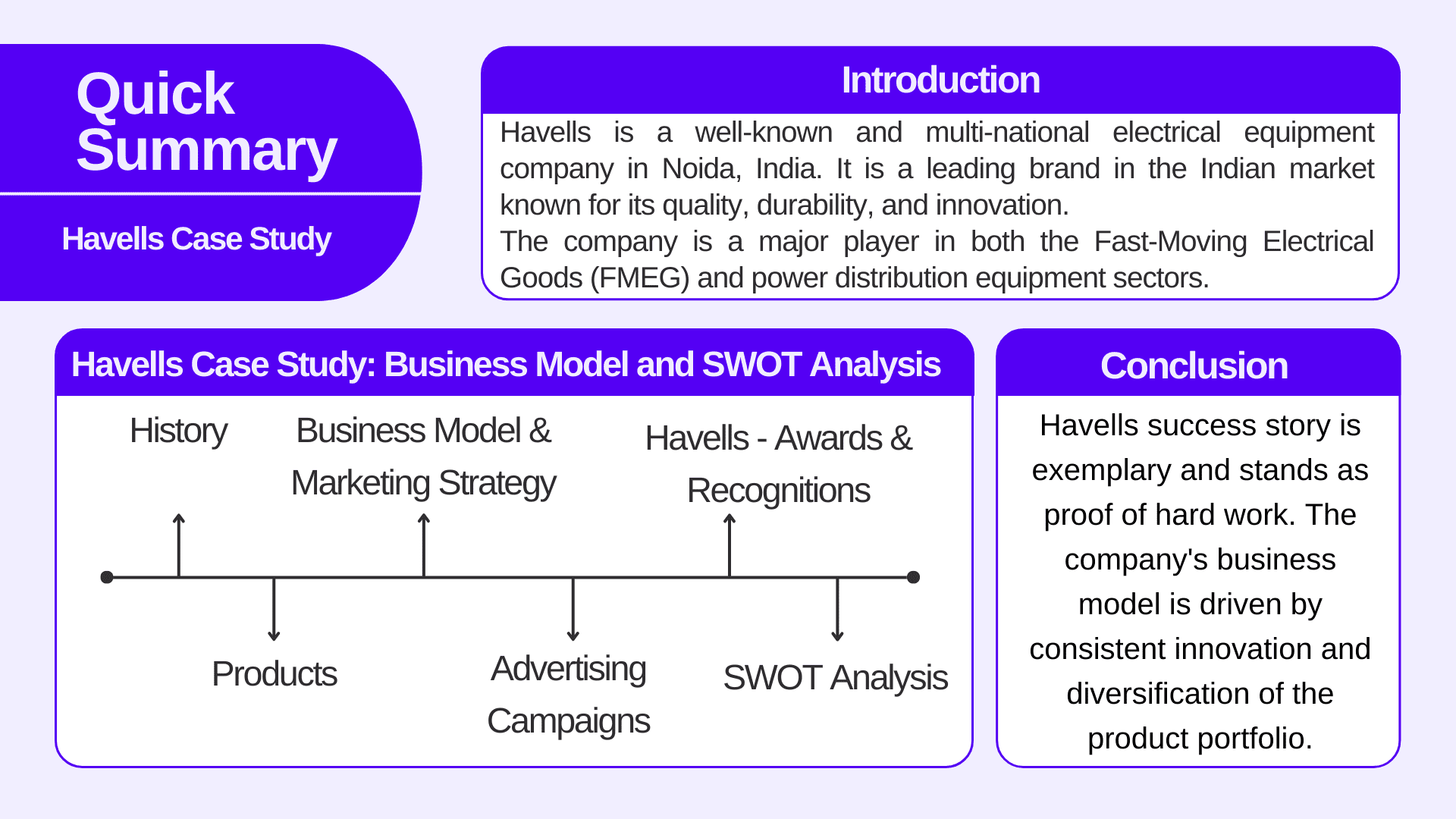

Business Model

The company operates under the two lines of business.

1. Primary Business

It involves distribution of healthcare products to retail pharmacies, hospitals, and healthcare clinics in India.

The company periodically buys the products in bulk from product manufacturers and then curates and offers a diverse product portfolio to retail pharmacies, hospitals, and healthcare clinics based on their requirements through its distribution network.

Healthcare Product Distribution – provide distribution and logistics services for healthcare products to retail pharmacies, hospitals and healthcare clinics in India. Such products are sourced from healthcare product manufacturers and sold to pharmacies, hospitals and clinics at margins over the cost of the products. The product range offered includes pharmaceutical products, medical devices, surgical consumables, OTC, nutraceuticals and vaccines.

Furthermore, the healthcare products distribution channel consists of retail distribution and hospital distribution.

Retail Distribution – the company’s retail distribution channel involves distributing healthcare products to pharmacies, who then sell these products to end customers. Supply a wide range of healthcare products, including pharmaceutical, nutraceutical OTC products, and medical devices, to pharmacies through a distribution network.

Hospital Distribution – EHSL distributes healthcare products to hospitals and healthcare clinics across India through the hospital distribution channel . The prices of the products are pre-determined in the contract between the hospitals and the suppliers.

