In today’s world, silver is not only a precious metal but also a critical material used in various industries such as solar, electric vehicles, electronics, etc. Therefore, as an investor, you must be thinking about how to invest in silver-related stocks for better returns.

In this blog, we will give you an overview of top silver stocks along with the benefits of investing in them and key performance indicators.

What are Silver Stocks?

Silver stocks are shares of companies primarily engaged in exploration, mining, production, and selling silver. Silver and its related products are a major source of revenue for these companies. Their profit is dependent on production costs and operational efficiency. Investing in these shares can give one indirect exposure to the silver industry.

| S.No. | List of Best Silver Stocks in India |

|---|---|

| 1 | Hindustan Zinc Limited |

| 2 | Vedanta Limited |

| 3 | Kalyan Jewellers India Ltd |

| 4 | Goldiam International Limited |

| 5 | Thangamayil Jewellery Limited |

Market Information of Best Silver Stocks in India

| Company | Current Market Price (in INR) | Market Capitalisation (in INR crore) | 52-Week High (in INR) | 52-Week Low (in INR) |

|---|---|---|---|---|

| Hindustan Zinc Limited | 625 | 2,64,103 | 656 | 378 |

| Vedanta Limited | 614 | 2,40,000 | 620 | 362 |

| Kalyan Jewellers India Ltd. | 499 | 51,520 | 793 | 399 |

| Thangamayil Jewellery Limited | 3,329 | 10,347 | 3,536 | 1,523 |

| Goldiam International Limited | 360 | 4,064 | 569 | 251 |

Read Also: List of Best Metal Stocks in India

Best Silver Stocks – An Overview

An overview of the best silver stocks in India is given below:

1. Hindustan Zinc Limited

Hindustan Zinc Limited was established in 1966 by Metal Corporation of India. Initially, it was a public sector undertaking established to fulfil the demand for zinc in India. In 1980, after realising the increasing demand for silver, the company invested in refinery technologies to extract silver. In 2002, the government decided to divest this company and sold the majority stake to Sterlite Opportunities Limited, a subsidiary of Vedanta Limited. However, the government retains nearly 29.54% with itself. Today, the company is India’s largest integrated silver producer and sells silver as 30 kg bars, 1 kg bars and in powder form. The company’s headquarters are situated in Rajasthan.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 32.23% | 87.06% | 155.83% |

Read Also: Hindustan Zinc Case Study

2. Vedanta Limited

Vedanta Limited was founded in 1986 under the name Sterlite Industries (India) Limited and was initially focused on producing wires and cables for the telecommunication sector. In 1992, the company decided to enter into the refinery business and started smelting copper. The company formed a parent company in the United Kingdom known as Vedanta Resources Limited, and this company was listed on the London Stock Exchange. The company is a prominent player in the Indian mining industry. The company purchased Sesa Goa Limited in 2007. It also acquired the business of Carine India, which was a prominent player in the gas industry. Vedanta Limited holds a 64.9% stake in Hindustan Zinc Limited (HZL), which ranks as the world’s 5th largest silver producer. In FY2023, HZL reported an impressive annual silver production of approximately 714 tonnes. The company also owns mines in South Africa. The company’s headquarters are situated in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 33.54% | 98.06% | 264.78% |

Read Also: Vedanta Case Study

3. Kalyan Jewellers India Ltd.

Founded in 1993 by T.S. Kalyanaraman, Kalyan Jewellers India Ltd. is a prominent name in the jewelry industry, offering an extensive range of gold, silver, and precious stone jewelry. The company operates on a customer-centric business model focused on transparency, quality, and variety. One of its key differentiators is the wide selection of designs backed by unmatched warranties. To strengthen its presence in smaller towns, Kalyan Jewellers has launched the unique “My Kalyan” program, which operates through over 750 centers across India. This initiative significantly enhances customer outreach and plays a major role in expanding the brand’s market footprint.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 36.34% | 311.20% | 573.02% |

4. Goldiam International Limited

The company was founded in 1986 as Goldiam (International) Private Limited. Initially, the company began its work as an exporter of cut and polished diamonds and jewellery. It received Export Performance Awards in 1991. They regularly pay dividends and bonuses to their shareholders. However, because of lower margins, the company exited its wholesale business in Hong Kong and India. During 2023-24, the company announced its venture into the retail sector. The company has its headquarters in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -15.53% | 166.12% | 687.28% |

5. Thangamayil Jewellery Limited

The company was established in 1947 and was initially known as Balu Jewellery. It was founded by the Late Shri. N. Balusamy Chettiar. In 1979, the business was handed over to the son, Mr. Balarama Govinda Das, Mr. Ba. Ramesh and Mr. N.B. Kumar. The company formally began its operation in 2000 when it was incorporated as Thangamayil Jewellery Private Limited. The company launched its IPO in 2007 and became a publicly traded company. The company’s headquarters are situated in Tamil Nadu.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 67.71% | 523.61% | 1,063.94% |

Key Performance Indicators (KPIs)

| Company | Operating Profit Margin (%) | Net Profit Margin (%) | ROE (%) | ROCE (%) | Debt to Equity |

|---|---|---|---|---|---|

| Hindustan Zinc Limited | 43.22 | 30.37 | 77.69 | 63.24 | 0.80 |

| Vedanta Limited | 22.82 | 13.42 | 36.36 | 26.92 | 1.79 |

| Kalyan Jewellers India Ltd. | 5.26 | 2.85 | 14.88 | 20.88 | 0.20 |

| Goldiam International Limited | 22.13 | 14.99 | 15.81 | 22.55 | 0.01 |

| Thangamayil Jewellery Limited | 4.09 | 2.41 | 10.76 | 16.60 | 0.68 |

Read Also: List Of Best Jewelry Stocks in India

Benefits of investing in Silver Stocks

The significant benefits of investing in silver stocks are as follows:

- Portfolio Diversification: One can diversify their portfolio by investing in silver stocks.

