Aluminium prices in India are closely tied to how the real economy behaves. When construction slows, prices soften. When factories run at capacity and power costs rise, prices slowly move up. This is why aluminium rate prediction for next 5 years in India matters more for planning than for speculation.

For businesses, the concern is not daily price movement. It is whether aluminium remains affordable for contracts, projects, and manufacturing cycles. The same thinking extends to the aluminium rate in 2030 in India. It is a metal where the long-term demand and cost pressures are expected. And these will play a larger role than short-term market sentiment.

Hence, knowing the expected aluminium rate in 2030 in India is important. So, read this guide to know everything you need.

Why Demand for Aluminium Is Rising in India

Aluminium demand in India is increasing. It is mainly because of the various uses of the same. Starting from the household to industries, aluminium is used everywhere. This is one of the reasons why everyone is concerned about its pricing in the future.

This is not a trend but the truth that you must know. It is a gradual shift driven by cost, efficiency, and availability. This sustained usage has a direct impact on aluminium price predictions for next 5 years, as demand rarely drops sharply once it is established.

1. Infrastructure Expansion

India is in the phase of consistent and sustainable development. This is increasing the demand for aluminium. Starting from highway projects to construction, the projects are many. Once these projects begin, aluminium demand does not end quickly.

It continues for several years through construction, expansion, and upgrades. Even during periods when new project launches slow down, maintenance work and network extensions keep consumption steady.

2. Automobiles And Electric Vehicles

Vehicle manufacturers are using more aluminium currently. This is aimed to reduce overall weight and comply with efficiency norms. This shift has been gradual, not sudden. Electric vehicles add another layer of demand.

Aluminium is used extensively in battery casings, body panels, and structural components. This demand is linked to production capacity and platform design. But the demand is comparatively stable in nature.

3. Manufacturing And Packaging

Aluminium is widely used in appliances, industrial equipment, and packaging. This is because it offers a practical balance between strength and cost. As the consumption is rising, the demand for stable and good aluminium products is also on rise.

Packaging demand, in particular, tends to remain stable. This is applicable even during economic slowdowns, which helps keep aluminium usage consistent.

4. Renewable Energy And Power Sector

Solar panels, wind turbines, and power grid expansion rely on aluminium components. With the increase in the adoption of renewable projects, the demand for aluminium is also on rise. This works alongside the capacity building process.

This demand is driven by policy commitments and infrastructure planning, not short-term market sentiment, which gives it long-term visibility.

5. Shift Toward Recyclable And Lightweight Materials

Aluminium is easy to recycle and does not lose quality in the process. Many industries prefer it to manage long-term material costs. This preference is driven more by economics than sustainability branding, which makes the demand reliable and repeat-driven.

