As an investor always looking for investment opportunities in the market, you must balance risks with investment returns. Penny stocks can generate extraordinary returns, but most penny stocks in the stock market are highly risky. What if we tell you there are two companies listed on the stock market with a low stock price and are also linked to Mukesh Ambani?

In this blog, we will give you an overview of the Mukesh Ambani group’s penny stocks and their benefits.

What is Mukesh Ambani Group Penny Stock?

The term ‘Mukesh Ambani group penny stock’ refers to the penny stocks of companies linked with Mr Mukesh Ambani, a well-known Indian industrialist, but have a low market price and a small market capitalization. Investors considering investing in these companies must be aware of the extreme market volatility associated with these penny stocks.

Due to the lack of readily available information and the unreliability of their operations, investors avoid investing in penny stocks, however, because the companies mentioned below are controlled by Reliance Industries Ltd., which makes them more reliable than a normal penny stock.

Read Also: Mukesh Ambani Companies List

Best Mukesh Ambani Penny Stock List 2026

The list of penny stocks Under ₹100 associated with Mukesh Ambani are:

| S.No. | Stock Name | Stock Price |

|---|---|---|

| 1. | Hathway Cable and Datacom Limited | ₹ 16.99 |

| 2. | Den Network | ₹ 44.93 |

Overview of Best Mukesh Ambani Penny Stock

1. Hathway Cable and Datacom Limited

Hathway Cable & Datacom Limited was founded in 1959 and was initially known as Chics Display Services Private Limited. The company focuses on providing cable TV services and broadband services. The company changed its name to Hathway Cable & Datacom Private Limited in 1999. The company launched an initial public offering (IPO) in 2009 and was listed on the stock exchange in 2010. It provides high-speed internet access in over 16 cities, making it one of the first companies to offer broadband over cable TV networks in the country. In 2018, it was acquired by Reliance Industries. Its headquarters are in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -14.98% | -16.40% | -11.52% |

2. Den Network

In 2007, Den Network was founded as a public limited company and has grown over the years to become one of India’s leading cable TV service providers. Its market share has expanded significantly due to strategic partnerships with local cable companies, enhancing its customer base. The company operates in 17 states and over 433 cities nationwide. In 2018, Reliance Industries purchased a 66% stake in DEN Networks. The company’s headquarters is located in New Delhi.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -22.04% | 6.66% | 10.68% |

