Are you curious about the stock market and want to learn about stock trading without risking your money? Make it happen with a share market learning app that will build a solid foundation for your trading and investing journey.

Share market learning apps help in grasping essential concepts such as reading stock charts, portfolio management, etc. Several apps also provide live data feeds and news so that you remain informed about changing market trends. Whether you’re a student, working professional, or simply interested in investing, you can easily learn with these stock market learning apps. It is a smart and simple method to learn about the stock markets without making expensive mistakes.

We will discuss the top 5 learning apps in this blog. These apps or websites provide a beginner with easy to understand lessons, interactive quizzes, and practice trading scenarios to learn about market behavior.

What Is a Share Market Learning App?

A share market learning app is basically an educational tool that helps an individual to learn how the stock market functions. It converts complex financial topics and breaks them down into simple and easy to follow lessons. Commonly these apps use interactive content to keep things engaging, which makes learning a lot less intimidating.

These apps work on the motto that learning to trade does not need to be complicated. With the right app, you can, in a stepwise manner, gradually turn into a self-assured investor and trader.

Best 5 Share Market Learning Apps in India

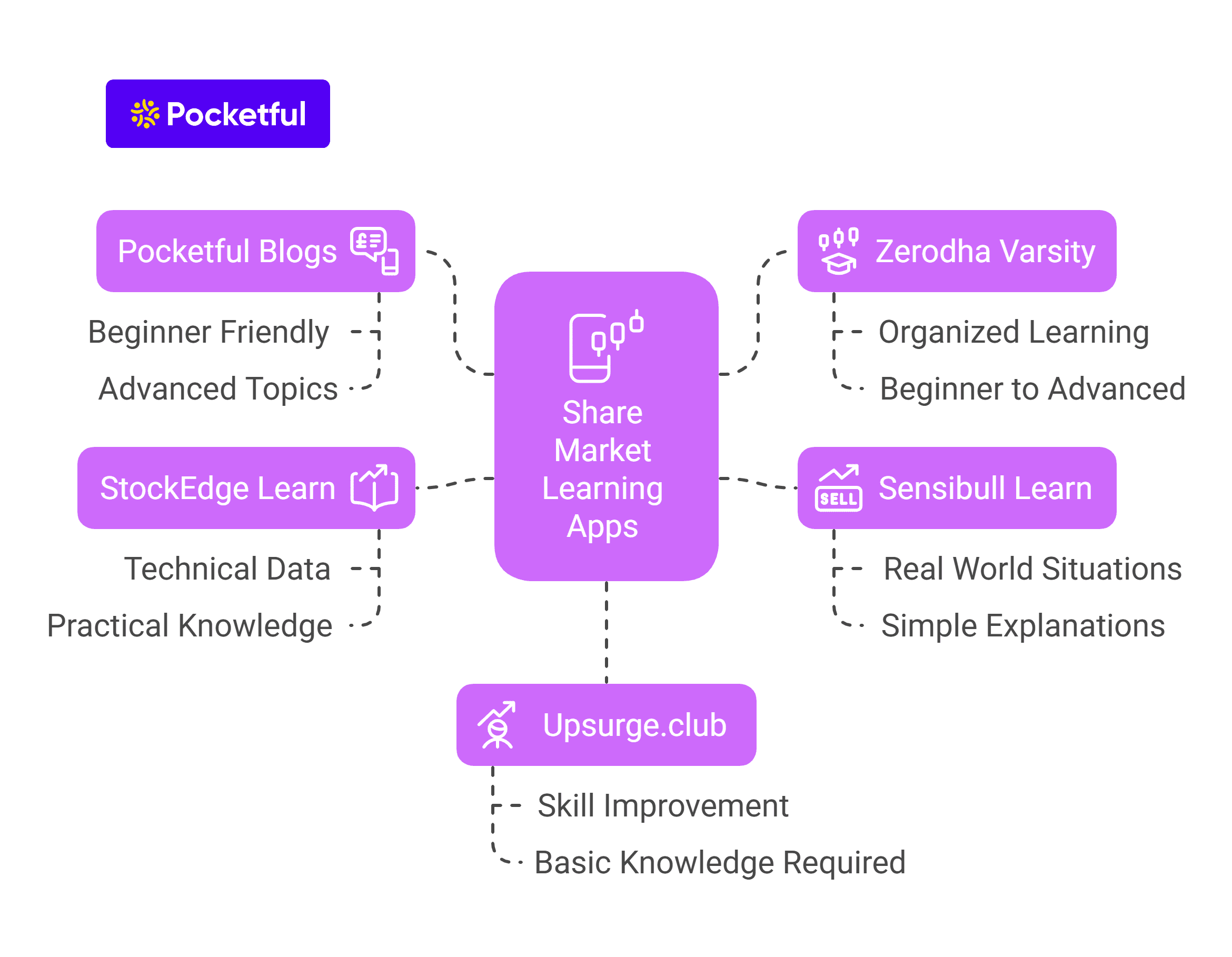

The top 5 share market learning apps in India are:

- Pocketful Blogs – Ideal for beginners as well as advanced market participants! They provide easy to understand blogs on complex topics to demystify investing and trading.

- Zerodha Varsity – Super popular! Great for learning everything from beginner to advanced trading concepts in an organized manner.

- Sensibull Learn – Best for those who want to explore options trading. Uses real world situations and simple explanations.

- StockEdge Learn – Learn the more technical aspects with actual market data. Ideal for those who want more than theoretical knowledge.

- Upsurge.club – This platform is best-suited for those traders who understand the basics and want to improve their trading skills.

Now, let’s look at each of these share market learning apps in detail.

1. Pocketful Blogs

Pocketful is a new age discount brokerage platform, most popularly known for being a go to stock broker for traders. Pocketful also has blog sections with information on a wide range of topics, such as investing, commodities, mutual funds, personal finance, etc., making it one of the simplest free resources to start your stock market journey.

