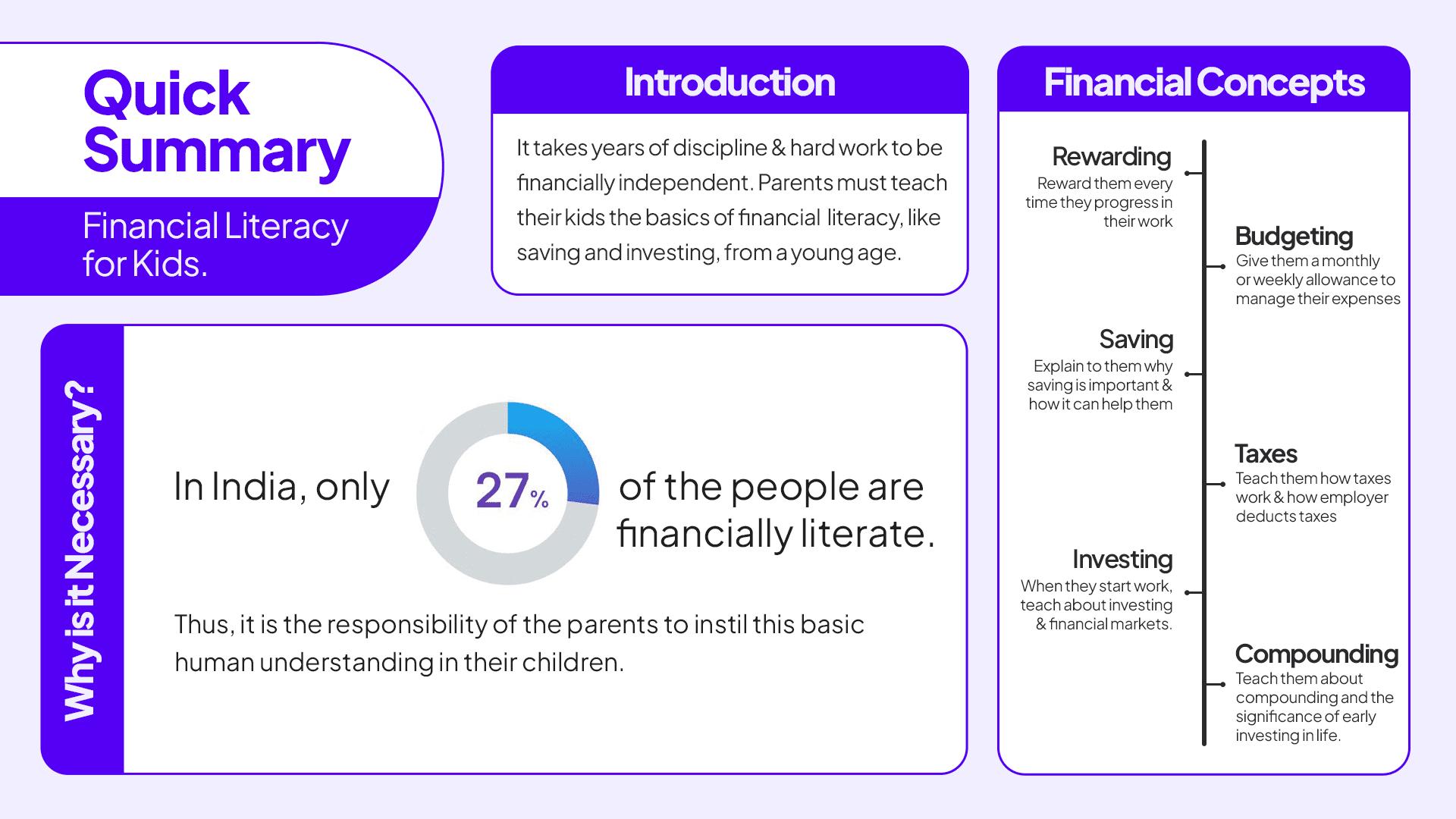

Where to invest? How much to invest? Should I go with investing in stocks, or should I go with bank fixed deposits?

These questions commonly arise whenever you have an ample amount of money and you are economical. In this blog, we will explore the difference between investing in stocks and fixed deposits. Before we learn about the key differences between stocks and fixed deposits, let’s have some basic ideas about financial planning. What is financial planning, and why do we need financial planning?

Financial Planning means channelling one’s income into consumption and savings, where consumption is defined as the unavoidable expenditure incurred by an individual on his basic needs, and the residual amount after spending is known as savings. The savings can be used to meet the financial goals.

Types of Saving Instruments

In a country like India, saving instruments can be divided into two parts

- Traditional Savings instrument

- Investments

Most people in India generally opt for traditional savings instruments because there is a lack of financial literacy. Some of the most common traditional methods to save are listed below.

- Fixed deposits

- Recurring Deposits

- Post Office

Some of the most widely used new-age investment options apart from traditional saving instruments are

- Stocks

- Mutual Funds

- Commodities

Now, let us dig deep into the concept of the most used methods of traditional and modern investing i.e., Fixed Deposits and Stocks.

What are fixed deposits?

Let’s make it easy, simplified and crisp with a short example.

Suppose, you received a Diwali Bonus of Rs.50000, and instead of buying something expensive, you decided to go for a Fixed Deposit. Now you will visit your nearest bank branch and will deposit your money to earn some amount of interest and will just sit back for some years. You will reach out to the bank once again when your Fixed Deposit matures to get your principal amount as well as the interest that you have earned over the years.