- Increasing Demand: The demand for silver is increasing due to its industrial applications and precious metal status. Therefore, investing in these companies can be considered a good investment opportunity.

- No Physical Storage: One is not required to buy and store physical silver and can get the benefit of the appreciation in the price of silver.

- Regular Income: Some companies discussed above regularly declare dividends, which can be a source of passive income for investors.

Factors to Consider Before Investing in Silver Stocks

The factors which need to be considered before investing in silver stocks are as follows:

- Company Financials: Before making any investment in silver stock, one needs to evaluate the financials of the company, such as revenue growth, profit margins, debt levels, etc.

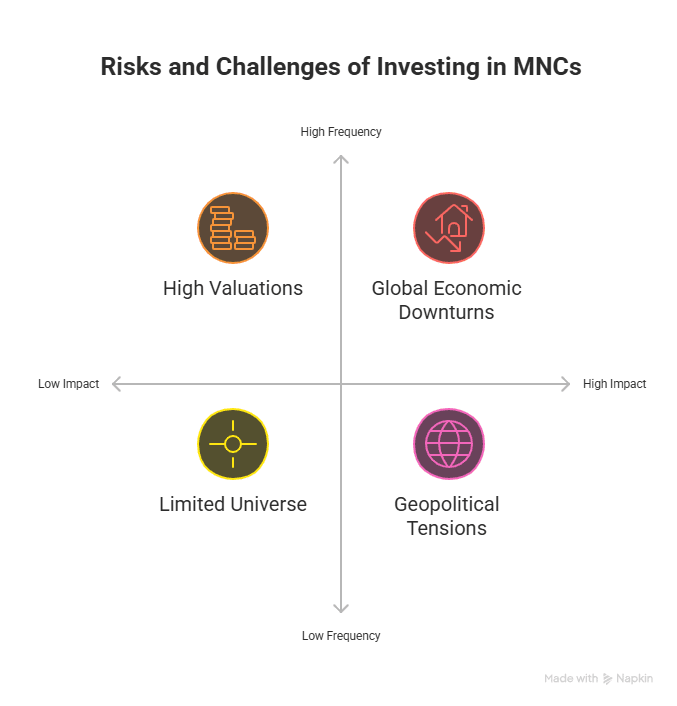

- Geopolitical Risk: The prices of silver are highly volatile as geopolitical events impact the share prices of silver companies.

- Demand from Industrial Sectors: Silver is widely used in industries such as solar energy, electronics, and electric vehicles. Monitoring the demand trends in these sectors can help you assess future growth potential for silver-related companies.

- Government Policies and Import/Export Regulations: Changes in government policies, import/export duties, or environmental regulations can significantly impact silver production and profitability of these companies.

Read Also: 10 Best Copper Stocks in India

Future of Silver Stocks

The future of silver stocks is very promising in India because the demand for silver is increasing day by day, due to its industrial applications, especially in the green energy sector. With the rise in the use of electric vehicles, the demand for silver will increase because electric vehicles use silver. Along with this, the government is also pushing clean energy adoption, in which silver plays an important role. Therefore, one can invest in silver stocks for the longer horizon.

Conclusion

On a concluding note, investment in silver stocks provides you with an opportunity to earn profit from the increasing price of silver. Investment in silver stocks offers a mix of capital appreciation, inflation hedging, and participation in the renewable energy sector. However, the performance of silver companies depends on the global prices of silver, which can be very volatile because of various factors such as geopolitical events, demand for silver, etc. Therefore, it is advisable to consult your investment advisor before making any investment in silver stocks.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | 10 Most Undervalued Stocks in India |

| 2 | List of Best Monopoly Stocks in India |

| 3 | Top 10 Best Summer Stocks in India |

| 4 | List of Top 10 Blue Chip Stocks in India with Price |

| 5 | List Of Best Logistics Stocks in India |

Frequently Asked Questions (FAQs)

Which stocks are associated with silver in the Indian stock market?

Some commonly traded silver stocks in India are Hindustan Zinc Limited, Vedanta Limited, Kalyan Jewellers India Ltd., Goldiam International Limited, and Thangamayil Jewellery Limited.

Do silver stocks pay dividends?

Yes, some silver stocks pay dividends. However, one needs to check the dividend yield of the company before making any investment. Dividend-paying silver stocks are suitable for investors who are looking for a passive income.

What are the major risks of investing in silver stocks?

The major risks related to investing in silver stocks are volatility in the global price of silver, geopolitical risk, environmental regulations, etc.

How can I invest in silver stocks in India?

One can easily invest in silver stocks by opening a demat and trading account. You can easily open a demat account with Pocketful, and you also don’t need to pay any brokerage on equity delivery trades.

What is a good time to invest in silver stocks?

You can invest in silver stocks at any time as it offers diversification; however, certain factors need to be considered before investing in silver stocks, such as silver price trends, macroeconomic factors, etc.