- Easy to understand blogs with clear explanations of technical terms to explain both basic and advanced stock market topics.

- They have 8 categories of blogs – Case Studies, Commodities, Demat Account, Investing, IPO, Trading, Personal Finance, and Mutual Funds.

- Each article contains clear and concise explanations in a consistent format.

- Perfectly suited for beginners as well as pro level traders/investors.

For people who fear being bombarded with complex stock market jargons, Pocketful uses a beginner-friendly approach to make everything as simple as possible. You can check out the website at: https://www.pocketful.in/blog/

2. Zerodha Varsity

The Zerodha Varsity app is often mentioned as one of the finest share market learning apps in India and for a good reason. Created by Zerodha, which is one of India’s biggest stock-broker by volume, this app provides:

- In depth investing and trading modules

- More than 15 structured learning modules

- Content available in both Hindi and English

- Chapters are followed up by quizzes, enabling users to test their educational progress.

Courses offered on Zerodha Varsity are free of cost and do not require a Zerodha account. The structured, text-based content on the app is ideal for serious learners who wish to start their stock market journey.

3. Sensibull Learn

India’s first focus-driven options trading platform, Sensibull, is gaining traction with its trading learning app as the options segment is still new to the market. Their learning section, now featured on the app, is simpler with:

- Webinars, blogs, and other content are updated on a regular basis.

- Clubs real world trading scenarios with derivative strategies.

- Professional traders offer bite-size video lessons.

This trading learning app caters to new users who wish to immerse themselves into the complex world of options trading. While some lessons are free, others are subscription based.

4. StockEdge Learn

StockEdge is one of the best analytical apps in India with a robust educational module alongside stock analysis articles. It’s perfect for users who want to learn and apply stock market concepts along with real world data.

- Provides free and paid tutorials on technical indicators, candlestick patterns, and tools for charting.

- Mentorship workshops for premium users.

- Stock data by sectors and themes.

- Real time stock data filtering and scanning.

With the tools provided, one can learn many strategies and execute simulations in real time.

5. Upsurge.club

If you are interested in developing trading strategies, trading psychology and want to be mentored by the experts, then this platform can be a good fit for you. However, learning modules on this platform are paid.

- Offers in-depth modules on intraday trading as well as futures and options trading, along with portfolio creation.