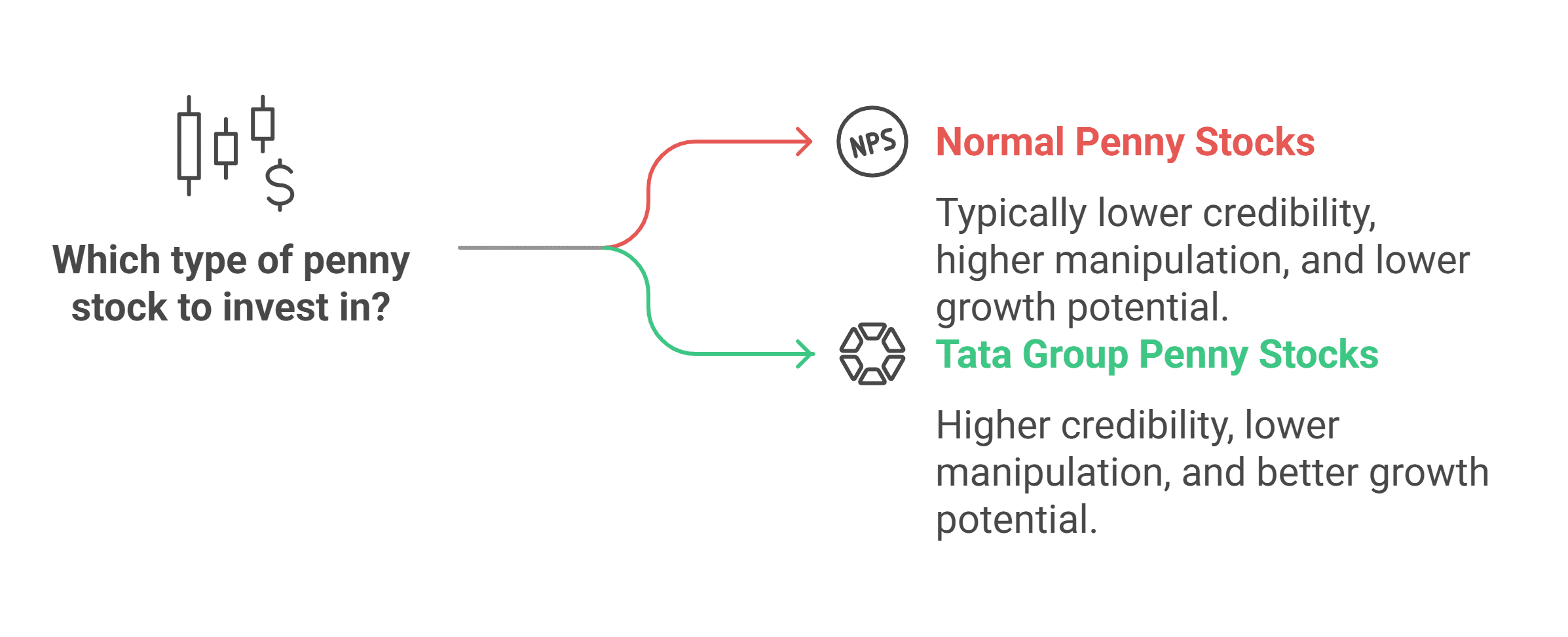

What is the difference Between Normal Penny Stocks and Mukesh Ambani Penny Stocks?

The following are the main distinctions between Mukesh Ambani penny stocks and regular penny stocks:

| Particulars | Normal Penny Stocks | Mukesh Ambani Penny Stocks |

|---|---|---|

| Trustworthiness | A typical penny stock might be issued by a startup or lesser-known business. | These stocks are associated with the Ambani Group, one of the biggest business conglomerates in India. |

| Risk | Penny stocks of other companies carry high risk. | The penny stocks of the Ambani group carry comparatively lower risk than other penny stocks. |

| Industry | Normal penny stocks can be of companies operating in new industries with an uncertain future. | These companies operate in industries with a good track record. |

| Manipulation | Normal penny stock prices can be manipulated and can be affected by pump-and-dump strategies. | Since Ambani Group penny stocks are part of a reputed group and are often in the news, stock price manipulation is less likely. |

| Future Possibility of Growth | Due to their weak fundamentals, these businesses have lower chances of generating substantial investment returns. | As Reliance Group supports them, Ambani Group penny stocks can deliver substantial returns over the long run. |

| Availability of Buyers and Sellers | Other penny stocks are less liquid as they are unpopular, making it challenging for investors to buy or sell such penny stocks. | The Ambani Group penny stocks have more liquidity than the other penny stocks. |

| Market Capitalization | The market capitalization of these penny stocks is generally lower. | In comparison to other penny stocks, Ambani Group’s penny stock market capitalization is higher. |

Read Also: Reliance Penny Stocks List in India

Advantages of Investing in Mukesh Ambani Penny Stocks

The key advantages of investing in Ambani Group penny stocks are outlined below;

- Investors with limited funds can easily buy these penny stocks due to their low prices.

- These are small companies within the Ambani Group that have the potential to deliver substantial returns for investors over the long term.

- Diversification is important, and one way to achieve this is by including Ambani Group penny stocks in your portfolio.

- The Ambani Group’s brand value can positively impact stock performance.

Future of Mukesh Ambani Stocks

Reliance Group is one of the biggest business conglomerates in the world. The group’s businesses are focused on sustainability and innovation, and the organization offers a broad range of products. The companies are diversifying into new industries that can eventually lead to superior investment returns in the long run. Currently, Reliance Industries is regarded as a market leader in several industries, including telecom and petrochemicals. As a result of the company’s continued efforts to diversify into the renewable energy sector and financial services, we can say that Ambani Stocks has a bright future.

How to Invest in Mukesh Ambani Penny Stocks?

