Retail investors are always looking for new investment opportunities. They always try to copy a famous investor’s portfolio. Mukul Agarwal is one such investor who holds a portfolio of 6000-7000 INR.

In today’s blog post, we will give you an overview of Mukul Agarwal’s Portfolio, along with the learning from his portfolio.

Who is Mukul Agarwal?

Mukul Agarawal is one of India’s most famous investors. He has been actively investing in stocks for the past several years. According to reports, he holds a large portfolio of stocks worth nearly 7,000 crores. He often uses an aggressive style of investing and primarily invests in mid and small-cap stocks.

Career of Mukul Agarwal

Mukul Agarwal started his career in the late 90s by trading unlisted IPOs and earned lakhs of INR. He founded Param Capital in 1993, which primarily focused on managing private and public portfolios. He also founded Agarwal Corporates in 1993 to focus on financial education and workshops on the equity market, while continuing to provide consultancy services to clients. Param Capital invests the amount in both small-cap companies and private unlisted companies’ equity. In 2022, he founded Finowing, which is primarily a training academy. This holds a Guinness World Record in organising a large “Financial Freedom Conclave”.

List of Mukul Agarwal Portfolio

| Stock | Holding Value | Qty Held |

|---|---|---|

| IFB Industries | 88.2 Cr | 500,000 |

| Kilitch DrugsI | 8.4 Cr | 235,000 |

| N R Agarwal Industries | 17.2 Cr | 340,000 |

| Protean eGov Tech | 50.9 Cr | 600,000 |

| Osel Devices | 90.6 Cr | 1,338,400 |

| Solarium Green Energy | 18.0 Cr | 600,000 |

| Unified Data Tech Solutions | 45.6 Cr | 1,055,000 |

| Laxmi Finance | 27.4 Cr | 2,000,000 |

| Vikran Engineering | 32.7 Cr | 3,000,000 |

| Zelio EMobility | 14.8 Cr | 424,000 |

| ASM Technologies | 579.1 Cr | 1,500,000 |

| Tatva Chintan Pharma | 74.5 Cr | 500,000 |

| Monolithisch | 32.7 Cr | 600,000 |

| Zota Healthcare | 402.0 Cr | 2,516,989 |

| WPIL | 57.8 Cr | 1,500,000 |

| PDS | 130.9 Cr | 3,362,589 |

| Sirca Paints | 74.6 Cr | 1,433,421 |

| OneSource Specialty Pharma | 207.8 Cr | 1,200,000 |

| Pearl Global | 135.0 Cr | 800,000 |

| Oriental Rail | 54.4 Cr | 3,400,000 |

| InfoBeans Tech | 61.2 Cr | 1,000,000 |

| Kingfa Science | 128.1 Cr | 300,000 |

| Stanley Lifestyles | 16.8 Cr | 700,000 |

| Vasa Denticity | 23.8 Cr | 410,000 |

| Ajmera Realty | 74.8 Cr | 759,493 |

| LT Foods | 161.0 Cr | 3,900,000 |

| Valor Estate | 95.1 Cr | 6,500,000 |

| Deepak Fertilisers | 211.7 Cr | 1,500,000 |

| Allcargo Gati | 46.2 Cr | 7,000,000 |

| Hind Rectifiers | 39.0 Cr | 250,000 |

| Indo Count | 77.3 Cr | 2,500,000 |

| India Metals & Ferro Alloys | 82.2 Cr | 599,329 |

| Jammu & Kashmir Bank | 150.1 Cr | 14,000,000 |