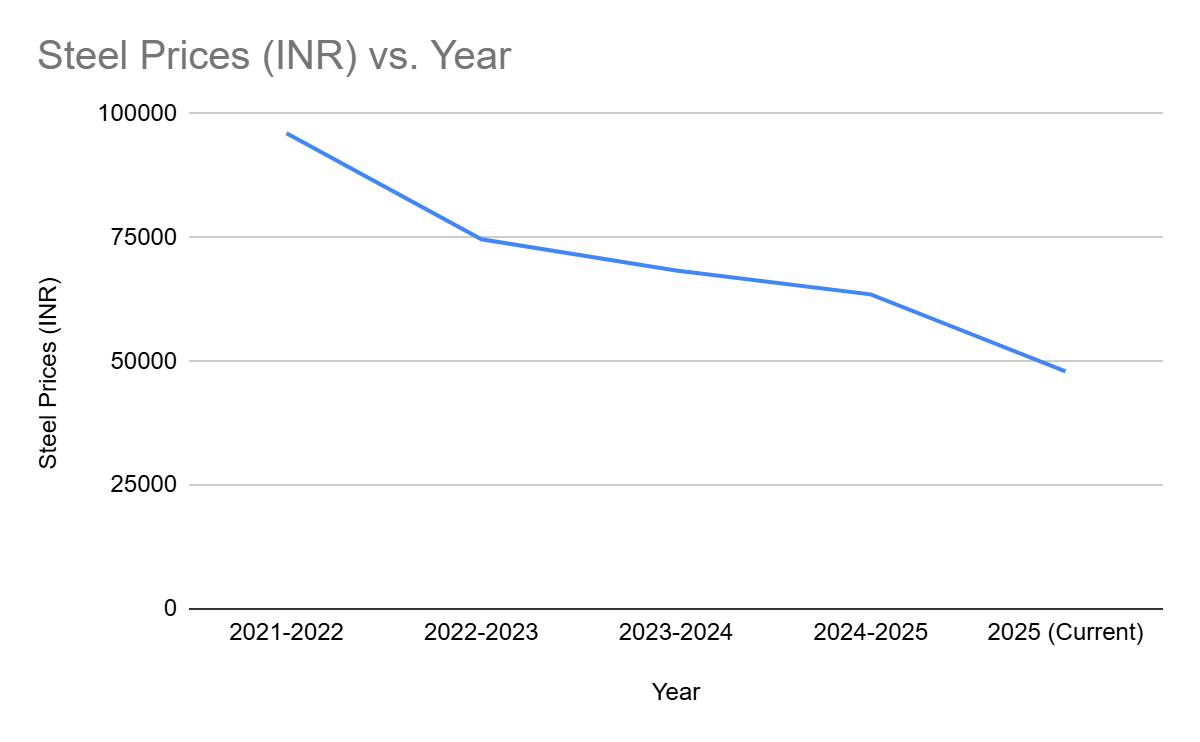

Next 5 Year Outlook of Aluminium Prices

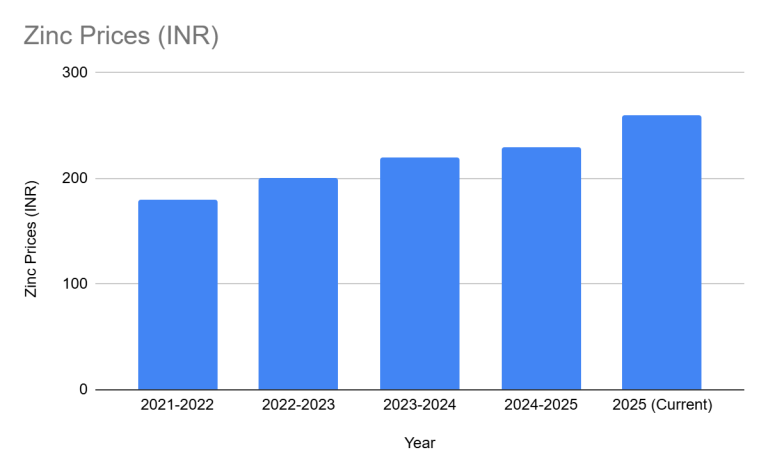

| Year | Expected Price (INR/kg) | Market Phase | Directional Outlook | Key Factors Driving the Outlook |

|---|---|---|---|---|

| 2026 | 250.00 | Tightening / Early Upswing | Slightly Upward | Analysts expect the global aluminium market to move from surplus toward deficit. Demand is projected to outpace smelter capacity, while trade barriers and constrained Chinese supply tighten availability. Several forecasts point to prices nearing USD 3,000 per tonne, though selective capacity additions in other regions may lead to consolidation in rupee terms. |

| 2025 | 260.00 | Cyclical Strength | Upward | Rating agencies and banks have revised medium-term price assumptions higher, reflecting continued market tightness. Infrastructure spending, energy transition demand, and transport usage remain strong, while new capacity additions stay constrained by power costs and carbon policies. |

| 2028 | 275.00 | Moderation / Controlled Growth | Moderately Upward | Structural demand from construction, packaging, power, and transport continues to rise. At the same time, higher recycling rates and gradual capacity expansion begin to ease supply pressure, limiting sharp spikes but keeping prices firm. |

| 2029 | 290.00 | Upside Bias | Upward | India-specific demand from construction, electric vehicles, and renewable energy is expected to remain strong. Rising domestic consumption, combined with disciplined global supply and limited low-cost expansions, supports further upside in prices. |

| 2030 | 310.00 | Premium Segment | Upward With Premium | By 2030, aluminium demand is expected to be structurally higher than previous cycles. Decarbonisation policies, carbon taxes, and net-zero commitments are likely to create a premium for low-carbon or green aluminium, even as overall demand remains significantly above 2020 levels. |

India Aluminium Market Outlook Toward 2030

India’s aluminium market is expanding due to real demand. In 2023, the market was valued at USD 11.28 billion. It is expected to reach USD 18.84 billion by 2030. This is growing at a 7.6% CAGR. This growth reflects steady usage. This is across construction, automobiles, packaging, and electronics.