- Conduct extensive real-world case studies to ensure theory is put into practice.

- Conduct weekly webinars and doubt-clearing classes.

- Focus on developing trading psychology, mindset, and discipline.

This app is best suited for stock market learners who understand the fundamentals, but wish to polish their skills and become more disciplined traders.

Which is the go-to Share Market Learning App?

If you are confused about which app is best-suited for me, then consider the following factors to find the best stock market trading app in India:

- Content Quality: Is the information latest and actionable?

- User-Friendly Features: Is the app user-friendly, particularly for beginners?

- Language Inclusivity: Is the content available in English and local languages?

- Practical Application: Is there a mock trading system and is the data updated in real-time?

- Webinars and Forums: Does the platform provide access to webinars by industry experts or forums for users?

- User Testimonials: Is the platform or app highly rated based on ratings on Google Play Store, user testimonials, etc.

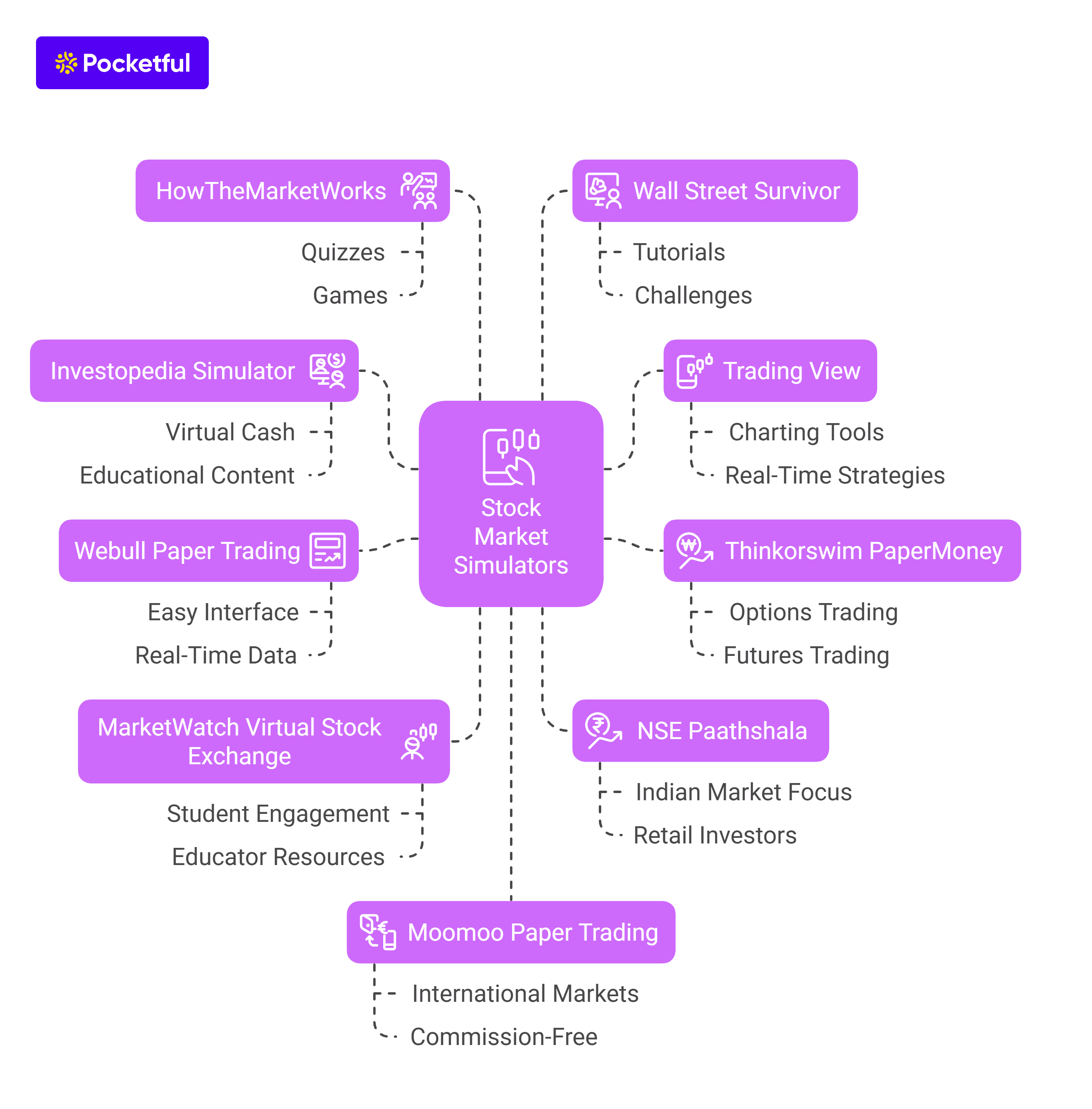

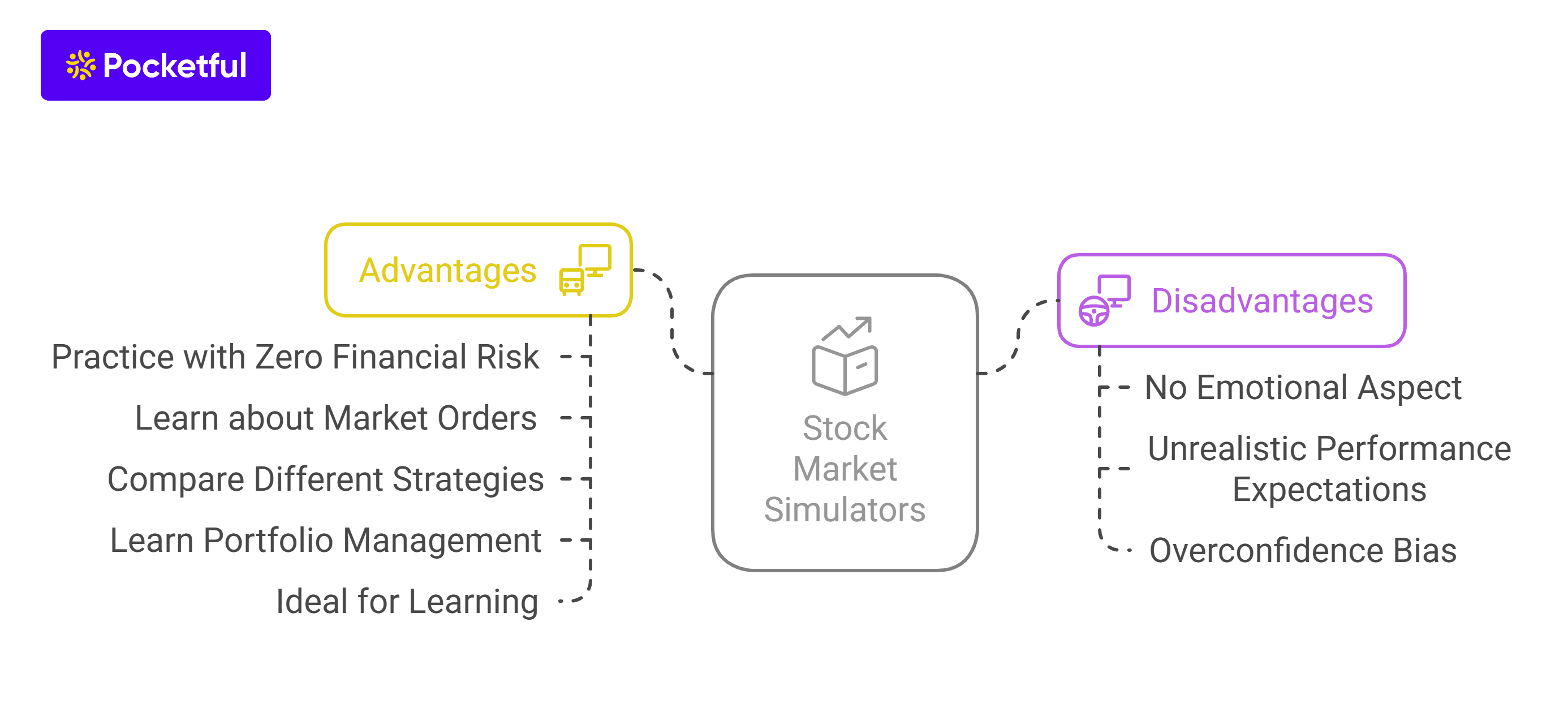

Read Also: 10 Best Stock Market Simulators for Beginners – Platforms and Apps

Key Features of Share Market Learning Apps

The key features of share market learning apps are as follows:

- Digital Lessons: Most of these apps include clear, easy to understand videos with voiceovers and visuals that explain key concepts of the share market.