| Jagsonpal Pharma | 24.3 Cr | 1,157,557 |

| J Kumar Infraprojects | 121.5 Cr | 1,975,000 |

| MPS | 171.1 Cr | 762,457 |

| Neuland Laboratories | 698.4 Cr | 400,000 |

| Prakash Industries | 45.4 Cr | 3,083,177 |

| Radico Khaitan | 456.4 Cr | 1,400,083 |

| Sarda Energy & Minerals | 207.2 Cr | 4,000,000 |

| Strides Pharma | 100.6 Cr | 1,066,000 |

| Surya Roshni | 60.5 Cr | 2,200,000 |

| Wendt | 41.3 Cr | 50,000 |

| West Coast Paper | 38.8 Cr | 900,000 |

| Intellect Design Arena | 217.9 Cr | 2,000,000 |

| AYM Syntex | 41.6 Cr | 2,301,369 |

| Lux Industries | 53.2 Cr | 442,100 |

| Vidhi Specialty Food | 30.0 Cr | 800,000 |

| KDDL | 103.4 Cr | 423,180 |

| Kirloskar Ferrous | 94.6 Cr | 2,000,000 |

| Ravindra Energy | 37.8 Cr | 2,162,162 |

| Transpek Industry | 16.9 Cr | 118,578 |

| Arman Fin Serv | 69.2 Cr | 400,000 |

| Apollo Pipes | 45.3 Cr | 1,500,000 |

| PTC Industries | 271.1 Cr | 160,000 |

| Bella Casa Fashion | 37.4 Cr | 917,500 |

| TAAL Tech | 84.8 Cr | 277,931 |

| Capacit’e Infraprojects | 149.8 Cr | 5,150,000 |

| Dishman Carbogen | 214.7 Cr | 8,617,000 |

| Autoriders Intl | 31.2 Cr | 61,250 |

| Thejo Engineering | 30.4 Cr | 180,000 |

| Prakash Pipes | 15.7 Cr | 564,500 |

| Suryoday Small Finance Bank | 41.3 Cr | 3,000,000 |

| Tracxn Technologies | 9.4 Cr | 2,000,000 |

| Concord Control | 73.2 Cr | 346,167 |

| Yatharth Hospital | 87.4 Cr | 1,100,000 |

| Nuvama Wealth | 367.0 Cr | 500,000 |

| Siyaram Recycling | 18.6 Cr | 2,200,000 |

| Raymond Lifestyle | 89.9 Cr | 799,856 |

| KRN Heat Exchanger | 82.6 Cr | 1,000,000 |

| Sahasra Electronic Solutions | 19.6 Cr | 620,000 |

Read Also: Raj Kumar Lohia Portfolio: Holdings, Strategy & Analysis

Investment Approach and Philosophy of Mukul Agarwal

The key investment approach and philosophy of Mukul Agarwal are mentioned below:

- Small Cap: Mukul Agarwal primarily invests his portfolio in small-cap and micro-cap stocks. He believes that investment must be made in small-cap stocks so that they can perform in the long run.

- Long-term Investing: He follows the approach of long-term investing. He purchases the stocks based on his own research and holds them for several years.

- Research: Mukul Agarwal checks the stocks fundamentally and, based on factors like corporate governance, business growth opportunities in future, etc., he identifies the stock for investment.

- Focus on Business Model: Mukul Agarwal generally focuses on the quality of the business model. He does not focus on the stock’s price; therefore, his primary focus is the company’s valuation.

- Different Portfolios: He manages two different portfolios. One is for trading, which primarily focuses on short-term gains, whereas the other is a long-term portfolio that focuses on investment.

