Craving a crispy treat that speaks to your Indian taste buds? This Gujarat-based company has been a leader in the snacking game for over a decade. From the ever-popular ‘gathiya’, a fried gram flour snack, to a diverse range of delicious offerings, the company caters to every craving.

So, settle in and grab your favourite snack while we dive deep into the company’s financials, strengths, key risks, and upcoming IPO details.

Gopal Snacks IPO Overview

Gopal Snacks is an Indian fast-moving consumer goods (FMCG) company based in Rajkot, Gujarat. The company sells and manufactures a variety of snacks and other products. They are the fourth largest brand in the organised sector of ethnic savouries in India in terms of market share and the largest manufacturer of ‘gathiya’ and snack pellets in terms of volume. They sell their products in 10 states and 2 Union Territories of India.

The company was established in 1999 by Bipin Hadvani as a partnership firm with Gopal Gruh Udhyog and was converted into a corporate entity in 2009.

The company’s manufacturing plants are located in Rajkot, Nagpur, and Modasa, Gujarat. The installed manufacturing capacity of the plants cumulatively (as of September 30, 2023) is 4,04,729 tons per annum, whereas the primary facility holds a manufacturing capacity of 3,03,669 tons (for finished products).

Gopal Snacks IPO Segments

Gopal Snacks manufactures ‘ready-to-eat’ packaged snacks, which include:

1. Ethnic snacks – Over 65% of Gopal’s revenue in FY 2023 came from their namkeen segment and ethnic namkeen achieved a sales volume of approximately 27,630 tons.

2. Western Snacks – wafers, nachos, extruder snacks, and snack pellets constitute the western snacks category. This category offers flexibility to meet a variety of tastes. Since the product is semi-finished and unexpanded, it allows for customisation during the final preparation stage. By adding different spices and ingredients, manufacturers can create products that cater to the specific demand of the end users.

3. Other products – The category includes gram flour or besan, papad, powdered spices, noodles, washing bars, and packaged sweets such as soan papdi, rusk, and chikki.

The company has also introduced its product line offering premium wafers under the brand name ‘Cristos Gopal’ and extruder snacks under ‘Cornigo’.

Additionally, Gopal Snacks holds 276 Stock Holding Units (SKU) in its portfolio and is the first company to launch gram flour in INR 10 SKU.

The varieties offered in the Gathiya segment by Gopal Snacks create a strong competitive advantage over other established players in the segment. Gopal’s Gathiya offerings include Vanela Gathiya, Fulvadi Gathiya, Tikha Gathiya, Papdi Gathiya, Tikha Papdi Gathiya, Bhavnagari Gathiya, Champakali Gathiya, and Nylon Gathiya.

Gopal Snacks IPO Presence

In addition to Gujarat, the company holds a strong presence in the states of Maharashtra, Uttar Pradesh, Madhya Pradesh, and Rajasthan with a distribution network of 617 distributors.

The company is strategically increasing its pan-India presence, by focusing on states of Northern India like Uttar Pradesh, Rajasthan, Haryana, and Delhi and Southern India states like Karnataka and Telangana. Gopal Snacks Owner also plans on selling their products to countries like Australia, Kuwait, Saudi Arabia, UAE, and the USA through both direct exports and merchant exporters.

To sum it up, the company’s product portfolio includes 84 products which include 8 types of gathiya, 31 types of namkeen, 12 types of snack pellets, 8 flavours of Wafers, 4 types of Papad, 6 types of spices, 5 types of extruded snacks, and 9 other products.

Did You Know?

Gopal Snacks reigns supreme as India’s Gathiya king, holding a whopping 31% market share in FY 2023.

Read Also: Pune E-Stock Broking Limited IPO: Key Details, Business Model, Financials, Strengths, and Weaknesses

Key IPO Details

| IPO Date | March 6, 2024 to March 11, 2024 |

| Price Band | INR 381 to INR 401 per share |

| Lot size | 37 Shares |

| Total Issue Size | 16,209,476 shares |

| IPO Type | Main-board IPO |

| Issue Type | Book Built Issue IPO |

| Listing Date | Thursday, March 14, 2024 |

| Initiation of Refunds | Wednesday, March 13, 2024 |

| Employee Discount | Rs 38 per share |

Objectives of the Issue

The company will not receive any proceeds from the Offer (the “Offer Proceeds”), and the Selling Shareholders will receive all the Offer Proceeds in proportion to the Offered Shares sold by the respective Selling Shareholders.