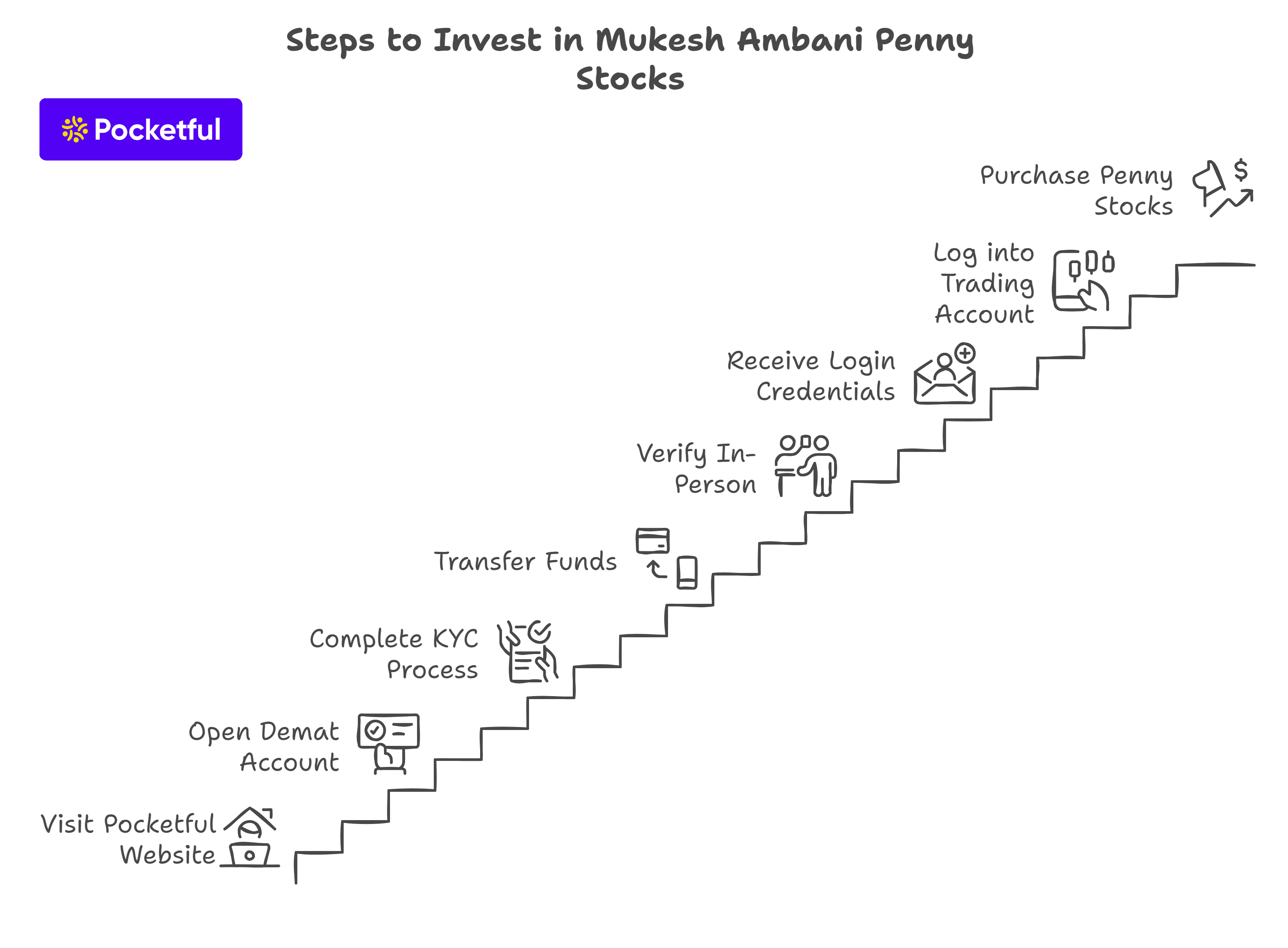

The steps listed below must be followed if you want to invest in Mukesh Ambani penny stocks:

1. Go to the Pocketful website.

2. Click on the “Open Demat Account” Tab.

3. Fill out your KYC and provide the pocketful team with all the necessary information. Submit scanned copies of Pan card, identity proof, address proof, etc.

4. To transfer money from your bank account to your trading account, enter your bank account information.

5. Complete the In-Person Verification (IPV) and e-sign the Demat account opening form. After successful verification of the documents and information provided, your Demat account will be opened.

6. The login credentials will be sent to your registered email address and mobile number.

7. Go back to the website and select the Home Page’s Login Section.

8. Search and buy Mukesh Ambani penny stocks after logging into your trading account.

Read Also: Adani Penny Stock and List of Lowest-Priced Adani Shares

Conclusion

In conclusion, penny stocks of the Mukesh Ambani group give you the chance to invest in penny stocks that are more reliable than normal penny stocks. However, investing in penny stocks carries several risks, including a lack of liquidity and a lack of public information. You should only think about investing in penny stocks like these if you are willing to take these risks. However, because Reliance Industries has a significant stake in the Mukesh Ambani Group’s penny stocks, they are more dependable than other penny stocks. You must speak with your investment advisor before making any investment decisions.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Best Pharma Penny Stocks List Under ₹50 |

| 2 | Top 5 PSU Penny Stocks List in India |

| 3 | 10 Best FMCG Penny Stocks in India |

| 4 | Top 10 Highest Dividend Paying Penny Stocks in India |

| 5 | Top 10 Cement Penny Stocks in India |

Frequently Asked Questions (FAQs)

Is it safe to invest in Mukesh Ambani stocks?

It is relatively safe to invest in Mukesh Ambani stocks compared to other penny stocks because these companies are acquired by Reliance Industries. However, it is advised to conduct thorough research before investing.

Which are the best penny stocks of Mukesh Ambani?

Mukesh Ambani’s top two penny stocks are Den Networks and Hathway Cable & Datacom Limited.

Which Mukesh Ambani share is under INR 100?

Mukesh Ambani’s two shares that are under INR 100 are Hathway Cable and Datacom Limited and Den Network Limited.

Who is the current chairman of Reliance Industries?

Reliance Industries’ current chairman and managing director is Mukesh Dhirubhai Ambani.

Who is the owner of Den Networks?

Den Networks was founded by Sameer Manchanda, but Reliance Industries purchased the majority of the business in 2018.