Therefore we can say that fixed deposit (FD) is a tenured deposit account provided by banks or NBFCs (Non-banking financial companies ) which provides investors with a higher interest rate than a regular savings account until the given maturity date. Investment in fixed deposits is considered a risk-free investment.

Merits & Demerits of Investing into FDs

There are certain merits and demerits of saving your money in FDs

Merits of Investing in Fixed Deposit

1. Guaranteed Rate of Interest

2. Easy to Monitor

3. Tax Benefits

4. Loan Against FD

5. Flexible Period

6. Better option for senior citizens

Demerits of Fixed Deposits.

1. May not beat inflation

2. Lower rate of return

3. Penalty on pre-mature withdrawal.

4. Lack of re-investment opportunity.

Taxation of Fixed Deposits in India (Example):

In India, the interest income earned from fixed deposits is subject to taxation under the Income Tax Act. Here’s a simplified example to explain how FD interest is taxed. Suppose Mr. Y has a bank FD of Rs.1 lakh and as per the current rate he is earning an interest 6.5% per annum on his FD, which amounts to 6500 (6.5% of 1 lakh). Now he is liable to pay tax on 6500 as per his income slab. By now, you must have understood the basics of Fixed Deposits. Now let’s throw some light on the most discussed yet so undervalued concept of investing i.e., stocks

What do you mean by investing in stocks?

A stock, also known as equity, represents a part of an individual’s ownership in a corporate or government company. Investing in stocks carries a level of higher risk because the value of a stock can be influenced by various factors, including the company’s financial performance, economic conditions, and market sentiment. However, stocks have historically offered higher returns compared to other investment options. Many investors choose to build a diversified portfolio of stocks to spread their risk. Diversification involves owning a basket of stocks from different sectors to reduce the impact of poor performance in any one stock. Stocks can be diversified into large-cap, mid-cap and small-cap companies

Large-cap

Companies are generally growth-oriented companies that are considered safer while investing. They are less risky and give lower returns than other companies since risk and reward in the stock market go hand in hand.

Mid Cap

Companies possess higher risk when compared with large-cap companies and they are suggested for investors who are well-versed with the concept and idea of investing in stocks.

Small cap

Companies carry higher risk since they are start-ups, having good potential to perform in longer investment horizon.

Read Also: Which is Better: Fixed Deposit or Residential Property Investment

From where can we buy or sell stocks?

Stocks are bought and sold on stock exchanges, organized marketplaces where buyers and sellers join together to trade. Stock exchanges in India are NSE and BSE. If we talk about the returns of the stock market, they are highly volatile and are dependent on the performance of the market. If you are planning to invest in stocks from the point of view of the short term, then be ready for the volatility you might face. Still, if you stay invested for a longer horizon, the market will surely reward you for your patience with outstanding higher returns, which can fight inflation.

Taxation of Equity in India

Just like taxation on FDs, stocks are also subject to tax deductions. The taxation on equity is divided into two parts, the first being the short-term capital gain and the second being the long-term capital gain.

- Short-Term Capital Gain

The realized gain within 365 days of investing is considered short-term and taxable at 15%.

- Long-Term Capital Gain

The realized gain after 365 days of investing is considered long-term and is taxable at 10% over and above 1 Lakh.

Merits & Demerits of Stocks

Now, let’s discuss the merits and demerits of investing in stocks.

Merits of investing in stocks

1. Inflation rate adjusted Returns

2. Dividend income

3. Liquidity

4. Tax benefits

5. Wealth creation

Demerits of investing in stocks

1. Volatility of markets

2. Higher Risk of Loss

3. Brokerage

In India, 3% of the current population is investing in stock markets and we hope that with our blogs we will be able to make our upcoming population financially more aware.

After having an overview of the basics of Fixed Deposits and stocks.

We can now easily create a table of differences between stocks and FDs.

| Basis of Difference | Fixed Deposit | Stocks |

|---|---|---|

| Liquidity | It has very little liquidity as compared to stocks. | Stocks have high liquidity. |

| Risk | Investment in Fixed Deposit is considered risk-free. | Investment in stocks possesses higher risk. |

| Investment Horizon | Pre-decided investment horizon. | Suggested for individuals having high-risk appetites. |

| Rate of Interest (Return) | Guaranteed | Market Linked |

| Taxation | Interest is fully taxable. | Long |

| Expenses | No expenses | Transaction Cost |

| Inflation Rate | Returns of FD may or may not beat inflation. | It offers inflation-adjusted returns. |

| Duration of investment | Generally suggested for the shorter horizon. | It is suggested for individuals having long-term investment horizons. |

Read Also: A Guide To Fixed Deposits: Exploring Types And Interest Rates

Conclusion

Therefore, it is always suggested to select between the two as per your investment objective, financial goal and risk appetite. Eventually, there is no one-size-fits-all answer, and the optimal choice depends on your preferences. Do not forget to consult a financial planner to tailor your investment strategy if you are confused.

Frequently Answered Questions (FAQs)

Which is considered safer, Fixed deposits or stocks?

Fixed deposits are generally considered safer as they provide a fixed return.

Which investment option offers higher returns between stocks and FDs?

Stocks offer higher returns than FDs.

Who provides FDs?

Banks and Non-Banking Financial Institutions provide FDs.

What is STCG in stocks?

STCG in stocks stands for short-term capital gains, which are 15% of your realized gains.

Who decides the interest rate on FDs?

Banks and NBFCs decide interest rates on FDs, which vary from bank to bank.