The main reasons for why businesses use aluminium more is:

- Light weight in nature

- High strength

- Corrosion resistance is great

This makes it a durable material for various industrial needs. On the supply side, better production methods and higher recycling are also helping this. It is bringing in efficiency and sustainability. These changes are building a strong base for long-term growth as India moves closer to 2030.

What to Expect From Aluminium Rate in 2030 in India

By 2030, aluminium prices in India are unlikely to behave like a speculative commodity. Here is what the aluminium rate in 2030 in India may realistically look like.

1. Prices Likely to Stay Supported by Demand

Infrastructure and other projects demand the consistency supply of raw material and that too with long-term commitments. These sectors consume aluminium continuously and so support consistent demand for aluminium.

2. Energy Costs Will Continue to Shape Pricing

Electricity is the single largest cost in aluminium production. If there is a rise in the cost of power, the cost of production increases. This will impact the entire cost and the efficiency improvement might soften the impact greatly.

3. Sharp Price Collapses Are Unlikely

Aluminium demand in India is spread across multiple sectors. When one slows, others usually continue operating. This balance reduces the risk of deep and prolonged price falls by 2030.

4. Domestic Supply Will Matter More Than Ever

If domestic production capacity grows alongside demand, prices become easier to manage. However, any continued dependence on imports means global prices and currency movement will still influence Indian rates.

5. Growth Expected to Be Gradual, Not Aggressive

The aluminium rate in 2030 in India is more likely to show controlled growth. This will mainly be due to the long-term and steady contracts that are in place. But keeping an eye on volatility is important.

Factors That Influence Aluminium Prices In India

Aluminium prices do not change overnight. They move gradually, based on costs and availability. When analysing aluminium price predictions for next 5 years, these factors explain most long-term price movement.

1. Global Price Direction

Indian aluminium prices follow global metal markets. When global prices rise, imports become expensive and domestic prices usually move up. When global demand weakens, prices ease.

2. Power And Energy Costs

Aluminium production uses a lot of electricity. Higher coal prices or power tariffs raise production costs. This is then eventually reflected in selling prices.

3. Domestic Demand From Key Sectors

Construction, power, transport, packaging, and manufacturing consume aluminium regularly. Strong demand from these sectors helps prices stay supported.

4. Government Policies And Regulations

Import duties, export controls, and environmental rules affect supply. Policy changes can either stabilize prices or create short-term pressure.

5. Currency Movement

A weaker rupee makes imported aluminium costlier. Even if global prices remain flat, domestic rates can rise due to currency impact.

Read Also: Gold Rate Prediction for Next 5 Years in India (2026–2030)

What This Growth Means for Aluminium Prices in the Coming Years

As India’s aluminium market grows, prices are more likely to move steadily than sharply. This will be mainly from the rising demand from the infrastructure, transport, and manufacturing sectors. This kind of demand does not disappear quickly, which helps prevent sudden price drops.

At the same time, production costs continue to influence rates. Power and energy remain major expenses for aluminium producers. But if all these are controlled and managed, the demand for aluminum will rise. Also, businesses and investors will see a consistent price as well which will make investing worthy.

Read Also: Silver Rate Prediction for the Next 5 Years in India

Conclusion

Aluminium prices in India are moving in line with long-term economic activity rather than short-term market noise. This showcases that there will be consistent changes in the prices which will impact the economy as well. And this is why investors and businesses need to keep an eye on the changing rates consistently.

Knowing the aluminium rate in 2030 in India is just the start. And if you wish to know more such details, use Pocketful. It can help you follow price movements and analyse market signals. This will help make better-informed decisions with clarity and confidence.

Frequently Asked Questions (FAQs)

Is aluminium demand expected to grow in India over the next decade?

Demand is expected to grow steadily. This will be mainly due to the increasing demand of aluminium in infrastructure, automobile, and other projects.

Will aluminium prices be very volatile in India in the coming years?

Extreme volatility is unlikely. Prices may fluctuate, but broad-based demand and long-term consumption patterns should help keep movements gradual.

How do power costs affect aluminium prices in India?

Aluminium production depends heavily on electricity. When power and fuel costs rise, production becomes expensive. This will make the market prices also high.

Does India rely heavily on aluminium imports?

India has strong domestic production, but imports still play a role. Global prices and currency movement can influence domestic aluminium rates.

Is aluminium suitable for long-term business planning?

Yes. Aluminium demand is spread across multiple sectors, making it relatively stable and suitable for long-term cost and procurement planning.