- Structured Courses: Lessons are usually divided into levels: beginner, intermediate, and advanced, so you can learn trading step by step at your own speed.

- Practice Trading: Learning apps offer trading lessons and doubt clearing sessions, which let the users test their trading strategies without taking financial risks.

- Live Market Data: Some learning apps offer the facility of tracking stock prices in real time, providing you valuable insight into the workings of the market.

- Interactive Tools: Quizzes, flashcards, and other activities aid in retaining what you have learned.

- Certificates: Completing a course or module allows you to earn a course completion certificate as a reward for your achievement.

- Community Support: Most platforms provide forums or chat facilities where you can post questions and learn from more experienced users.

Read Also: Lowest MTF Interest Rate Brokers in India | Top 10 MTF Trading Apps

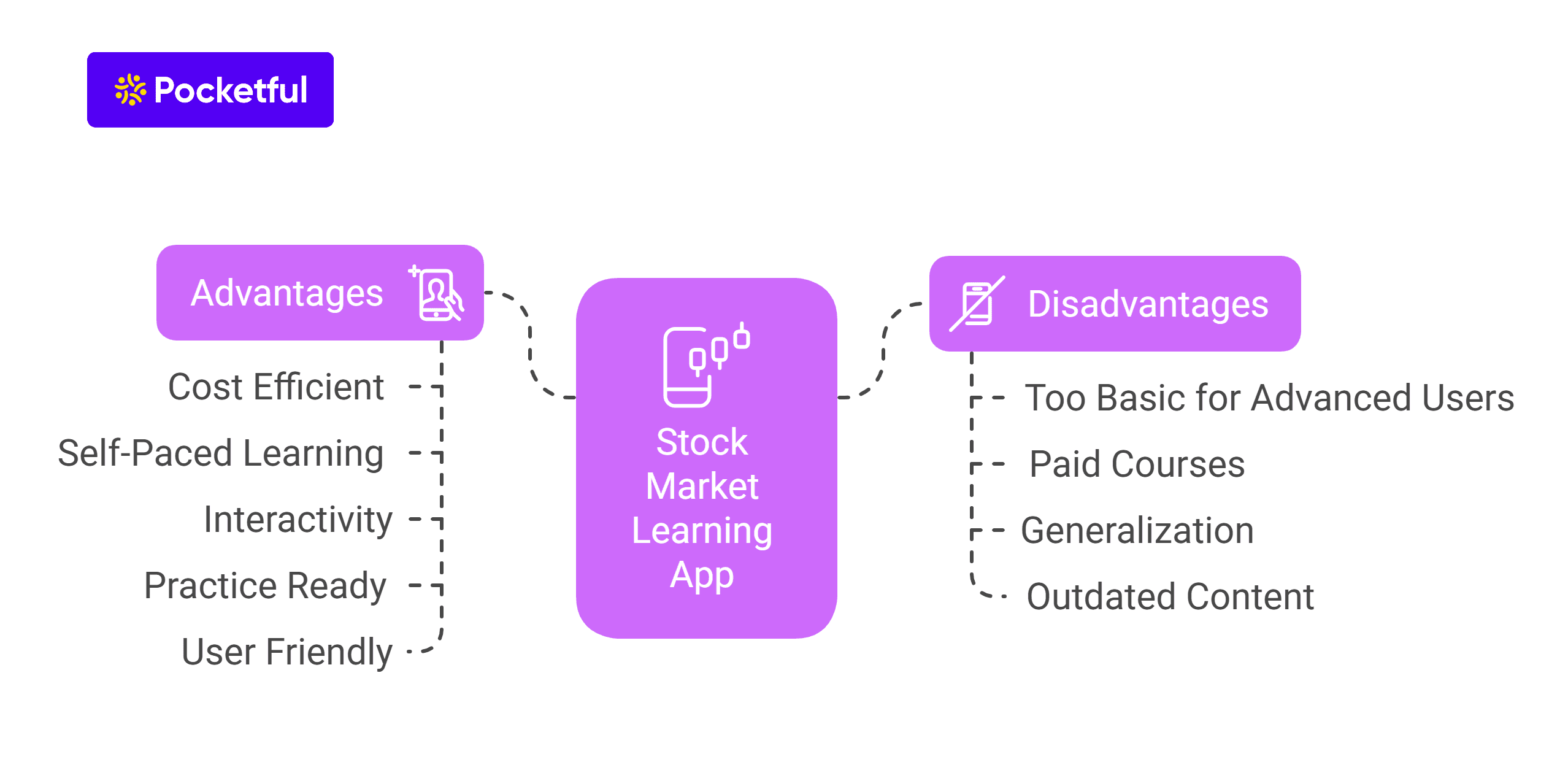

Advantages & Disadvantages of Stock Market Learning App

The advantages and disadvantages of stock market learning app are:

Advantages

- Cost Efficient: A majority of the applications and platforms provide learning material for free or charge a minimal fee.

- Self-Paced Learning: Students can learn about the stock market from any place at any time.

- Interactivity: Greater engagement is a result of videos, quizzes, and gamification.

- Practice Ready: Some applications come with features that allow mock trades or utilize live data to test trading strategies.

- User Friendly: Content is structured to build up in complexity as the learning module progresses, making it easy for beginners.

Disadvantages

- Too Basic for Advanced Investors and Traders: The majority of apps and learning platforms focus solely on basics and therefore do not cater to expert investors and traders.

- Paid Courses: Subscriptions may be necessary in order to access certain premium features or course materials.

- Generalization: Some users may find some stock market concepts too generic, which may not represent the reality of the domestic financial markets.

- Outdated Content: Not all apps and platforms refresh their content routinely.

Read Also: Best Commodity Trading Platforms in India: Top 10 Picks for Traders

Conclusion