The company’s promoters are Bipinbhai Vithalbhai Hadvani, Dakshaben Bipinbhai Hadvani and Gopal Agriproducts, and the pre-issue promoter shareholding stands at 93.50%.

Financial Statements Analysis

Key Metrics

| Key Metrics | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|

| Total Assets | 461.28 | 399.72 | 341.89 |

| Total Liabilities | 170.40 | 222.06 | 206.15 |

| Total Income | 1,398.53 | 1,356.47 | 1,129.84 |

| Total Expenses | 1,246.69 | 1,302.41 | 1,103.34 |

| Profit After Tax | 112.36 | 41.53 | 21.12 |

| EBITDA | 196.22 | 94.79 | 60.35 |

Key Margins and Ratios Analysis

| Key Ratios | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|

| Gross Margin | 28.38% | 20.61% | 18.13% |

| EBITDA Margin | 14.07% | 7.01% | 5.35% |

| PAT Margin | 8.06% | 3.07% | 1.87% |

| ROE | 38.63% | 23.38% | 15.56% |

| ROCE | 43.08% | 18.69% | 13.48% |

| Debt-to-Equity ratio | 0.37 | 0.92 | 1.02 |

| Net Fixed Asset Turnover Ratio | 6.27 | 6.86 | 7.14 |

Cash Flow Statements

| Cash Flows | FY 2023 | FY 2022 | FY 2023 |

|---|---|---|---|

| Cash flow from/ (used in) operating activities | 121.52 | 58.59 | 22.43 |

| Cash flow from/(used) investing activities | (25.12) | (74.03) | (75.67) |

| Cash flow from/(used in) financing activities | (68.83) | 11.75 | 57.50 |

Gopal Snacks IPO Strengths

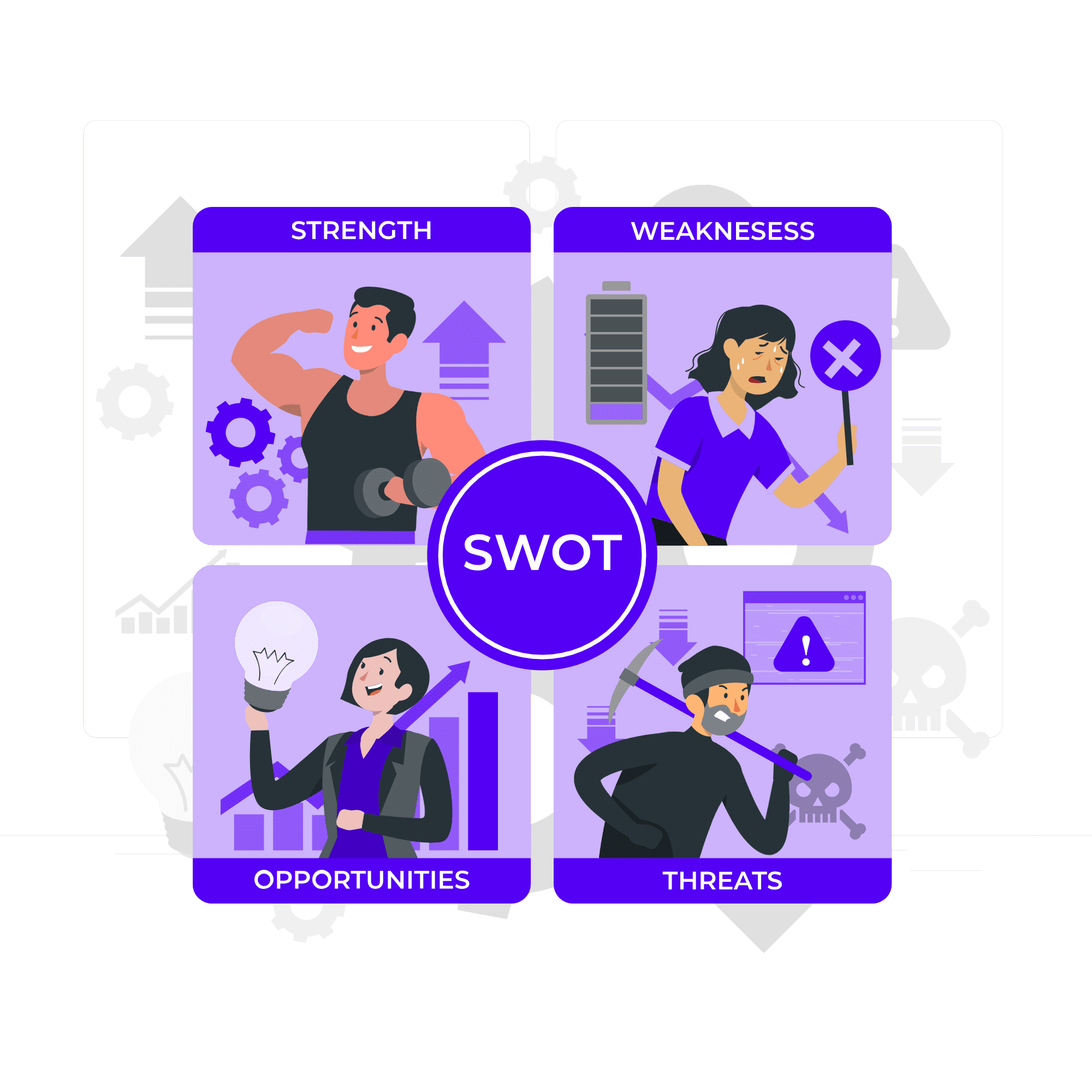

- Gopal Snacks is a national leader in ethnic savouries, ranking India’s fourth-largest brand and offering quality and affordable products. Also, the company has a strong brand image, which allows it to stand out in a competitive market.

- The company boasts a diverse product portfolio, perfectly positioned to capitalize on the booming Indian snack market.

- The company owns six manufacturing facilities, comprising three primary and three ancillary manufacturing facilities. These manufacturing facilities are focused on processing, manufacturing, and packaging the products.

- Gopal Snacks’ comprehensive distribution network ensures their products are conveniently located near you, making it easy for customers to satisfy their snack cravings.