Entero also supplies healthcare products to customers based on their orders, which are placed through the Entero Direct application or other order-taking applications or which have been communicated through salespeople or call centre representatives.

2. Ancillary Business

The segment can be broadly categorised into 2 further classifications.

- The provision of complete and integrated commercial solutions, including sales, marketing and supply chain solutions to pharmaceutical companies and healthcare product manufacturers.

- The sale of private label products and medical devices under their private label, Entero Surgicals.

Private Label Products

Entero Surgical comprises brands such as Carent, Entros, Entair, Safent and Glovent. The product categories under the private label products business entail homecare medical devices, surgical consumables, and rehabilitation products and devices. Furthermore, key private-label products include nebulizers, hygiene and surgical consumable products, homecare medical devices, gloves and mobility equipment.

Read Also: How to Cancel Mutual Fund SIP?

Future Outlook

The Indian healthcare market is expected to grow significantly in the coming years, driven by several factors like rising disposable income, increasing awareness about healthcare and an ageing population. Entero is well-positioned to capitalise on this growth with its strong business model, vast network and technology focus.

As of FY23, Entero Healthcare had a market share of 1.24% while making a revenue of 3,300.2 Crores. This indicates that the potential for growth is huge, and the company is poised for success if it continues to provide value to the end consumer.

Financial Highlights

| Particulars | As of March 31, 2023 (FY23) | As of March 31, 2022 (FY22) | As of March 31, 2021 (FY21) |

|---|---|---|---|

| Total Assets | 1,308.73 | 1,125.98 | 833.79 |

| Total Liabilities | 711.07 | 562.77 | 346.73 |

| Total Borrowings | 342.45 | 247.90 | 141.70 |

| Revenue | 3,305.72 | 2,526.55 | 1,783.67 |

| Net Profit/(Loss) | -11.10 | -29.44 | -15.35 |

| Revenue from Operations | 3,300.21 | 2,522.07 | 1,779.74 |

| Expenses | 3,309.41 | 2,546.36 | 1,794.51 |

| EBITDA | 21.55 | 24.44 | 64.01 |

| EBITDA Margin | 1.21% | 0.97% | 1.94% |

| ROCE | 1.88% | 1.49% | 6.05% |

EHSL has shown impressive revenue growth, which indicates a healthy financial track record, and its turnaround from losses, which have narrowed over the past three years, highlights improvement. The debt level might be a concern, but the company seems to be managing it effectively.

Strengths

- Benefit of consolidation – The company operates in a large and highly fragmented Indian healthcare products distribution market. This could prove beneficial for EHSL if they can consolidate such a fragmented industry.

- Growth – Entero is one of India’s largest and fastest-growing healthcare product distribution platforms with a major focus on network expansion and cost efficiency, catering to the needs of a wide range of customers.

- Large reach – In a matter of just 4 years, EHSL has reached 37 cities and employs 3040+ people. This indicates that it is no longer a small player.

- Industry growth – The healthcare market in India is expected to grow at 11% p.a. in the next 5 years. This opens up a long list of opportunities for EHSL to grow.

Risks

- High short-term borrowing – The majority of EHSL’s borrowing exists for the short term. This may not be a good sign, as failure to meet these payments could be catastrophic for the company.

- Competition – There are many players in the industry, and any of the behemoths can enter the industry and cause substantial damage to the bottom line figures.

- Negative Cash Flows – Historically, the company has had negative cash flows, and this trend could continue for some more years.

Awards & Recognitions

- ‘Best Healthcare Brand of 2021’ – Economic Times

- ‘Outstanding Performance’ Award for FY 2022-23 – Mankind Ltd.

- ‘Outstanding Performance’ – JB Chemicals Ltd.

- Recognised as ‘Maximiser 2022’ by Pfizer for improving access to quality medicine.

- Received ‘Outstanding Contribution’ Award – Alkem Laboratories Ltd.

Read Also: Rashi Peripherals Limited: IPO Analysis

Conclusion

Entero Healthcare Solutions boasts rapid growth, a sizable customer base and a well-established distribution network. The company’s turnaround from losses to profitability (11.6 Crores in 2Q24) highlights financial improvement over the years.

It is important to consider the risks and uncertainties before drawing any definite conclusions. The performance of the stock after listing will depend on various factors, including the overall market conditions and Entero’s competitive landscape. It is important to conduct your research and analysis before investing in any IPO.

Frequently Answered Questions (FAQs)

What is the expected use of proceeds from the IPO?

The proceeds from the IPO will be used to repay the borrowings and fulfill the working capital requirements.

Who are the major competitors of the EHSL?

The company faces tough competition from Mankind Pharma, Max Healthcare, and Apollo Pharmacy.

What is the minimum investment amount for the IPO?

The minimum lot size is 11 shares, with an investment amount of INR 13,838.

What are the risks of investing in EHSL?

Some analysts consider the pricing aggressive, and the company has a relatively short track record compared to other established players.

Should I invest in EHSL?

This depends on your individual risk tolerance and investment goals, and do your research before investing.