How would you go about approaching a bank for funding if you wanted to grow your company and needed some extra cash? Is there any option to obtain financing if the bank rejects your application? Indeed, some businesses are registered with the RBI as non-banking financial companies.

In today’s blog, we will be introducing you to a company known as “Shriram Finance Limited”.

Overview of Shriram Finance

The Shriram group, parent company of Shriram Finance, is well-known for its diverse industry expansion, which includes consumer goods, infrastructure, and financial services. Since its founding in 1974, the business has expanded rapidly and made a name for itself as a major force in the non-banking financial institution market. The organization caters to a broad clientele of individuals and businesses by providing tailored financial solutions. R. Thyagarajan, T. Jayaraman, and V.S. Sudarshan started the company’s operations and currently has the headquarters in Chennai. The company has expanded tremendously from a modest loan company to commercial vehicle financing and has emerged as one of India’s top non-banking financial companies (NBFCs).

Business Model of Shriram Finance

The Shriram Finance business model revolves around 3 segments.

1. Retail Financing – The company provides loans for commercial, passenger, and construction equipment as well as other assets to individuals and corporations, ranging from small business owners to major fleet operators.

2. SME Financing – To meet clientele’s operating and working capital requirements, small and medium-sized businesses also look to this corporation for loans.

3. Customized Financial Products – Additionally, the business creates tailored financial solutions to meet the needs of individual clients.

Competitive Edge

1. This organization combines innovation and technology through its digital platform, including an online loan application and a digital payment system.

2. The organization serves customers from both urban and rural areas with its extensive nationwide network of branches.

3. The business is doing its best to manage risk and compliance. It uses a strong risk assessment procedure and an assessment system for credit.

4. The company’s customer-centric strategy, which emphasizes establishing long-term relationships with clients, is the key to its success.

Market Details

| 52 Week High | INR 2605 |

| 52 Week Low | INR 1306 |

| Face Value | INR 10 |

| TTM PE Ratio | 13.8 |

| Market Capitalization | 91,697 Crores |

Read Also: TCS Case Study: Business Model, Financial Statement, SWOT Analysis

Financial Highlight of Shriram Finance

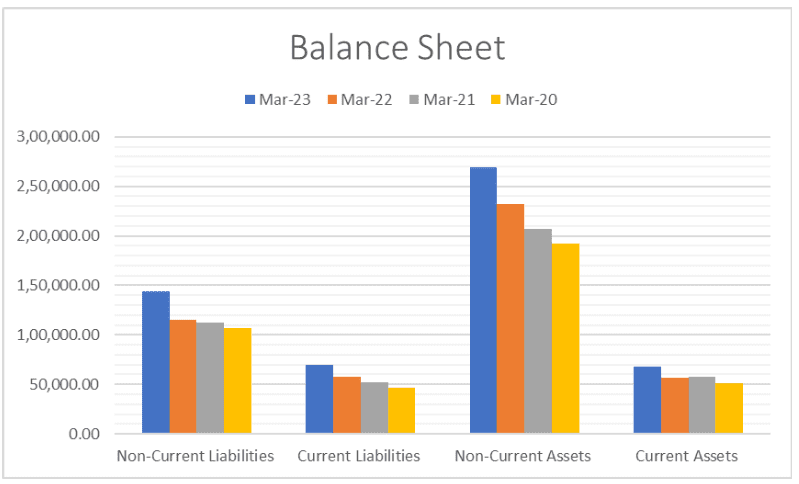

Balance Sheet

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Current Assets | 203615 | 140442 | 128368 |

| Non Current Assets | 6984 | 1826 | 1459 |

| Non Current Liabilities | 86751 | 68119 | 61258 |

| Current Liabilities | 80535 | 48054 | 46851 |

From the above table, we can say that the company’s current assets have shown a growth on YoY basis while the non-current assets have stayed consistently low. Correspondingly, the current liabilities witnessed a growth of almost 67%, on a YoY basis.

Income Statement

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Total Income | 30508 | 19274 | 17436 |

| Total Expenses | 9363 | 5990 | 5104 |

| Profit before tax | 21144 | 13283 | 12332 |

| Profit after tax | 6011 | 2707 | 2487 |

The company’s income has increased by almost 58% in the year FY 2023 as compared to FY 2022, although its expenses have increased in the same proportion, leading to a relatively smaller jump in net profit.

Cash Flow Statement

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Cash flow from operating activities | -17625 | -8859 | -4239 |

| Cash flow from investing activities | -193 | -34 | -24 |

| Cash flow from financing activities | 11819 | 8504 | 12225 |

The company’s cash flow from operating activities has been negative for the last three fiscal years. This is a major reason of concern regarding the company’s performance.

KPIs of Shriram Finance

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Operating Profit Margin (%) | 69.38 | 68.98 | 70.79 |

| Net Profit Margin (%) | 19.72 | 14.06 | 14.27 |

| Return on Capital Employed (%) | 16.25 | 14.09 | 14.86 |

| Debt to Equity Ratio | 3.77 | 4.39 | 4.89 |

| Current Ratio | 2.53 | 2.92 | 2.74 |

Read Also: Titan Case Study: Business Model, Financials, and SWOT Analysis

SWOT Analysis of Shriram Finance

Strengths

1. The company has a strong brand presence in the country and utilises this strength to its full potential.

2. A wide range of services are available from Shriram Finance, such as building loans, auto loans, and financial support for a range of client needs.

3. The business combines creativity and technology to ensure that its operational activities function smoothly.

Weaknesses

1. The business is heavily exposed to a few distinct industries, such as automotive, real estate, etc. so any downturn in these industries will affect their bottom line.

2. Strict regulatory requirements apply to the banking industry, and any tightening of RBI banking policies will make the business more difficult and risky.

3. The corporation is concentrating heavily on underbanked areas of the country, which may lead to a reduced NPA in the future.

Opportunities

1. They would be able to reach more people in rural India thanks to the government’s financial inclusion plans.

2. Strategic partnerships and acquisitions can help them expand their product offerings even further.

3. By incorporating cutting-edge technology into its online digital products, the corporation may expand its customer base even further.

Threats

1. The financial sector in India is highly competitive, and various companies are offering their services to retailers, hence intense competition could be a major threat for the company.

2. Any major modification to regulatory requirements will result in higher operating costs and lower profit margins for the business.

Conclusion

Shriram Finance Company is an important player in the Indian financial sector and advances the nation’s economy by giving different societal segments access to financing.

To promote growth and profitability, the company has made use of its strong brand, a large range of products, a national presence, and a customer-focused philosophy.

However, before making any investment decisions it is advised that you analyse your risk tolerance.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Hindustan Unilever Case Study |

| 2 | Elcid Investments – India’s Costliest Stock |

| 3 | Reliance Power Case Study |

| 4 | Burger King Case Study |

| 5 | Zara Case Study |

Frequently Asked Questions (FAQs)

How old is Shriram Finance Company?

Shriram Finance has been in business for more than 50 years and is one of the top NBFCs in India.

What does Shriram finance do?

A variety of financial services are offered by the firm, including auto and truck financing.

Who is the owner of Shriram Finance?

R. Thyagarajan is the founder of the Shriram Group, while Y S Chakravarti serves as the CEO of the business.

Is Shriram Finance approved by RBI?

Shriram Finance is an NBFC (Non-Banking Financial Company) established under the Company’s Act 2013 and is registered with RBI.

Which companies merged with Shriram Finance?

In 2022, Shriram Finance merged with Shriram Transport Finance and Shriram City.