- The company is guided by a team of experienced promoters and managers bringing knowledge and expertise.

Gopal Snacks IPO Weaknesses

- The Indian FMCG market, especially the snack segment, is highly competitive. Gopal Snacks faces tough competition from established players and new entrants, both domestic and international.

- The company’s dependence on raw materials and packaging can be risky. Any shortages, disruptions, or price swings could affect the profits and cash flows.

- An inefficient management of the distribution network could severely impact the business.

- Food safety is paramount. Any contamination issues or product recalls could damage the brand image and lead to a decline in sales.

- The food industry is subject to several regulations. Changes in regulations or difficulty complying with existing regulations could pose challenges for Gopal Snacks.

Read Also: Bikaji Foods Case Study – Product Portfolio, Financial Statements, & Swot Analysis

Conclusion

On a parting note, Gopal Snacks Limited is a rising company. With solid market positioning, experienced leadership and a diversified product portfolio, the company holds a strong foundation for future growth. The IPO could be a springboard for further expansion and innovation. However, it is crucial to know the risks involved before making any investment decisions.

Frequently Asked Questions (FAQs)

What are Gopal Snacks famous for?

The company is known for their wide range of delicious snacks, specifically gathiya and ethnic namkeens.

How has Gopal Snacks adapted to changing consumer trends?

The company has consistently evolved its offerings, incorporated healthier ingredients, and stayed updated on changing consumer needs for a wholesome snacking experience.

Who are Gopal Snacks’ competitors?

The company faces tough competition from Bikaji, Haldiram’s, Britannia, etc.

How can I benefit from Gopal Snacks IPO?

Investors can join the growing snack industry and reap the rewards as Gopal Snacks expands its market presence.

Beyond ‘gathiya’, what else does the company offer?

Gopal Snacks offers a diverse range of ethnic namkeens, from spicy to mild.