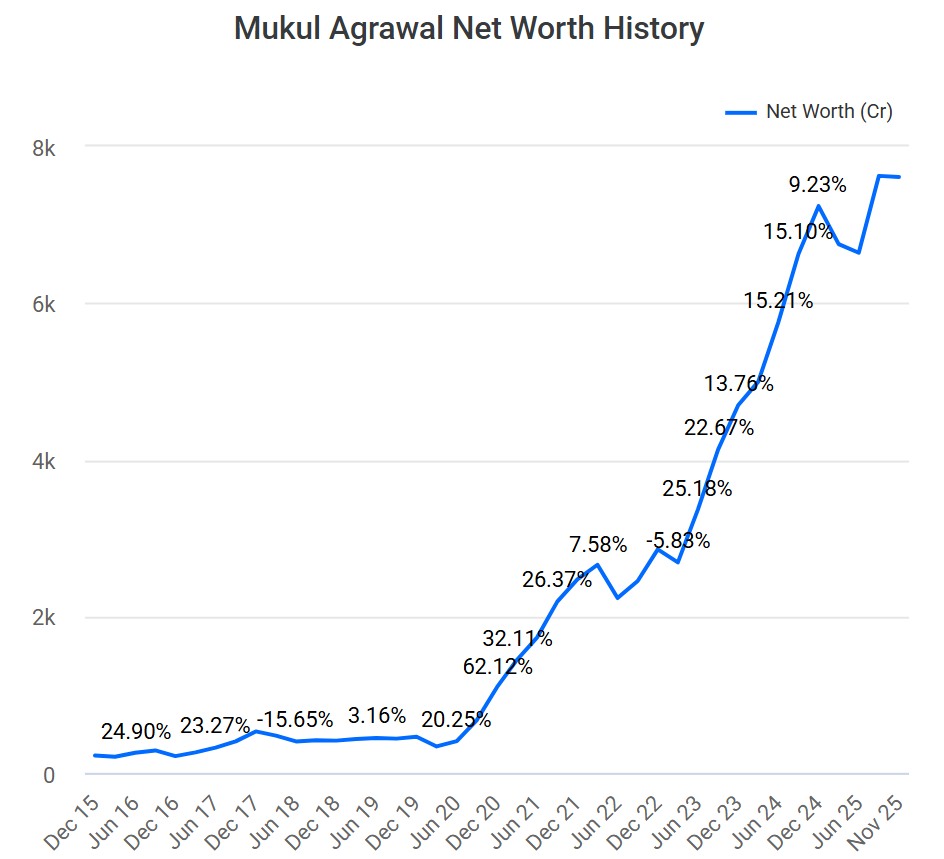

Networth of Mukul Agarwal

The net worth of Mukul Agarwal has increased significantly over the past few years. And based on various reports. Mukul Agarwal holds around 61-72 stocks in his portfolio. The value of which is around 7000 – 7500 crores. As of September 2025, his net worth is around 7623 crores.

Learning from Mukul Agarwal’s Portfolio

The key learning from Mukul Agarwal’s Portfolio is as follows:

- Portfolio Diversification: Mukul Agarwal holds a diversified range of portfolios, which helps him in reducing sector-specific risk.

- Long-term Approach: One should not invest in the stock market for the short term. It is advisable to invest in stocks and hold them for the long term.

- Fundamental Research: Before investing in any stocks, one should conduct thorough research and analyse the company’s profitability, revenue, growth prospects, etc.

- Monitoring of Portfolio: One should monitor their portfolio regularly. Continuous monitoring of investments helps in removing underperforming stocks from the portfolio.

Read Also: Radhakishan Damani Portfolio: Stocks & Strategy Insights

Conclusion

On a concluding note, Mukul Agarwal is one of the seasoned investors in India, who is well-known for investing primarily in small-cap and micro-cap stocks. He follows the approach of long-term investing and tries to identify the potential multibagger stocks. He clearly sets an example of how long-term disciplined investing can help in creating wealth in the long term. However, it is advisable to consult your investment advisor before making any investment.

Frequently Asked Questions (FAQs)

Who is Mukul Agarwal?

Mukul Agarwal is a famous Indian investor who primarily focuses on investing in small-cap and micro-cap stocks. He is also the founder of Param Capital.

What is the net worth of Mukul Agarwal?

As per the latest available reports, Mukul Agarwal has a total net worth ranging from INR 7000 to 7600 crores.

What investment strategy is followed by Mukul Agarwal?

Mukul Agarwal follows a buy-and-hold investment strategy. He invests in small-cap and micro-cap stocks and holds them for the long term. He picks stocks based on fundamental research.

How many stocks does Mukul Agarwal hold in his portfolio?

Mukul Agarwal holds around 60-70 stocks in his portfolio as per the recent reports.

What are the top 5 stocks in Mukul Agarwal’s portfolio?

Based on the holding value, Mukul Agarwal’s top 5 holdings include Neuland Laboratories Limited, AMS Technologies Limited, Radico Khaitan Limited, Zota Healthcare Limited, and Nuvama Wealth Limited.