The wide variety of platforms provides options to all users, and the best stock market learning app in India will depend on the individual user’s learning objectives. From text-based lessons to video tutorials and even webinars, there is a share market learning app for everyone.

They not only teach you how to trade and invest, but also how to be financially disciplined, develop strategies, and gain confidence. It is important to start with basics and gradually move on to more advanced concepts. Through consistent effort, transforming from a novice into an informed trader is achievable.

Which app will you choose? Regardless of the choice – Pocketful, Zerodha Varsity, or Sensibull – one thing should always be remembered: knowledge is the best investment.

Frequently Asked Questions (FAQs)

What are share market learning apps?

Learning apps for the share market are mobile applications that help beginners learn the stock market along with trading strategies, investing principles, and more through videos, articles, mock trading, quizzes, and tutorials.

Are these apps free to use?

Many applications provide free educational content but some may charge for premium plans or certifications. However, platforms such as Pocketful have blogs with information related to investing, trading, commodities, etc. for free.

Am I allowed to make use of these apps for trading or investment purposes?

Certain apps like Pocketful are primarily stock brokers where investing and trading in stocks, ETFs, etc. can be done. You can open a demat account with Pocketful in a couple of minutes.

Are these apps safe and trustworthy?

Yes, these apps are safe to use as they follow strict data security protocols. Stick to popular highly-rated apps and platforms.

Is it possible to learn and apply those concepts in live markets simultaneously?

Yes, most educational apps and platforms feature real-time stock prices, charts, and screening tools, which allows you to immediately implement what you have learned.

Is Pocketful the best platform to start my stock market journey?

If you are a beginner, Pocketful is the best as it has blogs on recent stock market events, case studies of companies, trading and investing concepts. It is the best as everything can be done through a single platform – learning, analysis, and trade execution.